A Complete Guide To Senior Travel Insurance

Senior Travel Insurance purchase is being prudent in protecting your Trip Cost and your travel.

It would appear that last-minute changes are more likely to ruin a trip, and in some instances, the money spent on nonrefundable purchases may be at risk. For Senior Citizens, the risks are higher as last-minute health issues can also prevent you from traveling.

In the event that unforeseen obstacles prevent you from going on the trip you may be able to get reimbursed for a significant part of the nonrefundable trip cost. Trip Insurance helps you protect your Trip cost and extend coverage to other uncertainties of travel.

Travel Insurance for a senior citizen will provide medical coverage if things go wrong when you are in the midst of a trip and get sick or suffer an injury. Travel Medical Insurance is designed to protect you and pay for eligible expenses covered in your travel insurance policy.

People who are older than 65 have options to choose from when it comes to travel insurance, but it is essential to have a solid understanding of the specifics of senior travel insurance. Also, given the age special attention should be paid to the medical coverage policy maximum.

Even the most well-laid plans can be derailed if an emergency arises in your home country, your destination, or while on the way to when you are traveling or returning back from your trip.

Read more about What is Travel Insurance?

Travel Insurance Options

There are multiple ways to get the travel insurance coverage you need.

- Credit Cards: One of the benefits offered by the majority of credit cards is some form of travel insurance. These plans are designed to provide assistance in the event that a traveler’s baggage is misplaced or delayed, in case of trip cancellation or trip interruption if a flight is delayed or canceled, or other changes need to be made to a trip that was paid for with a specific credit card. They may have limited medical coverage and more travel-related coverage.

- Embedded Trip Insurance coverage: if you are used to booking all your trips from travel marketplaces like Expedia, Booking.com, and the like, you can also buy trip insurance through the embedded options where you click and protect your trip. These are through the tie-ups such marketplaces have with trip insurance providers.

- Insurance Company: you have the option to buy travel insurance directly from a specialist travel insurance company like IMG, Seven Corners, or WorldTrips.

- Travel Insurance Marketplace: There are travel insurance marketplaces that offer you the benefit of Quote-Compare-Buy travel insurance. They offer unique advantages where you are able to compare travel insurance from different insurance companies.

Read our guide on How Does Travel Insurance Work?

When shopping for senior travel insurance for senior citizens, you shouldn’t rely on the default option provided by your travel provider or credit card issuer. Medical coverage should be an important element of your travel insurance plan and the maximum limit available for the plan should cover the risks and medical expenses you may incur.

Instead, you should look into purchasing additional coverage. There are a lot of things to think about, such as how far away from home you plan to be, the possibility of getting hurt or sick (including any pre-existing medical conditions you may have), and what aspects of potential injuries or illnesses may already be covered by other insurance policies you already have. Emergency medical transport in case you need it overseas.

A little research on the medical expenses in the destination country can help you in this process. For example, relatively speaking medical expenses in an Asian country may be affordable as compared to the United States. However, Medical Evacuation could cost a lot in any country if an air ambulance is involved.

Also read: Top 10 Reasons to Buy Travel Insurance

For instance, emergency medical evacuation might not be included in the coverage, but local transportation to the hospital could be covered. Keep in mind that the coverage provided by domestic health insurance plans is especially limited when traveling outside the country. Domestic health insurance may cover preexisting conditions, and medical evacuation in a life-threatening situation, but these coverages and limits may not apply overseas.

Domestic health plans are good at protecting you in the home country but the moment you step out of the country for international trips you have health issues, need medical evacuation, hospitalization, etc. You will need travel insurance protection to cover any unforeseen medical expenses.

Traveling International? Read our Guide on Essential Documents for International Trips

What Does Senior Travel Insurance Cover?

Medical emergencies usually come unannounced, having travel insurance coverage especially Senior Travel Insurance provides coverage to senior travelers for:

- Trip Cancellation

- Trip Interruption

- Trip Delay

- Lost or Delayed Baggage Coverage

- Lost Documents Coverage

- Cancel for Any Reason (CFAR)

- New Sickness or Injury

- Acute Onset of Pre-Existing Medical Conditions

- Emergency Medical Coverage

- Emergency Medical Evacuation

- Repatriation of Remains

- AD&D: Accidental Death and Dismemberment

- Eligible Medical Expenses like a hospital room, doctor visit, etc.

It is important to note that all plans do not provide coverage for all the options listed above. Most travel insurance plans exclude coverage for preexisting medical conditions. This is even more true for senior travel insurance options. Senior travelers are high-risk consumers for travel insurance companies hence limited options are provided by companies to limit their exposure.

Visiting the USA? get details on carrying prescription medicines with you on your Trip to the USA

Best Insurance for a Senior Traveler

The best senior travel insurance is one that meets your travel insurance needs. It helps to list down the coverage needs based on the destination and activities planned.

As a senior traveler if you have an active lifestyle and plan to participate in leisure activities with high risk like Skiing etc. ensure that these are covered by the plan you shortlist.

Generally, seniors save money as many countries have discounts available to seniors on public transport and other such government and private services. However, when it comes to travel insurance the entire cost of the premium with add-on coverages is generally higher than that for a younger traveler.

Medical costs for treatment to seniors can be high hence this factor also impacts the pricing apart from several other factors. Travel Insurance providers consider all factors and then price the product.

If you are going on an expensive vacation you may need Trip cancellation coverage with a CFAR add-on.

Similarly, if you have medical issues then you may want to consider travel medical insurance with benefits like coverage for the acute onset of a pre-existing condition.

Travel insurance is primarily of 2 types:

- Trip Insurance plan

- Travel Medical Insurance plan

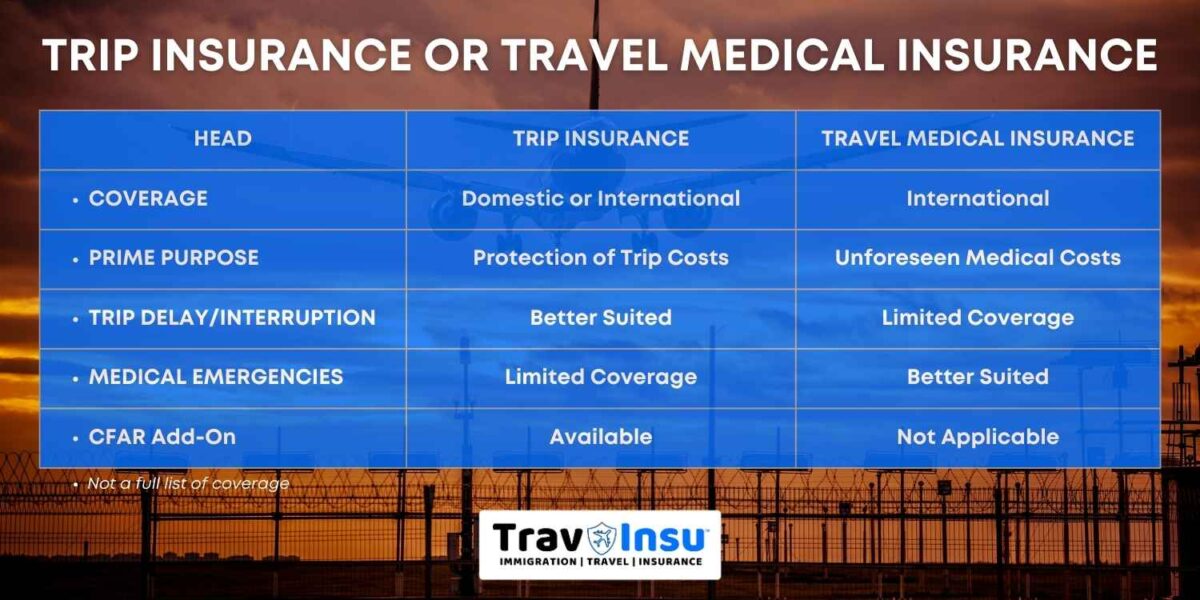

Some key differences between a trip insurance plan and a travel medical insurance plan are:

Trip Insurance is designed for the financial protection of your trip costs while travel medical insurance focuses more on medical coverage and emergency medical evacuation coverage limits. Their primary objective is very different.

There are several overlaps as well between trip insurance and travel medical insurance. Assess your needs and select an option accordingly. You will get CFAR insurance in trip insurance but travel medical insurance may not offer CFAR coverage apart from cancellation benefits provided in the plan.

If you are visiting a country with low healthcare costs you may be better off with Trip Insurance depending on how much the trip costs you. But if you are traveling to a country like the United States where healthcare costs are very expensive then you may want to consider travel medical insurance.

Within Travel Medical insurance you have the option to buy limited or fixed coverage travel insurance plans or comprehensive travel insurance plans. It is highly recommended to buy comprehensive plans as the coverage limits are higher and these plans offer wide coverage.

Read more on Comprehensive vs Limited Coverage, which option is best for you?

If you take several international trips then you can save on travel insurance by purchasing options of annual multi-trip policies but for one-off travel insurance for seniors, a single-trip plan would be the best fit.

Planning to travel in a group? Read more on Travel Insurance for Groups.

International Travel Insurance For Seniors Over Age 65

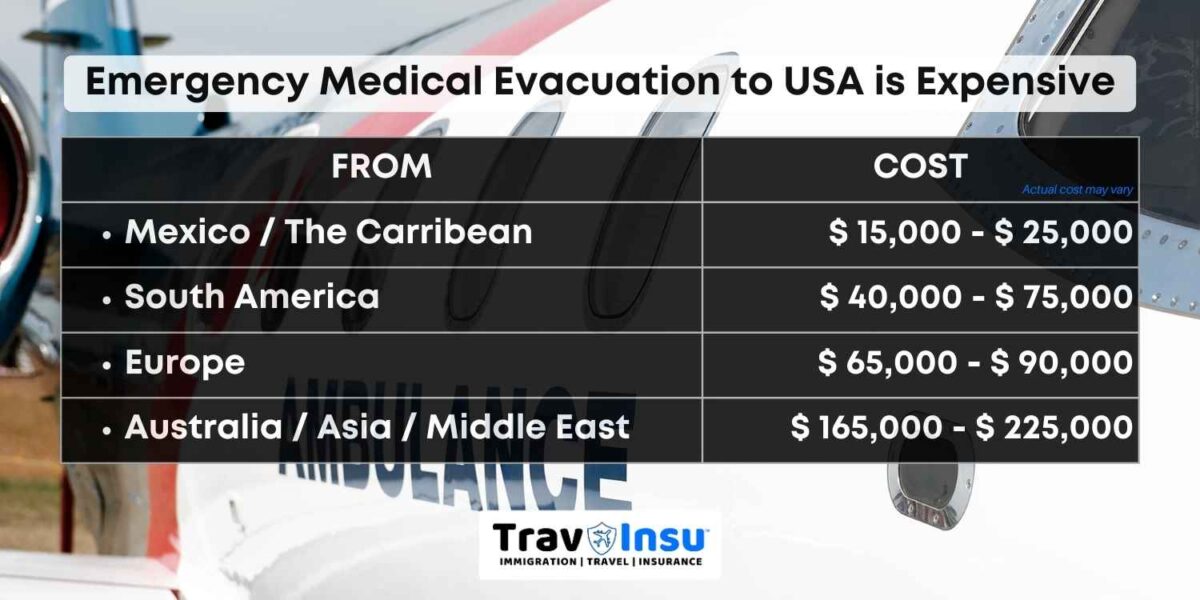

Travel Insurance for Seniors traveling internationally is extremely critical. Unexpected medical expenses can burn a hole in the pocket and also spoil a vacation. If you don’t have emergency medical evacuation coverage then it can become a question of life and death. Medical

Evacuation is always very expensive and if the evacuation involves an air ambulance then the costs can become exponentially high.

Emergency Medical Evacuation costs or Medevac costs to the United States can run into thousands of dollars.

Similarly, if senior travelers visiting the United States have medical issues and need medical evacuation to the nearest hospital in a life-threatening situation, the costs can run into thousands of dollars. Senior Travel insurance needs to offer coverage for such incidents.

Senior travel insurance costs can be higher than that for a young traveler. The premium for travel insurance takes into account the age of the person, the destination, the number of days coverage needed, healthcare costs in the country being covered, coverage for pre-existing medical conditions (acute onset), and several other factors.

Also Read:

- If you are a AAA member you can explore the Travel Insurance Options for AAA Members

- If you have a Costco membership then explore the Travel Insurance Options for Costco Members

- If you are visiting the United States then read more on Health Insurance for Parents Visiting USA

Best Senior Travel Insurance for High Coverage

Travel Insurance for Seniors generally comes with lower coverage limits. This is done so by insurance companies to limit their risk and exposure. You may be able to find some travel insurance plans that offer higher coverage for at least some of the coverages within the policy or you may be able to add on higher coverage at a cost. Search for travel insurance on a marketplace and compare plans before you buy. Read the policy document on the coverage limits for each type of incident.

Coverage for Pre-Existing Conditions

Travel Medical Insurance generally only covers the acute onset of preexisting medical conditions. Some Trip Insurance plans may have a medical condition exemption waiver that will eliminate the conditions that you are currently experiencing. The waiver can be obtained within 2 – 3 days of receipt of the initial deposit.

Frequently Asked Questions – FAQs

Do seniors need travel insurance?

For seniors travel insurance is essential. These policies are meant to provide security on the trip and may also protect you against unexpected events or disasters. Travel insurance benefits are many like coverage for trip cancellation, trip interruption, coverage for medical emergencies, reimbursements for a doctor visit, and eligible medical expenses paid…

Can you get travel insurance if you are over 70?

Yes, there is travel insurance for seniors available, though the options tend to get limited with age and the coverage amount may have lesser defined limits. The policy document is a good resource to see the eligibility of a travel insurance plan.

What is the average cost of travel insurance?

Travel insurance costs vary but the average is around 10 to 12%. Trip Cancellation can cost you the nonrefundable part of your trip cost f you don’t have trip cancellation coverage. Trip Cancellation insurance will protect you. If you have a medical emergency then the medical expenses can ramp up, and medical evacuation coverage can protect you. When it comes to travel insurance for seniors while you want to consider the costs, knowing that the premium is high in travel insurance for seniors. Don’t look for the cheapest policy but read the policy document carefully to ensure you have the coverage you need. Even if you have to pay extra for additional coverage assess the need and include it in your plan.

Which is the best international travel insurance company?

While there are several lists that get published on the best travel insurance companies, what you need to be cautious of when evaluating travel insurance is if it meets your travel insurance needs as a senior citizen. The coverage options for travel insurance reduce with age as the insurance companies want to lower their risk. The coverage limits, policy maximum, and per-incident coverage limits are things you want to pay attention to when buying travel insurance.

Remember insurance companies are in this business to make money and the way they manage this is by offering coverage but ensuring that their profits remain intact. So policies are designed in a way to minimize their risks of payouts. Some specialist travel insurance companies you can consider are Seven Corners Travel Insurance, IMGlobal Travel Insurance, and WorldTrips Travel Insurance…

Can you buy just medical travel insurance?

Yes, you can buy Travel medical cover available as part of a comprehensive plan. Look for plans based around the traveler’s specific needs if needed i.e. seniors. A Travel Medical Insurance plan will also offer some travel-related coverage like trip cancellation coverage, trip delay coverage, loss of baggage or passport, etc…

What is the age limit for travel insurance?

The options of coverage through travel insurance for seniors start to dwindle with age. The medical coverage limits in the health insurance component may reduce a per-incident or per-policy period. These are ways insurance companies protect their risks. While travel insurance is available for seniors as aged as 99 years, the policy maximum limit will be restricted and each individual plan will have inclusions, exclusions, and restrictions. Generate a free travel insurance quote on a travel insurance marketplace and compare plans before you buy.

Which travel insurance provider offers the best travel insurance?

When looking to buy travel insurance see if the company specializes in international travel insurance and check for their A.M.Best Ratings, apart from this look for their reviews on websites like Trustpilot – Best in Travel Insurance Company. Also, pay attention to the underwriters of the policy, one insurance company may work with different underwriters for different series of plans. Ensure the underwriter has a good rating.

Conclusion

If you are visiting a foreign country and face health-related issues which need medical attention, travel insurance will be of great help.

Your domestic health insurance in your home country may not extend coverage in a foreign country. In some countries like the USA medical treatments can be very expensive, staying in a hospital room may be more than the cost of an entire treatment for the same condition in your home country.

Unforeseen events can happen to anyone, be it active travelers, frequent travelers, or a senior on a one-off trip. Buy travel insurance, look for high maximum limits, read the fine print in the policy document, buy insurance for every trip, and buy annual insurance for multiple trips to save money.

Travel Safe with Insurance!