Travel Smarts 101: Travel Insurance VS Trip Insurance

Are there differences in travel insurance vs trip insurance?

Travel insurance is generally considered the only product type available when you need protection for your international trip.

An international trip can result in a challenge if one was to get an unexpected illness while traveling or if there is a trip interruption due to bad weather. Medical expenses overseas can turn out to be quite expensive.

Luckily travel insurance provides options like medical coverage, trip cancellation coverage, trip interruption coverage, emergency medical expenses, emergency medical evacuation, political evacuation, or even repatriation of mortal remains.

It is important to know all the details of travel insurance to ensure you have the best coverage for the trip.

There are a few types of travel coverage options available:

- Travel Coverage

- Travel Protection

- Trip Assistance

Let’s understand the differences and similarities between travel insurance and trip insurance plans and also discuss briefly the travel protection and trip assistance options.

What Is Travel Medical Insurance?

If you are unsure about why should consider travel insurance for your trips knowing the

Top 10 Reasons to Purchase Travel Insurance

Travel Insurance

Also referred to as:

- Travel Medical Insurance

- Visitors Insurance

- Short-Term Health Insurance

- Visitors Coverage

- Travel Health Insurance

Usually provided by travel insurance companies that are regulated, travel insurance product covers medical & travel-related risks that you might face. Generally, these travel insurance companies work with reputed insurance underwriters for their plans.

Coverage may include medical risks:

- New unexpected illness or sickness

- Doctor visits and hospitalization

- Covid-19 coverage

- Urgent care visits

- Accident and medical expenses for an injury

- Emergency medical evacuation

- Acute onset of pre-existing conditions

- Medical costs for emergency dental treatment

- Medical expenses for an emergency eye exam

- Prescription/medication

- Natural disasters

- Repatriation of remains

- Personal effects coverage

A travel medical insurance plan also offers travel-related coverage like trip delay, trip cancellation, trip interruption, lost baggage, delayed baggage, lost passport or travel documents, etc.

Most reputed travel insurance companies also provide 24/7 assistance services to help their customers find doctors or emergency medical assistance providers. Some travel insurance plans may also provide pre-existing conditions coverage with maximum limits per incident or policy period.

For travel medical insurance, the cost of a plan may vary depending on the age of the traveler, duration of coverage, and destination country apart from other factors.

It’s important to note that medical protection and covering medical expenses is the primary objective of travel insurance plans. Also, all travel medical insurance plans do not offer all the coverages, each plan will have inclusions and exclusions plus limits on how much coverage it provides per incident or policy period.

Always read the policy document to understand the plan details, for example, one plan may offer emergency medical evacuation up to the policy maximum limit while another plan may offer emergency medical evacuation up to say $50,000. The policy document is the best resource to see the limits defined for the plan’s coverage limits.

What is Trip Insurance?

Trip insurance coverages may include:

- Trip cost protection

- Trip cancellation coverage

- Trip interruption coverage

- Trip delay coverage

- Lost luggage

- Stolen luggage

- Rental car coverage

- Medical coverage

- Medical evacuation

- Cancel for any reason (CFAR) add-on benefit

- Adventure sports cover

- and more…

Trip insurance plans may also cover pre-existing conditions with a waiver signing. A typical trip insurance policy may cost between 5% to 10% of the total trip cost including costs for add-ons like cancel for any reason.

It is important to note that financial protection is the primary aim of trip insurance plans supported with medical coverage.

A travel insurance provider or travel insurance company distributes sales of its plans through insurance providers, travel insurance agents, online travel insurance marketplaces, and even travel agencies apart from other vendors involved in the travel business.

Trip Protection, Travel Assistance, TripAssist Plans

These plans are usually offered by companies or providers that may not be regulated. The travel protection or trip assistance plans may offer both medical and travel-related coverage including some plans offering pre-existing medical conditions coverage.

You may get coverage for new sickness, accident, or injury, trip cancellation coverage, trip interruption coverage, lost luggage, and more.

The plans may be offered directly on the website of such providers or through a travel agency or a tour operator. The premium costs of these plans can vary, but generally, they are less expensive than travel insurance or trip insurance plans.

Some plans may even offer travel insurance discounts on premiums if you buy a plan for a slightly longer term like 60 days or more.

These plans may meet the needs of certain leisure or business travelers. Just because these plans are not regulated doesn’t mean they don’t provide good coverage. But do remember that your recourse options in case of a shortfall to meet the travel insurance coverage promised in the policy document may be limited.

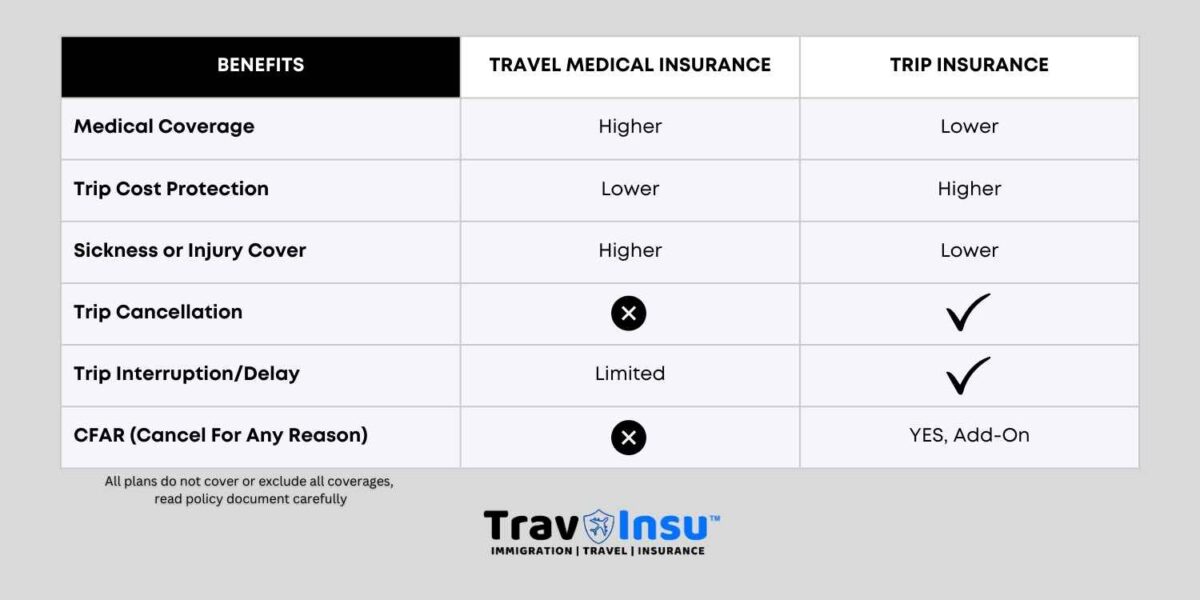

Key Differences Between Travel And Trip Insurance

Often used interchangeably “trip insurance” and “travel insurance” plans have a lot of common coverages and many differences. It will be important for one to assess travel insurance needs before deciding on the type of insurance to buy.

Is travel insurance and trip insurance the same or are there differences?

There are many similarities and differences between Travel Medical Insurance and Trip Insurance plans.

While they both offer medical coverage and financial protection the medical coverage limits vary and the level of protection they offer also varies.

Travel insurance works like short-term health insurance with some financial protection for travel-related risks while trip insurance works like a financial protection for trip costs with some medical coverage limits to ensure medical care and medical expenses are covered.

Most travel insurance providers offer 24/7 assistance and concierge services to their customers. These services can be used during emergency situations and sometimes it is mandatory to reach out to them before availing of any medical coverage-related expense. Sometimes the travel insurance or trip insurance provider needs to mandatorily arrange for services from their trusted providers like an air ambulance for medical evacuation coverage offered in the plan. To avoid issues during the claims process always follow the protocols as defined in the policy document.

Which Coverage Should You Opt For Health Insurance OR Financial Protection?

When traveling abroad nothing is more important than your health. However, there could be circumstances or situations where you need to choose travel medical insurance or trip insurance.

Sometimes we have to invest in the trip cost upfront, to get good deals on travel costs like an airline ticket or a hotel booking.

And, at times to show proof of bookings to get a visa approved. Trip insurance plans are best suited for such a purpose.

If you are traveling to a country where medical costs are very high due to the nature of the healthcare system in a country like the USA, you can consider travel medical insurance plans as they provide overall coverage.

Considering short-term health insurance plans irrespective of the visa type on which you plan to travel to the USA, is prudent.

Planning to travel to the USA or inviting your parents to visit you in the United States, the B-1/B-2 Visa also known as a visitor visa and form DS-160 is a good starting point.

When a Trip Insurance Plan Makes Sense For Financial Protection

If you are a non-US Citizen living in the USA or anyone from other countries planning to travel to Europe, you most likely will need proof of travel insurance coverage when you apply for a Schengen Visa.

You can consider Trip Insurance Plans that offer a Schengen Visa letter as proof of insurance when you apply for the visa. Add cancel for any reason (CFAR) and for some reason if the Schengen visa is not approved you can get reimbursed for the trip cost due to trip cancellation. You can use the funds for some other trip.

Cancel for any reason: usually, the trip cancellation benefits only reimburse the refundable part of the tickets, canceling for any reason helps you get reimbursed for the non-refundable part of the booking. Cancel for any reason coverage can help you get reimbursed between 50-75% of the non-refundable booking amount. It gives you the flexibility to cancel for any reason.

Another scenario could be where business travelers traveling for a short trip duration and uncertain about their plans or need last-minute changes or cancelations. Trip insurance could be an option to consider.

Trip insurance plans may offer pre-existing conditions coverage with a waiver signed within the stipulated time period from the initial trip deposit.

Some Popular Trip Insurance Plans

When Does Getting Travel Medical Insurance Make Sense?

As highlighted earlier if you are traveling to a country where medical costs are a serious concern then travel medical insurance plans can be of great help. Medical expenses can quickly shoot up if you need to visit a hospital for emergency medical treatment. A visit to a doctor for a common cold or flu can set you back by a few hundred dollars!

Travel medical insurance has two categories:

- Comprehensive Travel Insurance Plans

- Limited Travel Insurance Plans

Understanding the difference between comprehensive coverage and limited coverage will help you when you are researching which type of coverage to select.

A travel medical insurance plan provides overall coverage and offers travel insurance benefits like:

- Medical expense coverage

- Acute onset of pre-existing medical conditions

- Emergency medical coverage

- Medical evacuation coverage

- Accidental death & dismemberment

- Repatriation of remains

Knowing how travel insurance works helps to decide if you need travel insurance coverage for your next adventure. Comprehensive coverage plans are more expensive than limited coverage plans but they offer better limits and incidents being covered.

Always compare plans before you decide to purchase travel medical insurance. The comprehensive plan always overscored a limited cover plan but it’s a good practice to assess your needs and risks and then decide which one to go for.

The cost for a comprehensive travel insurance plan may look expensive but it makes up for the limits and options provided. There can be situations when you need to be prudent and opt for a limited cover plan if the risks are limited.

If you are concerned about pre-existing medical conditions, there are a few travel insurance plans that cover them. You may need to purchase the plans for a minimum of 90 days, and overall coverage limits and/or limits for medical expenses will apply per incident or plan period.

Some popular comprehensive travel medical insurance plans

Comprehensive travel insurance policies offer higher maximum limits for incidents as compared to limited coverage plans.

Some Popular limited-coverage travel medical insurance plans

- VisitorSecure

- Visitors Care

Compare Travel Insurance Plans

Cost of Coverage

The cost of short-term travel health insurance depends on several factors:

- Age of traveler

- Medical costs at the destination country

- Coverage duration

- Policy maximum and deductible limits selected

- Add-ons to travel medical insurance plan

Trip Insurance cost depends on several factors, the premium can range between 5% – 10% of the average trip cost:

- Age of traveler

- Destination

- Trip cost

- Policy maximum and deductible limits selected

- Add-ons like cancel for any reason etc.

Best Travel Medical Insurance Companies

Some of the best travel insurance companies are:

- International Medical Group (IMG)

- Seven Corners

- Trawick International

- WorldTrips by Tokio Marine HCC

- HTH Worldwide

There are several other travel insurance providers with excellent reputations and service quality. You can generate free no-obligation quotes to compare travel insurance costs and benefits.

Is Travel Medical Insurance Better than Trip Insurance?

Should you select travel medical coverage or trip insurance will depend on your needs and the kind of travel being undertaken. For example, trip delay coverage may be more important to business travelers as compared to a retired senior traveler.

Travel medical insurance and trip insurance are both good options, they need to meet your specific insurance needs. One needs to assess the individual needs. Unsure whether you should lay more emphasis on medical coverage or trip delay coverage? Knowing that trip cancellations are quite common you can speak to the helpline offered by travel insurance companies, they can guide you to the best travel insurance coverage specific to your needs.

You can get travel insurance coverage for a single trip, or you can consider multi-trip plans. If you are a frequent traveler a plan for multiple trips can help you save on your travel insurance cost.

Conclusion

When traveling, it is safe to get coverage and evaluate plans basis the medical benefits or other benefits you seek.