Safe Travels USA Cost Saver – Review

Safe Travels USA Cost Saver is a budget-friendly, comprehensive travel insurance plan that is designed to provide, medical coverage and other travel and emergency services-related benefits, for non-US citizens and international travelers visiting the United States.

The plan is available to individuals, groups, and families. The plan provides coverage to visitors:

- aged up to 90 years traveling to the USA

- who reside outside the U.S. and

- are traveling outside their home country

It is a secondary/excess plan providing all the options available under the Safe Travels medical insurance and coordinates and covers medical expenses that the primary health plan does not cover like medical evacuation, co-insurance, and deductibles. The plan is administered by Trawick International.

Healthcare costs in America are extremely expensive. When it comes to traveling to the USA, it’s important to have adequate travel insurance coverage to protect yourself against unexpected medical expenses. Travel medical insurance should be a priority when traveling out of your home country.

If you are new to travel insurance knowing how travel insurance works is a good place to start.

If you are here searching for health insurance for parents visiting the USA, knowing these details will be beneficial.

Safe Travels USA Cost-Saver – Will It Cover You?

This plan is designed for non-US citizens traveling to the United States.

It Covers Non-US Citizens

- En-route to the USA

- While in the USA

- In Countries while on the way to the USA

- On the way to the Home country

- As well as countries on the Itinerary

This plan is not available to

- US Citizens

- US Residents

- US Green Card Holders in the United States of America

- US Green Card holders traveling to the United States of America

- Anyone who has been residing in the United States for more than 365 days (Prior to the policy effective date

Safe Travels USA Cost Saver Plan Details

- A.M. Best Rating: “A”

- Administrator: Trawick International

- Underwritten By: C&F Crum & Forster SPC

- Coverage Type: Comprehensive Coverage

- Medical Benefit Options: Up to $1,000,000

- Extendable: Yes (up to 364 days total)

- Cancelable: Yes

- Pre-Existing Conditions: Unexpected recurrence of Pre-Existing Conditions covered.

- Terrorism Coverage: Excluded

- COVID-19 Expenses: Excluded

The plan offers various levels of coverage, including options for trip interruption, baggage loss, emergency medical evacuation, and other travel-related risks.

You can purchase coverage from 5 days up to 364 days, If purchased for a minimum of 5 days it can be extended for 364 days.

Within the PPO network (After the deductible is satisfied)

- The plan pays 100% of eligible medical expenses up to the policy maximum.

Outside the PPO network,

- The plan pays 80% for the first $5,000, and

- Then 100% thereafter towards eligible covered expenses for each sickness or injury.

Compare Travel Insurance Plans

Safe Travels USA Cost Saver Insurance – Is It The Right Choice? Factors To Consider

This plan is one option that visitors to the USA may want to consider. But is it worth buying?

If you still have questions about travel insurance and whether it is worth it?

Knowing the top 10 reasons to buy travel insurance may address any questions you might have.

Remember that your primary health plan in your home country may not cover you when you travel internationally.

In this review, we’ll take a closer look at the benefits and limitations of the Safe Travels USA Cost Saver travel insurance plan, to help you decide whether or not, it’s the right choice, for your travel needs.

This plan is worth buying or not depends on a variety of factors, including:

- The individual’s travel plans

- Health insurance needs and

- Budget

Some other things to consider when evaluating this product include:

- The cost of the plan compared to the benefits provided

- The specific coverage options included in the plan and whether they meet your needs

- The plan’s exclusions and limitations, including any pre-existing condition exclusions

- The company’s reputation and track record in the travel insurance industry

- The ease of purchasing and using the plan, including customer service and claims support

It’s always a good idea to carefully review the terms and conditions of any travel insurance plan before purchasing it and to compare multiple options to find the one that best meets your needs and budget.

Here is some general information about the plan and some factors to consider when deciding whether or not to purchase this plan.

What Type Of Insurance Plan Is Safe Travels USA Cost Saver?

This is a travel medical insurance plan designed to provide medical coverage for travelers who are visiting a foreign country and may not be covered by their primary health plan from their home country while traveling abroad.

Travel medical insurance plans typically provide coverage for emergency medical treatment, medical evacuation, repatriation of remains, and other medical expenses related to illness or injury during the trip.

This plan specifically provides coverage for non-U.S. citizens traveling to the United States, as well as U.S. citizens returning to the United States from abroad.

The plan is available for individuals and families and offers several different levels of coverage to choose from, with varying limits and deductibles. Coverage can be purchased for trips up to 364 days in length.

This plan offers a lower level of coverage at a more affordable price. Offers coverage minimum of 5 days for up to 364 days.

It does not include coverage for COVID-19-related expenses.

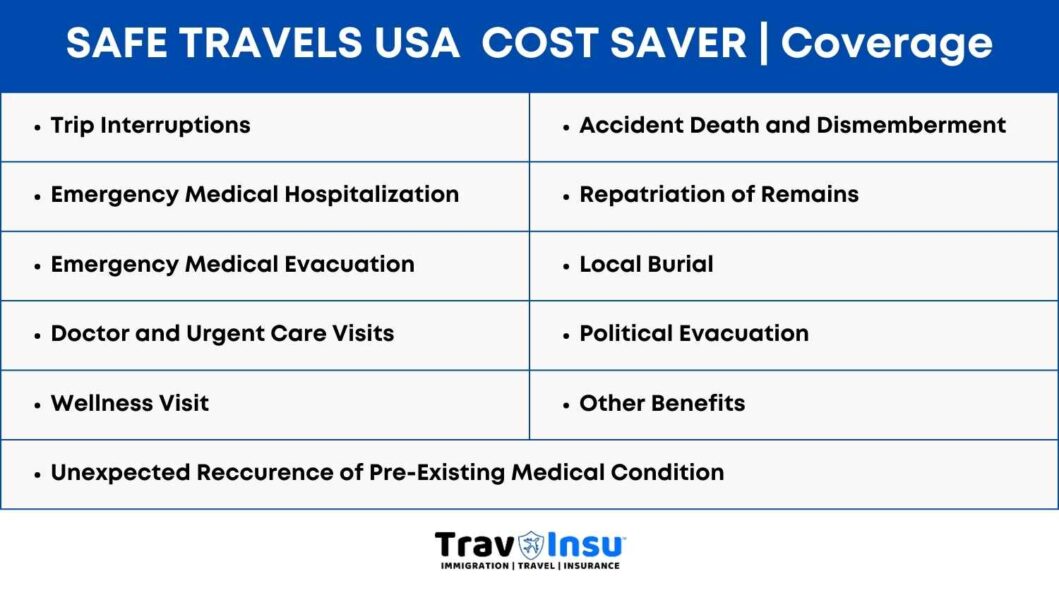

It covers:

- Trip Interruption

- Emergency Medical Hospitalization

- Emergency Medical Evacuation

- Political Evacuation

- Doctor and Urgent Care Visits

- Wellness Visit

- AD&D: Accidental Death and Dismemberment

- Repatriation of Remains

- Local Burial

- Acute Onset of Pre-Existing Condition Coverage

- Other Benefits

Safe Travels USA Cost Saver Insurance Plan

This plan is designed to provide medical coverage and other travel-related benefits for international travelers visiting the United States.

The plan is administered by Trawick International and offers several different levels of coverage to choose from, depending on your needs and budget.

Some of the benefits include:

- Medical Expense Coverage: This can help cover the costs of medical treatment for illness or injury that occurs during your trip.

- Emergency Medical Evacuation: This can cover the cost of transportation to a medical facility in the event of a medical emergency.

- Trip Interruption Coverage: This can provide reimbursement for non-refundable trip expenses if your trip is interrupted or canceled due to a covered reason.

- Baggage Loss or Delay Coverage: This can provide reimbursement for lost or delayed baggage, as well as the cost of essential items purchased during the delay.

- Accidental Death and Dismemberment Coverage (AD&D): This can provide a benefit to your beneficiaries if you suffer a covered loss of life or limb during your trip.

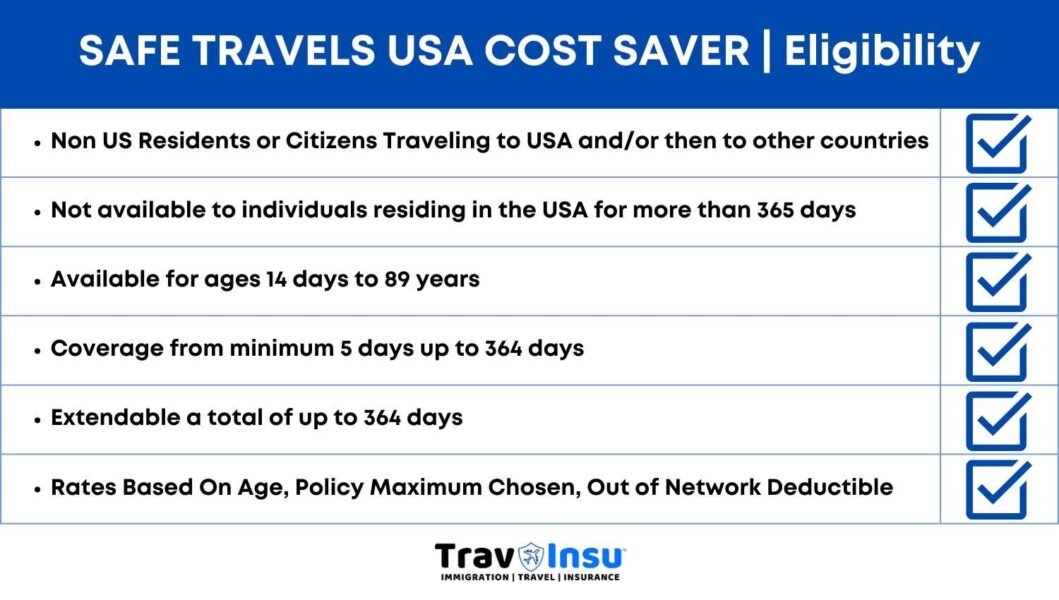

Safe Travels USA Cost Saver Insurance Eligibility

- For Non-US residents/Non-US citizens, traveling to USA or USA and then other countries

- Not available to individuals residing within the US for more than 365 days

- For Ages 14 days to 89 years

- Coverage Minimum 5 days Up to 364 days

- Extendable (Total) up to 364 days

Rates based on:

- Age

- Policy Maximum Selected

- Out-of-Network Deductible

Safe Travels USA Cost Saver Coverage Highlights

This is a travel medical insurance plan designed for international travelers visiting the United States. Here are some coverage highlights of the plan:

- Accident and Sickness medical Policy maximum choices: $50,000 $100,000, $250,000, $500,000, $1,000,000

- Cardiac Conditions Limit:

- For ages up to 69: Up to $25,000(Per Policy period)

- For ages 70 and above: Up to $15,000(Per Policy period)

- Dental Treatment: Up to $250 (Per Policy period for injury or pain)

- In Network deductible $0

- Co-Insurance:

- First Health Providers are (In Network) – 100%

- All Others are (Out of Network)

- In USA: 80% of the first $5,000 then 100% up to the policy maximum

- Outside of USA: Up to 100%

- In Network deductible: $0

- Out-of-Network Deductible Choices: $0, $50, $100, $250, $500, $1,000, $2,500, $5,000

- PPO Provider: First Health

- Urgent Care Co-Pay: $30 Per Incident

- Unexpected Recurrence of pre-existing condition: Limitations Apply

- Wellness Visit: Covered up to $125

- Other Benefits: Emergency Medical Evacuation, Medically Necessary Repatriation, Repatriation of Remains, Local Burial, Cremation.

- Medically Necessary Repatriation: 100% Up to $15,000 (Per Policy Period)

- COVID-19 Expenses: NOTCovered

Safe Travels USA Cost Saver Insurance Plan Details

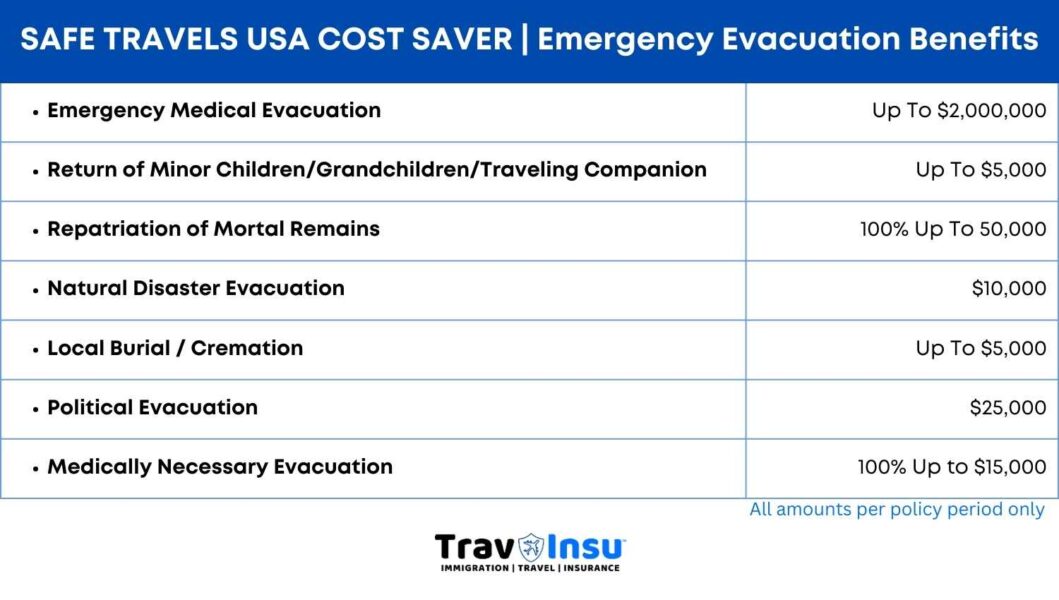

- Emergency Medical Evacuation: Up to $2,000,000 (Per Policy Period)

- Return of minor children or grandchildren or traveling companion: Up to %5,000 (Per Policy Period)

- Repatriation of mortal remains: 100% Up to $50,000 (Per Policy Period)

- Natural Disaster Evacuation: $10,000 (Per Policy Period) up to $250/day to a maximum of 5 days for reasonable Expenses

- Local Burial/Cremation: Up to $5,000 (Does not cover funeral costs)

- Political Evacuation: $25,000 (Per Policy Period)

- Medically Necessary Repatriation: 100% up to 15,000 (Per Policy Period)

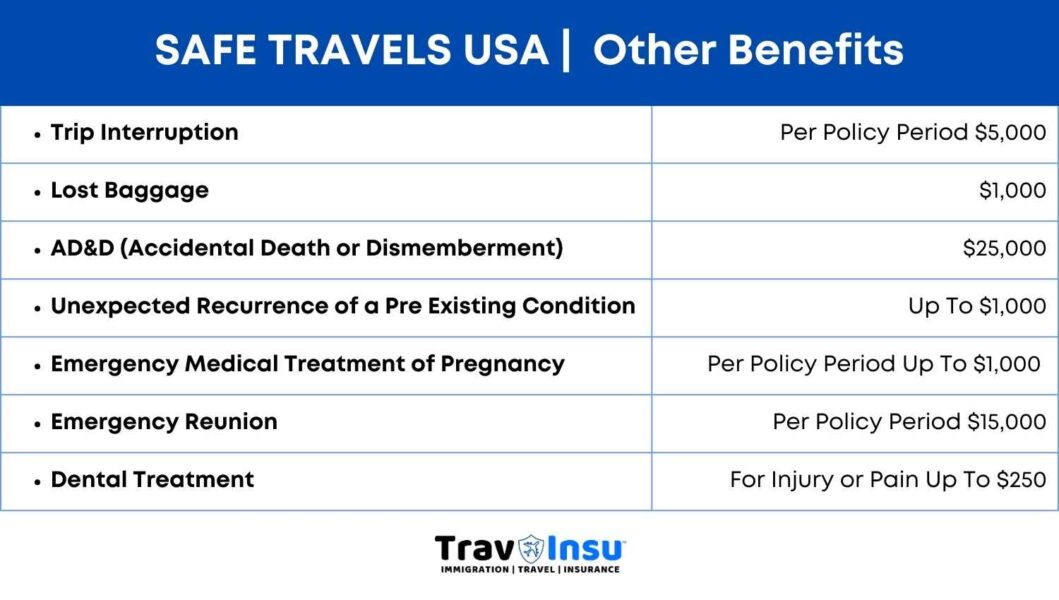

Other Benefits:

- Trip Interruption: $5,000

- Lost Baggage: $1,000

- Accidental Death and Dismemberment (AD&D): $25,000 (Principal Sum)

- Unexpected Recurrence of a Pre-existing Condition: Up to $1,000

- Emergency Medical Treatment of Pregnancy: Up to $1,000 (Per Policy Period)

- Emergency Reunion: $15,000 (Per Policy Period)

- Dental Treatment: Up to $250 (For Injury or Pain)

Safe Travels USA Cost Saver Insurance – Claims

If you need to file a claim under this plan, you should follow these steps:

- Notify the insurance provider as soon as possible: In case of a medical emergency, you should contact the emergency assistance provider listed in your policy documents immediately. If it’s a non-emergency claim, you should notify the insurance provider within a reasonable amount of time.

- Provide necessary documentation: You will need to provide documentation to support your claims, such as medical bills, receipts, and other relevant records. Make sure you keep copies of all documentation for your records.

- Complete the claim form: You will need to complete a claim form and submit it to the insurance company. The claim form can usually be downloaded from the insurance company’s website or obtained by contacting their customer service department.

- Wait for a decision: The insurance company will review your claim and make a decision based on the terms and conditions of your policy. If your claim is approved, the insurance company will reimburse you for covered expenses, subject to any deductibles or limits in your policy.

It’s important to note that you should always read your policy documents carefully and understand the terms and conditions of your coverage before you travel. This will help you understand what is covered, what is excluded, and how to file a claim if you need to do so.

How do I cancel my Safe Travels USA Cost Saver policy?

To cancel your Insurance policy, you can follow the steps below:

- Log in to your MyAccount on the insurance provider’s website.

- Select the policy you would like to cancel and click on ‘Cancel Policy’.

- Complete the required fields and submit the request.

Alternatively, you can also cancel via email. All insurance companies prefer to receive such cancellation emails directly from the insured.

Please note that there is a $25 cancellation fee, and if the refund due is less than the $25 cancellation fee, the insured person would need to pay the difference to cancel coverage.

Can I cancel my Safe Travels USA Cost Saver Insurance policy after the effective date?

Yes, you can cancel your Safe Travels USA Cost Saver policy after the effective date. However, a $25 cancellation fee is applicable for any policy canceled after the effective date.

A pro-rated daily refund is possible if no claims have been filed since the effective date. Only unused days’ premiums will be considered refundable.

If any claims have been filed with the company, the premium is fully earned and is non-refundable

Full cancellation and refund will only be considered if a written request is received by the insurance provider prior to the effective date of the coverage

Medical Outpatient

Medical outpatient coverage refers to coverage for medical treatment received outside of a hospital or inpatient facility. This can include treatment at a doctor’s office, urgent care center, or other outpatient facility.

The Safe Travels USA Cost Saver insurance plan provides coverage for emergency medical treatment received on an outpatient basis, subject to the policy limits and terms and conditions. This includes coverage for outpatient medical services such as physician visits, lab tests, x-rays, and prescription medication.

What is the minimum policy duration for Safe Travels USA – Cost Saver?

The minimum policy duration for the Safe Travels USA – Cost Saver is 5 days. This means that you can purchase coverage for a trip to the United States for a minimum of 5 days.

The plan is designed for individuals or families who are visiting the United States for a short period of time, and coverage can be purchased for up to 364 days.

It’s important to note that the premium for the plan is based on the length of your trip, so the longer your trip, the higher the premium will be.

After your travel dates are confirmed, buy the Safe Travels USA Cost Saver plan

It’s a good idea to purchase travel insurance like the Safe Travels USA Cost Saver as soon as your travel dates are confirmed. Travel insurance can provide peace of mind and protection in case unexpected events occur before or during your trip.

By purchasing the insurance early, you can ensure that you are covered for any unexpected events that may occur leading up to your trip, such as a sudden illness or injury.

Additionally, some travel insurance plans may have exclusions or limitations that apply if you purchase the plan too close to your travel dates.

When purchasing travel insurance, be sure to carefully review the policy details, including coverage limits, exclusions, and any required documentation or pre-authorization for medical treatment.

It’s also important to understand the claims process and how to contact the insurance company in case of an emergency or if you need to file a claim.

Safe Travels USA Cost Saver Insurance PPO Network

The PPO provider for Safe Travels USA – Cost Saver is First Health, Which is recognized by all major hospitals and healthcare facilities.

While you can visit any provider of your choice outside the network, when you visit a provider within the network, the provider will charge only the network-negotiated fees.

Which company Administers Safe Travels USA – Cost Saver?

Safe Travels USA – Cost Saver is administered by Trawick International. Trawick International is a travel insurance company that has been providing travel insurance plans for over 20 years. They offer a variety of travel insurance products, including plans for students, groups, and individuals traveling internationally. Trawick International is headquartered in the United States and is licensed and regulated by the Department of Insurance in the State of Texas.

Why is Safe Travels USA cost-saver Insurance Good for Visitors?

Safe Travels USA Cost Saver is a good choice for visitors to the USA for several reasons:

- Comprehensive coverage: The Safe Travels USA Cost Saver provides comprehensive coverage for a range of medical expenses, including hospitalization, outpatient treatment, emergency medical evacuation, accidental death and dismemberment, and more.

- Affordable: The plan is designed to be budget-friendly, making it a good option for visitors who want comprehensive coverage at an affordable price.

- Flexible coverage options: You can purchase coverage for as little as 5 days, up to a maximum of 1 year, and you have the option to renew your coverage for up to 24 months. This makes it easy to customize your coverage to meet your specific needs.

- PPO network: Safe Travels USA Cost Saver has a large network (First Health PPO Network) of healthcare providers, which can help you save money on out-of-pocket expenses.

Overall, Safe Travels USA Cost Saver is a good choice for visitors to the USA who want comprehensive coverage at an affordable price, with the added benefit of COVID-19 coverage and a large network of healthcare providers.

Apart from Safe Travels USA Cost Saver, there are various other plans from Trawick worth considering

- Safe Travels USA Insurance

- Safe Travels USA Comprehensive Insurance Plan

If you are looking for international plans for Indian Travelers visiting the USA, Here are a few other options to consider.

- CoverAmerica-Gold

- Atlas America

Frequently Asked Questions

Does Safe Travels USA – Cost Saver cover Pre-Existing Medical Conditions?

A sudden and unexpected outbreak or recurrence of pre-existing conditions is covered by the plan. It provides coverage up to $1,000, subject to chosen deductible and coinsurance for covered expenses incurred.

This benefit does not include coverage for Known, Scheduled, Required, or Expected medical care, drugs, or treatment existent or necessary prior to the effective date of coverage.

Pre-existing conditions are defined as medical conditions for which you have received treatment, medication, or advice from a healthcare provider in the 180 days prior to the start of your policy period.

What is a Sudden and Unexpected Outbreak of a Pre-Existing Medical Condition?

A sudden and unexpected outbreak of a pre-existing medical condition refers to the acute onset of a pre-existing condition. It is a sudden occurrence or manifestation of the prior condition that happens spontaneously and without warning in the form of symptoms. It is of short duration, rapidly progressive, and requires urgent and immediate medical care.

Does Safe Travels USA – Cost Saver offer dental insurance coverage?

The plan does not provide coverage for routine dental care, such as checkups, cleanings, and fillings.

However, the plan may provide limited coverage for dental care that is necessary due to an injury or illness, up to the chosen policy maximum.

For example, if you experience a dental emergency during your trip and require treatment for dental pain or infection, the plan may provide coverage for emergency dental treatment.

Does Safe Travels USA – Cost Saver insurance cover dependents?

Yes, the plan offers coverage for dependents of the primary insured. Dependents are defined as spouses or unmarried children under the age of 26 who are traveling with the primary insured.

Coverage for dependents is subject to the same terms and conditions as coverage for the primary insured, including policy maximums, deductibles, and any exclusions or limitations that may apply. The premium for dependent coverage will depend on the number of dependents and the plan option chosen.

It’s important to note that dependent coverage is only available if the primary insured is also covered under the plan.

Where can I get Safe Travels USA – Cost Saver full policy details?

You can obtain the full policy details from the insurance company’s website or by contacting their customer service department.

You can contact the insurance company’s customer service department by phone or email to request a copy of the policy documents or to ask any questions you may have about the coverage provided under the plan.

Conclusion

In conclusion, this plan is a good option for visitors to the USA who are looking for affordable and comprehensive coverage.

The plan offers a range of benefits, including coverage for medical expenses, and emergency medical evacuation.

The plan is also flexible, allowing you to purchase coverage for as little as 5 days up to a maximum of 1 year, with the option to renew for up to 24 months.

Additionally, the plan has a large PPO network of healthcare providers, which can help you save money on out-of-pocket expenses.

Overall, the plan is a reputable and reliable insurance plan, administered by Trawick International, a well-known and respected insurance provider.

While it’s important to carefully review the policy details and limitations before purchasing any insurance plan, this plan is generally considered a good option for budget-conscious travelers who want comprehensive coverage at an affordable price.