Atlas Essential America – Complete Review

Atlas Essential America Insurance plan administrator is WorldTrips, the same travel insurance company that also offers the Atlas America Insurance Plan.

The Atlas America Insurance Plan is a very popular travel insurance plan among parents visiting the USA.

Atlas Essential America Travel Insurance is one of the most popular low-cost comprehensive coverage travel medical insurance.

Atlas Essential America can be an option to consider for:

- Parents visiting the USA

- Foreign nationals visiting the USA

This travel insurance plan does not provide any acute onset of pre-existing condition coverage. Hence, a good option to consider for those who do not have any need for pre-existing condition coverage.

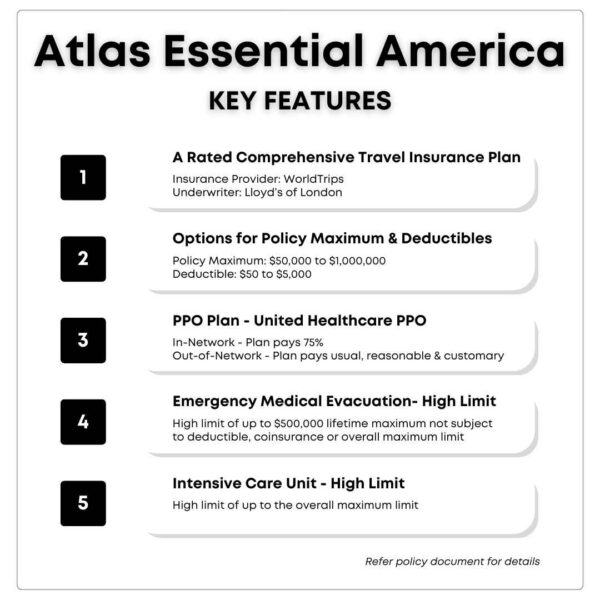

Atlas Essential America Insurance – Key Features

This travel medical insurance plan is designed for budget-conscious travelers. This travel medical insurance plan provides maximum coverage for traveling away from your home country.

Atlas Essential Insurance offers 2 plan options:

- Atlas Essential America: Travel insurance option for traveling to the USA Atlas Essential America is a good option to consider.

- Atlas Essential International: For travel outside of the USA Atlas Essential International is a good option to consider.

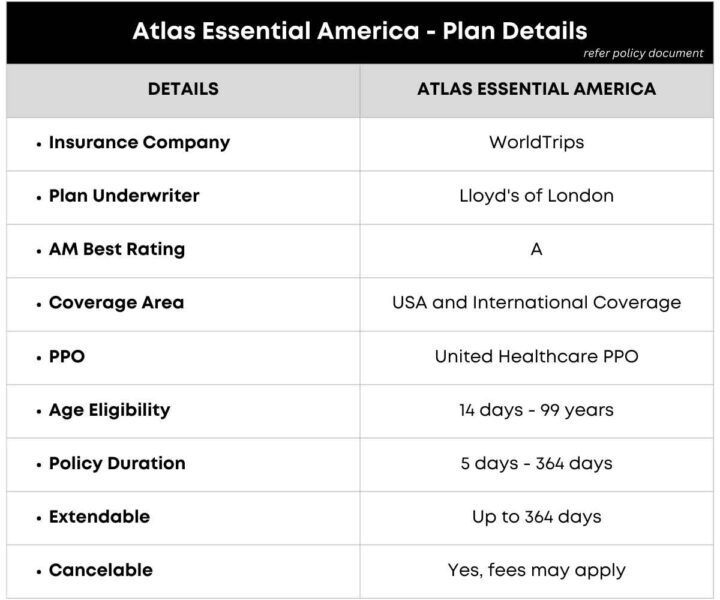

Atlas Essential America – Eligibility And Highlights

The Atlas Essential plan is available to US and non-US citizens traveling outside of their home country. The plan does not provide coverage to US Citizens and Residents within the USA.

This plan is quite popular with parents visiting the USA, especially for ones who do not have any pre-existing conditions and don’t need acute onset of pre-existing conditions coverage benefits.

U.S. citizens and non-citizens who are at least 14 days to 99 years old are eligible for coverage, outside their home country.

This travel medical insurance plan can be purchased for a minimum certificate period of 5 days to a maximum of 364 days. The plan is renewable to a maximum of 364 days of continuous coverage.

Cancelation Clause:

If you buy this travel insurance plan and for some reason after reading the plan details, this insurance does not meet your requirements, you can cancel the plan and get your premium refund.

- Premiums are refunded in full if a cancellation is requested prior to the certificate’s effective date

- Premiums may be refunded after the certificate’s effective date subject to the following provisions:

- A $25 cancellation fee will apply for administrative costs incurred by the insurance company

- Only the prorated portion of the premium will be refunded; and

- You cannot have filed any claims to be eligible for a premium refund

The Plan Details – Atlas Essential America Insurance

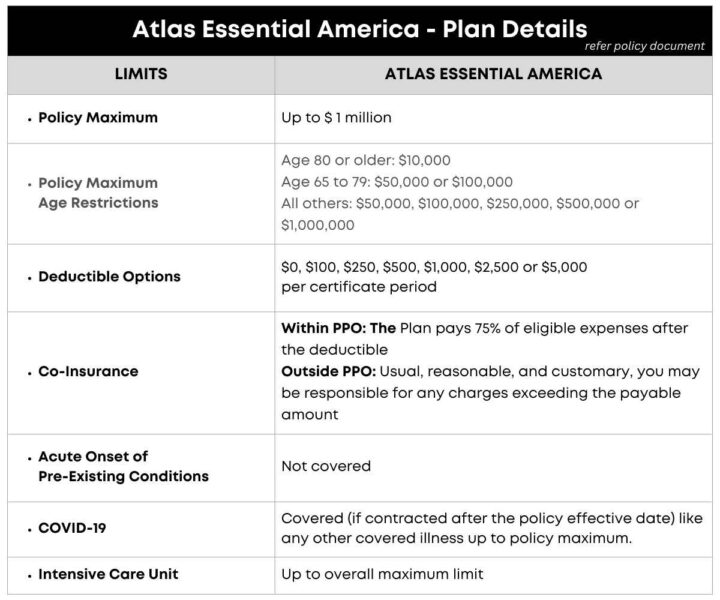

Policy Maximum Limit

The plan provides up to $1mn policy maximum coverage:

Age 80 or older: $10,000

Age 65 to 79: $50,000 or $100,000

All others: $50,000, $100,000, $250,000, $500,000, or $1,000,000

If you choose a higher maximum limit for your plan, you will pay a higher monthly premium.

Please note that the above limits are also the maximum payable per injury or eligible illness.

Plan Deductible

Plan deductible options available are:: $0, $100, $250, $500, $1,000, $2,500, or $5,000 per certificate period. The policy premium will be lower for higher deductible options and vice-versa.

Age Factor

Any person who is older than 14 days may avail of the coverage benefits up to 99 years of age. The policy maximum limits as per age restrictions as highlighted earlier will apply.

PPO Network

This plan offers United Healthcare PPO Network. You get the benefit of discounted, pre-determined prices for medical services offered by a United Healthcare PPO Network. The PPO Network of hospitals and doctors is available across the USA.

Pre-Existing Conditions Coverage

Pre-existing conditions are generally defined as any sickness, illness, injury, disease, or other physical, or mental, condition existing at the time of application for insurance. It also includes any nervous disorder, condition, or ailment that is referred to as a pre-existing condition.

Each insurance plan may define what it considers as a pre-existing condition and it is important to read the policy document explanation.

It is important to understand travel insurance for pre-existing medical conditions.

This plan does not offer any coverage benefits for pre-existing conditions or acute onset of pre-existing conditions.

Other plans that offer acute onset of pre-existing condition coverage benefits:

- Atlas America Insurance

- Patriot America Plus

- Safe Travels USA Comprehensive

- Safe Travels USA Cost Saver

- Visitor Secure

Compare Travel Insurance Plans

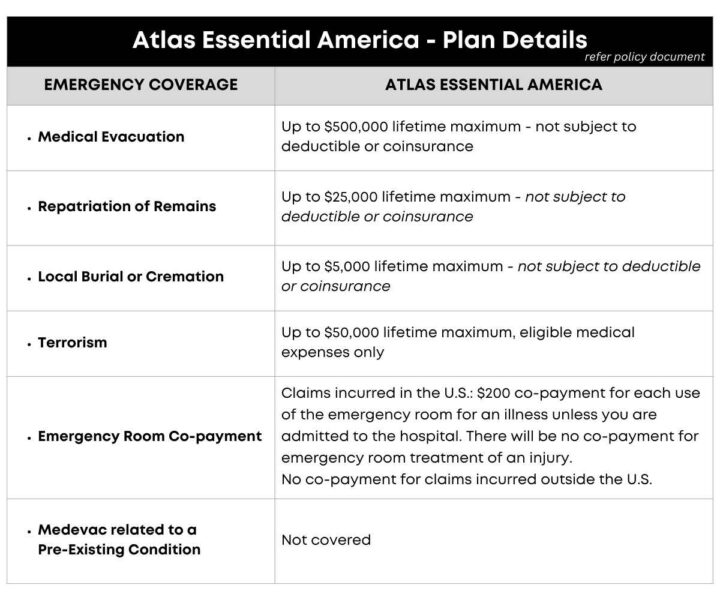

Emergency Services and Coverage

The plan provides for emergency medical evacuation, repatriation of remains coverage, and a few other emergency services cover.

Emergency Medical Evacuation

Emergency medical evacuation can turn out to be very expensive. In a life-threatening situation emergency medical evacuation coverage benefits can be a life-saviour. This plan provides a limit of up to $500,000 and this limit is not subject to deductible or coinsurance. Emergency medical evacuation is generally to the nearest medical hospital where you can be provided treatment to save your life or limb.

Repatriation of Remains

In the case of the death of the insured, the plan provides for the repatriation of remains with a limit of up to $25,000. The plan also provides for a local burial or cremation limit of up to $5,000.

Hospital Emergency Room Treatment

This plan covers hospital room charges as eligible expenses if you are admitted for treatment. For claims inside the USA, the insured is responsible for a $200 co-payment for each use of the emergency room for an illness unless the insured is admitted to the hospital. There is no co-payment for the emergency room for the treatment of an injury. For claims incurred outside the USA, there is no co-payment, international travelers can benefit from this.

COVID-19 Coverage

The plan offers coverage for COVID-19 if contracted after the policy’s effective date. The coverage limit is up to the policy’s maximum, it covers any other covered illness.

Please note that the plan will only cover eligible medical expenses and does not cover COVID-19 preventive treatment, such as immunizations.

Atlas Essential America Insurance Plan vs. Atlas America Insurance Plan

Here is a quick snapshot of some differences between this plan as compared to Atlas America Insurance Plan which is very popular amongst visitors to USA

Atlas America insurance plan is not a low-cost option as Atlas Essential insurance. There are differences between comprehensive coverage and limited coverage plans, Atlas Essential insurance fits somewhere between i.e. a low-cost comprehensive coverage plan.

Both plans are available to international travelers visiting the USA and they provide PPO Network (United Healthcare). Atlas America is a comprehensive coverage plan that offers maximum coverage benefits. The Atlas America is a very popular plan for parents visiting the USA.

Atlas Essential Insurance is a good option for people who do not have any current health issues. Atlas Essential Insurance does not provide any pre-existing condition coverage benefits.

Compare Travel Insurance Plans

What is the Insurance Cost of Atlas Essential Insurance?

The monthly premium cost depends on several factors such as:

- the policy maximum

- deductible options

- age of the person

- and more…

You can generate a free quote to check the price of medical coverage.

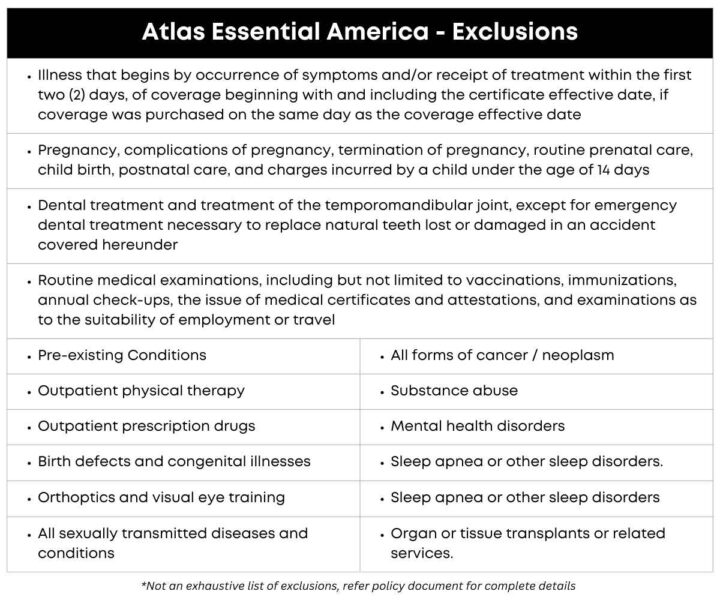

Exclusions

Atlas Essential Insurance provides essential medical coverage and medical treatment. The eligible medical expenses are covered benefits but many exclusions also apply. Here is a sample list of exclusions, refer to the policy document for both medical coverage and exclusions in detail.

Conclusion

Medical care and medical expenses can quickly start piling up if you get sick or injured overseas. Not having an insurance plan to cover the eligible medical expenses can burn a hole in your pocket. Its a recommendation to get Travel Insurance to avoid the risk of a big financial impact.

Travel health insurance can also become very expensive and if you are someone who does not have any pre-existing conditions exploring plans like this one can help save money spent on coverage you don’t need.

Bon Voyage!