Safe Travels USA Comprehensive Plan Reviews

Safe Travels USA Comprehensive plan is a highly popular and comprehensive visitor insurance plan for non-US citizens visiting the U.S. or traveling outside their home country. The Plan provides accident and illness medical coverage with Acute Onset of Medical Conditions to non-US citizens who live outside of the US and are traveling outside of their home country while visiting the US or to the US and Worldwide.

The insured person is covered on the way to the U.S., while in the U.S., in countries on the way to or from the U.S., and in countries on the itinerary.

Coverage (at first) can be bought for a minimum of 5 days for up to a maximum of 364 days.

You can extend the plan for up to 364 days (If coverage is bought for a minimum of 5 days)

COVID-19 EXPENSES are covered and treated like any other illness.

Safe Travels USA Comprehensive travel insurance is a very popular travel insurance plan for parents visiting the USA.

If you are traveling internationally and looking for international travel medical insurance from your home country to the USA and back to your home country, this could be a plan that meets your needs.

Note: Always remember to read the policy document carefully before you purchase travel insurance. If you are contemplating visiting the USA and are not sure about the visa type to apply for, USA Visa types will be of help.

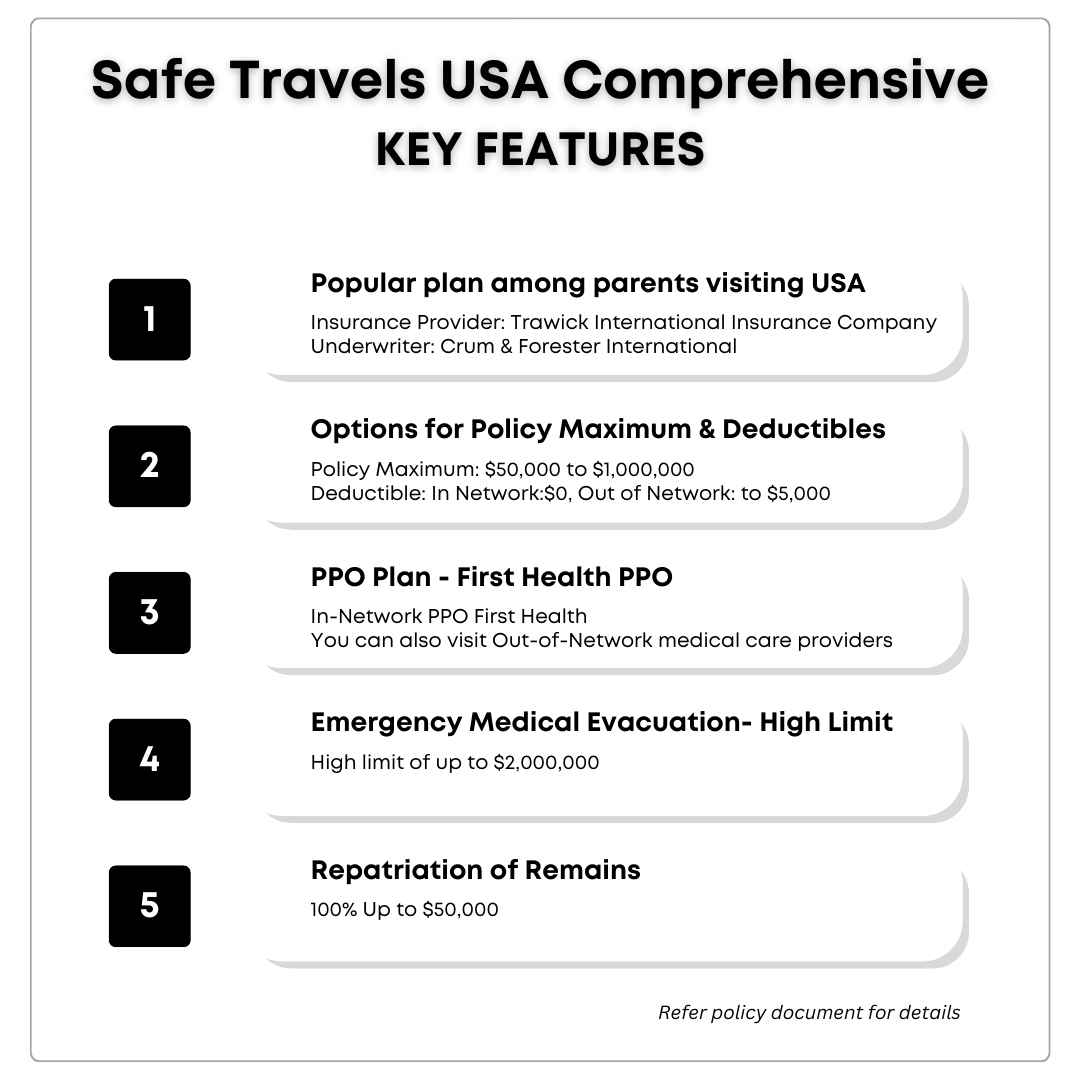

Key Features of Safe Travel USA Comprehensive Insurance Plan

Here are some key features of the Safe Travel USA Comprehensive Insurance Plan that gives some insight into the plan.

- Safe Travels USA Comprehensive Plan is administered by Trawick International Insurance Company

- Trawick Insurance Company specializes in providing international travel medical insurance

- Safe Travels USA is underwritten by Crum & Forester International with an A.M Best rating of “A”

- Safe Travels USA Insurance covers any new sickness, injury, or emergency medical treatment

- Safe Travels USA Insurance covers:

- Emergency services like political or medical evacuation

- Repatriation of remains, AD&D – accidental death & dismemberment

- Trip interruption or trip cancellation

- Baggage loss or delay

- Up to $1,000,000 in coverage related to emergency services medical coverage and eligible medical expenses

- It covers sudden and acute onset of pre-existing medical conditions up to the medical policy maximum purchased

- The plan uses the First Health PPO network, but you are free to visit any doctor or hospital of your choice outside the network

- The plan also offers a wellness visit benefit for a $125 copay

- Safe Travels USA Comprehensive is available for non-U.S. residents visiting the USA for 5 days to 365 days

- The plan has a co-insurance percentage, which pays 100% for in-network treatment within the PPO network and 80% of eligible expenses up to $5,000 outside the network.

- The plan has a wide choice of deductibles ranging from $0 to $5,000 and a $0 deductible for treatment provided by an in-network provider

If this is your first time exploring travel insurance then how travel insurance works will be of help to you.

Compare Travel Insurance Plans

Safe Travels USA Comprehensive Visitor Insurance

Affordable & Popular: Safe Travels USA comprehensive visitors Insurance is an affordable and popular option, for visitors to the US, who want comprehensive medical coverage for their stay.

Accident & Sickness Medical Coverage: This accident and sickness medical plan provides the most comprehensive coverage for travelers, including acute onset of pre-existing medical conditions.

Offers Range and Choices: The plan offers a range of policy maximums and deductibles including coverage for medical emergencies, political evacuations, and other covered expenses.

Popular for Parents Visiting the USA: Safe Travels USA is amongst the top-selling travel insurance plans among those buying health insurance for parents visiting the USA.

If you need information to get your parents to visit you in the USA then the B-1/B-2 Visa guide will be of help.

For parents traveling from India to the USA, the details on the best flights from India to the USA can be beneficial.

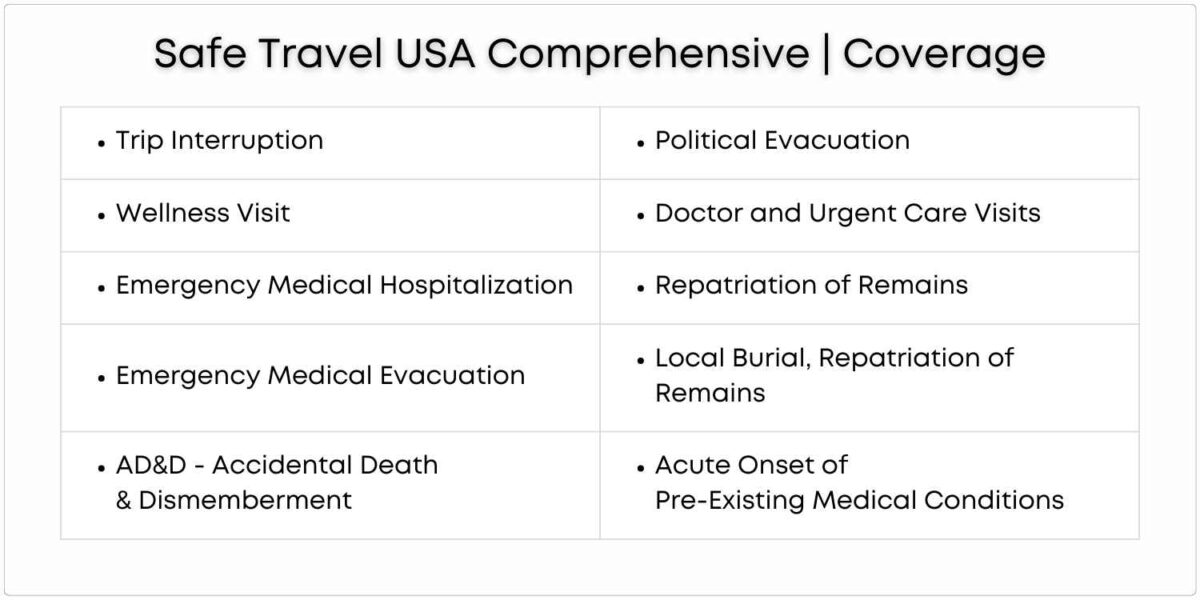

Safe Travels USA Comprehensive plan provides medical coverage for non-US citizens who reside outside the US. It includes coverage for:

- Trip Interruption

- Emergency Medical Hospitalization

- Emergency Medical Evacuation

- Doctor and Urgent Care Visits

- Wellness Visit

- Political Evacuation

- Accidental Death and Dismemberment (AD&D)

- Repatriation of Remains

- Local Burial

- Acute Onset of Pre-Existing Condition Coverage (requiring urgent treatment)

- Other Benefits

Summary Of Safe Travels USA Comprehensive Insurance Plan

The Safe Travels USA Comprehensive plan is designed for foreign residents coming to the USA or to the USA and then other countries.

This plan is not available to individuals residing in the US for more than 365 days.

This plan is a temporary accident and sickness medical coverage/Evacuation/ Repatriation plan.

The plan covers the acute onset of a pre-existing condition up to the policy’s maximum (for some ages).

This plan is available to purchase for a minimum of 5 days and extendable up to 364 days.

Expenses for COVID-19 are covered and treated like any other sickness.

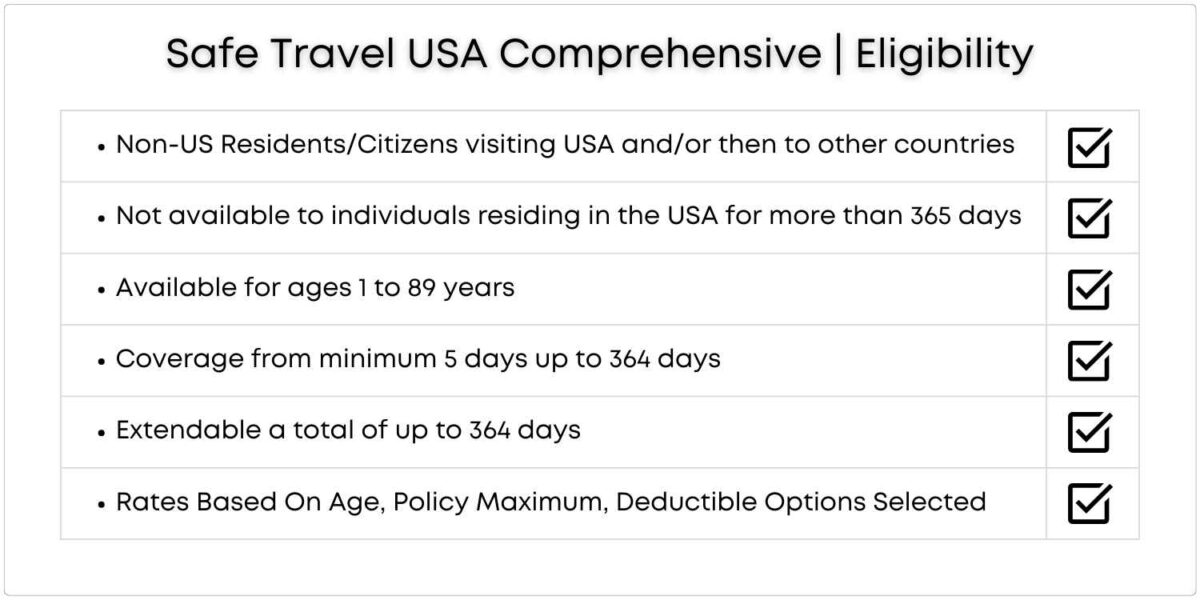

Safe Travels USA Comprehensive Plan Eligibility

For non-US residents/non-US citizens, traveling to USA or USA and then other countries.

Not available to individuals residing within the US for more than 365 days.

For Ages 1 to 89 years.

Rates based on:

- Age

- Policy Maximum selected

- Out-of-Network deductible

Safe Travels USA Comprehensive Plan Highlights

The Safe Travels USA Comprehensive is a travel health plan for visitors to the USA, the plan is available from 5 days up to 364 days, Safe Travels USA Comprehensive plan includes coverage for COVID-19 and the acute-onset of pre-existing conditions. The coverage starts from the time you board a flight from your home country (if the policy effective date includes travel dates). The plan is renewable for the same policy period or a different one.

Accident and Sickness medical Policy maximum choices: $50,000 $100,000, $ 250,000, $ 500,000, $1,000,000

Cardiac Conditions Limit(For ages up to 69): Up to $25,000 (Per Policy period)

Cardiac Conditions Limit(For ages 70 and above): Up to $15,000 (Per Policy period)

Dental Treatment: Up to $250 (Per Policy period for injury or pain)

In Network deductible: $0

Co-Insurance:

- First Health Providers are (In Network) – 100%

- All Others are (Out of Network)

- In the USA: 80% of the first $5,000 then 100% up to the policy maximum

- Outside of the USA: Up to 100%

In Network deductible: $0

Out-of-Network Deductible Choices: $0, $50, $100, $250, $500, $1,000, $2,500, $5,000

PPO Network: First Health

Urgent Care Co-Pay: $30 Per Incident

Acute Onset of Pre-Existing Condition: Limitations Apply

Wellness Visit: Covered up to $125

Other Benefits: Emergency Medical Evacuation, Medically Necessary Repatriation, Repatriation of Remains, Local Burial, Cremation

Medically Necessary Repatriation: 100% Up to $15,000

Trip Interruption: $5,000

Emergency Reunion: $15,000

Natural Disasters Evacuation: Up to $10,000

Accidental Death and Dismemberment: $25,000

Emergency medical Evacuation: Up to $2,000,000

Political Evacuation: Up to $25,000

Repatriation of Mortal Remains: 100% Up to $50,000

Local Burial/Cremation: Up to $5,000

COVID-19 Expenses: Covered and Treated as any other sickness

Safe Travels USA Comprehensive Insurance Benefits

Some of the benefits provided by Safe Travels USA insurance plans include:

Emergency Medical Expenses: Coverage for medical expenses incurred due to illness or injury while traveling

Emergency Medical Evacuation: Coverage for the cost of transporting you to a medical facility in the event of a medical emergency

Trip Cancellation and Interruption: Coverage for trip cancellation or interruption due to unforeseen events such as illness, injury, or death

Baggage and Personal Effects: Coverage for lost, stolen, or damaged baggage and personal items

Accidental Death and Dismemberment (AD&D): Coverage for accidental death or dismemberment while traveling

Sports Benefits: Benefit Covers you while Practicing, Performing, or Participating in Class 1 or Class 2 sports:

- Class 1 sports Like Tennis, Swimming, Archery, Track, Volleyball, Golf, Cross Country

- Class 2 sports Like Rugby, Soccer, Polo, Softball, Hockey, Karate, Baseball, Rowing, Basketball, Equestrian, Cheerleading, Lacrosse

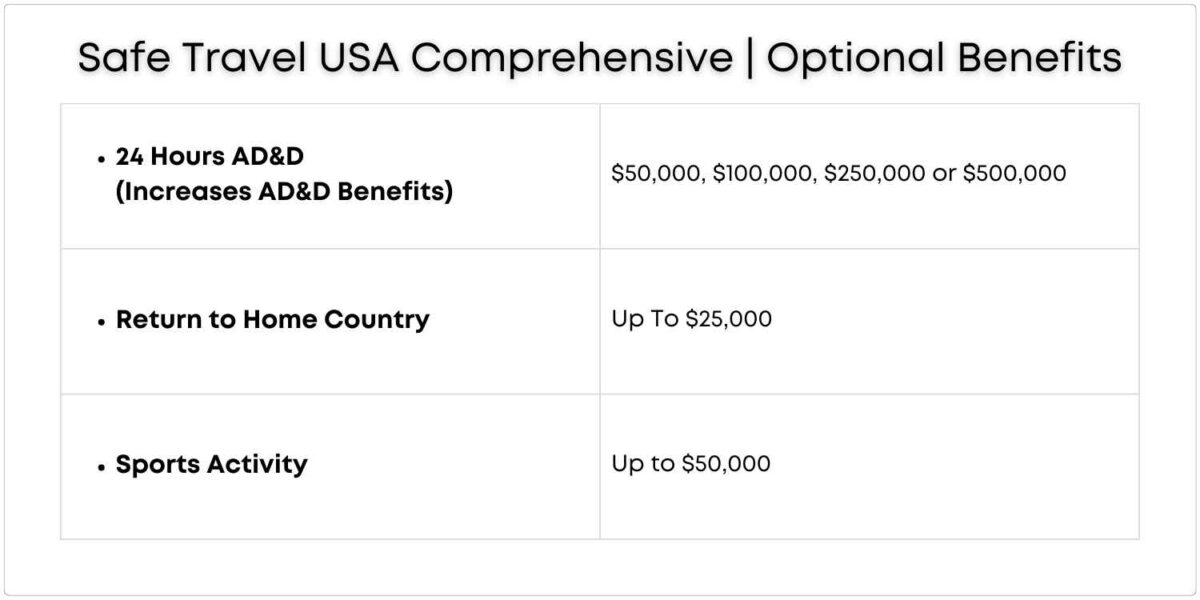

Optional Coverage Benefits

- 24 Hour AD&D: Increases AD&D Benefits

- Return to Home Country Coverage: Up to $25,000

- Sports Activity Coverage: Up to $50,000

Pre-Existing Conditions Coverage

It is important to note that a pre-existing condition is typically excluded by travel insurance, and coverage for the acute onset of a pre-existing condition may have specific terms and conditions that vary depending on the plan and the age of the traveler.

There are plans available if you need coverage for a pre-existing condition, these plans are typically available for a minimum of 90 days and have to be bought before departing the home country. Please note that home-country coverage is not offered. The insurance premium for these plans can be three times as high as a regular travel insurance plan.

What Is Acute Onset Of Pre-Existing Condition?

As per the definition of “acute onset of a pre-existing condition” it is the sudden and unexpected outbreak or recurrence of a pre-existing condition that occurs spontaneously and without advance warning.

It is a medical emergency that requires immediate treatment within 24 hours of the onset of symptoms.

The coverage may vary depending on the plan and the age of the traveler.

Safe Travels USA Comprehensive Insurance provides coverage for the acute onset of a pre-existing condition:

- Up to and 69 years: Up to Medical Policy Maximum (Per Policy Period)

- Attained age 70: Reduced to a maximum of $35,000

For a cardiac condition or stroke:

- Up to age 69: Limited to $25,000

- Attained 70 years: Limited to $15,000

The plan also covers COVID-19, but pre-certification is required before seeking testing or treatment.

Some Travel Medical Insurance Plans provide coverage for the acute onset of a pre-existing condition during the period of coverage for which the insured is eligible.

| Atlas America Travel Medical Insurance Plan | Offers acute onset of pre-existing conditions |

| Safe Travels USA Cost Saver | Covers the acute onset of pre-existing conditions |

| Patriot America Plus | Covers the acute onset of pre-existing conditions |

*Conditions, restrictions, and limits may apply

Compare Travel Insurance Plans

Safe Travels USA Comprehensive Cost

The cost of Safe Travels USA Comprehensive insurance plan varies depending on several factors:

- Age of the insured person

- Duration of the coverage and

- Level of coverage or policy maximum selected

- Destination Country

- And more…

Premium is higher for:

- Higher: Plan Limit selected

- Higher: Age

- Higher: Coverage days selected

- Adding: Optional coverage

Premium reduces when opting for a higher deductible.

Generally, the cost of the plan ranges from $4 to $9 per day for an individual, depending on the factors mentioned above.

For example, a 30-year-old person traveling to the United States for two weeks can expect to pay around $70 for the Safe Travels USA Comprehensive plan with a maximum coverage limit of $100,000.

However, the actual cost of the plan may vary depending on the individual’s circumstances, such as:

- Age of the traveler

- Selection of Policy Maximum and Deductibles

- Duration of Coverage

- Other factors like policy add-ons

It is important to note that the cost of the plan is subject to change based on the prevailing market conditions and the policy terms and conditions.

It is always advisable to obtain a quote from the insurer before purchasing the plan to get an accurate estimate of the cost of coverage. Additionally, it is recommended to compare the cost and features of different insurance plans to select the one that best fits the traveler’s needs and budget.

Safe Travels USA Comprehensive Insurance PPO Network

The Safe Travels USA Comprehensive Insurance uses the First Health PPO network, which is recognized by all major hospitals and healthcare facilities.

- Within the network, the plan pays 100% up to the policy maximum, after the deductible is met

- Outside of the network, the plan pays 80% for the first $5,000, and 100% thereafter for covered expenses after the deductible is satisfied

Safe Travels USA Comprehensive Insurance Claims

If you have a claim for Safe Travels USA Comprehensive Insurance, you can follow these steps:

Contact the Claims Department

The first step is to contact the claims department of Safe Travels USA Comprehensive Insurance as soon as possible.

You can find their contact information on their

- Website of Trawick International Insurance Company or

- In your policy documents

They will guide you through the process of filing a claim.

Gather all necessary documents, before filing your claim, make sure you have all the necessary documents such as your

- Policy number

- Proof of loss

- Receipts (doctor visit fee, hospital visit fee, medical treatment fee, etc.)

- Medical records, and

- Any other relevant information

You may also need to provide a police report or accident report apart from copies of your passport and visa.

Fill out the claim form

You will need to fill out a claim form, which you can obtain from the claims department. Make sure to fill out the form completely and accurately.

Attach all the necessary documents to the claim form and submit it to the claims department.

Wait for a response

After submitting your claim, you will receive a confirmation from the claims department. They will review your claim and contact you if they need any additional information. You can check the status of your claim on their website or by contacting the claims department.

Receive payment

If your claim is approved, Safe Travels USA Comprehensive Insurance will send you a payment for the amount of the covered loss, minus any deductibles or other applicable fees.

If you are a non-U.S. citizen traveling to the United States, consider Safe Travels USA, let’s have a brief look at the plan

Safe Travels USA – The Plan

Safe Travels USA is a comprehensive travel medical insurance plan that provides medical coverage and other covered travel benefits for non-US citizens traveling to the USA and other countries.

It is an A-rated plan that covers the sudden and acute onset of pre-existing conditions and has a policy maximum of $50,000 for persons of certain ages.

The plan has a co-insurance percentage that pays 100% for in-network treatment (within the PPO network) and 80% of eligible expenses up to $5,000 (outside the PPO network).

The Benefits of Safe Travel USA Insurance Plans

Safe Travels USA Insurance plans provide a range of benefits for non-US citizens traveling to the USA and worldwide.

The plans provide coverage for in-patient and out-patient medical expenses due to illness and injury, prescription drugs, emergency medical and political evacuation, repatriation of remains, trip interruption, baggage, and accidental death & dismemberment.

Information on how to carry prescription drugs into the USA will be of help.

Safe Travels USA Cost Saver Insurance Plan

Safe Travels USA Cost Saver Insurance is a budget comprehensive plan for visitors to the USA that provides coverage for sudden and unexpected recurrence of pre-existing conditions up to the first $1,000 of covered expenses.

- The policy offers policy maximum options starting from $50,000 and provides coverage for $100,000, $250,000, $500,000, and $1,000,000

- With deductible options ranging from $0 to $2,500

- Safe Travels USA Cost Saver is underwritten by Crum & Foster SPC and has an A rating from A.M. Best

- It is a comprehensive travel medical insurance plan that provides medical coverage and other covered travel benefits

- The policy can be purchased for a minimum of 5 days up to a maximum of 364 days

- The plan can be renewed for up to 364 days

Frequently Asked Questions

What is comprehensive travel coverage?

Comprehensive travel coverage is a type of travel insurance that provides a wide range of coverage for unexpected events that may occur during a trip. This type of policy typically covers trip cancellation or interruption, lost or delayed luggage, emergency medical expenses, and emergency evacuation. It is the most common type of travel insurance policy and is often what people think of when they hear the term “travel insurance.” The other type of coverage is limited or fixed benefit travel insurance, know the differences between comprehensive and limited coverage plans.

Do I need travel insurance going to the U.S.?

Technically, no, you are not required by law to have health insurance or travel insurance when traveling to the US for a short period of time. However, it is highly recommended to have travel insurance when visiting the US due to the high cost of medical care in the country. Travel insurance can provide coverage for unexpected medical expenses, trip cancellation or interruption, lost or delayed luggage, and other unforeseen events that may occur during your trip

Is Trawick International a reputable company?

Yes, Trawick International is a reputable company for international travel insurance needs. Trawick International offers a good balance of cost to coverage and has a range of excellent benefits, including superior coverage for medical evacuation.

What is safe travel insurance?

Safe travel insurance is a type of insurance that provides coverage for unexpected events that may occur during a trip. Compare Travel Insurance Plans.

Can a tourist visiting the USA get health insurance?

Yes, tourists visiting the USA can get health insurance in the form of travel insurance or visitors’ medical insurance. Short-term healthcare coverage for visitors to the U.S. is important because the U.S. has some of the highest healthcare costs in the world even for basic expected medical care.

A tourist on a non-immigrant visa is ineligible to obtain domestic health insurance from a health insurance company or other healthcare providers. Their only option is to purchase travel insurance for their trip.

Do I need travel insurance USA?

While it is not a legal requirement for travelers to the USA to have insurance, the out-of-pocket cost of medical care in the USA can burn a big hole in your pocket. Travel insurance can help minimize the cost of any medical problem or accident that can occur while traveling. Compare Travel Insurance Plans.

Conclusion

Safe Travels USA Comprehensive Insurance is an affordable and popular comprehensive visitor insurance plan for non-US citizens traveling to the US and other countries.

If you are still unsure if you need travel insurance then the top 10 reasons to buy travel insurance will help you understand more about the risks and reasons to get insurance.