Medical Evacuation Travel Insurance

Medical evacuation travel insurance is important.

- Over 2 million tourists need emergency medical transportation each year

- Over 10 million get admitted to a hospital during international travel.

While you are traveling abroad, a sudden life-threatening illness/sickness or injury can sabotage your trip and leave you with long-term financial debt. And if you’re far from your home country, it’s even worse.

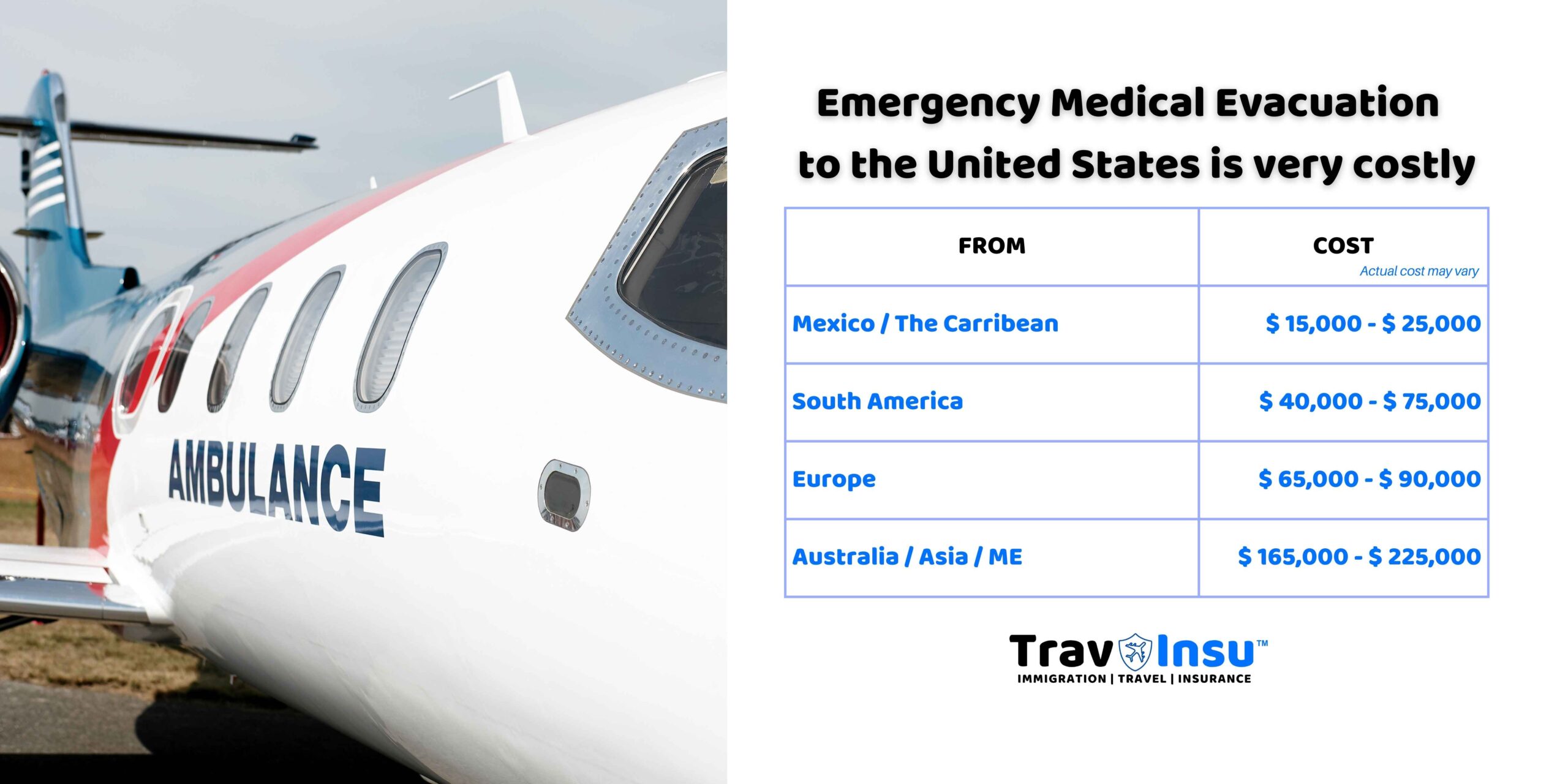

Medical expenses in some countries, such as the United States, are extremely high. Emergency Medical Transportation can cost tens of thousands of dollars or more, especially if you are in a remote location with limited medical facilities.

A comprehensive travel insurance plan with emergency medical evacuation benefits will help reduce out-of-pocket medical expenses, including the need for air ambulance transportation for urgent medical attention.

This article covers how medical evacuation also called medevac is a life-saver if you are traveling abroad and the importance of a comprehensive travel insurance plan that covers it. Before we delve into medical evacuation insurance let’s understand how travel insurance works.

What is Emergency Medical Travel Insurance?

A comprehensive travel insurance plan generally includes coverage for medical expenses for any new sickness, illness, or injury and emergency medical evacuation insurance.

Understand the differences between Comprehensive and Limited Coverage Plans.

Also known as medical evacuation and repatriation insurance. The maximum coverage amount varies from plan to plan, make sure to compare travel insurance plans and look around for a wider coverage amount.

It is an insurance policy that covers you if you need in the hospital while traveling overseas due to a sickness or accident. The cost of medical care overseas, without this insurance, might be rather costly.

Medical evacuation coverage transfers you to the hospital of your choice and subsequently to your nearest hospital. This can be extremely critical during a life-threatening situation.

Medical coverage covers medical emergencies while on vacation. Emergency medical evacuation covers the costs of transporting you to the nearest medical facility during a life-threatening situation. In a remote location, a hospital for treatment can be hundreds of miles away.

Pro-Tip: Opt for a travel insurance plan from a travel insurance company that offers medical evacuation coverage as part of the plan. Always read the travel insurance plan brochure/document carefully to ensure this is part of inclusion in the plan and not exclusion.

What are the different types of Evacuation Coverage?

There are two basic types of evacuation coverage:

- Coverage for medical evacuation (also called medevac)

- Coverage for security/political evacuation

Medevac Coverage

Medical evacuation coverage pays for the logistics and cost of transportation to and from a medical facility. Depending on your treatment needs, it will also transfer you to your home or to a nearby medical facility that can continue your care.

Security and Political Evacuation Coverage

Security and political evacuation cover your transit from a dangerous location to a safe location. Depending on the outcome of the issue, you and your dependents may be returned to your vacation destination or to your home.

How can I get Medical Evacuation Travel Insurance?

You can purchase emergency evacuation coverage with comprehensive travel coverage or an independent travel medical plan. Travel medical insurance and urgent travel insurance are sometimes included within comprehensive travel plans, which also cover trip cancellation insurance, travel delay insurance, trip interruptions, acute onset of pre-existing medical conditions, and luggage protection policies.

If you are not concerned about trip cancellation, you can locate policies that only cover medical-related travel difficulties.

What is Emergency Medical Evacuation Insurance and how does it work?

Generally, emergency medical evacuation policies are covered by a travel insurance package.

The majority of travel insurance companies offer minimal medical evacuation coverage. They transport you to the nearest medical facility that can handle your emergency in accordance with the terms of your contract with them.

More than two million tourists need emergency medical transportation each year and over 10 million are hospitalized overseas.

Before you buy travel medical insurance check the coverage amount and ensure you have a sufficient amount available in the plan to cover an unfortunate event.

Atlas America Insurance offers coverage up to $1mn lifetime maximum for emergency medical evacuation.

Safe Travels USA Comprehensive Insurance offers coverage up to $2mn for emergency medical evacuation.

When you require a medical evacuation, you need to get in touch with your plan’s provider, who will organize it, deal with family communications, offer language services, and offer assistance along the route.

When you are healthy enough to return home, they will make arrangements for medical transportation to the hospital of your choice in your country.

Why is it important to get Medical Evacuation Coverage?

The truth of life is that sickness, injury, and emergencies come unannounced, imagine these situations:

- A person has a heart attack while working on a volunteer project in the midst of the forest.

- An Adolescent kid is involved in a jet ski accident while on a family cruise and suffers a severe concussion at sea.

- A young woman falls and breaks her leg while hiking.

- Old parents are traveling and the father had a stroke.

- A young daughter’s graduation trip ends in a horrifying road tragedy hundreds of miles away.

Any such unfortunate event with a serious injury or medical condition will need immediate and further treatment. If this happens on international travel you will need medical transportation and also need to fly in a bedside companion from your family.

In extreme cases where a death occurs then the mortal remains will need repatriation. Before you plan your next trip ensure you account for having medical evacuation insurance coverage.

What makes Medical Evacuation unique?

Most travel insurance plans that extend coverage for evacuations and repatriation to those who travel to a foreign country for work on a regular basis also explain in detail how this coverage works in the policy document.

- Describes all forms of evacuations

Emergency medical expenses, foreign security evacuations, and repatriation are the primary focus of medevac programs. The travel insurance company must coordinate these efforts, and they normally manage payment to the rescue crew as well. Evacuations are only covered up to the policy limitations and for the reasons specified in the policy document.

- Take care of the people who are important to you

Medevac policies frequently contain emergency medical reunion and return of minor children benefits, allowing you to care for the people who are essential to you.

- AD&D or term life benefits are frequently included

Many Medevac plans also include accidental death and dismemberment (AD&D) and/or term life insurance.

- Extra benefits may be included

Some medical evacuation plans contain package-like advantages, such as:

- Interrupted journey

- Baggage misplacement

- Coverage for adventure sports

Why is Emergency Medical Evacuation Insurance necessary?

This benefit will ensure that you obtain medical assistance, no matter where you are in the world, even if it involves being evacuated to the nearest medical institution. An airlift could cost you thousands of dollars if you do not have this coverage.

Anyone traveling outside of the country is recommended to have emergency medical evacuation insurance. The insurance company provides transportation for you with an emergency medical evacuation plan, so you don’t have to worry about the logistics. Furthermore, you will not be required to pay for an expensive emergency medical evacuation out of pocket.

Any visitor’s travel medical insurance should include emergency medical evacuation insurance. It can also be applied as an add-on to any basic travel plan.

We have covered the top 10 reasons to buy travel insurance.

Do you need evacuation insurance for trips within the United States?

In some cases, medical evacuation travel insurance is a good option. If you are going on vacations or taking adventures that take place in a distant area, it is important that your property is evacuated. Depending on your health coverage, a medical treatment package may be provided for medical treatment. You will also have to pay the co-insurance and deductibles of the insurance you purchase.

Do I need emergency evacuation and repatriation coverage?

Sadly accidents are possible for everyone. When one is traveling in an unfamiliar place, bad events may have severe consequences. When traveling, there are many reasons to know that you’re protected by an insurance policy that will protect your money from theft. Repatriation of remains coverage helps transport the deceased individual’s bodily remains to the home country/country of residence as applicable.

What Is Covered by Medical Evacuation Insurance?

- Transportation in an emergency

Medical evacuation insurance can pay for the cost of emergency transportation to the closest suitable treatment facility if you become very ill or wounded while traveling and need prompt attention. If necessary for your health, it might also cover the cost of your return to the US.

Alternatively, if you’ve been treated but need to return to the United States for more treatment or to recover, it may pay for your return airfare.

- Your return home will be accompanied by a medical escort

Medical evacuation insurance may cover the cost of medical escort services if you require specialized treatment on your travel back home, such as a medical professional who can provide intravenous medications.

- The cost of bringing a friend or family member to you

If you are hospitalized while traveling due to an illness or injury covered by your policy, depending on the insurance plan, your medical evacuation travel insurance may pay for a round-trip flight for a friend or family member to come to stay with you.

Who should purchase Medical Evacuation Travel Insurance?

If you are traveling to a foreign country you should consider this insurance. Especially for the following situations:

- Families and individuals cruising

The medical facilities on a cruise ship are limited, and if you have a medical emergency, you’ll need coverage to plan and pay for your evacuation in order to receive proper medical care. If you are purchasing Cruise Insurance for you and your family members, do check if the plan will provide coverage for Medevac.

- Travelers to remote destinations

If you plan to go to remote locations and as generally known medical care is limited in a remote area, you will need assistance if you become very ill or injured and if your situation in such a condition is life-threatening.

- Foreign aid workers and missionaries

Missionaries and foreign aid workers frequently travel to politically hazardous places or countries devastated by natural disasters. Make sure you can save yourself if something bad happens so you can keep doing crucial tasks.

- International business travelers

When working in a foreign nation, you may have access to your own health care or universal health care, but without medical evacuation insurance, you will not be able to return home if something truly catastrophic occurs.

How much is the cost of medical evacuation from Mexico?

You will need to contact a business that specializes in medical evacuations and pay in advance for any services necessary if you don’t have a medical evacuation insurance plan.

For dedicated air ambulances to transport you from Mexico back to the US or Canada, these costs typically range from US$25,000 to US$60,000 and may be higher if your home country is further away.

If you are planning to visit Mexico for business or leisure, a Medical Evacuation Insurance Plan will ensure that you (or members of your family) are transported back to your home country’s hospital and doctors where you can be treated and have access to ongoing medical care.

What is a medical evacuation in health insurance?

Medical evacuation insurance covers the cost of urgent medical care in an emergency to the most appropriate care facility. The insurance can even reimburse you for going home for medical reasons to the USA.

If you need to be transported, either to your home country or to the closest suitable medical facility, Emergency Medical Evacuation offers transportation services. When you are stabilized, the plan may bring you home; however, you should confirm this with your insurance provider.

How much is medical evacuation from Europe to the US?

The average American medical evacuation is $25k per person based on the latest estimates. In Europe, costs could be up to $50,000. A nurse escort typically costs $11,000 within North America and $24,000 from Europe to North America.

Source: Travelex Travel Insurance’s latest report on medical evacuation costs.

How much does it cost to be medically evacuated from a cruise ship?

If your medical emergency is serious and urgent, emergency medical evacuation to the nearest suitable medical facility is necessary. This procedure can be an expensive nightmare without travel insurance. The price of a medical escort or stretcher flight can cost an additional $25,000 to $30,000.

Conclusion

We hope our article has helped you gather the information on why emergency medical evacuation insurance is important for your parents traveling to the US.

If you are looking for visitors insurance for your parents visiting the USA, we have compiled a list of some of the top insurance providers that offer such services.

Always travel under the cover of insurance!