Health Insurance For Parents Visiting USA

Are parents visiting the USA? Short-term health insurance for parents visiting the USA is important. The elderly are vulnerable and a medical emergency can disrupt their visit.

Given the high healthcare costs in the USA, should you consider purchasing insurance for parents visiting you?

Your parents may have a domestic insurance plan in their home country but that plan may only protect them in the home country as they set foot overseas the home country insurance plan may cease to provide protection.

For parents visiting the USA, it is recommended to get visitors’ health insurance coverage.

How to buy medical insurance for parents visiting the USA is a concern we all have. Should we just go ahead and buy travel medical insurance for parents visiting the USA, online?

Will travel medical insurance save your parents visiting you from paying expensive medical bills? Will visitor travel insurance be helpful in the event of sudden medical emergencies requiring hospitalization during their stay in the US?

If you are the one taking financial responsibility for visiting parents then you can protect their stay in the US.

It is best to purchase the visitors’ health insurance when planning parents’ visits along with the air tickets and visitor visa if they don’t have one already.

Buy travel medical insurance before leaving the home country, it is possible to have the trip and stay covered.

Let’s get into the blog where we discussed visitor insurance for parents visiting the USA in detail.

Compare Travel Insurance Plans

What Is Visitors Insurance For Parents Visiting USA?

Visitors Insurance is a type of insurance that will cover your parents’ short-term health care while traveling to the US and overseas.

Visitors insurance works more like traditional US medical insurance with deductibles, copays, and provider networks, than traditional travel insurance.

But you do need to bear in mind that this is travel insurance and though it works like health insurance there are differences.

Visitor insurance provides coverage for unexpected emergency medical expenses due to accidents or illnesses while traveling abroad. In life-threatening situations getting emergency medical care and being able to get emergency medical evacuation to the nearest medical facility can be the difference between staying alive or death.

Many visitor health insurance plans also cover baggage loss/delay, trip cancellation or delays, and loss of personal belongings and have other benefits to help travelers with unexpected problems such as loss of documents, etc.

You can buy health insurance based on the length of your parents’ stay, their medical history, age, the amount of medical insurance required, and the premium you prefer to pay.

If you are keen to know more about the reasons to buy travel insurance for parents read our article on the top 10 reasons to buy travel insurance.

Why Do You Need Visitors Insurance For Parents Visiting the USA?

You need to purchase a visitors insurance plan for your parents visiting the USA because non-immigrants and visitors are not eligible for domestic US health insurance.

And most domestic health and travel insurance do not offer coverage outside the home country. If you purchase insurance for parents visiting the USA it can prevent unnecessary financial hardships.

Also, maintaining the legal status and validity of their visa while in the US along with a good visitor insurance plan is advantageous. Knowing how travel insurance works is helpful in situations when you need to use one.

Besides being a great help in case of any medical emergencies, it makes the claiming process easy and straightforward.

Visitors’ health insurance plan benefits for parents include hospitalization expenses, intensive care treatment, inpatient surgery, hospital ward admission, ambulance services, medical evacuation, and much more.

While it is not mandatory to have medical insurance or visitor insurance to enter the United States there have been cases where the Immigration officers at the port of entry have asked for proof of return air ticket and medical insurance.

Pro-Tip: Always read the visitor insurance plan policy document carefully to understand the extent of the coverage, plan inclusions, exclusions, limits, and other important details.

Different Types Of Visitors Insurance For Parents Visiting The USA

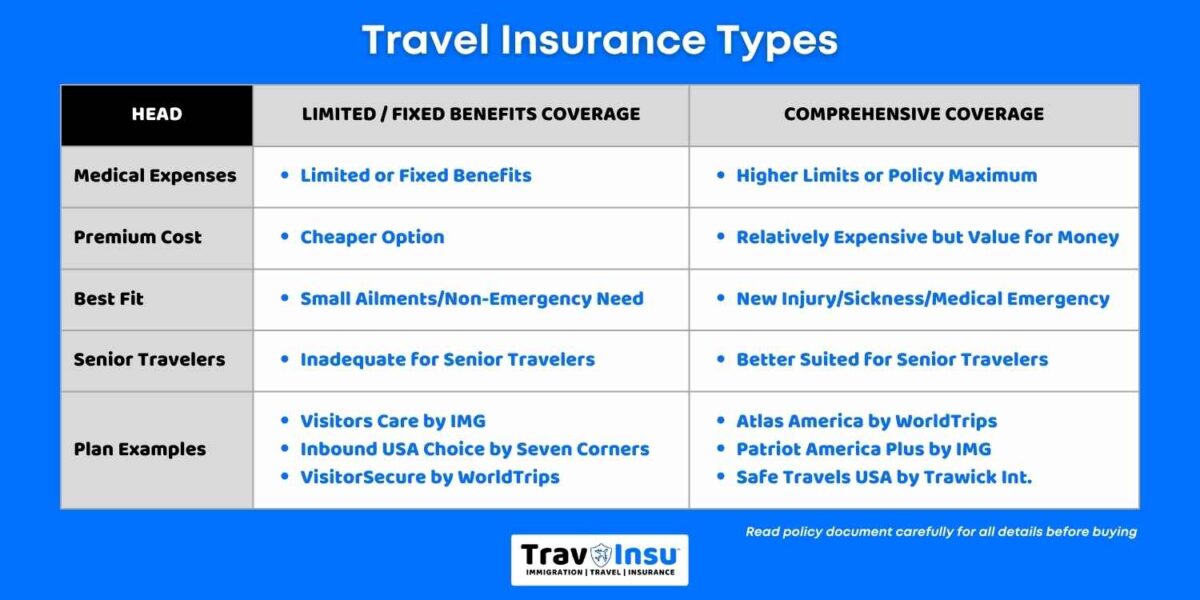

There are two main types of visitor insurance for parents visiting the USA:

- Fixed or Limited Benefits Plan

- Comprehensive Benefits Plan

The types of visitors’ insurance plans differ significantly in terms of coverage, price, benefit limits, etc.

Pro-Tip: International travelers need to assess their medical insurance needs and select a travel medical insurance plan accordingly. While low cost is critical the premium should not be the only criterion for evaluating a travel medical insurance plan.

Fixed Benefits Travel Insurance

This is a low-cost option for travel medical insurance.

Fixed travel insurance only provides limited coverage as compared to comprehensive plans. It only pays a fixed amount of medical expenses incurred for every medical treatment. Hence the premiums are relatively low-cost.

Even if the overall maximum medical coverage might have a higher limit, there is a pre-defined amount for each medical situation.

If the medical expenses exceed the pre-defined amount for each benefit, the remaining balance will become out-of-pocket expenses. This is not ideal if you are traveling on a budget.

Also, the plan usually requires a deductible before the insurance provider pays the agreed amount.

Fixed-benefit travel insurance does not generally cover trip-related expenses.

Due to its limited coverage, the medical expenses they provide can be insufficient in most cases. You may pay less for the travel insurance plan but you also get less.

Fixed or limited coverage travel insurance for parents visiting the USA might be a good option when you only need to cover some medical expenses incurred on your parents’ visit. But comprehensive coverage plans though relatively expensive, are better insurance for parents.

Comprehensive Travel Insurance

A comprehensive plan is more expensive than a fixed benefits plan, but you get better coverage for medical expenses to pay less out-of-pocket expenses.

The policy maximum limit of comprehensive coverage plans is much higher than the limit of a fixed-benefit travel insurance plan.

Some visitor insurance covers incidents up to the policy maximum meaning your out-of-pocket spending on medical bills and other expenses can be lower.

Generally, a comprehensive travel insurance plan requires a deductible, but thereafter the insurance provider covers a certain percentage of the expense in question. Insurance covers 100% of the medical bill after the maximum expense amount has been reached.

The comprehensive plan is also much more flexible toward the acute onset of pre-existing conditions. Your insurance provider will set the maximum limit for pre-existing conditions.

Comprehensive medical insurance is far better insurance for parents visiting the USA than fixed plans since they have extensive coverage, better protection against financial burden, and unforeseen costs, and offer additional services.

In the event of a serious medical emergency, these insurance plans are worth every penny of the premium paid.

Detailed comparison: Limited or Fixed Benefit Medical Insurance vs Comprehensive Coverage

Pro-Tip: Travel Health Insurance, Travel Insurance, and Visitor Insurance, Visitor Medical Insurance are different names for Travel Medical Insurance. An insurance company designs these plans with more emphasis on medical insurance part to ensure medical care is available to international travelers when they need it. Trip Insurance on the other hand focuses more on the financial impact of the Trip costs like trip cancellation, trip interruption, etc. Both types of insurance overlap in many aspects.

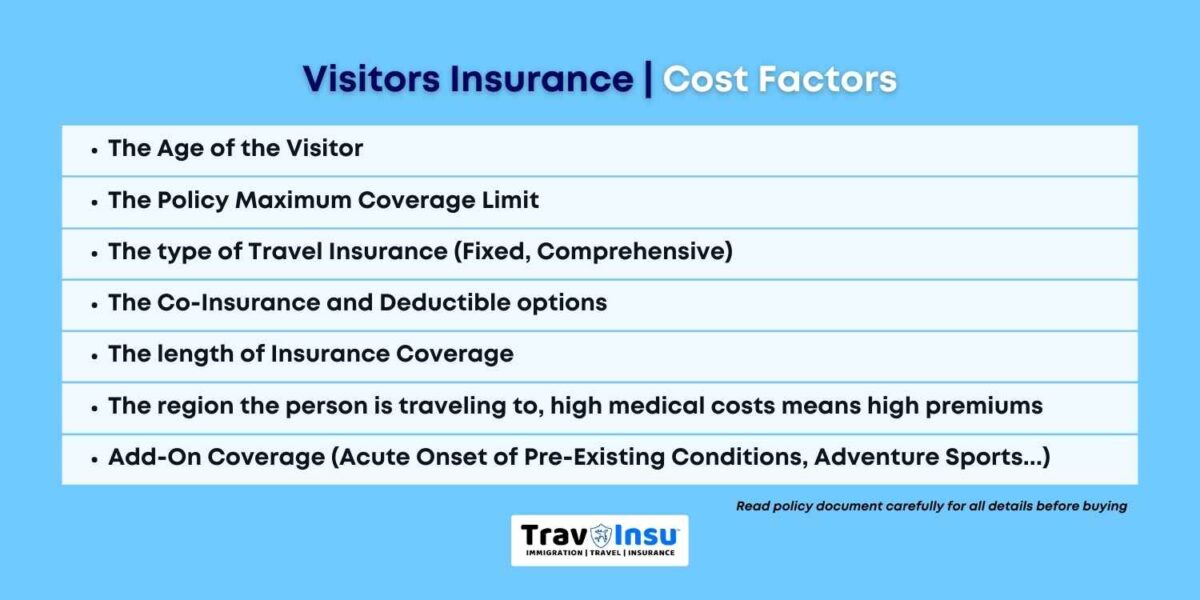

What Is The Cost Of Visitor Insurance For Parents Visiting USA?

There is no one-size-fits-all when it comes to US visitor insurance plans. The premium price for travel medical insurance varies depending on several factors.

Insurance providers take into account several factors when pricing their travel medical insurance products:

Also, the price of travel medical insurance is directly related to the cost of medical care in the country the international travelers are visiting. Due to the high expense of health care in the US, travel insurance is usually expensive as compared to some other countries.

Generally, a low-cost plan will offer less coverage as compared to a plan with a higher premium. Other factors for some USA visitor insurance plans to be expensive are that they offer several premium benefits bundled into a single plan:

- Acute Onset Of Pre-Existing Conditions Coverage is offered as standard, not an add-on

- Emergency Medical Evacuation Benefit

- Repatriation of Remains Benefit

- AD&D, Accidental Death, and Dismemberment Benefit

- low copay, etc…

After considering the potential medical and travel emergencies, visitor insurance plans are relatively inexpensive when compared to the risk of having a medical problem and the need to have medical coverage while visiting the US.

Knowing that medical care is available without having the burden of paying huge medical bills, visitor medical insurance for parents visiting the USA is a savior.

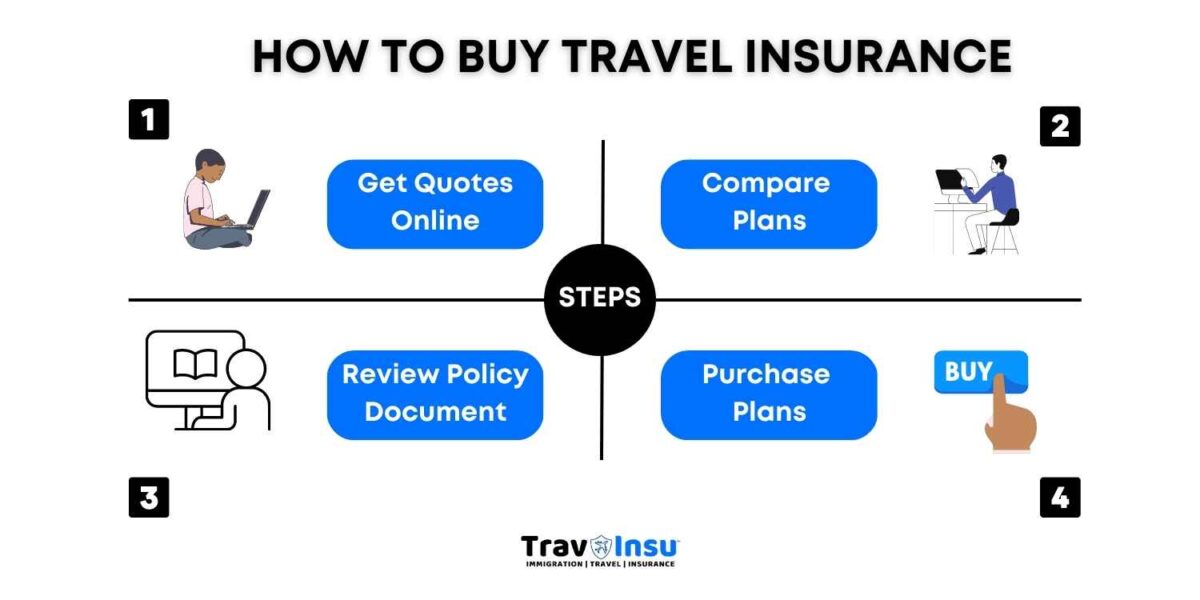

How To Buy Visitors Medical Insurance For Visiting Parents?

When it comes to visitor insurance plans there are several options. Sometimes it may be hard to comprehend the policy with insurance terms and insurance industry references.

To find the best health insurance for parents visiting the USA, a useful approach is to compare travel insurance USA of different companies. You can compare prices, coverage benefits, and more all at once.

Here are steps you can follow to buy travel insurance for parents visiting the USA:

- Search for available US visitors’ medical insurance.

Get quotes from the insurance companies by providing details of your parents and their requirements and needs. You can get a quote and buy visitor insurance for parents online you need your parents’ names, passport numbers, date of birth, and duration of coverage.

- Compare the different travel insurance options

Before choosing your preferred plans, compare the price, and the benefits of the parent travel insurance options to identify what best suits your needs.

- Review the insurance plan documents carefully

Review the policy documents carefully for coverage details and relevant contact numbers.

- Buy the travel insurance plan that you like the best

Buy the travel insurance plan that fits your needs and budget best.

You can also seek the help of an online visitor insurance guide or a travel insurance agent to navigate you through the maze and pick the one that is the best insurance for parents visiting you in the US.

Best Visitors Insurance For Parents Visiting USA

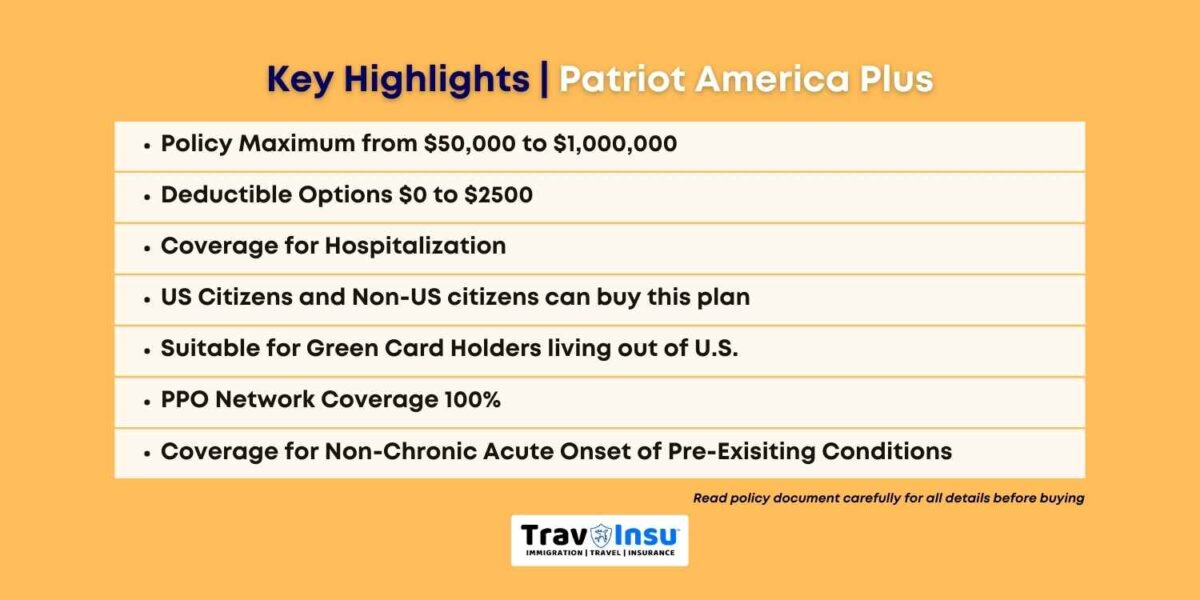

Patriot America Plus

Patriot America Plus is a comprehensive plan for foreign nationals as visitors to the USA. The plan coverage includes COVID-19 testing/treatment, and acute onset of pre-existing conditions for individuals who are aged below 70 years and offers a wide PPO network of providers; renewable for up to 2 years. The plan provides coverage for the acute onset of pre-existing conditions.

This plan is administered by the International Medical Group (IMG) and underwritten by SiriusPoint.

Key Highlights:

Atlas America Travel Insurance

Atlas America Travel Insurance is a comprehensive plan designed for travel to the U.S. which includes coverage for testing/treatment of COVID-19, eligible sudden illnesses and injuries, emergency medical evacuation, complications of pregnancy (in the first 26 weeks), repatriation of mortal remains, acts of terrorism, pre-existing conditions and more. The plan provides coverage for the acute onset of pre-existing conditions.

Plans are available for purchase for a minimum of 5 days or up to a maximum of 364 days; renewable for up to a total of 364 days. The plan is administered by WorldTrips and is underwritten by Lloyd’s, the oldest and largest insurance market in the world.

Key Highlights:

Safe Travels USA Comprehensive

Safe Travels USA Comprehensive is a plan for visitors to the USA. It is one of the few comprehensive plans that offer a $50,000 policy maximum for persons aged 80 through 89 years. The plan offers acute onset of pre-existing conditions coverage.

This plan can be purchased for a minimum of 5 days up to a maximum of 364 days; coverage can be renewed or extended for up to 2 years.

The plan is administered by Trawick International and underwritten by Crum & Forster, SPC, rated A by A.M. Best.

Key Highlights:

CoverAmerica-Gold

CoverAmerica-Gold is a comprehensive travel medical insurance plan that provides coverage for medical, travel, and emergency services for US visitors. This is the only plan currently on the market to offer the Public Health Emergency benefit which covers testing for illnesses including COVID-19. The plan pays 100% coverage after the deductible is satisfied and allows easy and affordable access to urgent care and an extensive PPO network.

The coverage duration is available from 5 days to 365 days. It provides coverage for the acute onset of pre-existing conditions for those below 70 years of age.

The plan is administered by IMG and is underwritten by Sirius Specialty Insurance Corporation.

Key Highlights:

Definition of Common US Health Insurance Terms

Policy Maximum

This is the maximum the plan will pay over the lifetime of the policy.

Deductible:

The deductible is the portion of the expenses that you agreed to pay out of your own pocket if you make a claim before your travel insurance provider begins to pay the balance amount of the claim. The higher the deductible, the lower the premium of the plan.

Copay:

A copay is the fixed amount that you need to pay for the medical service availed from your own pocket under your health insurance policy. In other words, the copay covers your portion of the cost of a doctor’s visit or medication.

Co-Insurance:

Co-insurance is the percentage of the medical expenses you pay after your deductible has been met. If the co-insurance is 10% of the travel insurance, you will be responsible for paying 10% of the total bill.

PPO Network:

Most hospitals in the US are linked with the Preferred Provider Organization (PPO) networks. The term “PPO network” refers to a group of doctors and hospitals with established working relationships with insurance providers. If you go to the hospital for treatment within a PPO network, the hospital or the doctor will bill your insurance company directly. This is way cheaper and more convenient.

Usually, you will be provided with a list of hospitals and doctors in your destination country to easily locate a suitable hospital for medical treatment.

Out of network: If you visit an out-of-network hospital or a doctor in the U.S., you will have to pay for the medical treatment and then file for reimbursement. This can be troublesome and time-consuming. Sometimes, out-of-network doctors and hospitals may not be covered at all by your policy.

Riders:

Riders are additional benefits that can be added to standard travel insurance while purchasing the insurance. These are optional that provide additional coverage and added protection against risks, often at an extra cost.

Pre-Existing Medical Conditions:

Medical conditions that existed before the policy’s effective date are considered pre-existing conditions. This also applies to pre-existing medical conditions that may not have been diagnosed before the policy’s effective date.

Frequently Asked Questions

Can I get health coverage for parents visiting the USA?

YES, you can buy health insurance for your parents visiting the USA. Any foreign visitors to the US or their family members can buy health insurance or visitors’ medical insurance from a US-based insurance company.

What are Pre-Existing Conditions? Can I get travel insurance for parents visiting the USA with Pre-Existing Conditions Coverage?

A pre-existing condition is any medical condition that a visitor has, that exists prior to the effective date of the travel insurance coverage. You can get visitor insurance for parents visiting the USA with a pre-existing condition as long as the pre-existing condition is considered to be ‘stable’ for a specified period of time before the effective date of the plan, to receive coverage. A pre-existing condition should not let your parents be confined to their home country and not visit you in the United States.

What is the best type of insurance for parents visiting the USA?

Although you can choose between a fixed/limited or comprehensive plan based on the level of coverage and premium. It is recommended that you get comprehensive visitor insurance for parents that covers eligible medical expenses, COVID-19, the acute onset of pre-existing conditions, and additional services that other policies lack. Fixed or limited coverage plans are affordable but these come with certain pre-defined limits for the benefits and anything above this amount is out of your pocket.

Do I need to get a separate insurance policy for each parent?

Travel insurance for parents can be bought as a single plan or separately a plan for each parent. Having both parents on the same application or separate applications has no effect on the premium. You might need to fill out a separate application for some plans, depending on the kind of plan and the age of the parents. Also, you will need to submit a separate application if your parents have different travel dates.

This is also helpful in case one of them has to return to the home country earlier than the scheduled stay, you can cancel one policy and get any eligible refund while the policy of the parent staying back continues to be effective.

My parents intend to spend most of their time at home. Which type of medical insurance should I buy?

Accidents and sicknesses can occur at any time and at any place. It really does not matter if your parents stay at home or travel around. Having proper visitor insurance is always a good idea. Especially for elderly parents who can be prone to illness. Be sure that travel insurance for parents covers necessary medical and travel expenses, as well as COVID-19 treatment and acute onset of pre-existing conditions.

Which medical insurance is the best for my parents traveling to the USA?

Comprehensive travel insurance for parents is a better option. These plans are the best for parents visiting the USA as they provide coverage for a wide range of medical and health care services including coverage for acute onset pre-existing conditions.

Should I purchase travel medical insurance from their home country or the USA?

It is better to buy visitor insurance for parents from the USA. The payment and claims process is easier if the visitor insurance for parents is bought from the US. The convenience and coordination of buying visitors’ insurance for parents from the US are very helpful when you need to use the plans.

Can the insurance plans be canceled if my parents change their travel plans?

Yes. Most travel insurance plans are cancellable and renewable. The dates can be adjusted based on the plan you bought. There may be a small cancellation fee on some plans.

Can I buy visitors’ insurance for my parents, who are older than 70?

Yes, you can buy travel health insurance for parents older than 70. There are many visitor insurance plans designed for elderly parents. A travel health insurance marketplace is a good option to quote, compare, and buy plans. You can also talk to a licensed professional before buying one so that you are informed to pick the most suitable for your parent’s needs, health conditions, and length of stay. If the person being insured has a pre-existing medical condition then do look for coverage in the policy document or ask the representative about this.

Which is the best visitor insurance for parents?

There is no best visitor insurance for parents or for that matter for anyone. A plan that meets your specific travel insurance needs is the best visitor insurance for you. Assess your need(s) and then shop for a plan that meets those insurance needs. Visitor health insurance options are plenty, rely on an insurance company that specializes in travel insurance and has excellent or good ratings and reviews.

Does travel insurance cover costs for doctor visits?

Yes, travel insurance usually covers costs for doctor visits for any new sickness or injury. Routine doctor visits are generally not covered. There will be a copay that you need to pay as defined in the policy document.

Conclusion

The US travel medical insurance plans cater needs of international visitors.

International travelers have different needs. Some are looking for cheaper options while others are looking for comprehensive coverage even if it is costly, they want a wide range of coverage.

You should review the different travel insurance pricing factors, plan benefits, and exclusions to make an informed decision while purchasing visitors’ insurance for parents visiting the USA.