Safe Travels USA Insurance Plan – Complete Review

Safe Travels USA is a travel insurance plan designed for non-U.S. citizens traveling to the United States. It is underwritten by Crum & Foster SPC and has an A rating from A.M. Best.

Administrator: Trawick International

Coverage Type: Comprehensive Coverage

The plan provides medical coverage and other travel and emergency benefits, Including coverage for Unexpected recurrence of Pre-Existing Medical Conditions.

The plan offers a range of coverage options to suit different travelers’ needs.

The plans offer the following medical expense coverage

- For ages 70-79: up to $1,000,000

- Up to age 89: $50,000

- Repatriation Benefit: $50,000

- Local Burial: $5,000

In this review, we’ll take a closer look at the Safe Travels USA insurance plans, including:

- Features

- Benefits

- Limitations

Plan Options:

There are different plan options for Non-citizens/Residents to choose from, each with different levels of coverage and pricing. Some plans offer coverage for COVID-19 expenses and treat it like any other sickness.

These plans are generally not available to:

- US Citizens

- US Residents

- Green Card Holders

- Anyone who has been in the United States for more than 365 days

Our detailed review on the Safe Travels Series plans to consider:

Safe Travels USA

This accident and sickness medical Plan offers comprehensive medical coverage for travelers visiting the United States. Offers coverage minimum of 5 days for up to 364 days

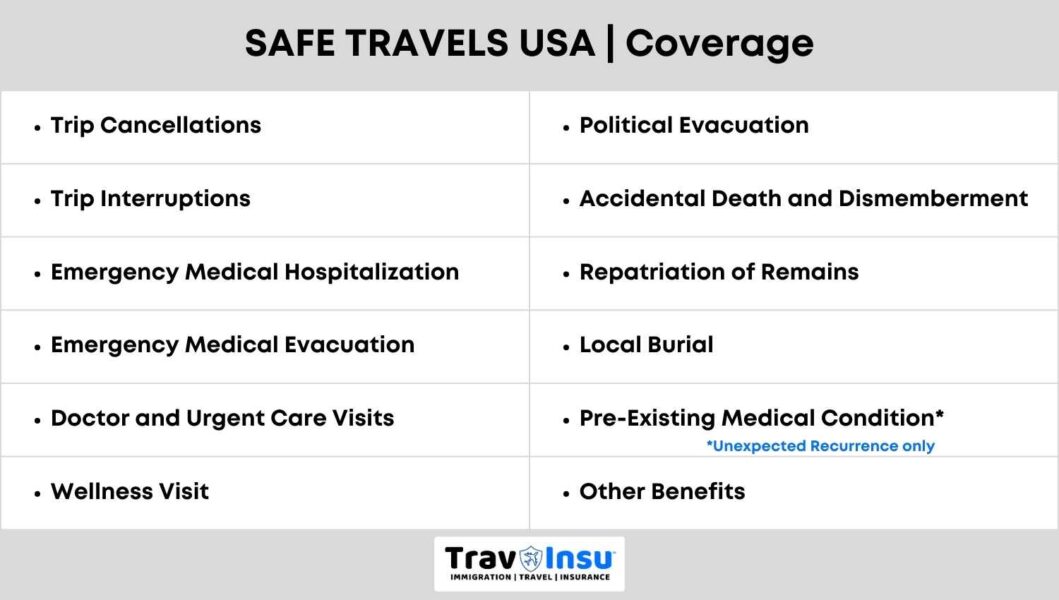

It Includes coverage for COVID-19-related expenses, as well as coverage for:

- Trip Interruptions

- Emergency Medical Hospitalization

- Emergency Medical Evacuation

- Doctor and Urgent Care Visits

- Wellness Visit

- Political Evacuation

- Accidental Death and Dismemberment

- Repatriation of Remains

- Local Burial

- Unexpected recurrence of Pre-Existing Medical Condition

- Other Benefits

Safe Travels USA Insurance Plan

- Safe Travels USA is designed for foreign residents visiting the USA or the USA and then other countries.

- This plan is not available to US Citizens or individuals residing in the US for more than 365 days.

- This plan is an excess temporary accident and sickness medical coverage/evacuation/ repatriation plan.

- This plan is extendable up to 364 days.

- Expenses for COVID-19 are covered and treated like any other sickness.

- Not available to green card holders in the USA.

- Not available for age 90 or above.

Eligibility Safe Travels USA Insurance

- For Non-US residents/Non-US citizens, traveling to USA or USA and then other countries

- Not available to individuals residing within the US for more than 365 days

- For Ages 14 days to 89 years

- Coverage Minimum 5 days Up to 364 days

- Extendable (Total) up to 364 days

Rates based on

- Age

- Policy Maximum selected

- Out-of-network deductible

Highlights Safe Travel USA

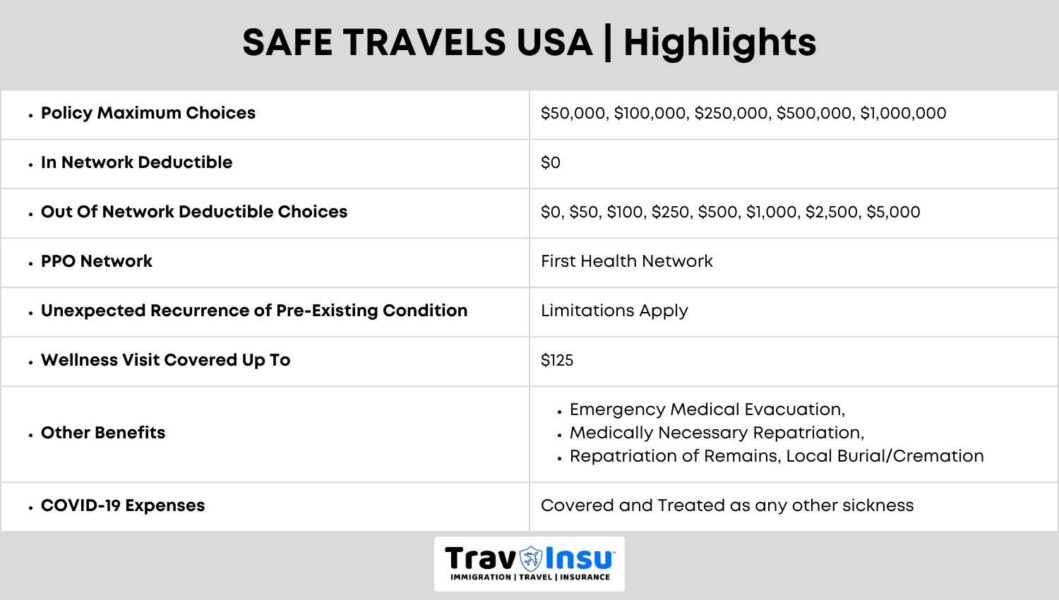

- Accident and Sickness Medical Policy Maximum Choices: $50,000 $100,000, $ 250,000, $ 500,000, $1,000,000

- Cardiac Conditions Limit (For ages up to 69): Up to $25,000(Per Policy period)

- Cardiac Conditions Limit (For ages 70 and above): Up to $15,000(Per Policy period)

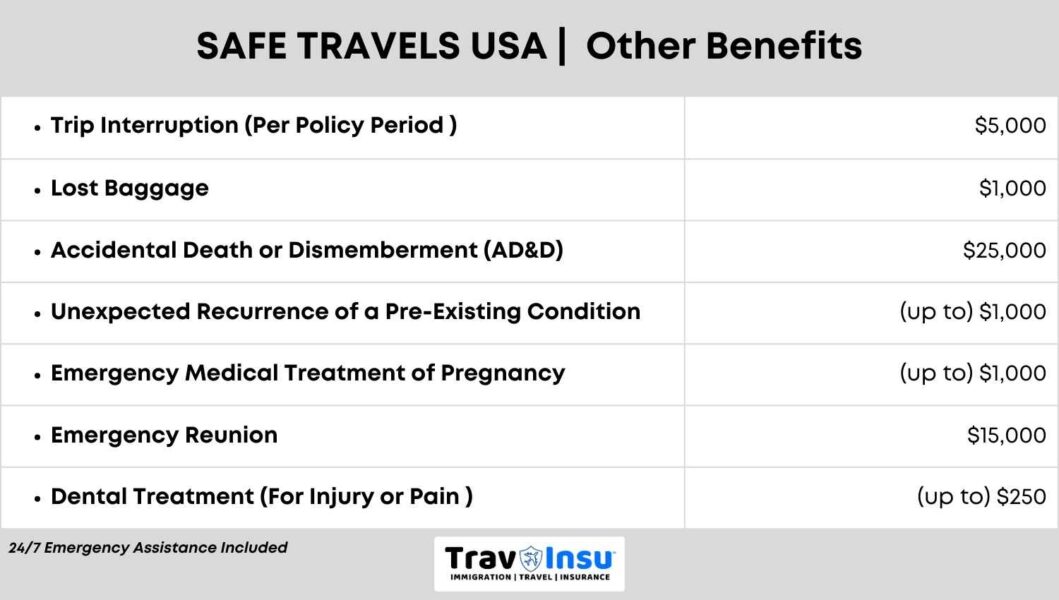

- Dental Treatment: Up to $250 (Per Policy period for injury or pain)

- In Network Deductible: $0

- Out-Of-Network Deductible Choices: $0, $50, $100, $250, $500, $1,000, $2,500, $5,000

- Co-Insurance:

- First Health Providers are (In Network) – 100%

- All Others are (Out of Network)

- In the USA: 80% of the first $5,000 then 100% up to the policy maximum

- Outside of USA: Up to 100%

- PPO Network: First Health PPO network

- Urgent Care Co-Pay: $30 Per Incident

- Unexpected Recurrence Of pre-existing condition: Limitations Apply

- Wellness Visit: Covered up to $125

Safe Travel USA Insurance Plans – Other Benefits:

- Emergency Medical Evacuation

- Medically Necessary Repatriation

- Repatriation Of Remains

- Local Burial

- Cremation

Medically Necessary Repatriation: 100% Up to $15,000 (Per Policy Period)

COVID-19 Expenses: Covered and Treated as any other sickness

Optional Benefits Safe Travels USA

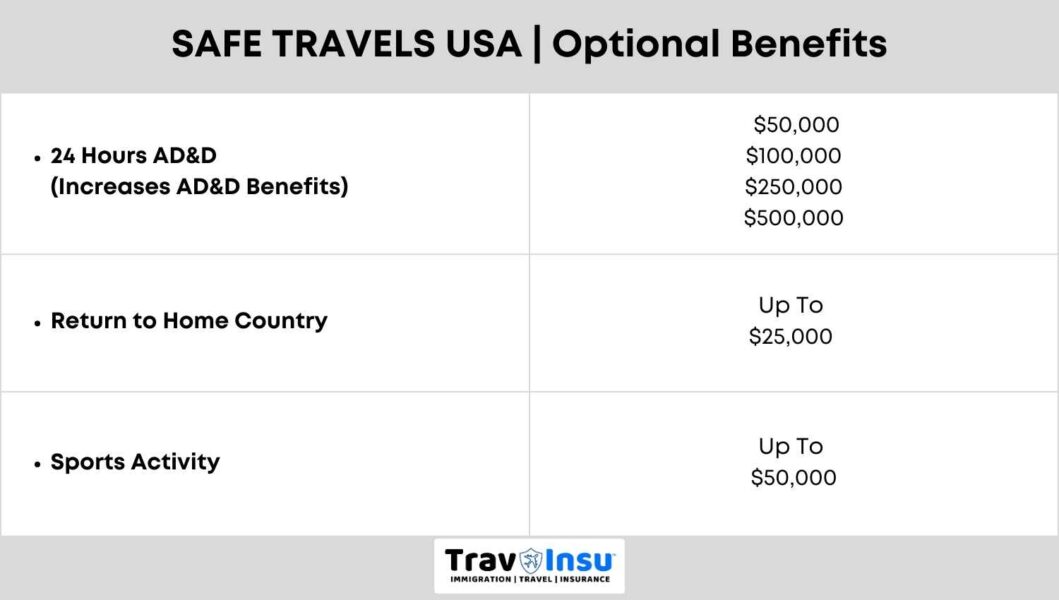

- 24 Hour AD&D: Increases AD&D Benefits

- Return to Home Country Coverage: Up to $25,000

- Sports Activity Coverage: Up to $50,000

Benefits Safe Travels Insurance

Some of the benefits provided by Safe Travels USA insurance plans include:

- Emergency Medical Expenses: Coverage for medical expenses incurred due to illness or injury while traveling

- Emergency Medical Evacuation: Coverage for the cost of transporting you to a medical facility in the event of a medical emergency

- Trip Cancellation And Interruption: Coverage for trip cancellation or interruption due to unforeseen events such as illness, injury, or death

- Baggage And Personal Effects: Coverage for lost, stolen, or damaged baggage and personal items

- (AD&D) Accidental Death And Dismemberment: Coverage for accidental death or dismemberment while traveling

- Sports Benefits: coverage while Practicing, Performing, or Participating in Class 1 or Class 2 sports

- Class 1 Sports Like Tennis, Swimming, Archery, Track, Volleyball, Golf, Cross Country

- Class 2 Sports Like Rugby, Soccer, Polo, Softball, Hockey, Karate, Baseball, Rowing, Basketball, Equestrian, Cheerleading, Lacrosse

Safe Travels Insurance – Limitations

It’s important to note that Safe Travels USA insurance plans come with certain limitations and exclusions. Some of these include

- Adventure Sports

- Some adventure sports and activities are not covered under these plans

- Terrorism

- Terrorism-related incidents may not be covered under these plans

- Policy Maximums

- Each plan has a maximum limit on coverage, which may not be enough to cover all expenses in the event of a major emergency

Here Are Some Other Plans From Trawick That Can Be Considered

Safe Travels USA Comprehensive Insurance

It is an affordable and popular option for visitors to the US who want comprehensive medical coverage during their stay.

This accident and sickness medical plan provides the most comprehensive coverage for travelers. including acute onset of pre-existing conditions.

The plan offers a range of deductibles and provides coverage, for medical emergencies, political evacuations, and other covered travel and medical expenses.

Offers coverage minimum of 5 days for up to 364 days.

A Travel Medical Insurance plan that provides medical coverage for non-US citizens who reside outside the US.

It includes coverage for

- Trip Interruption

- Emergency Medical Hospitalization

- Emergency Medical Evacuation

- Doctor And Urgent Care Visits

- Wellness Visit

- Political Evacuation

- Accidental Death And Dismemberment

- Repatriation Of Remains

- Local Burial

- Acute Onset Of Pre-Existing Condition Coverage (Requiring urgent treatment)

- Other Benefits.

The Safe Travels USA Comprehensive

The Safe Travels USA Comprehensive plan is designed for foreign residents coming to the USA or the USA and then other countries.

- This plan is not available to individuals residing in the US for more than 365 days.

- This plan is a temporary accident and sickness medical coverage/Evacuation/ Repatriation plan.

- The plan covers the acute onset of pre-existing conditions up to the policy’s maximum (For some ages)

- This plan is extendable up to 364 days

- Expenses for COVID-19 are covered and treated like any other sickness

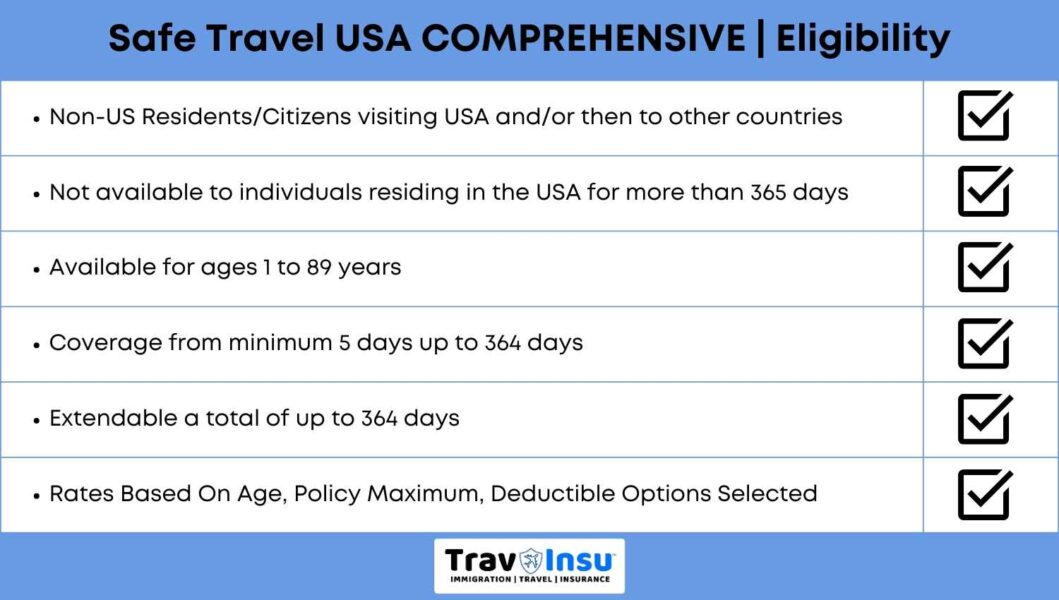

Safe Travels USA Comprehensive – Eligibility

- For Non-US residents/Non-US citizens, traveling to USA or USA and then other countries

- Not available to individuals residing within the US for more than 365 days

- For Ages 1 to 89 years

- Coverage Minimum 5 days Up to 364 days

- Extendable (Total) up to 364 days

Rates based on

- Age

- Policy Maximum selected

- Out-of-network deductible

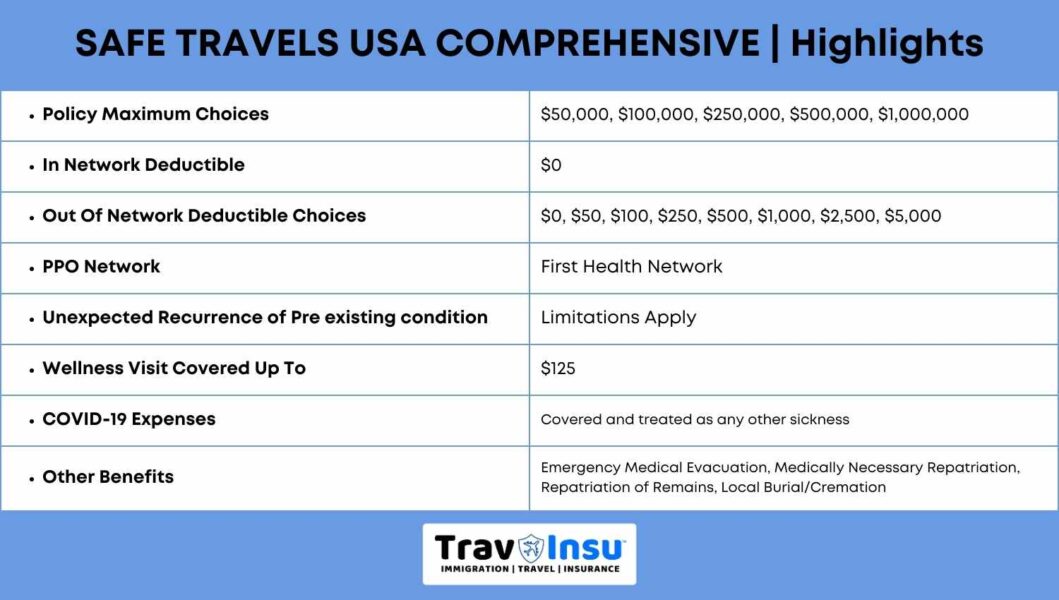

Safe Travel USA Comprehensive – Highlights

- Accident And Sickness Medical Policy Maximum Choices: $50,000 $100,000, $ 250,000, $ 500,000, $1,000,000

- Cardiac Conditions Limit

- For ages up to 69: Up to $25,000(Per Policy period)

- For ages 70 and above: Up to $15,000(Per Policy period)

- Dental Treatment: Up to $250 (Per Policy period for injury or pain)

- In Network Deductible $0

- Co-Insurance:

- First Health Providers are (In Network) – 100%

- All Others are (Out of Network)

- In the USA: 80% of the first $5,000 then 100% up to the policy maximum for covered expenses

- Outside of USA: Up to 100%

- In Network Deductible $0

- Out-Of-Network Deductible Choices: $0, $50, $100, $250, $500, $1,000, $2,500, $5,000

- PPO Network: First Health PPO network.

- Urgent Care Co-Pay: $30 Per Incident

- Acute Onset Of Pre-Existing Condition: Limitations Apply

- Up to ages 69: Up to the Medical Policy Maximum Purchased/Policy period except for coverage related to cardiac disease or conditions

- Reoccurrence within the same policy period will not be considered an acute onset of a pre-existing condition and shall not be eligible for additional coverage

- This benefit covers only (one) 1 acute onset episode

- Does not include coverage for known, scheduled, & expected medical care

- Wellness Visit: Covered up to $125

- Doctor Visit: From 50,000 to $1,000,000

- Other Benefits: Emergency Medical Evacuation, Medically Necessary Repatriation, Repatriation of Remains, Local Burial, Cremation.

- Medically Necessary Repatriation: 100% Up to $15,000 (Per Policy Period)

- Optional Benefit (24 Hour AD&D): Increases AD&D Benefits

- COVID-19 Expenses: Covered and Treated as any other sickness

What Is Safe Travels USA Comprehensive Travel Insurance?

- Safe Travels USA Comprehensive is designed for non-U.S. citizens residing out of the US, Traveling outside their home country, coming to the USA or to the USA and worldwide.

- Covered on the route to the US, and countries while en route to the US or on the way to the home country and countries on your itinerary.

- This plan offers medical accident and sickness medical coverage with acute onset of medical conditions to non-US Citizens.

- Provides both inpatient and out-patient benefits such as physician visits, labs, prescription drugs, and more

- The plan can be purchased for coverage for a minimum of 5 days up to a maximum of 364 days.

- This plan is extendable up to 364 days when purchased for a minimum of 5 days. Coverage has to be extended at the rates in force at the time of an extension.

- Expenses for COVID-19 are covered and treated like any other sickness.

Additional Details Of Safe Travels USA Comprehensive Insurance Plan

Here are some additional details of the Safe Travels USA Comprehensive Insurance Plan:

Safe Travels USA Eligibility

The plan is available to non-US citizens and non-US residents traveling to the United States or the USA and then to other countries

- Coverage Minimum 5 days for up to 364 days

- The minimum age for coverage is 14 days old

- Extendable for up to 364 days total

- For ages 1 to 89 years

- Not available to Individuals residing within the US for more than 365 days

- Rates are based on Age, Policy Maximum Choice, and out of Network Deductible

Safe Travels USA Coverage Limits

The plan provides up to

- $1,000,000 in medical coverage and

- up to $50,000 in travel benefits

The plan also includes coverage for emergency services, emergency medical evacuation, and repatriation of remains

Safe Travels USA Pre-Existing Conditions Coverage

- The plan provides limited coverage for the acute onset of pre-existing conditions.

Policy Duration

- The plan can be purchased for a minimum of 5 days up to a maximum of 364 days.

- Coverage can be extended if needed, as long as the policy has not expired.

Safe Travels USA Exclusions

- The plan does not cover certain activities, such as high-risk sports or activities

- Illegal activities, and

- Pre-existing conditions that do not meet the eligibility requirements

Safe Travels USA Premiums

The premium varies and are based on:

- Age of the traveler

- Coverage limits

- Deductible, and

- Duration of coverage

The premium can be paid in full at the time of purchase or in installments

Safe Travels USA Claims

To file a claim, you have to submit documentation of the expenses incurred and submit the claim within the specified time frame. The claims process is managed by the insurance provider and may take several weeks to process

Safe Travels USA Comprehensive Insurance – Claims

If you have a claim, you can follow these steps:

- Contact the claims department

- The first step is to contact the claims department of Safe Travels USA Comprehensive Insurance as soon as possible.

- You can find their contact information on their

- Website or

- In your policy documents

- They will guide you through the process of filing a claim.

- Gather all necessary documents

- Before filing your claim, make sure you have all the necessary documents such as your

- Policy number

- Proof of loss

- Receipts

- Medical records, and

- Any other relevant information.

- You may also need to provide a police report or accident report.

Fill out the claim form

You need to fill out a claim form, which you can obtain from the claims department. Make sure to fill out the form completely and accurately. Attach all the necessary documents to the claim form and submit it to the claims department.

Wait for a response

After submitting your claim, you will receive a confirmation from the claims department. They will review your claim and contact you for any additional information. You can check the status of your claim on their website or by contacting the claims department.

Receive payment

If your claim is approved, Safe Travels USA Comprehensive Insurance will send you a payment for the amount of the covered loss, minus any deductibles or other applicable fees.

Safe Travels USA Comprehensive Cost

The cost of Safe Travels USA Comprehensive insurance plan varies depending on several factors such as the

- Age of the insured person

- The duration of the coverage and

- The level of coverage selected

Generally, the plan cost ranges from $4 to $9 per day for an individual, depending on the factors mentioned earlier.

For example, a 30-year-old person traveling to the United States for two weeks can expect to pay around $70 for the Safe Travels USA Comprehensive plan with a maximum coverage limit of $100,000.

However, the actual cost of the plan may vary depending on the individual’s circumstances, such as

- Pre-Existing medical conditions

- The level of coverage required, and

- Other factors

It is important to note that the plan cost is subject to change based on the prevailing market conditions and the policy terms and conditions.

It is always advisable to obtain a quote from the insurer before purchasing the plan to get an accurate estimate of the cost of coverage. Additionally, it is recommended to compare the cost and features of different insurance plans to select the one that best fits the traveler’s needs and budget.

Which Company Administers Safe Travels USA Comprehensive?

The Safe Travels USA Comprehensive travel insurance plan is administered by Trawick International. Trawick International is an insurance company based in the United States that specializes in providing travelers worldwide

- Travel Insurance and

- Emergency Assistance Services

Safe Travels USA Cost Saver

This plan offers a lower level of coverage at a more affordable price. Offers coverage minimum of 5 days for up to 364 days

It does not include coverage for COVID-19-related expenses

It covers:

- Trip Interruption

- Emergency Medical Hospitalization

- Emergency Medical Evacuation

- Doctor And Urgent Care Visits

- Wellness Visit

- Political Evacuation

- Accidental Death And Dismemberment

- Repatriation Of Remains

- Local Burial

- Acute Onset of Pre-Existing Condition Coverage (Requiring urgent treatment)

- Other Benefits.

Safe Travels USA Cost Saver Insurance Plan

- Safe Travels USA is designed for foreign residents coming to the USA or the USA and then other countries.

- This plan is not available to individuals residing in the US for more than 365 days.

- This plan is an Excess temporary accident and sickness medical coverage/Evacuation/ Repatriation plan.

- This plan is extendable up to 364 days.

- Expenses for COVID-19 are not covered.

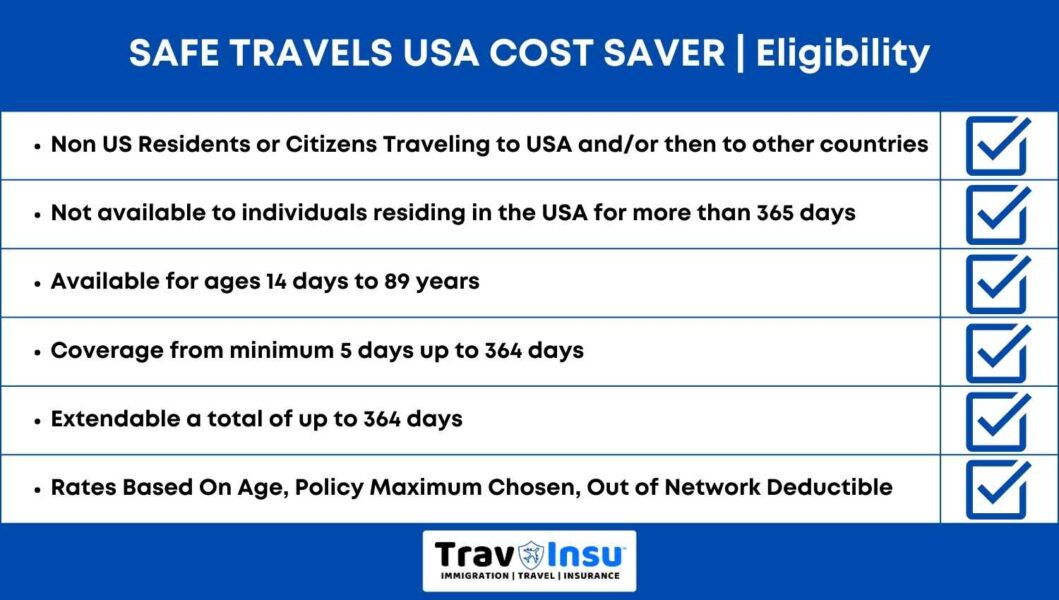

Eligibility Safe Travels USA Cost Saver Insurance

- For Non-US residents/Non-US citizens, traveling to USA or USA and then other countries

- Not available to individuals residing within the US for more than 365 days

- For Ages 14 days to 89 years

- International Coverage Duration Minimum 5 days Up to 364 days

- Extendable (Total) up to 364 days

Rates based on

- Age

- Policy Maximum selected

- Out-of-network deductible

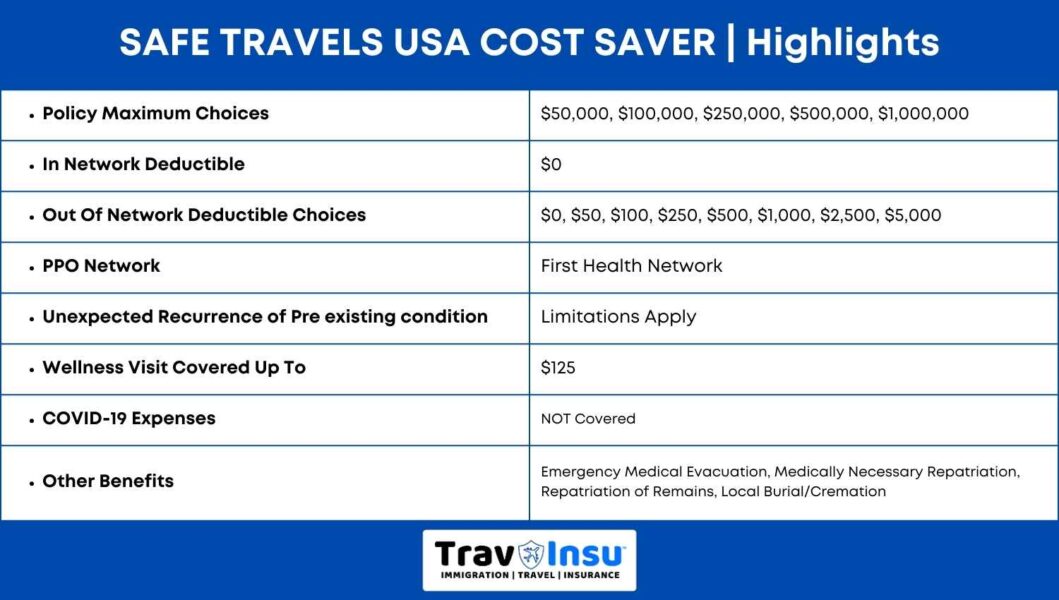

Highlights Safe Travel USA Cost Saver

- Accident and Sickness Medical Policy Maximum Choices: $50,000 $100,000, $ 250,000, $ 500,000, $1,000,000

- In Network Deductible $0

- Out-of-Network Deductible Choices: $0, $50, $100, $250, $500, $1,000, $2,500, $5,000

- PPO Network: First Health PPO network.

- Unexpected Recurrence Of Pre-Existing Condition: Limitations Apply

- Wellness Visit: Covered up to $125

- Other Benefits: Emergency Medical Evacuation, Medically Necessary Repatriation, Repatriation of Remains, Local Burial, Cremation.

- COVID-19 Expenses: NOTCovered

Safe Travels USA Comprehensive Insurance Plan

The Safe Travels USA Comprehensive Plan is a travel medical insurance plan suitable for foreign nationals, relatives, or parents visiting the USA that provides comprehensive coverage for non-US citizens traveling to the United States. The plan offers coverage for both

- medical expenses and

- travel-related benefits

including

- Trip interruption

- Trip cancellation, and

- Baggage loss.

Some key features of the Safe Travels USA Comprehensive Insurance Plan include:

- Medical Coverage: The plan provides medical coverage for illnesses and injuries that may occur during the trip. This includes emergency medical treatment, hospitalization, and outpatient care.

- Travel Benefits: The plan also includes travel benefits such as trip interruption, trip cancellation, and baggage loss coverage. If your trip is interrupted or canceled due to covered reasons, the plan will reimburse you for the non-refundable portion of the trip cost.

- Deductibles: The plan offers a range of deductibles to choose, allows you to customize your coverage to fit your budget.

- Network Providers: Safe Travels USA Comprehensive Insurance Plan has a network of providers throughout the United States, making it easy to find a provider in case of an emergency.

- 24/7 Assistance: The plan also provides 24/7 assistance services, including medical assistance, travel assistance, and emergency assistance.

Other Plans That Can Be Considered

Atlas America Travel Insurance

Frequently Asked Questions

What Is Acute Onset Of A Pre-Existing Condition?

Acute onset of a pre-existing condition is a sudden and unexpected outbreak or recurrence of pre-existing conditions that occur spontaneously and without a warning.

A pre-existing condition which is a chronic or congenital condition, or, that gradually becomes worse over time is Known, scheduled, may require medical care, and drugs or treatments existing prior to the policy effective date are not considered acute onset of a pre-existing condition.

Can You Cancel The Safe Travels USA Comprehensive Policy?

Yes the policy can be cancelled. The cancellation policy and refund may vary depending on the provider and the policy purchased.

Is Safe Travels USA Comprehensive Policy Renewable?

Yes, the policy is renewable. The plan can be extended online. The coverage can be purchased for a minimum of 5 days, If a minimum of 5 days is purchased the coverage may be extended.

Does Safe Travels USA Comprehensive Cover Pre-Existing Conditions?

Yes, the plan covers sudden and acute onset of a pre-existing condition for ages up to and including 69, The coverage for acute onset of pre-existing medical conditions is subject to certain limitations and exclusions.

Do Safe Travels USA Comprehensive Offer Dental Insurance Coverage?

The plan does not offer dental insurance coverage

Do Safe Travels USA Comprehensive Insurance Cover Dependents?

Yes, insurance covers dependents. The plan provides coverage for individuals and families visiting the US who are 89 years or younger by age.

Where Can I get Safe Travels USA Comprehensive Full Policy Details?

The full policy details can be found on the website of the provider or by contacting the provider directly

What Is The Coverage Limit For Safe Travels USA Comprehensive Plan

The coverage limit for the plan is up to $1,000,000 in emergency medical coverage. The plan also offers coverage for sudden and acute onset of pre-existing conditions up to the medical policy maximum purchased

What Is The Cancellation Fee If No Claim Is Made With The Company?

Generally, there is a $25 charge as a cancellation fee if no claim has been filed with the company. Only the unused number of days premiums will be considered refundable. However, if a refund is made, it is determined that a claim was presented on a covered person’s behalf.

Conclusion

After a complete review of Safe Travels USA, Safe Travels USA Comprehensive, and Safe Travels USA Cost Saver, it can be concluded that all three insurance plans are designed for non-US residents traveling to the United States. These plans provide comprehensive medical coverage, emergency medical evacuation, and repatriation benefits, among other travel-related benefits.

The Safe Travels USA Comprehensive plan offers higher coverage amounts and additional benefits, such as coverage for acute onset of pre-existing conditions, sports and activities coverage, and more. The Safe Travels USA Cost Saver plan, on the other hand, offers lower coverage amounts at a more affordable premium.

Disclaimer

Plan features listed are for your convenience and information purposes only. Please review the evidence of coverage and plan contract (policy) for a detailed description of coverage benefits. Terms and conditions of Coverage Benefits listed in the policy are binding