A Complete Atlas America Insurance Review [2024]

This Atlas America Insurance review will help you with information and details about this plan. If you’re an international traveler seeking comprehensive coverage for your trip, this might just be the perfect plan fit for your needs.

Offering a wide range of benefits, this insurance plan ensures you can enjoy your journey without worrying about unforeseen medical costs.

The Atlas America is a visitor health insurance offering medical coverage and travel-related protection to:

- Parents visiting the USA

- Tourists visiting the USA

- Business professionals visiting the USA

- International travelers traveling outside their home country

- International Students and exchange program participants who don’t have to meet specific university or college insurance requirements

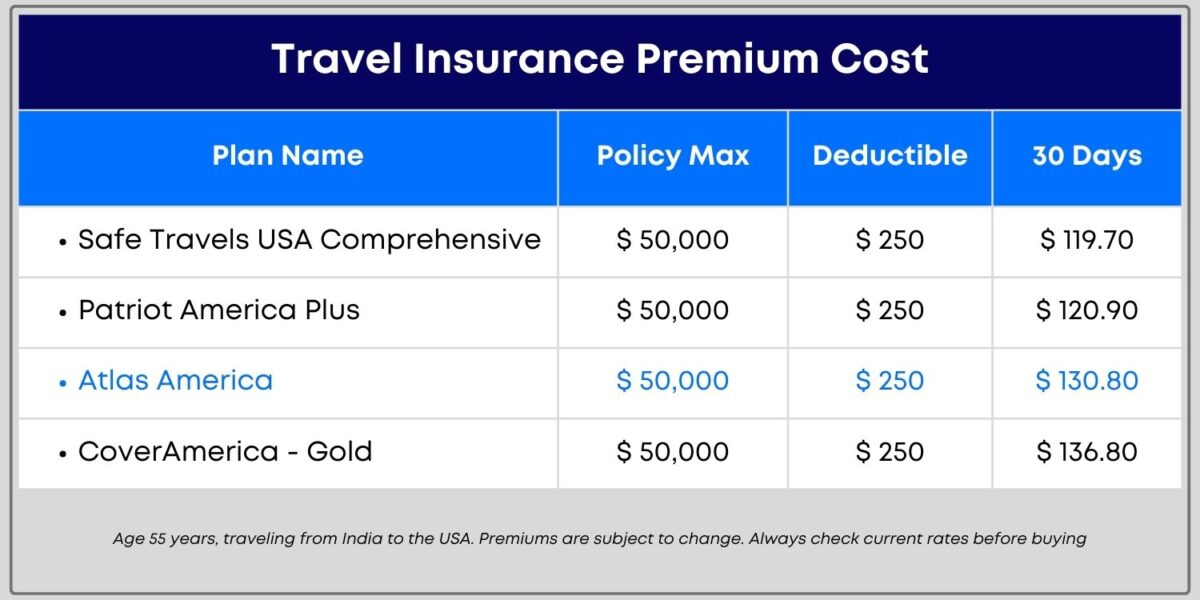

Atlas America Travel Insurance Plan vs Competition

Compare travel insurance to decide which is the best plan that meets your needs. Atlas America is competitively priced against similar category plans.

Key Takeaways

- Atlas America provides comprehensive health coverage for non-US citizens traveling abroad

- Policy duration flexibility from 5 days to 364 days and easy online policy extensions

- Policy maximum options range from $50,000 to $2 million

- Coverage for unforeseen injuries and illnesses, including COVID-19-related expenses

- The insurance plan offers flexibility in deductibles from $0 to $5,000

- Purchase of the Atlas travel insurance plan is simple through an online quote system and convenient payment methods

Please refer to the policy document for limits, restrictions, inclusions, and exclusions.

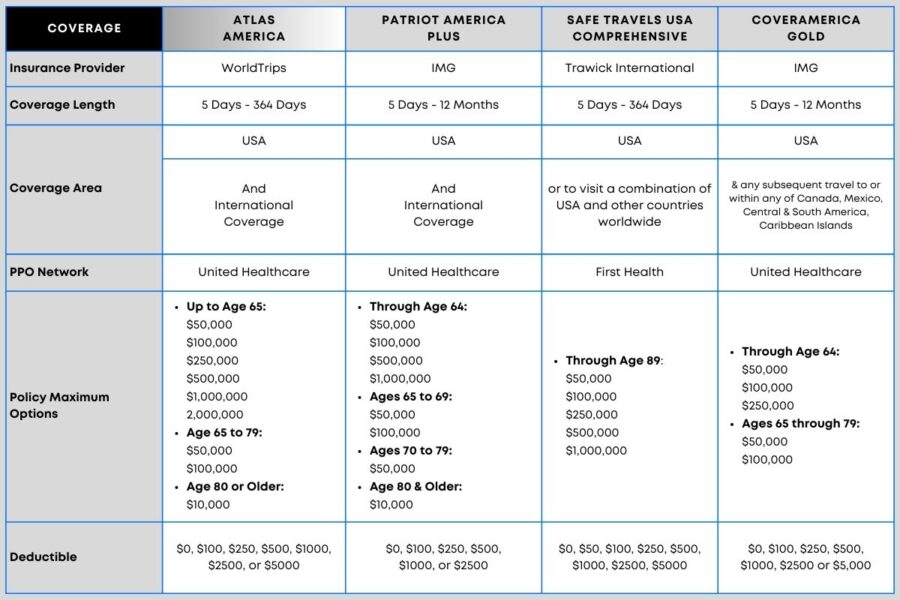

Comparison Of Atlas America Insurance Plan

The Atlas America is a good plan offering a range of policy maximums, from $50,000 to $2 million, to cater to the varying needs of international travelers.

This flexibility extends to their deductible options as well, offering choices from $0 to $5,000.

Eligible medical expenses are covered (after the deductible is met). Within the United Healthcare PPO network are comprehensively covered by Atlas America, up to the policy maximum.

Atlas America travel insurance augments its coverage of eligible medical expenses with supplementary benefits.

Get a detailed comparison of Atlas America vs Patriot America Plus, these travel insurance plans are very popular amongst parents visiting the USA.

Atlas America Travel Insurance: An In-Depth Look

The Atlas America travel insurance is a comprehensive coverage plan, tailored for foreign tourists who are non-US citizens and non-U.S. residents traveling outside their home country and their international travel plan includes the USA.

Be a business professional or a group of foreign tourists visiting the USA, Atlas America can provide travel medical coverage.

Atlas Travel Insurance plan offers coverage for a wide range of unforeseen injuries and illnesses, adventure sports coverage, and emergency medical evacuation. It even provides medical coverage for COVID-19-related expenses.

Wondering what is travel insurance and what its benefits are?

Acute Onset Coverage For Pre-Existing Medical Conditions

The Atlas America plan defines an acute onset of a pre-existing condition as a sudden outbreak or recurrence that occurs spontaneously and without warning. While pre-existing medical conditions are not covered, the plan provides coverage for an acute onset of pre-existing conditions that aren’t chronic or congenital.

There are age limitations for policy maximum acute onset of pre-existing conditions coverage:

- For individuals aged 70 to 79, a $50,000 overall maximum applies

- Those aged 80 and above have a $10,000 overall maximum

Evaluating the Atlas America Insurance Plan

In the realm of travel insurance, Atlas America outshines its competitors. Offering features such as hospitalization, emergency room visits, and coverage for acute onset of pre-existing conditions, it’s an insurance plan that’s designed with the traveler in mind.

What Makes Atlas America Stand Out?

One of the standout features of Atlas America Insurance is its comprehensive coverage, which includes:

- Hospitalization

- Office visits

- Prescription drugs

- Medical Emergencies

This depth of coverage ensures peace of mind for travelers.

Yet, the plan’s appeal goes beyond what it covers – its flexibility is equally important. Atlas America offers diverse maximum coverage limits and deductible amounts, allowing travelers to tailor their coverage to their individual needs and financial considerations.

The extensive PPO network ensures that travelers have access to a wide range of hospitals and medical facilities.

Cost-Benefit Analysis

Assessing the Atlas America Insurance Plan necessitates considering various cost factors like coverage length, deductible, and policy maximum. All these factors can influence the overall cost of the insurance. Despite these factors, the plan remains cost-effective, with a typical daily cost varying from $2.00 to $4.00 per day.

Starting at a price point of $195.30 (excluding optional coverages), Atlas America offers a competitive value considering the comprehensive benefits it provides. It’s a plan that offers significant value for the cost, providing a cost-effective solution for different financial situations.

The Claims Process Unveiled

Dealing with a foreign insurance company, particularly when navigating the claims process, can be a daunting task. However, Atlas America Insurance simplifies this process, offering a clear and straightforward procedure for submitting claims and providing dedicated customer support throughout.

Step-by-Step Guide to Filing a Claim

To submit a claim with Atlas America Insurance, you’ll need to complete, sign, and submit a Claimant’s Statement and Authorization form. This should be accompanied by supporting documents including a copy of the insured’s passport, all medical receipts, and any other relevant documentation for each incident.

Claims are typically processed within a timeframe of 15 to 30 business days. This ensures that policyholders can receive their entitled benefits promptly, easing the financial burden of any medical expenses incurred.

Customer Support Experience

Atlas America Insurance offers various methods for submitting a claim, including an online claim request form, mailing a claim form, or contacting the customer service hotline. This ensures that you receive support and guidance throughout the claims process, making it as stress-free as possible.

Nonetheless, as with any insurance company, the claim process may present some challenges. These can include managing complications related to certain treatments or conditions that are not covered by the insurance policy. Despite these potential challenges, Atlas America’s dedicated customer support team is always ready to assist and guide policyholders through the claims process.

A User’s Guide To Purchase Atlas America Insurance

The process of purchasing Atlas America Insurance, designed for customer convenience, is straightforward. You have multiple options to purchase this plan:

- Online travel insurance marketplace

- From an Insurance Agent

- Directly from the Insurance company

With an online purchase system that provides immediate quotes and facilitates credit card payments, getting covered for your trip has never been easier.

Online Purchase Simplified

Just by accessing their website and providing the necessary details, you can obtain an immediate quote for Atlas America Insurance. This instant online quote system simplifies the process of purchasing insurance.

To top it off, Atlas America Insurance supports a variety of credit card payment options, providing a convenient process for customers.

Policy Duration and Extensions

Atlas America Insurance offers flexible coverage duration that caters to different trip lengths. The minimum duration of coverage is 5 days, while the maximum is 364 days. This flexibility caters to a variety of travel plans, whether you’re planning:

- A short visit

- A week-long vacation

- A month-long backpacking trip

- A year-long adventure

If you need to extend your coverage, Atlas America makes it easy. You can extend the policy online for a minimum of 5 days. The maximum extension allowed is 364 days. However, it’s important to note that extending the policy may incur a $5 renewal fee and the premium cost can vary based on the chosen deductible.

Real User Reviews and Testimonials

Insights into the company’s services can be gleaned from the valuable feedback of real users of Atlas America Insurance. From positive experiences highlighting comprehensive coverage and flexibility to constructive criticisms regarding claim handling, these user reviews present an unbiased look at what you can expect from Atlas America Insurance.

Positive Experiences Shared

A multitude of users have shared positive experiences with Atlas America Insurance. They have highlighted the extensive coverage and flexible policy options as major benefits. With an ability to meet a wide range of needs, Atlas America Insurance has garnered many recommendations from its users.

In terms of ratings, Atlas America’s comprehensive coverage has been highly appreciated by customers. This reflects satisfaction with the extent and quality of the coverage provided. And, reinforcing the value of this insurance plan.

Atlas America Insurance for Different Traveler Types

Atlas America Insurance caters to a diverse range of traveler types, international students, a corporate traveler, or visiting family in the USA. With plans tailored to different needs, this insurance offers comprehensive coverage that ensures peace of mind.

Coverage for International Students and Academics

Atlas America Insurance can be greatly beneficial for international students and academics traveling to the U.S. The insurance provides Emergency Medical Evacuation and Repatriation coverage, ensuring safety and peace of mind for those studying abroad.

Atlas America Insurance offers coverage for medical costs. The plan extends emergency travel benefits coverage in a medical emergency. This allows international students and academics to focus on their studies without worrying about unexpected incidents.

Corporate Travel and Insurance Needs

Atlas America Insurance caters to the specific insurance needs of corporate travelers. It offers coverage for:

- Trip cancellation, interruption, and delay

- Medical and emergency evacuation

- Lost baggage

- Stolen items

With these coverage options, including crisis response coverage, business travel is made less stressful.

Atlas America Insurance offers extendable and renewable business travel health insurance coverage. This ensures that corporate travelers can have uninterrupted coverage even for longer or extended business trips.

Family Visits and Ensuring Safety for Loved Ones

Atlas America Insurance offers comprehensive coverage for parents or relatives visiting the USA. This includes medical expenses, emergency medical evacuation, and repatriation of remains. With such extensive coverage, family members can make family visits to the USA without worrying about medical emergencies.

Atlas America Insurance surpasses many competitors with its customized benefits for visitors. This demonstrates Atlas America’s commitment to providing top-notch service and coverage to its customers. Some of the benefits include:

- Comprehensive medical coverage

- Emergency medical evacuation

- Repatriation of remains

- Trip interruption coverage

- Accidental death and dismemberment coverage

These benefits ensure the best care possible at the urgent care center.

Atlas America Sports Coverage, Crisis Response, And Add-Ons

- Includes coverage for taking part in amateur/non-professional sports and activities, sports, acute onset of pre-existing conditions (with age-related limitations), and additional options for more comprehensive protection

- Crisis Response Coverage – Ransom, Personal Belongings, and Crisis Response Fees and Expenses

- Optional Crisis Response Coverage Rider with Natural Disaster Evacuation

The Atlas America Insurance Review

Atlas America Insurance provides comprehensive and flexible coverage options for a variety of traveler types. Its extensive benefits, combined with a straightforward claims process and positive Atlas America insurance reviews by users, make it a reliable choice for international travelers. Visiting for a short time or planning a long-term stay, Atlas America Insurance offers a peace of mind that allows you to focus on what truly matters – enjoying your journey.

Frequently Asked Questions

Is Atlas America a good travel insurance?

Yes, Atlas America is a good travel insurance option, as it is reputable and highly rated by A.M. Best.

What is the difference between Atlas Premium America and Atlas America?

The key difference between Atlas Premium America and Atlas America is that it offers additional features and benefits for discerning travelers. The plan provides high-end offerings for individuals seeking comprehensive coverage.

Is Atlas America a legitimate travel insurance plan?

Yes, Atlas America provides comprehensive travel medical insurance for temporary stays outside of the home country. It is a legitimate option for coverage provided by WorldTrips Travel Insurance Company.

What coverage does Atlas America Insurance provide?

Atlas America Insurance provides comprehensive health and travel medical coverage for non-US citizens traveling outside their home country. Covers any new injury or illness, and provides additional benefits like adventure sports coverage and emergency medical evacuation.

Are adventure sports covered by Atlas America insurance?

Atlas America provides coverage for amateur/non-professional sports activities. Professional sports activities may not be covered.