Atlas America Travel Insurance Review 2023

Traveling can be an exciting experience that exposes you to different cultures, languages, and cuisines. However, it also comes with some potential risks, such as accidents, illness, and theft.

These risks can be even more pronounced when traveling to a foreign country, where you may not have access to your regular healthcare provider, and communication can be challenging.

This is why it is essential to have travel insurance.

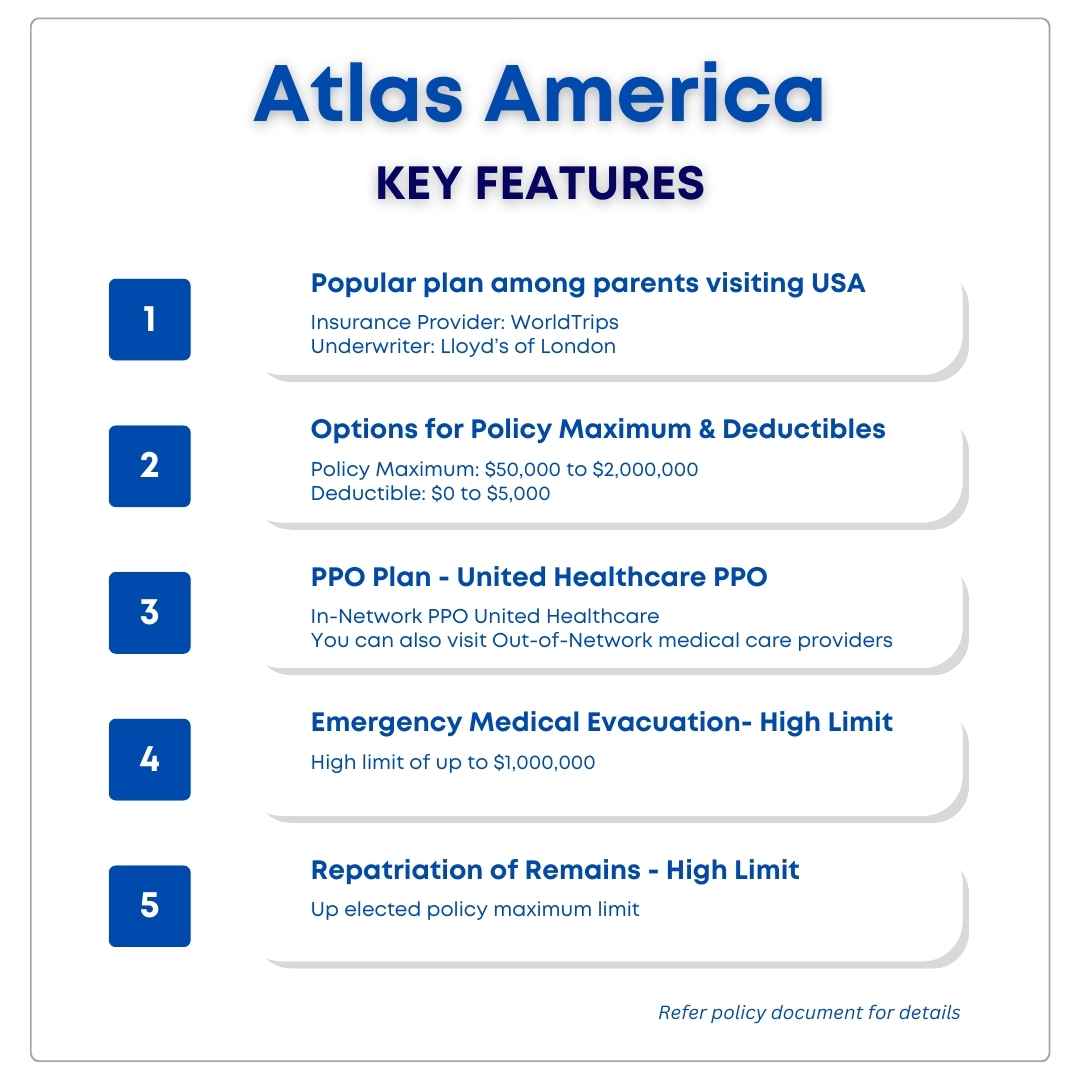

In this review, we will explore the key features of the World Trips Atlas Travel Insurance Plan.

The details include Travel Medical Expense Coverage, Benefits, Limitations, Pricing, and more.

We will look closer at this insurance policy to help you determine if it is the right choice for your travel needs.

If your parents are visiting the USA the details will help you with information if this plan can be a good option to buy visitors coverage for them.

By examining these aspects we aim to give you a comprehensive understanding of whether Atlas America Travel Insurance is the right fit for your travel insurance requirements in 2023.

Why Buy Travel Medical Insurance?

Travel Medical Insurance is an important consideration for anyone who travels.

If you are visiting the USA it becomes extremely important primarily because healthcare is very expensive in the United States.

There are several reasons to invest in travel medical insurance:

- It protects you against unexpected medical emergencies that can occur while traveling.

- Travel medical insurance can help to cover the costs of

- Medical Treatment

- Hospitalization

- Emergency Medical Evacuation

- Other related medical expenses

- It can provide peace of mind knowing that you are protected in the event of a medical emergency. This can help to reduce the stress and anxiety associated with traveling.

- It protects you against financial loss. Medical emergencies can be expensive, and without travel medical insurance, you may pay high for medical expenses out of pocket.

- It gives you access to quality medical care.

- Some countries require travelers to have travel medical insurance in order to enter the country. Without travel medical insurance, you may be denied entry or face other penalties.

- Travel medical insurance policies can be customized to meet your specific travel needs.

If you are still unsure of the benefits then the top 10 reasons to buy travel insurance will help you with more details on the reasons to buy coverage for your international trip. Knowing how travel insurance works is helpful to ensure you know the details.

WorldTrips Atlas America Travel Insurance is one of the most popular travel insurance options available to travelers, offering comprehensive coverage for a wide range of potential risks.

Worldtrips also sells travel health insurance plans for international students, business travelers, and group travel insurance plans. WorldTrips is part of the Tokio Marine HCC Group.

Compare Travel Insurance plans

What is Atlas America?

Atlas America is a comprehensive visitor health insurance that provides medical coverage and other covered travel and emergency services for non-US citizens visiting the US or traveling outside their home country.

The Atlas Travel Insurance plan offers various travel insurance plans to relatives and parents visiting the USA, business professionals, tourists, international students, exchange scholars, and more.

Atlas Travel offers a range of benefits that can help protect you against unexpected events while you are traveling, such as medical emergencies, trip cancellation, or interruption, baggage loss, and more.

| A.M. Best Rating | A++ (Superior) |

| Administrator | WorldTrips |

| Underwriter | Lloyd's of London |

| Policy Duration | 5 days - 364 days |

| COVID-19 | Included |

| Extendable | Yes (Up to a maximum of 364 days) |

| Cancelable | Yes |

| Coverage Type | Comprehensive Travel Medical Insurance |

| PPO Network Provider | United Healthcare PPO Network |

| Eligibility | Visitors to the USA or International travelers, traveling outside their home country (To be eligible for coverage the individual should be at least 14 days old) |

What is covered by Atlas America?

Atlas America plan is a comprehensive plan with flexible maximum coverage limits, coverage length, and deductible amounts.

It covers new Medical Conditions, Accidents, or Injuries that occur after the effective policy date.

It does not cover any routine expenses related to:

- Pre-Existing Conditions

- Preventive Checkups

- Immunization, or Maternity

Key Benefits, with coverage for eligible expenses:

- Emergency Medical Evacuation and Emergency Reunion

- Repatriation of Remains

- Return of Minor Children

- Terrorism

- Political Evacuation

- Natural Disaster -Replacement Accommodation

- Acute Onset of Pre-Existing Conditions

- Hospitalization and outpatient treatment

- Sports Coverage

- Complications of Pregnancy Only (first 26 weeks of pregnancy)

- Crisis Response

- COVID-19

Atlas Travel Insurance Plan Details

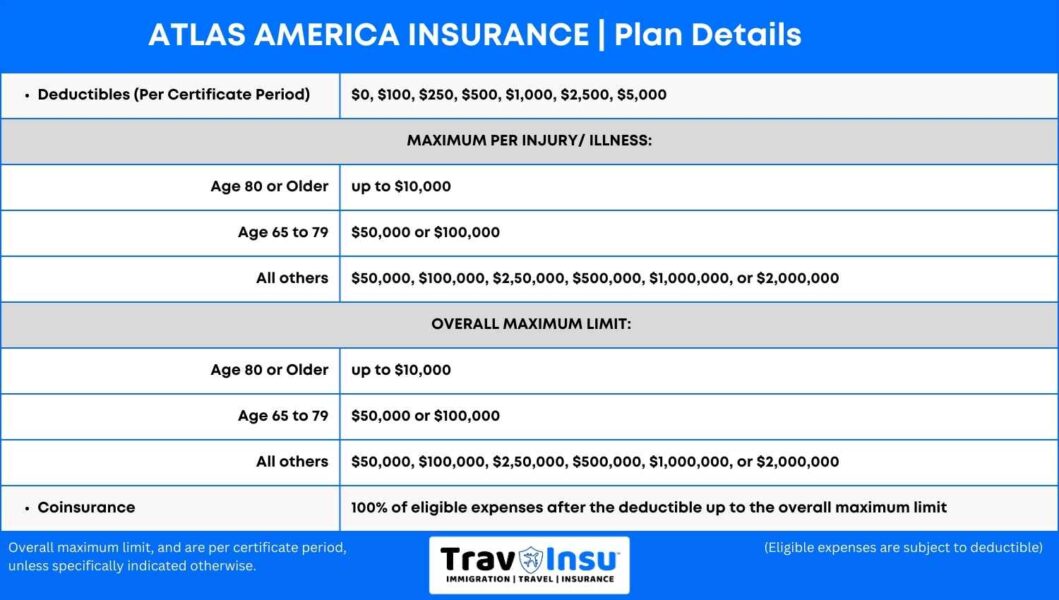

Plan Deductible: $0, $100, $250, $500, $1,000, $2,500, or $5,000

Maximum Per Injury/Illness:

- Age 80 or older – $10,000

- Age 65 to 79 – $50,000 or $100,000

- All others – $50,000, $100,000, $250,000, $500,000, $1,000,000, or $2,000,000

Overall Coverage Maximum Limit:

- Age 80 or older – $10,000

- Age 65 to 79 – $50,000 or $100,000

- All others – $50,000, $100,000, $250,000, $500,000, $1,000,000, or $2,000,000 (for ages 14 days – 64 years based on the travel insurance plan you choose)

Coinsurance: Atlas travel insurance will pay 100% of eligible expenses* after the deductible up to the overall maximum limit.

*Eligible expenses are subject to the deductible, and overall maximum limit, and are per certificate period unless specifically indicated otherwise.

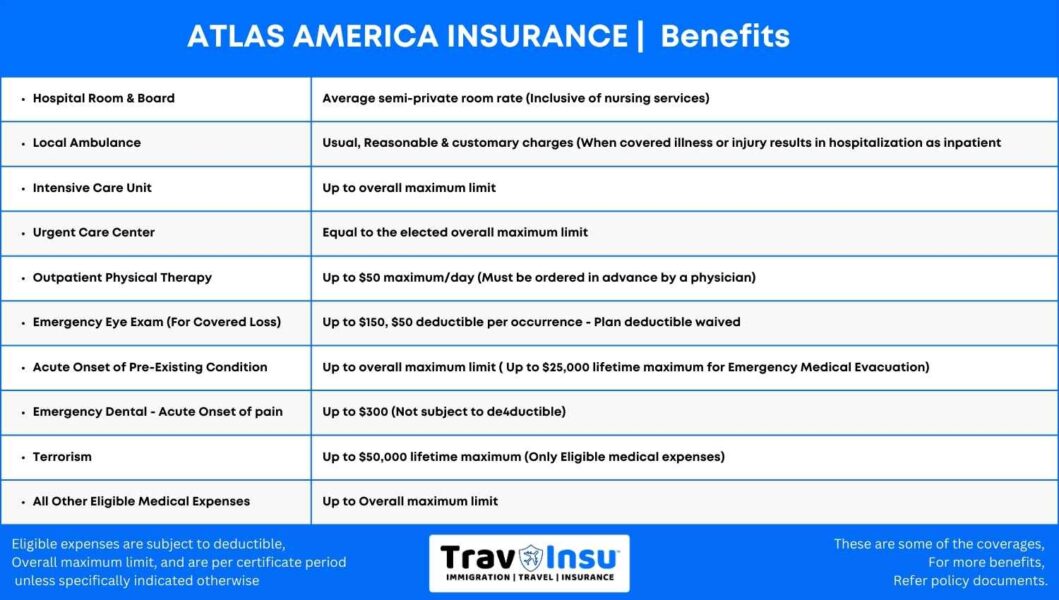

Medical Benefits

- Medical coverage for Eligible expenses related to COVID-19 included

- Acute onset of a pre-existing condition (only for travelers of ages below 80 years). Up to the overall maximum limit ($ 25,000-lifetime maximum for Emergency Medical Evacuation)

- Hospital room charges

- Intensive Care Unit charges (Up to the maximum overall limit)

- Local ambulance expenses: Usual, reasonable & customary charges only when covered illness or injury results in hospitalization as an inpatient

- Emergency Eye Exam: Up to $150, $50 deductible emergency eye exam per occurrence

- Emergency Dental: Up to $300

- Hospital emergency room charges

- Urgent Care Centre Co-payment:

- Claims Incurred in the U.S:

- For each visit, a $15 co-payment

- Co-payment is waived for members with a $0 deductible

- Not subject to deductible

- Claims Incurred outside the U.S.:

- No co-payment

- Claims Incurred in the U.S:

- Terrorism Up to $50,000 Lifetime Maximum

- All other eligible medical expenses: Up to the overall maximum limit.

- Emergency Room Co-Payment

- Claims Incurred in the U.S:

- $200 Co-payment for each use of an emergency room for an illness unless you are admitted to the hospital

- No co-payment for Emergency room treatment of an injury

- Claims Incurred outside the U.S.:

- No Co-payment

- Claims Incurred in the U.S:

Emergency Travel Benefits Limit

- Emergency Medical Evacuation: Up to $1,000,000

- Return of Minor Children: Up to $50,000 (Not subject to Deductible)

- Pet Return: Up to $1,000

- Repatriation of Remains: Equal to the elected overall maximum limit

- Emergency Reunion: Up to $100,000

- Local Burial or Cremation: Up to $5,000 (Lifetime Maximum)

- Natural Disaster: Replacement Accommodations: Up to $250 a day (for up to 5 days)

- Trip Interruption: Up to $10,000

- Travel Delay: Up to $100 a day (Maximum 2 days)

- Lost Checked Luggage: Up to $1,000

- Lost or Stolen Passport/Travel Visa: Up to $100 (Not subject to deductible travel delay)

- Personal Liability: Up to $25,000 or Up to $1,00,000 (If additional coverage is selected)

- Political Evacuation: Up to $100,000

- Crisis Response (fees & Expenses): Up to $10,000 (Ransom, Personal belongings, and crisis response)

- Optional Crisis Response (With Natural disaster evacuation):

- Up to $90,000 per certificate period, with a $10,000 maximum for Natural disaster evacuation coverage

- Bedside Visit: Up to $1,500

- Hospital Indemnity: $100 per day (Inpatient Hospitalization)

- Natural Disaster (Replace Accommodation): Up to $250 per day (For 5 days)

- Border Entry Protection: Up to $500 if traveling on a valid B2 visa & denied entrance at the U.S. border

- Terrorism: Covered

- Sports Coverage: Eligible injuries & illnesses that occur while participating in popular vacation sports

- Complications of Pregnancy Only: coverage for the first 26 weeks of gestation

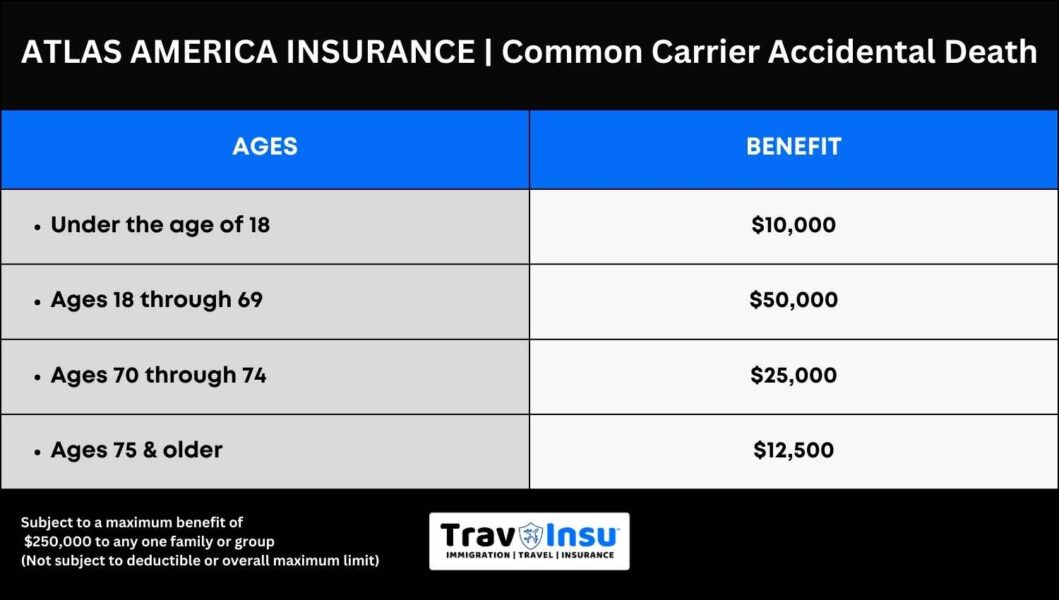

- Common Carrier Accidental Death: Up to $250,000 for any one family or group. Not subject to a deductible or overall maximum limit

- Under age 18: $10,000

- Ages 18 through 69: $50,000

- Ages 70 through 74: $25,000

- Ages 75 and older: $12,500

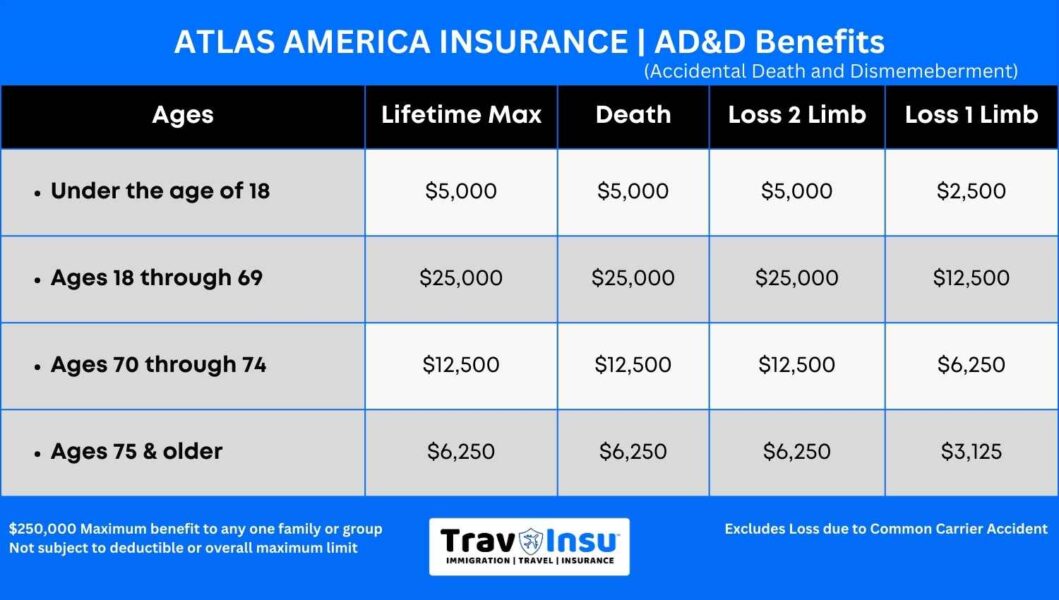

- Accidental Death and Dismemberment (Excludes loss due to common carrier accident): Up to $250,000 maximum benefit for any one family or group

- Under the age of 18 years:

- Lifetime maximum: $5,000

- Death: $5,000

- Loss of 2 limbs: $5,000

- Loss of 1 limb: $2,500

- Ages 18 Through 69 years:

- Lifetime maximum: $25,000

- Death: $25,000

- Loss of 2 limbs: $25,000

- Loss of 1 limb: $12,500

- Ages 70 through 74

- Lifetime maximum: $12,500

- Death: $12,500

- Loss of 2 limbs: $12,500

- Loss of 1 limb: $6,250

- Ages 75 years and Older:

- Lifetime maximum: $6,250

- Death: $6,250

- Loss of 2 limbs: $6,250

- Loss of 1 limb: $3,125

- Accidental Death & Dismemberment (Optional) Rider: Available only to ages 18 through 69

- Lifetime Maximum: $25,000

- Death: $25,000

- Loss of 2 limbs: $25,000

- Loss of 1 Limb: $12,500

- Personal liability:

- Up to $ 25,000-Lifetime Maximum

- Up to 25,000 Third Party Injury

- Up to 25,000 Third Party Property

- Up to $2,500 Related Third-Person Property

- Optional Personal Liability Rider: Up to $75,000 Lifetime Maximum

Note: The coverage benefits will vary from plan to plan.

Pre-Existing Conditions Coverage

Atlas travel insurance does not cover pre-existing conditions, however, it provides coverage benefits for the Acute Onset of a Pre-Existing Condition that is not chronic and congenital in nature.

Acute Onset of Pre-Existing Condition is available: for persons under 80 years old up to the policy maximum

- For ages under 70 years: The plan provides up to the overall maximum limit

- For ages 70 to 79 years: The plan provides up to the overall maximum limit OR $100,000 (Whichever is lower)

What is the Acute Onset of a Pre-Existing Condition?

As per the policy document As the acute onset of a pre-existing condition is a sudden and unexpected outbreak or recurrence that is of short duration, is rapidly progressive, and requires urgent care.

A pre-existing condition that is chronic or congenital or that gradually becomes worse over time, is not the acute onset of a pre-existing condition

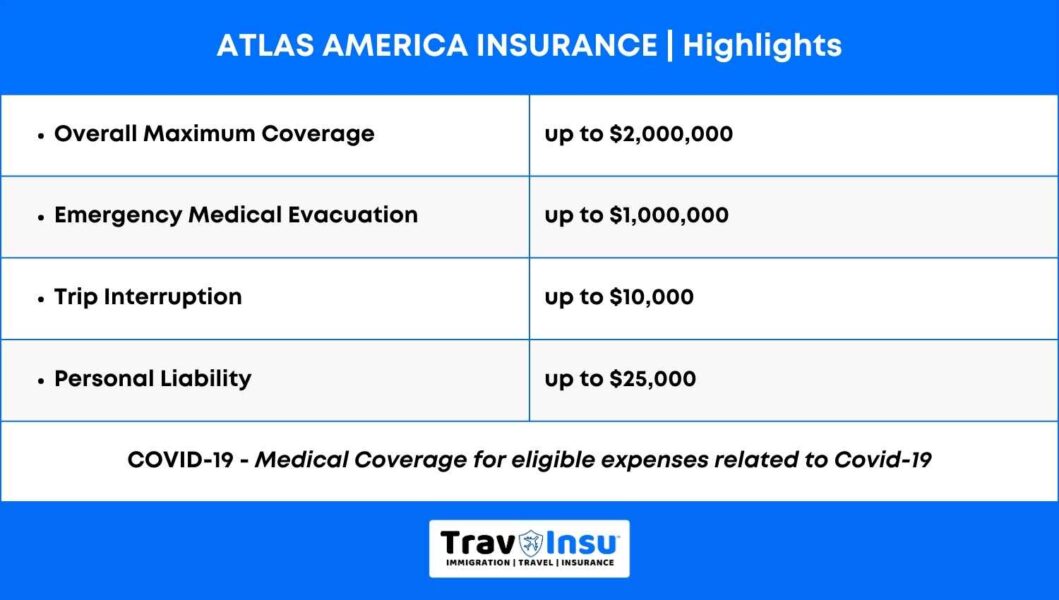

Atlas Travel Insurance Highlights

Overall Maximum Coverage: Up to $2,000,000

Emergency Medical Evacuation: Up to $1,000,000

Trip interruption: Up to $10,000

Personal Liability: Up to $25,000

COVID-19: Medical coverage for eligible expenses related to COVID-19

PPO Network

Atlas travel insurance plan participates in the United Healthcare PPO Network. The policy offers the option of a PPO Network (United Healthcare PPO) for medical treatment received in the U.S.

This network allows access to a wide network of hospitals, physicians, and providers all across the United States.

When you visit an in-network provider they generally bill the insurance company directly and charge you only the network-negotiated fees. (fees that are usually lower than regular fees)

While in the United States, After the deductible is satisfied within the United Healthcare PPO network, the plan pays 100% of eligible medical expenses (Up to the policy maximum limit)

Outside the PPO network, the plan pays 100% of eligible medical expenses (Up to the policy maximum limit)

Acute Onset of Pre-Existing Conditions

If you are below 80 years of age, you may be covered for an acute onset of a pre-existing condition. This also includes up to a $ 25,000-lifetime maximum for emergency medical evacuation.

Acute onset of a pre-existing condition refers to the sudden and unexpected outbreak or recurrence of a medical condition that is of short duration, is rapidly progressive, and requires urgent care. The medical condition must have existed before the start of the travel medical insurance policy.

The term “pre-existing condition” generally refers to any medical condition (chronic or congenital) that a person has been diagnosed with, received treatment for, or sought medical advice for before purchasing their insurance policy. If the condition gradually becomes worse over time, is not the acute onset of a pre-existing condition.

The acute onset of pre-existing condition benefit can only be applied if all the following conditions are met as described in the plan.

Why Choose Atlas America Insurance Plans?

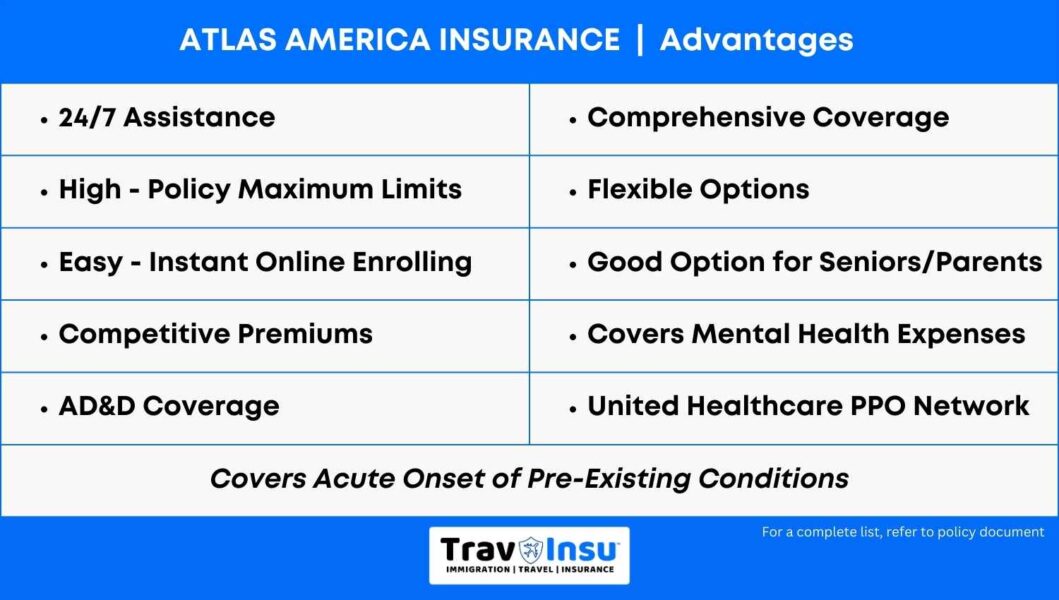

There are several reasons why one might choose Atlas Travel Medical Insurance as their travel insurance provider, including:

- The plan offers comprehensive coverage for a range of travel-related events, including medical emergencies, emergency medical evacuation, trip interruption, trip cancellation, lost or stolen baggage, and more.

- The insurance plan covers the acute onset of pre-existing medical conditions, which can be a concern for travelers with such conditions. This helps avoid costly out-of-pocket expenses in the event of an emergency.

- Enrolling in Atlas America is quick and easy, with online application and payment options. You can purchase the plan and get instant policy documents online.

- It offers competitive premiums, making it an accessible option among similar visitor insurance plans.

- It provides access to the United Healthcare PPO Network, ensuring quality medical care without worrying about out-of-pocket expenses.

- You get 24/7 assistance, including emergency medical assistance, travel assistance, and concierge services.

- There are no age limits to buying this plan, making it easier to get senior travel insurance, regardless of their age.

- The Atlas travel insurance plan offers flexible options, including short-term cover for those visiting the USA for a short period, and long-term cover for those staying for an extended period.

- The plan covers mental health expenses, providing peace of mind when traveling.

- In the unfortunate event of accidental death or dismemberment, Atlas Travel Insurance offers up to $25,000 in coverage.

- It is a cost-effective option amongst similar plans.

Compare Travel Insurance Plans

Claims Process

This is where Atlas America shines a little brighter than most travel insurance options. Their claim process is not only easy but also quicker than most fish in the travel insurance pond. So if you submit the relevant paperwork timely (within 60 days from the date of medical service availed), your claim process will be smooth sailing.

Terms of Claims

The terms of the claim vary from plan to plan. However, if you’ve attached the following documents, you’ll be good to go:

- Completed claims form

- Copy of the insured’s passport

- Copies of all medical receipts, bills, and itemized services

- Cover letter comprising brief information about the insured, his/her illness/accident, and the treatment received

The cost of the Atlas America Insurance plan starts at $1.49 per day, while the Atlas International plan starts at $0.81 per day

J Visa Insurance Coverage

If you are traveling to the United States on a J-1 visa for work and study-based exchange programs, your visa may require travel medical insurance or proof that you’ll be able to pay for unexpected expenses incurred in the U.S.

Atlas America meets the requirements of the J-1 visa for work and study-based exchange programs in the U.S.

It also provides policyholders with a visa letter that can serve as proof of coverage or help prove their ability to pay for unexpected medical expenses

Frequently Asked Questions

Can I Extend or Renew Atlas America Insurance Coverage?

After your initial purchase, you can extend your Atlas international insurance plan for up to a maximum of 364 days. As long as your coverage is continuous your coinsurance, deductible, and benefit limits will not reset.

Does Atlas Travel Cover Terrorism?

The plan offers coverage of up to $50,000 lifetime maximum, (Eligible medical expenses only)

Countries you are visiting must not be under level 3 or higher travel advisory, issued by the U.S. Department of States

Are Adventure Sports covered in the Atlas America Health Insurance Plans?

Yes, Atlas travel insurance plan offers coverage for eligible medical expenses for injuries and illnesses that could occur while participating in many popular vacation sports, at no extra cost sports like:

- Snorkeling,

- Water skiing,

- Skiing and snowboarding – Recreational downhill and/or cross country.

- Other

Some extreme sports are not covered

Is Incidental Home Country Coverage available for U.S. Citizens in the plan?

Yes, the Incidental trip benefit is available to U.S. citizens for a maximum of 15 days per three months period of coverage.

This benefit may be necessary if you have an incidental trip back to the U.S. and if you incur medical expenses during that time.

This is in effect only if you have purchased a minimum of three months of coverage

Is Incidental Home Country Coverage available to individuals with a Home Country other than the U.S.?

Yes, the incidental trip benefit is available to such individuals for a maximum of 30 days per three months period of coverage

Is Natural Disaster Replacement Accommodation covered by this Insurance Plan?

Yes, Atlas Travel offers $250 a day for 5 days to help cover the cost of alternative accommodations if a natural disaster occurs on your trip that causes you to be displaced from your planned & paid accommodation

Conclusion

With an extensive network of healthcare providers worldwide and a range of coverage options, Atlas America aims to address the diverse needs of travelers traveling outside their home country. From medical emergencies and trip cancellations to lost baggage and emergency evacuation, Atlas America’s comprehensive policies seek to provide you with the necessary support and coverage throughout your journey

When choosing travel insurance, it’s important to evaluate your needs and compare policies from different providers to find the best coverage for your trip.