Guide to Travel Insurance Options for AAA Members

AAA Membership is a smart investment for people taking road trips and needing help in an emergency. If you get stuck by the roadside you can call AAA!

Trip Insurance is a smart investment if you want to protect your trip from any unforeseen events like flight delays, trip cancellations, or trip interruption. If you are in a dire situation overseas you can call the concierge services if provided in your travel coverage.

A Trip Insurance policy also covers travel risks, medical risks, flight disruptions, etc. Having these risks covered adds an extra layer of protection against financial loss.

Medical Emergencies come un-invited. When you travel domestically within the United States your health insurance coverage options may protect you from such medical emergencies. During international travel, your domestic insurance may not protect you overseas, this is where travel insurance comes into play.

Travel insurance can relatively be inexpensive after taking into account how much you will have to pay out of your pocket if something goes wrong during your trip: trip cancellation, accidents, baggage loss, and medical expenses can quickly add up.

If you are still thinking if travel insurance is worth it then see The Top 10 Reasons to Buy Travel Insurance.

As a AAA member, you must be familiar with AAA Insurance, did you know that with AAA Insurance you can also consider buying AAA Travel Insurance?

Let’s get to know what is AAA, and what travel insurance options are they offering. This AAA Travel Insurance Review may help you in evaluating if this is a good option for your next trip.

For Costco Members, we have covered Costco Travel Insurance.

What is AAA?

AAA (pronounced as ‘Triple A’) stands for American Automobile Association. It is a not-for-profit federation of 32 motor clubs with more than 1,000 offices throughout the United States. Established in 1902 by nine motor clubs with less than 1,500 members, AAA serves more than 61 million members today.

The AAA offers travel services such as hotels, cars, flights, cruises, and travel information, as well as member savings, automotive repair services, insurance, and financial services.

Since its founding, the association has been an advocate for motorists, safer roads and vehicles, better-educated drivers, and the rights of travelers.

Does AAA offer Travel Insurance?

Yes. AAA offers several travel insurance policies through its partnership with Allianz Global Assistance, a world leader in the travel insurance and assistance industry.

Allianz Global Assistance is a part of the Allianz Group. Allianz is of the world’s largest insurers, with 40 million customers in the United States, and operating in 35 countries.

You don’t have to be an AAA member to buy AAA travel insurance.

Note: Travelers who contracted COVID-19 before or during their trip can make use of temporary claim accommodations provided by AAA travel insurance partner Allianz Global Assistance. You can stay informed about the most recent coverage guidelines by consulting your AAA Trip Advisor. Always read the policy document carefully before you purchase travel insurance.

If you need assistance when traveling abroad, the Allianz travel insurance partner’s resources are available through the AAA Mobile app.

If you do have a AAA membership and plan to travel shortly or you are thinking of getting a AAA membership for its benefits, we cover AAA travel insurance options in this blog.

Compare Travel Insurance Plans

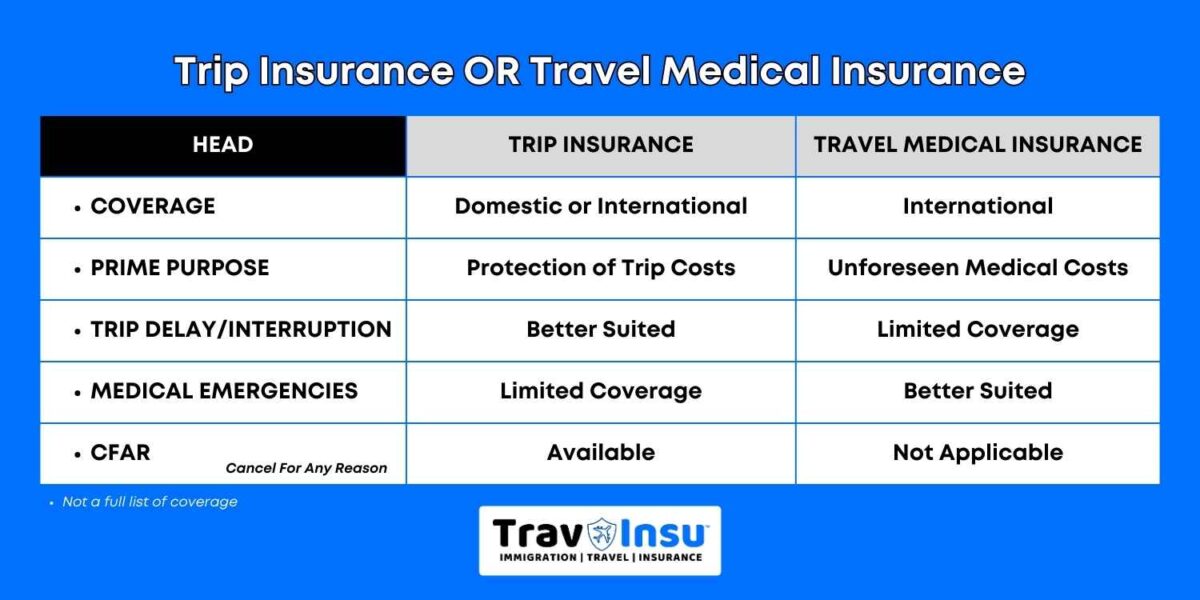

What is the Difference between Trip Insurance and Travel Insurance?

Trip Insurance and Travel Insurance are used interchangeably for buying insurance when you travel, but are these different?

There are some significant differences when it comes to Trip Insurance and Travel Insurance.

For Domestic travelers, Trip Insurance is a more suitable form of coverage option. Trip cancellation coverage and trip interruption coverage really come in handy when you need to use them.

The prime objective of TripInsurance is to offer protection to your financial investment in the Trip Costs, everything else follows.

The prime objective of Travel Insurance is to provide you protection against unforeseen medical expenses when you travel.

Travel Insurance is also known as Travel Medical Coverage or Travel Medical Insurance, it is also popularly known as Visitors’ Insurance.

You can buy either of these coverage options for a single trip or for multiple trips.

Best Travel Insurance Plans:

- Atlas America Insurance

- Safe Travels USA Comprehensive

- Safe Travels USA Cost Saver

- VisitorSecure Fixed Benefit Plan

Guide on How Travel Insurance Works? gives a detailed understanding of the benefits.

If your next trip is a group travel then our article on Travel Insurance for Groups may be of interest to you.

Compare Travel Insurance Plans

AAA Travel Insurance Plans and Costs

There are two types of AAA Travel Insurance Plans both for domestic and international travel:

- Single Trip Travel Insurance Plans

- Annual Travel Insurance Plans

The policies will differ by US state and the travel destination. So the plans available in your home state vary with other states. An annual plan is better suited for frequent travelers taking multiple trips a year.

Single Trip Plans

AAA’s single-trip plans will provide coverage for one trip where you are leaving home, traveling for a time (a month or less), domestic or international, and then returning home. It doesn’t matter if you go to multiple destinations as long as you leave your home and return home only once, it is considered a single trip.

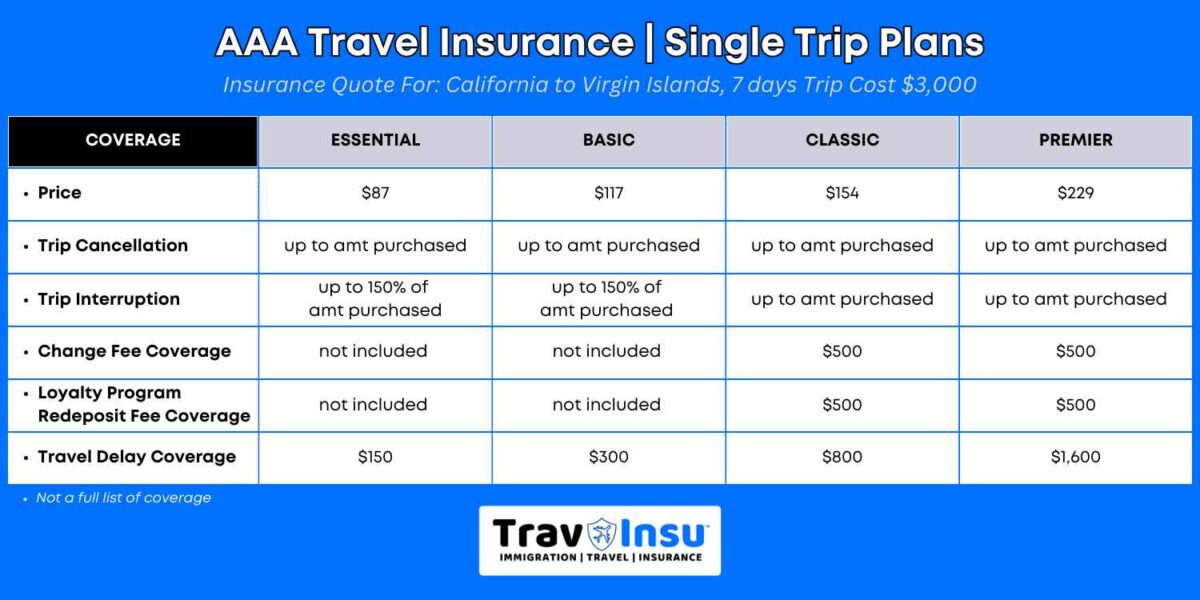

AAA offers 4 different Single-Trip Insurance Plans:

- Essential Plan

- Basic Plan

- Classic Plan

- Premium Plan

Let’s take a look at the pricing and coverage of each plan for a person aged 43-year-old traveling on a weeklong vacation from California to the Virgin Islands with a total trip cost of $3,000.

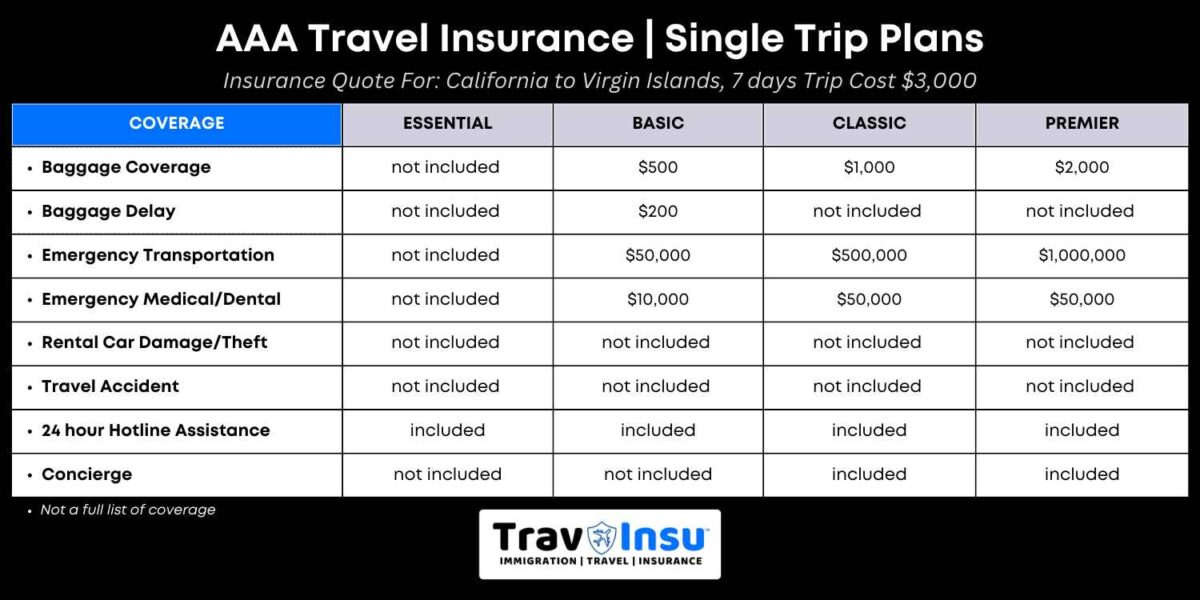

The Essential Plan ($87)

- Travel Delay: $150

The Essential Plan is AAA’s lowest-priced plan and hence ideal for the domestic traveler who just wants trip cancellation and trip interruption insurance but does not need other protection or benefits.

It has no medical coverage or evacuation benefits, and no baggage loss coverage.

If you already have health insurance in the U.S. and don’t have the plan to bring business equipment, this is a good travel insurance option.

The Basic Plan ($117)

- Travel Delay: $300

- Baggage Coverage: $500

- Emergency Medical Transportation: $50,000

- Medical Emergency/Dental Coverage: $10,000

The Basic Plan has all the features of the Essential Plan, plus medical coverage and increased coverage for baggage loss/delay and travel delays.

It offers $10k in Emergency Dental and Medical coverage which can be just enough for domestic travel if your health insurance can help out. And the $50k in Emergency Transportation may only be adequate for travel within the USA.

Out-of-state or international travel expenses could add up quickly.

This plan is an affordable option for weekend getaways and overnight trips and may not be sufficient for international destinations.

The Classic Plan ($154)

- Change Fee Coverage: $500

- Loyalty Program Redeposit Fee Coverage: $500

- Travel/Trip Delay: $800

- Baggage Coverage: $1000

- Baggage Delay Coverage: $300

- Emergency Transportation: $500,000

- Emergency Medical/ Dental Coverage: $50,000

The Classic Plan has increased coverage for Emergency Transport, baggage coverage, and travel delays, with additional features from the basic plan.

Another version of the Classic Plan is with RTW ($211.00) with the same benefits except the Medical Emergency/Dental coverage is lower at $25,000.

The Classic plan also offers a “Cancel For Any Reason – CFAR” optional upgrade at an extra cost.

The Premier Plan ($229)

- Change Fee Coverage: $500

- Loyalty Program Redeposit Fee Coverage: $500

- Travel/Trip Delay: $1600

- Baggage Coverage: $2000

- Baggage Delay Coverage: $600

- Emergency Transportation: $1,000,000

- Emergency Medical/ Dental Coverage: $50,000

The Premier plan is almost identical to the Classic plan but with 2 times the Emergency Transport, baggage coverage, and limits for trip delays.

This plan is the most expensive since it offers the highest coverage options.

However, it would be beneficial to have higher medical coverage benefits. At least, $100k in medical coverage is preferable since hospitals can often charge an average of $4k per day. $50k in medical coverage will fly past quickly should you have a serious injury.

$1m in Emergency Transportation is extremely high. It is preferable to have more medical coverage instead.

Please Note: Coverage benefits and insurance premiums are subject to change, always check for current information in the plan document.

Annual Plans

The Annual Travel Insurance Plan which is also called Multi-Trip Insurance provides 365 days of domestic and international coverage from the date the policy starts (date the policy is effective).

The plan is designed for frequent travelers, especially business travelers. So if you plan to travel more than once a year, domestically or internationally, it is better to buy a multi-trip policy instead of buying separate travel insurance.

Traveling Domestic? Have you heard of Skiplagged? Skiplagged is a travel hack used by savvy travelers to save money on their flights.

AAA Travel Insurance offers two different annual travel plans:

- Annual Deluxe

- Annual Executive

The Annual Deluxe Plan

The Annual Deluxe Plan is a good option if you don’t need business equipment protections or pre-trip cancellation benefits. But you want to have medical coverage while you are traveling abroad.

This plan is only sufficient if you already have some travel insurance through a credit card.

- Travel Delay: $600

- Baggage Coverage: $1000

- Baggage Delay: $200

- Emergency Transportation: $100,000

- Emergency Medical: $20,000

- Rental Car Damage & Theft: $45,000

- Travel Accident: $25,000

The Annual Executive Plan

The next three Annual Executive Plans are tier based on the amount of trip cancellation and interruption coverage provided ($5,000, $7,500, or $10,000). All the rest of the features under the Executive Plans are identical.

The three plans include business equipment coverage as well as business equipment rental and delay protections.

- Change Fee Coverage: $500

- Travel Delay: $1600

- Baggage Coverage: $1000

- Baggage Delay: $1000

- Business Equipment Coverage: $1000

- Business Equipment Delay/Rental: $1000

- Emergency Medical Transportation: $250,000

- Emergency Medical: $50,000

- Rental Car Damage & Theft: $45,000

- Travel Accident: $50,000

If you are traveling for work frequently, these plans may be suitable for you. However, do note that a single trip in these four annual plans cannot exceed 45 days.

Rental Car Damage Protector Plan

This protector plan provides $1,000 of trip interruption and baggage loss coverage and $40,000 of car damage and theft coverage.

If the rental car is stolen or damaged, this protection will cover your expenses. If your baggage gets lost or damaged, you will also be compensated for the period of your trip that was not used. This is an alternative to purchasing car insurance coverage at the rental counter.

Which AAA Travel Insurance plan is the best?

The best AAA Travel insurance plan will depend on what type of coverage you are looking for.

Before shopping for a travel insurance policy, check what coverage you already have. Some premium credit cards offer travel insurance provided the bookings are made using the credit card. If you already have such a credit card and the coverage options are adequate, you may only need a standalone emergency health insurance policy.

For example, the Business Platinum Card from American Express offers $10,000 per trip and $20,000 per year in trip cancellation insurance. The Annual Executive Plan has a comparable level of trip cancellation coverage.

If the coverage provided by your credit card is not enough, or you don’t have credit card coverage, then you should get a comprehensive plan such as single or annual trip plans, depending on your travel needs.

AAA offers a few plans, but your choices will depend on whether you are looking for annual or single-trip insurance plans. And the rates and options will differ by state, so be sure to enter your details correctly when looking for the right plans.

If you are a Senior Traveler, you can get more information from this Senior Travel Insurance Guide.

What is not covered by Travel Insurance?

There are many benefits of buying travel insurance but you have to be aware that your insurer cannot cover you under all circumstances. Always read the policy documents carefully to understand the inclusions, exclusions, limits, and restrictions before you decide on the travel insurance policy.

You will have to pay attention to know exactly what type of coverage you are getting.

Here are some expected exclusions:

- Adventure Sports and Activities: Most travel insurance plans will not have coverage options for adventure sports like skydiving, rafting, mountaineering, bungee jumping, scuba diving, and other types of high-risk sporting activities that are life-threatening. You will be taking part in these activities at your own risk, some high-risk activity coverage may be available as add-on benefits.

- Natural Calamities: Travel insurance usually covers unpredictable natural calamities such as earthquakes, hurricanes, pandemics, etc. But if you bought the travel insurance policy after the event has already taken place or the government released the notice of the calamity, then you will not be eligible to claim for any loss or damage.

- Intentional Behavior: Losses brought on by self-inflicted harm, drug use, intoxication, and criminal activity are not part of the travel insurance coverage options.

It’s important to note that exclusions may differ depending on the policy and where you reside, so it’s always smart to read the fine print to make sure you understand what is and isn’t covered.

Compare Travel Insurance Plans

Frequently Asked Questions

Does AAA offer Travel Insurance?

Yes. AAA offers travel insurance in partnership with Allianz Global Assistance. However, the travel insurance coverage option will depend on your state of residence and the length of your trip. There are various options for single trips and annual trips.

Single-trip plans are the best choice for travelers who are going from their place of residence to another location (whether it’s domestic or international) and then returning. Annual trip plans are made for those who intend to take multiple travels in a year, regardless of how frequently they return home.

Is Travel Insurance included with AAA Membership?

There is no travel insurance be it international travel insurance or domestic travel insurance, included with membership, but you can purchase AAA travel insurance from their website. However, the AAA membership plan offers several benefits as we have discussed.

Does AAA offer International Travel Insurance?

Yes, international travel is covered by AAA’s travel insurance products through their partnership with Allianz Global. To check the plans that are best suited for you, you can visit the AAA travel insurance site and get a quote.

Does AAA provide international benefits?

Many international Motoring Clubs participate in AAA Global Discount Programs. Members of these clubs are eligible to get discounts when traveling internationally thanks to AAA’s international partnerships (attractions, museums, hotels, retail stores, and restaurants).

How much does AAA Travel Insurance cost?

The length of your trip, where you live, the destination you are visiting, your age, and the level of coverage you choose are just a few of the factors that influence how much your AAA Travel Insurance cost will be.

Do all Credit Cards come with Travel Insurance?

Travel insurance is not a given with all credit cards. In some cases, you might be able to pay extra to get policies like emergency medical coverage or trip cancellation and interruption through your credit card provider.

Depending on the card type and the credit card issuer, the credit card can offer a variety of insurance coverage. These are often high-end credit cards that provide travel insurance. You’ll receive information on all of the insurance’s features along with your credit card’s welcome package.

Do Trip Insurance and Travel Medical Insurance cover the same things?

Both trip insurance and travel medical insurance have similarities and distinctions between the two types of coverage. The purpose of trip insurance is to safeguard your financial investment in a trip, whereas travel insurance offers more options for medical coverage.

Does Travel Insurance Offer Coverage for Pre-Existing Medical Conditions?

Travel insurance is designed to provide coverage for any new sickness or injury, most travel insurance plans do not cover pre-existing conditions. Some plans do offer coverage for the acute onset of pre-existing medical conditions.

Is it worthwhile to purchase Travel Insurance?

Yes, it can give you peace of mind that you will likely be covered financially if something goes wrong while on vacation. Your coverage will be useful in the event of a canceled flight, lost or damaged luggage, or medical attention in an emergency.

Most policies are not very expensive, so it is worth paying the premium to have some financial protection for your trip.

Although it’s never fun to anticipate unforeseen circumstances that can cause your trip to be cut short, think carefully before opting not to get a policy about how much risk you’re ready to accept. This will help you figure out if travel insurance is worth buying.

What is Emergency Medical Evacuation? Can I be sent to my home country during medical evacuation?

In a life-threatening situation, if you need medical evacuation, the cost of medical transportation to the nearest adequate medical facility where you can receive treatment is covered as part of your medical evacuation in an emergency. The medical evacuation generally is only to the nearest medical facility where you can receive treatment. Medical evacuation in an emergency is essential to save your life, read the policy document carefully to understand what circumstances are eligible for evacuation to your home country if your plan provides this benefit.

Is AAA membership worth it?

AAA membership offers a wide range of discounts and benefits. The perks stretch beyond automotive benefits with discounts and offers available for all types of travel including flights, hotels, vacation planning, and much more. Also, AAA offers a variety of insurance products, such as life, home, auto, and AAA travel insurance.

The main downside is that it may not be for everyone. If you are not a frequent traveler who is taking advantage of roadside assistance, emergency services, or travel discounts, the membership fee you are paying can be a waste of money. Also, the discounts are offered only by the AAA partners, so certain auto repair shops, hotels, and car rental services will not be offering discounts to AAA members.

Emergency roadside assistance may also be provided as a value-added service or an add-on at a nominal cost to your vehicle insurance policy do check with your insurance company.

Compare to the other insurers who are providing similar services, AAA insurance offerings tend to be costlier.

Ultimately, the worth of an AAA membership will depend on how frequently you plan to use their services. If you travel extensively and want to feel secure, AAA will provide you with the services you require quickly and affordably.

The Bottom Line

AAA is a great organization and they have a lot to offer. They have partnered with Allianz an insurance company of repute. Allianz is one of the world’s largest insurers and their plans are provided by AAA travel insurance. In the global insurance market, Allianz has one of the highest insurance ratings.

According to our AAA travel insurance review, the plans can be expensive and offer fewer travel medical benefits. We suggest that you shop around to find lower prices with more comprehensive travel insurance coverage. Many different insurers offer cheaper travel insurance with comparable or even greater travel perks.