USA Visitors Insurance for Parents Visiting from India

When it comes to Visitors Insurance for Parents visiting from India it needs to be a priority given the high medical expenses and healthcare costs in the USA.

While travel insurance coverage is not mandatory to visit the United States it is essential to prevent paying all unforeseen medical expenses from out-of-pocket.

Ensuring that their trip to USA from India and stay in the United States is comfortable, having travel insurance coverage benefits helps. Visitor insurance for parents visiting USA can be extremely helpful during medical emergencies.

We have listed the best visitor insurance plans for parents visiting USA, the listing is based on industry analysis, feedback from travel insurance companies, and online travel insurance marketplaces.

Visitor Insurance – Comprehensive Coverage and Limited Coverage Plans

When it comes to visitor insurance you can select a short-term health insurance plan that is either a comprehensive coverage or a limited coverage plan.

The difference will be in the policy’s maximum medical coverage, covered incidents, the amount payable per injury or sickness, medical emergencies covered, limits for emergency medical expenses, etc.

Understanding the differences between comprehensive coverage and limited coverage will be helpful.

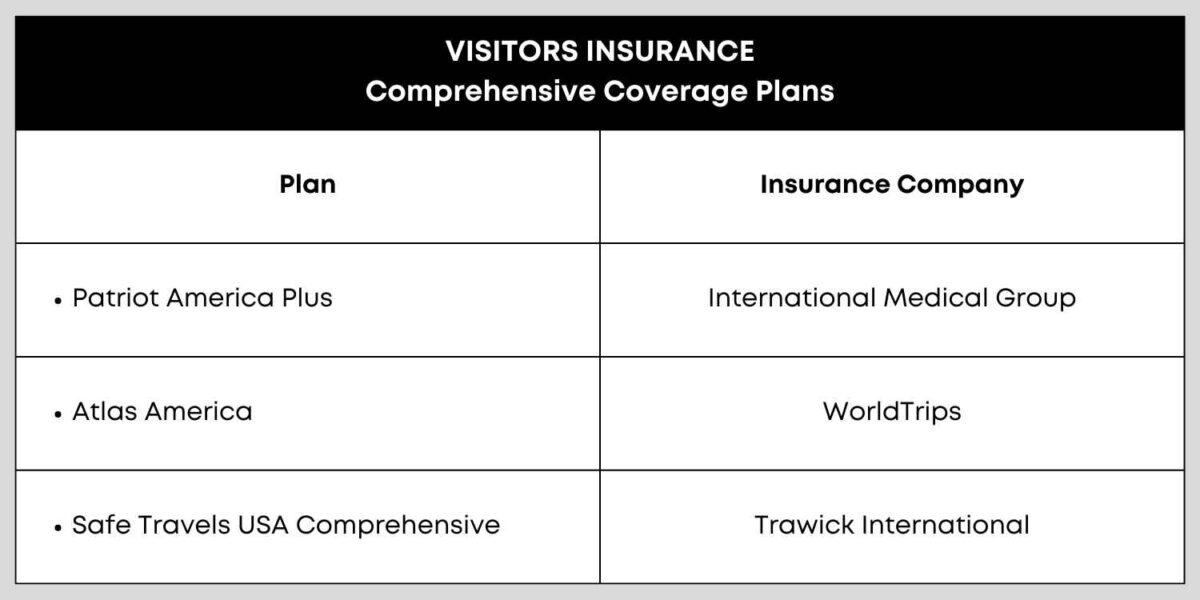

Best Comprehensive Coverage Visitors Insurance Plans

Best visitor insurance is a plan that meets your specific travel insurance needs. It is important to assess your needs before you decide to purchase a plan.

For example, a plan with the best medical insurance limit for the acute onset of pre-existing conditions can be useless for someone who does not have any pre-existing conditions. Do make a note of your requirements and see if the plan meets those needs.

Let’s look at some of the best visitor insurance plans that may be the best medical insurance for parents visiting USA.

When it comes to the best-selling travel medical insurance plans, the following 3 visitor insurance plans rule the charts and are offered by reputed insurance providers:

These 3 travel health insurance plans are very popular insurance for parents visiting USA offering a wide variety of insurance coverage with flexible policy maximum options and deductible choices.

These visitor insurance plans cover medical expenses for a new sickness or injury and also provide coverage for the acute onset of pre-existing medical conditions.

These visitor insurance plans also offer access to PPO Networks just like a health insurance plan. Do note that cashless settlement like in a domestic health insurance plan is not guaranteed with a visitor insurance plan.

Let’s look at the details of each of these “A” Rated plans:

PATRIOT AMERICA PLUS Travel Insurance

One of the best-selling Comprehensive Travel Insurance Plans from International Medical Group (IMG), a leading insurance provider. Patriot America offers the option of a higher coverage limit of up to $1mn.

The Coverage starts from ages 14 days up to 99 years. Available for a Coverage period of a minimum of 5 days to a maximum of up to 365 days. The plan is extendable for up to 24 continuous months.

Highlights

- Policy Maximum Options up to $1,000,000

- Acute Onset of Pre-Existing Conditions Cover

- Pre-Existing Conditions: No Coverage benefits

- Emergency Medical Evacuation

- Urgent Care Visits

- Emergency – Room Services, Eye Exam Coverage, Dental Coverage

- Prescriptions/Medication

- COVID-19 Coverage: Included

ATLAS AMERICA Travel Insurance

Amongst the high-selling travel insurance plans from Worldtrips a leading international travel insurance company. Coverage starts from ages 14 days up to 99 years.

Available for a Coverage period of a minimum of 5 days to a maximum of up to 365 days. The plan is extendable for up to 364 days.

Highlights

- Acute Onset of Pre-Existing Conditions Coverage

- Pre-Existing Conditions: No Coverage

- Emergency Medical Evacuation

- Urgent Care Visits

- Emergency – Room Services, Eye Exam Coverage, Dental Coverage

- Prescriptions/Medication

- COVID-19 Coverage: Included

SAFE TRAVELS USA COMPREHENSIVE Travel Insurance

This comprehensive coverage insurance plan from Trawick International Insurance Company is a popular short-term health insurance for parents visiting the USA.

Coverage starts from ages 1 year up to 89 years. Available for a Coverage period of a minimum of 5 days to a maximum of up to 364 days. The plan is extendable for up to 364 days.

Highlights

- Acute Onset of Pre-Existing Conditions Coverage

- Pre-Existing Conditions: No Coverage

- Emergency Medical Evacuation

- Urgent Care Visits

- Emergency Room Services

- Emergency Dental Coverage

- Prescriptions/Medication

- Emergency Medical Treatment of Pregnancy

- COVID-19 Coverage: Included

Best Limited Coverage Visitors Insurance Plans

Limited Coverage or fixed benefit travel medical insurance plans provide a fixed limit for any incident as defined in the policy document.

Some of the best-selling limited coverage or fixed benefit travel medical insurance plans from reputed insurance providers for parents visiting USA are:

- VisitorsSecure Travel Insurance

- Visitors Care Travel Insurance

VisitorSecure Travel Insurance

Available to international travelers for coverage when they travel anywhere outside their home country including the USA.

Coverage starts from ages 14 days to 89 years and is available for a minimum of 5 days to a maximum of up to 364 days. The plan can be extendable for up to 364 days

Highlights

- After the deductible, the plan pays Pre-Fixed Limited Coverage

- Coverage for Acute Onset of Pre-Existing Conditions

- Pre-Existing Conditions: No Coverage

- Emergency Medical Evacuation

- Urgent Care Visits

- Emergency: Room Services, Dental Coverage

- Prescriptions/Medication

- COVID-19 Coverage: Included

Visitors Care Travel Insurance

Highlights

Available to non-U.S. residents and non-U.S. Citizens traveling to the USA. Coverage starts from ages 14 days to 99 years and is available for a minimum of 5 days to a maximum of up to 364 days. The plan is extendable for up to 365 days

- After the deductible, the plan pays Pre-Fixed Limited Coverage

- First Health PPO Network

- Coverage for Acute Onset of Pre-Existing Conditions

- Outpatient & Inpatient Services

- Emergency: Room Coverage, Dental Accident

- COVID-19 Coverage

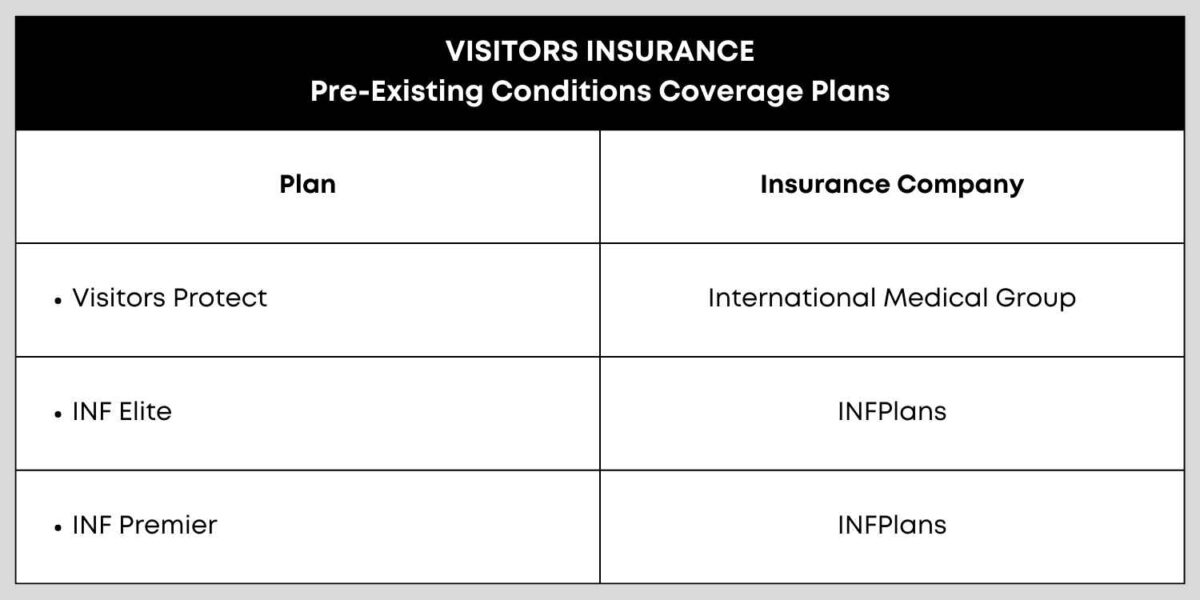

Best Plans Travel Insurance Plans to Cover Pre-Existing Conditions

Pre-Existing Medical Conditions are generally not covered in travel medical insurance plans.

For parents visiting the USA needing travel insurance to cover pre-existing conditions and not just acute onset of pre-existing conditions, the following travel medical insurance plans can be considered, these are plans from reputed insurance providers:

- Visitors Protect

- INF Elite

- INF Premier

Visitors Protect

This plan is available for purchase from a minimum of 90 days to 12 months. The plan maximum limits per injury or illness through age 69 are: $50,000, $100,000, or $250,000, and for Ages 70 and older: $50,000

Highlights

- Coverage for Pre-Existing Conditions

- Visitor insurance for parents visiting the USA, individuals, and families

- Maximum limits from $50,000 to $250,000

- Deductible options from $250 to $5,000

- Coverages for inside the U.S., Canada, and Mexico

- Coverage for medical expenses, evacuation, and repatriation

- Freedom to seek treatment with a hospital or doctor of your choice

Pre-Existing Conditions Coverage: Deductible: $1,500 per injury or illness (plan deductible waived). Maximum limit for pre-existing conditions through age 69: $25,000. Maximum limit ages 70 and older: $20,000

INF Elite

Highlights

- Coverage for non-US residents ages 0-99 years

- Short-term travel medical coverage (90 days to 364 days)

- Utilizes UnitedHealthcare Options PPO

- Includes coverage for Pre-Existing Conditions

- Pre-Existing Conditions Coverage up to $20,000 (Age 70-99) or $25,000, $30,000, $40,000, $50,000 (Age 0-69)

- Preventive and Maintenance Care

INF Premier

Highlights

- Coverage for non-US residents ages 0-99 years

- Short-term travel medical coverage (90 days to 364 days)

- Direct Billing may be available from providers

- Includes Pre-Existing Conditions Coverage (See plan details)

- Pre-Existing Conditions Coverage for ages 0-69 from up to $20,000 going up to $600,000 depending upon the maximum limit options selected out of 5 plan options

Please read the policy document for the respective plans before you shortlist them in your consideration, we have only listed a few highlights of the plans. The plan document details all the coverage limits and exclusions.

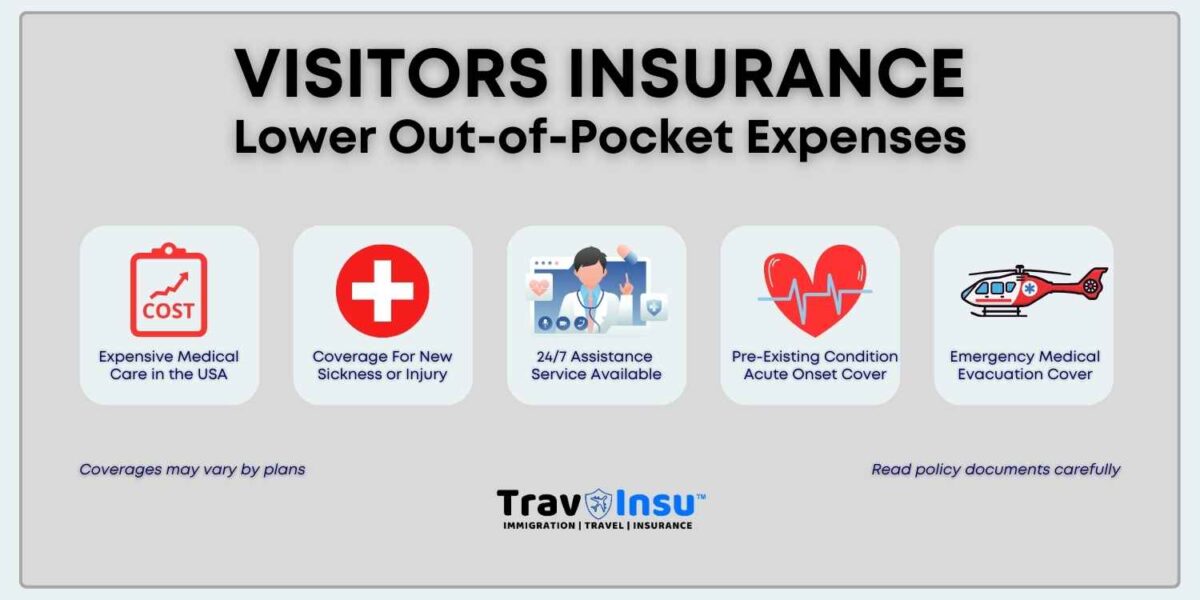

Visitors Insurance for Parents Visiting the USA – Top Reasons

Visitor insurance for parents visiting USA from India is important as the risks where you may need medical insurance coverage for a sickness, injury, or other medical emergencies.

A medical emergency can occur anytime to anyone at any place and emergency medical expenses can be extremely high in the USA.

Visitor insurance is critical for all international travelers visiting the USA to ensure they are covered for any new sickness, injury, or medical emergency:

- Due to the age factor parents are vulnerable to healthcare-related issues and medical emergencies, and visitors’ insurance can protect you financially by lowering the burden on emergency medical expenses

- Their domestic health insurance from their home country may not provide them with coverage limits overseas. Visitors’ insurance ensures they get coverage in the United States

- Healthcare costs in the USA are extremely high. Buying Visitor Insurance can help cushion the need to bear the medical treatment expenses.

- Accidents can happen anytime and if a medical emergency comes unannounced, the likelihood of such exigencies in new and unfamiliar surroundings is higher. Visitors’ insurance provides medical coverage for sickness and injury

- A trip to the hospital emergency room can mean thousands of dollars of medical expenses. Visitor insurance can help reduce your out-of-pocket expenses

- The U.S. healthcare system requires payment for services and without a health insurance plan, you will have to pay for medical treatment out of your pocket. Visitors insurance can help here too

- Having Visitor insurance does not guarantee cashless service at hospitals but you can get reimbursed for the medical expenses as defined in the visitor health insurance policy document

- If you have to be evacuated back to the nearest medical facility/home country for medical treatment, your insurance provider will coordinate and pay for the evacuation if your travel insurance plan covers it as a benefit.

- Emergency Medical Evacuation and Repatriation of Remains are two important travel insurance coverages to be considered for during search for insurance for parents and Senior Travelers

- Evacuation and Repatriation Coverage helps in times of desperate need of medical attention during a life-threatening situation or the demise of the insured person.

- For parents traveling from India or for that matter any other country, they can fall sick or get an illness while in the USA, visitor health insurance coverage can help in these situations

- The reason can be any like the stress of travel or the tiredness from long-haul flights, new surroundings, different weather, etc.

- If your parents need treatment or have to go to the hospital, the medical bills can put a burden on your finances

- Why pay medical bills from your pocket rather than have visitors’ insurance cover it?

- You need a travel medical insurance plan to cover your parents’ travel and stay in the USA, visitors insurance plans can help in dire medical situations

Having a good travel medical insurance plan means peace of mind for you and your parents.

You can Compare Travel Insurance Plans within minutes!

Keep these pieces of information handy when you generate a travel insurance quote to compare visitor insurance plans to purchase:

- Traveler’s Name

- Passport Number

- Duration of Coverage

- Date of Birth

- Destination

Domestic Medical Insurance OR Health Insurance In India

U.S. residents are well aware of the complexity and high cost of healthcare, visitors from other countries may not always be aware that medical care in the U.S. is not free.

When your parents are visiting USA from India you understand the medical risks involved. One question that comes to mind is will parents’ domestic health insurance in India provide them coverage benefits in the USA?

Most domestic health insurance coverage does not extend benefits when you leave the shores of the country. So if your parents are visiting USA from India it would be good to check the domestic medical insurance policy document if it provides international coverage and look for inclusions & exclusions.

Alternatively, call the customer service department to confirm their health insurance coverage to check for international benefits and then buy visitors’ insurance accordingly.

When parents are visiting USA from India the other question that will come to mind is should buy travel insurance from India or the USA.

The answer to this depends on many facets for consideration:

- Who is going to be following for claims?

- If you then dealing with a local travel insurance company will be easier.

- If parents then probably buying from India will be more beneficial

- Travel Insurance companies in the USA are regulated by the Department of Insurance

- Travel Insurance plans from the USA will provide access to the PPO network

- Visitor Insurance for Indian parents from the USA will be more expensive than buying from India

Health Insurance for Indian parents traveling to the United States is complex with many factors to consider.

Frequently Asked Questions About Visitors Insurance For Parents From India

Can I buy health insurance for my parents visiting the USA from India?

Yes, if your parents are non-U.S. Residents and non-U.S. Citizens visiting the USA on a B-1/B-2 visa, you can buy travel health insurance for your parents in the USA.

Visitor insurance can also be purchased for US citizens or green card holders living overseas, or traveling to the USA on other types of visas, do read the policy document to ensure eligibility for the short-term medical insurance plan you want to purchase.

Which country offers cheaper travel insurance, India or the USA?

Travel Insurance for parents visiting the USA from India will be cheaper to buy from India. But if you calculate the cost impact to your pockets you may find US travel medical insurance plans to eventually turn out more cost-effective.

Health insurance is regulated in the United States and you have recourse in case of disputes in claims etc, this privilege may not be available when it comes to travel health insurance plans from other countries.

There is a higher probability of travel health insurance plans from the USA being recognized at medical facilities. Managing the claims process would be easier to coordinate for you if you live in the USA and are considering buying visitor insurance for your parents visiting USA.

Do I need to worry about COVID-19 in 2023 for elderly parents?

Many travel medical insurance plans now offer coverage for COVID-19 as standard. Read the visitor insurance policy document to ensure the plan you shortlist, the coverage benefits includes Covid-19.

The travel insurance coverage plan for my parents be canceled if their travel plans change?

Yes. If the travel medical insurance plan date is not effective you may be able get complete reimbursement of the premium or there may be some fees and/or pro-rata refund.

Read the visitor insurance policy document of the plan you plan to purchase as the cancellation clause may vary by plan.

Can I buy travel health insurance for my parents or do they have to buy it themselves?

You can buy travel medical insurance for your parents, try an online travel insurance marketplace where you can get free quotes, and also be able to compare travel insurance plans.

Finding the Best Travel Insurance for Parents Visiting USA

When it comes to travel insurance coverage you need to invest some time to list down your requirements and evaluate visitor insurance plans that meet those insurance needs.

The plans listed in this article are the travel insurance plans being bought by thousands of people, you can add them to your consideration.

Always read the visitor insurance policy document before you buy travel insurance. It is important to note that travel insurance only pays for eligible medical expenses, assuming that an incident or sickness will be covered for parents visiting the USA will not help.

You need to ensure you have the right visitor insurance plan, if you need pre-existing medical conditions coverage benefits the plan needs to cover them.

Pay attention to the fine print in the visitor insurance policy document to avoid disappointments during claims.

Bon Voyage!