Travel Insurance For Pre-Existing Medical Condition

How to get travel insurance for a Pre-existing medical condition? This question looms large for many individuals with underlying health issues who dream of exploring new destinations and embarking on exciting adventures.

Travel insurance acts as a safety net, providing financial protection against unforeseen circumstances such as trip cancellations, medical emergencies, and lost luggage.

But what happens if you have pre-existing medical conditions? Can you still obtain adequate coverage?

In this comprehensive guide, we’ll delve into the intricacies of obtaining travel insurance for pre-existing medical conditions, addressing common challenges, and offering valuable tips to ensure you’re well-prepared for your journey.

This article only refers to pre-existing medical conditions in travel medical insurance.

Costco members can explore plans from Costco Travel and AAA Members can look for options with AAA Insurance

If you are considering travel insurance for your parents visiting the USA, you can get more information and details on visitor insurance.

What Is Considered A Pre-Existing Medical Condition?

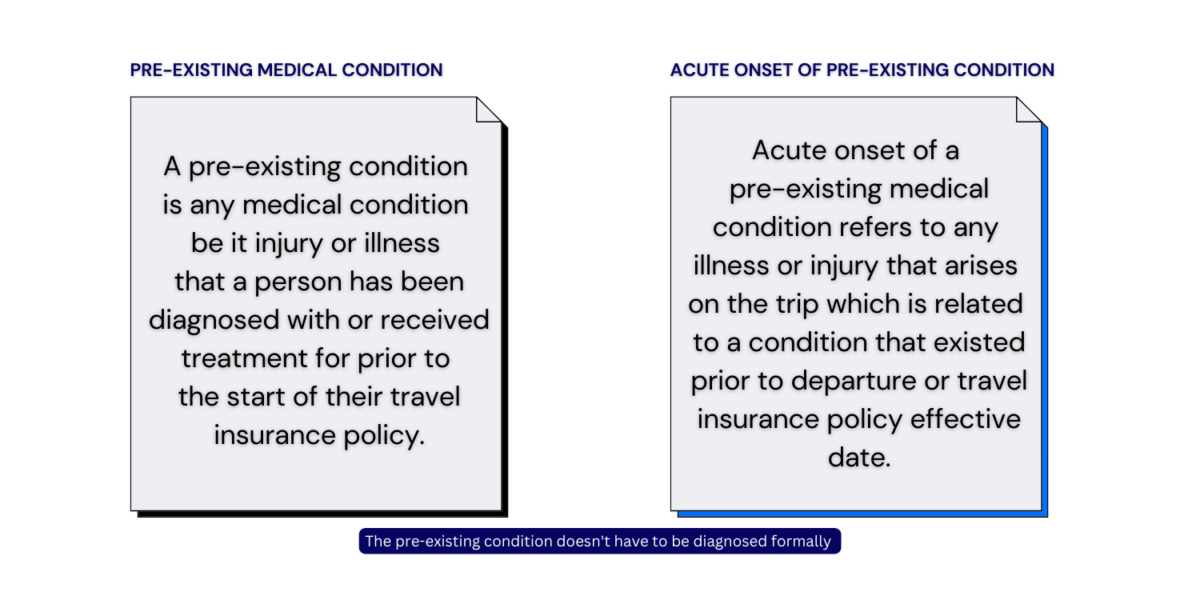

A pre-existing medical condition is an illness or injury that you had before your policy began or was renewed that caused someone to seek treatment or require medication. Examples of pre-existing medical conditions can range from diabetes and asthma to high cholesterol or long-term back conditions.

These conditions are typically determined based on whether you received medical advice or medical treatment for them before enrolling in an insurance plan.

It is important to note that a pre-existing medical condition is defined as an injury, illness, or medical condition that, within the 120 days before and including the purchase date of your policy, has caused:

- A new diagnosis, a decline in health, or the addition of new prescription medication.

- An injury, illness, or medical condition that does not need to be formally diagnosed to be considered a pre-existing medical condition.

- Mental and nervous health disorders and normal pregnancy are not covered by most travel insurance policies.

Do all Travel Insurance Plans Cover Pre-Existing Conditions?

There are 2 distinct types of travel insurance plans:

- Travel Medical Insurance Plan

- Trip Insurance Policy

Not all plans offer coverage for pre-existing medical conditions. As far as travel medical insurance plans are concerned only a select few plans cover pre-existing conditions, many travel medical insurance plans cover only the acute onset of a pre-existing condition.

For trip insurance policy again the insurance policy document will describe what coverages are included and what is excluded.

What is the Acute Onset of a Pre-Existing Medical Condition?

Acute onset of a pre-existing condition refers to any illness or injury that arises on the trip which is related to a pre-existing medical condition that existed prior to departure or travel insurance policy effective date.

Travelers with pre-existing conditions should be aware that:

- travel insurance policies may exclude coverage for pre-existing conditions

- travel insurance plan may only cover the acute onset of pre-existing conditions

- the plan may require you to purchase add-on coverage in order for these events to be covered

- you may have to sign a pre-existing condition waiver within a specified time period of your initial trip deposit to be eligible for coverage

- your pre-existing condition coverage plan may have limits to the maximum amount covered per incident or policy period

- there may be age restrictions for coverage

Travel insurance providers offer plans specifically designed to cover travelers with pre-existing conditions.

These plans typically provide comprehensive coverage including evacuation, emergency hospitalization, and repatriation services.

Travelers should always exercise caution while purchasing travel insurance and when in doubt contact the insurance providers to clarify that travel insurance coverage is available for pre-existing medical conditions in the plan being considered.

Compare Travel Insurance Plans

How Can I Find The Right Cover If I Have A Medical Condition?

To find the right travel insurance cover if you have a medical condition, following these steps can be helpful:

- Understand Pre-Existing Conditions: A pre-existing condition is a medical illness or injury you have before starting a new health care plan.

- Type of coverage: Travel insurance can be in the form of Travel Medical Insurance or Trip Insurance. Although used synonymously there are some differences between them.

- Travel Medical Insurance: Most travel medical insurance plans cover the acute onset of pre-existing conditions. There are only a select few travel insurance coverage plans that offer coverage for pre-existing conditions.

- Trip Insurance: Check for Pre-Existing Condition Waivers. Not all trip insurance plans cover pre-existing medical conditions, but some policies offer a pre-existing condition waiver. A pre-existing condition waiver allows you to have your pre-existing conditions covered under the policy, but rules vary by the travel insurance provider. This article only refers to pre-existing medical conditions in travel medical insurance.

- Compare Plans: Use a travel insurance marketplace with a comparison tool to find travel insurance plans that cover pre-existing conditions and see options from multiple providers.

- Purchase Insurance Early: To qualify for a pre-existing medical condition exclusion waiver, you may need to purchase your trip insurance the same day you make your first trip deposit or shortly after. Such restrictions do not apply in the case of travel medical insurance but it is recommended to purchase early.

- Read Policy Descriptions: Carefully read your policy’s description of coverage to ensure you have purchased the coverage needed for your trip, including coverage for your pre-existing medical condition.

- Check Coverage for Specific Needs: If you have a rare disease, pay attention to the plan’s coverage for specific drugs and treatments you need.

- Consider Plan Types: Different plan types offer varying levels of coverage and provider networks. Choose a plan that meets your needs and budget.

- Review the Summary Plan Description: Each plan has a summary plan description (SPD) that lists details about how the plan works and what it covers. Use your disease audit to assess the plan’s coverage for your specific needs.

By following these steps, you can find the right travel insurance cover that meets your medical needs and budget.

Criteria For Travel Insurance To Cover Your Pre-Existing Condition?

To get travel insurance coverage for pre-existing medical conditions, you need to meet certain criteria. These criteria include:

- Purchase before embarking on your trip: Some plans mandate that you must purchase travel insurance before your departure date from your home country. Some plans also need a minimum of 90 days of coverage.

- Medical clearance: You must be medically able to travel at the time of purchase. Some insurers may require a letter from your doctor clearing you for travel as proof.

- Stability of condition: Your condition must be stable, meaning there have been no changes within a certain time frame, usually between 60 and 180 days before taking out insurance. This requirement extends to everyone listed in your policy.

Meeting these criteria can help ensure that your pre-existing medical condition is covered by your travel insurance, providing you with financial protection in case of illness or injury during your trip.

Understanding Travel Insurance Pre-Existing Condition

Before we embark on our exploration of travel insurance, let’s first understand what pre-existing medical conditions entail.

These are health issues that existed before the inception of the insurance policy. They can range from chronic illnesses like diabetes and hypertension to past surgeries or ongoing treatments.

When it comes to travel insurance, the presence of pre-existing conditions significantly impacts coverage options and premiums, making it essential to grasp their implications.

Some of the top-selling plans are:

Can I Get Travel Insurance With Pre-Existing Medical Conditions?

Yes, you can get travel insurance with pre-existing medical conditions. Having a pre-existing condition does not stop you from traveling, getting medical coverage, or purchasing travel insurance. However, most travel insurance policies do not cover any pre-existing illness or any condition that may hamper your trip. This is because insurers are wary of pre-existing conditions due to higher financial risk.

Therefore, if you have a pre-existing condition, you may need to either inform the insurer in advance or check the policy documents to see if it can be included as an optional coverage or a specific plan made to cover pre-existing conditions.

In summary, while most travel insurance policies do not cover pre-existing medical conditions, it is possible to get insurance to cover those conditions by either informing the insurer in advance or checking the policy documents to see if it can be included as an optional coverage or specific plan made to cover pre-existing conditions.

INF Visitor Insurance Has The Best Pre-Existing Conditions Plans

The INF offers a few travel insurance plans that cover pre-existing medical conditions, including the INF Premier, INF Elite, and INF Elite Plus (UHC) plans.

- These plans provide coverage for in-patient, out-patient, urgent-care, and specialist visits related to pre-existing conditions, without any benefit waiting period.

- The maximum coverage for pre-existing conditions varies depending on the plan, ranging from $20,000 to $100,000.

- The INF Premier IVAS plan also provides coverage for non-US residents traveling worldwide, including to the USA, Canada, EU, UK, and Australia.

- The INF-Robin Assist service is also included, which arranges for direct billing and cashless claims with providers worldwide, and provides 24/7 responsive claims, emergency travel, and medical assistance.

- The INF Premier plan is a limited travel medical insurance plan that includes coverage for pre-existing conditions, making it an excellent option for travelers with these health concerns.

- However, it is not cancelable after the policy effective date, and even if it is canceled before the start date, there’s a cancellation fee of $25. INF Premier requires a minimum of 90 days of coverage, ensuring that customers are adequately protected against unforeseen medical expenses.

INF Elite Plan

The INF Elite is a travel medical insurance plan providing excellent coverage for international travelers visiting the U.S., Canada, or Mexico. It provides complete coverage for pre-existing conditions.

INF Elite Plus (UHC)

INF Elite Plus is a travel medical insurance plan providing excellent coverage for international travelers visiting worldwide including visiting the U.S., Canada, or Mexico. It provides coverage for pre-existing conditions.

INF Premier (PHCS)

INF Premier (PHCS) is a travel medical insurance plan providing excellent coverage for international travelers visiting anywhere worldwide outside their home country including visiting the U.S., Canada, EU, UK, and Australia. It provides coverage for pre-existing conditions.

INF PremierX (UHC) Plan

INF PremierX (UHC) is a travel medical insurance plan providing excellent coverage for international travelers visiting anywhere worldwide outside their home country including visiting the U.S., Canada, EU, UK, and Australia. It provides coverage for pre-existing conditions.

INF Premier PlusX (UHC) Plan

INF Premier PlusX (UHS) plan is a travel medical insurance plan providing excellent coverage for international travelers visiting anywhere worldwide outside their home country including visiting the U.S., Canada, and Mexico. The plan provides wellness expense benefits such as full body physicals, immunizations, and routine bloodwork for visitors to the USA, Canada, or Mexico. It provides coverage for pre-existing conditions.

INF Premier Plus (PHCS) Plan

INF Premier Plus (PHCS) plan is a travel medical insurance plan providing excellent coverage for international travelers visiting anywhere worldwide outside their home country including visiting the U.S., Canada, and Mexico. The plan provides wellness expense benefits such as full body physicals, immunizations, and routine bloodwork for visitors to the USA, Canada, or Mexico. It provides coverage for pre-existing conditions.

Other Options For Pre-Existing Condition Coverage Plans

- Visitors Protect by IMG

- Hop Mindoro

- Hop TripAssist Plus

Most Common Pre-Existing Medical Conditions That You Need To Disclose When Buying Travel Insurance

The most common pre-existing medical conditions that you need to disclose when buying travel insurance include:

- Asthma

- Heart disease

- High blood pressure (Hypertension)

- Diabetes

- Chronic illnesses, such as lupus

- Arthritis

- Mental and nervous health disorders

These conditions may affect a large portion of the population and could be considered pre-existing conditions by travel insurance companies. These are some of the pre-existing medical conditions refer policy documents for a complete list.

Challenges In Obtaining Travel Insurance For Pre-Existing Conditions

Navigating the realm of travel insurance with pre-existing medical conditions presents several challenges.

- Insurance companies often have strict policies regarding such conditions, leading to exclusions and limitations in coverage.

- Understanding these policies and their implications is crucial to avoiding unpleasant surprises during your travels.

- Factors such as the severity of your condition, recent medical history, and destination also influence coverage availability and cost, adding another layer of complexity to the process.

Options For Obtaining Travel Insurance For A Pre Existing Medical Condition

Despite the challenges, there are avenues to secure adequate coverage for your travels.

- Specialized travel insurance providers cater specifically to individuals with pre-existing conditions, offering tailored policies to meet their unique needs.

- Additionally, undergoing thorough medical screening and accurately declaring your conditions during the application process can help ensure you receive comprehensive coverage.

- Exploring additional options such as coverage riders can further enhance your protection against unforeseen medical expenses abroad.

Tips For Obtaining Travel Insurance With Pre-Existing Conditions

Securing travel insurance with pre-existing conditions requires careful planning and attention to detail. Researching and comparing insurance policies from different providers enables you to find the most suitable coverage for your needs.

When declaring your medical history, be thorough and accurate to avoid any disputes during the claims process. Understanding policy terms, conditions, and exclusions empowers you to make informed decisions regarding your coverage.

Seeking assistance from insurance brokers or agents with expertise in pre-existing conditions can also provide valuable guidance and support throughout the process.

Where To Find Coverage For Pre-Existing Medical Conditions?

With a plethora of options available, finding the most suitable travel insurance for pre-existing medical conditions can be a daunting task.

Amidst the array of providers, such as INF, IMG, and Travel Guard by AIG, it can be challenging to discern which plan aligns best with your needs.

Instead of sifting through numerous quotes from various insurance companies, we suggest utilizing OnshoreKare.com this free comparison site streamlines the process by enabling you to receive quotes from multiple providers simultaneously, facilitating a more informed decision-making process for your travel insurance needs.

Documentation For Claims Involving Pre-Existing Medical Conditions

If you have a pre-existing medical condition and are planning to travel, it is important to have the right documentation when filing a medical claim. This is especially important if your condition is pre-existing, as it may affect your coverage.

- To qualify for coverage of pre-existing conditions, you will need to purchase travel insurance shortly after making your initial trip payment, typically within 10 to 21 days. The insurance company will want to confirm that you have a pre-existing condition waiver on file before approving a claim.

- When filing a claim for medical travel insurance, you will need to provide a proper claim form, proof of your trip and insurance, written documentation from your attending physician, copies of your medical file and medical bills from the emergency care, and any other relevant documents.

- It is important to note that each travel insurance company has its definition of a pre-existing condition, but in general, it refers to any medical condition, illness, or injury that you have before your trip. If you have a chronic condition, such as Gaucher disease, it is important to check the plan’s coverage for specific drugs and treatments you need.

- If a non-traveling family member’s health puts your trip in jeopardy, the pre-existing condition exclusion and waiver may also apply to them. It is important to be aware of this in the event you may need to cancel or interrupt your trip due to a medical emergency or death.

In summary, having the right documentation is crucial when filing a medical claim involving pre-existing conditions. It is important to purchase travel insurance shortly after making your initial trip payment and to provide all necessary documentation when filing a claim. Additionally, it is important to check the plan’s coverage for specific drugs and treatments you may need, especially if you have a chronic condition.

Conclusion

In conclusion, obtaining travel insurance for pre-existing medical conditions may seem daunting, but with the right knowledge and preparation, it’s entirely feasible.

By understanding the intricacies of pre-existing conditions, navigating insurance policies’ challenges, and exploring available options, you can ensure you’re adequately protected during your travels.

Remember to plan ahead, research thoroughly, and seek assistance when needed to find the best coverage that suits your unique needs.

With proper preparation, you can embark on your journey with peace of mind, knowing you’re covered against any unforeseen medical emergencies that may arise along the way.

Safe travels!