Visitor Secure Insurance Information, Benefits, And Eligibility

In this complete guide, we will explore the key aspects of the VisitorSecure insurance plan, providing you with valuable information to help you make informed decisions and navigate the complexities of international travel insurance.

We will look into the features and benefits of a visitor secure insurance plan, outlining the types of coverage available, the eligibility criteria, and the essential information you need to know before obtaining this insurance.

Healthcare costs in the U.S. are extremely expensive, visitor health insurance is extremely critical to avoid huge medical costs from out-of-pocket.

U.S. citizens & permanent residents of the U.S. have domestic health insurance plans to take care of their eligible medical expenses. When family members or friends visit they need visitor health insurance that can provide them with medical coverage while on their visit to the U.S.

VisitorSecure provides these visitors with pre-defined amounts for medical coverage as eligible medical expenses in case something unexpected and unwanted happens and they need medical treatment while on their visit to the U.S. or abroad.

Visitors to the USA can carry prescription drugs from their home country with them.

This is an ideal visitor health insurance plan for Parents, Senior Travelers, Family, Members and Relatives visiting the United States or traveling abroad.

Compare Travel Insurance Plans

Visitor Secure Travel Insurance Plan

VisitorSecure provides visitor health insurance for a single individual or a group while traveling to the United States and also when traveling internationally.

Visitor Secure Insurance is a fixed-benefit, budget-friendly renewable travel medical insurance plan designed for budget-conscious visitors to the USA, or travelers outside America with coverage duration options from a minimum of 5 days up to 364 days. This plan is extendable and cancelable. the Policy can be purchased instantly online.

For individuals (above the age of 65 years) coming to the U.S coverage must be effective within 30 days of arrival. In order to be eligible for coverage U.S. citizens must be traveling outside of the continental U.S., Alaska, Hawaii, Puerto Rico, and the U.S. Virgin Islands.

| Administrator | WorldTrips (A subsidiary of HCC Insurance Holdings) |

| Underwritten By | Lloyd’s of London |

| A.M. Best Rating | A |

| Plan Type | Limited Benefit Plan |

| Extendable | Yes |

| Cancelable | Yes |

| Available To | Individuals traveling outside of their home country |

| Minimum Coverage Age | 14 days |

| COVID-19 | Covered like any other covered medical condition |

| Acute Onset Of Pre-Existing Conditions | Yes, offers coverage up to chosen plan’s maximum option |

| Pre-Existing Conditions | Does not offer coverage for pre-existing conditions |

| PPO Network | No PPO (Preferred Provider Network), you can visit any Doctor or Hospital |

| Terrorism Coverage | No |

Some restrictions may apply at the time of purchase if you are physically located in the states of New York, Maryland, or Washington or in the countries of Canada or Australia

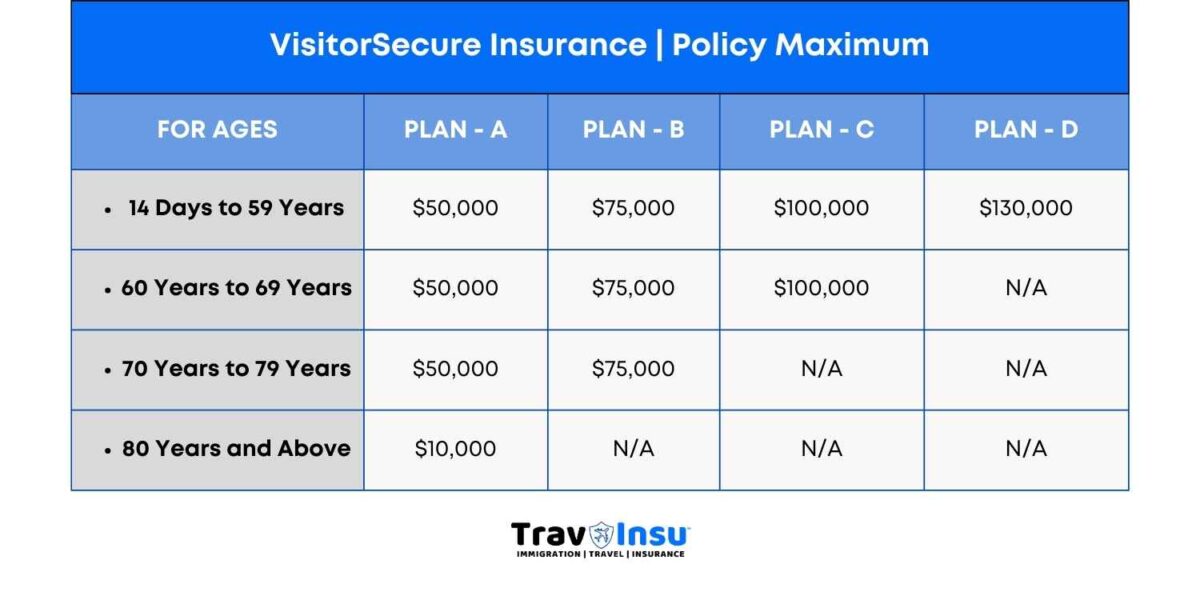

VisitorSecure is classified into four types based on the policy maximum amount for people of different age groups:

- Plan A

- Plan B

- Plan C

- Plan D

COVID-19 is covered by all the plans.

Plan Maximum Per Injury/Sickness For All The Plans:

| Plan A | $50,000 (Lifetime maximum for eligible expenses) |

| Plan B | $75,000 (Lifetime maximum for eligible expenses) |

| Plan C | $1,000,000 (Lifetime maximum for eligible expenses) |

| Plan D | $1,30,000 (Lifetime maximum for eligible expenses) |

Selection of Plan ( Plan A, Plan B, Plan C, or Plan D):

| For Ages 14 days And Under 59 Years | May Select any Plan |

| For Ages 60 to 69 Years | May Select Plan A, Plan B, or Plan C |

| For Ages 70 to 79 Years | May Select Plan A or Plan B |

| For Ages 80 And Above | Must Select Plan A |

VisitorSecure Insurance Plan Information

Visitor Secure is a low-cost limited coverage/fixed benefits travel medical insurance plan designed for budget-conscious visitors.

Visitors Secure Insurance provides a pre-defined amount for medical coverage and emergency services for visitors to the USA or travelers outside the USA.

- It is a fixed benefit plan that pays a fixed amount for each covered medical benefit

- The plan provides coverage for in-patient and out-patient medical accidents and sickness, emergency medical evacuation, repatriation of remains, accidental death, dental injury, and incidental trips

- The policy maximum chosen is for the life insurance of the insurance plan and not per incident

- Coverage duration available is from 5 days to 364 days

- Visitorsecure insurance plan does not participate in any PPO Network which means you can visit any Doctor of your choice

- While in the U.S. after deductibles are paid, The company pays up to the stated amount in the policy document(For each covered treatment or service)

- The visitor secure plan excludes coverage for Pre-existing conditions (Except as provided under the Acute onset of pre-existing conditions benefits).

- VisitorSecure covers COVID-19 like any other covered medical condition (If the virus is contracted after the policy effective date)

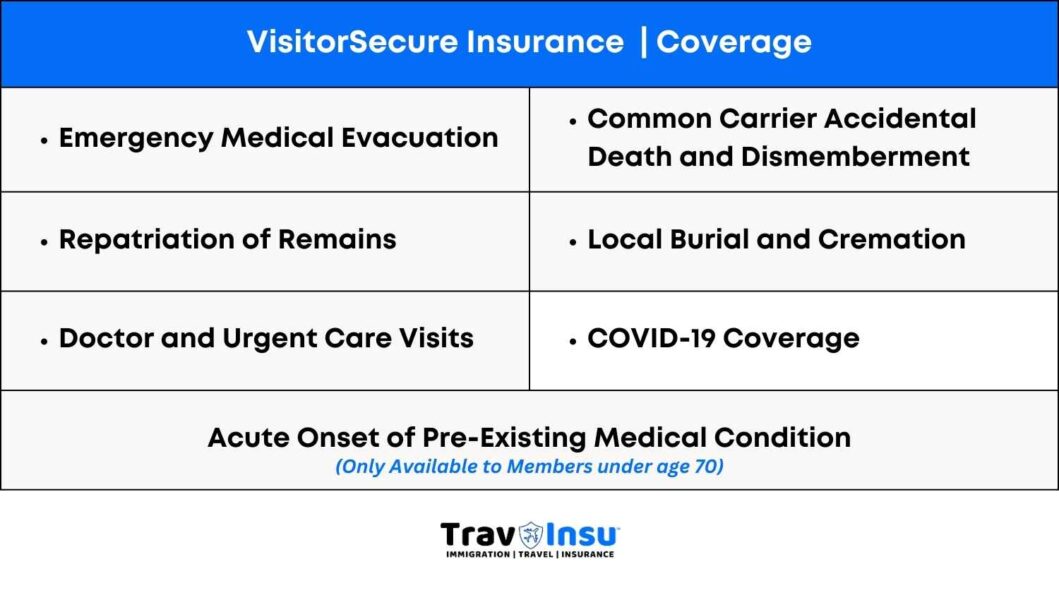

VisitorSecure Insurance Benefits

VisitorSecure Insurance typically includes medical coverage benefits and emergency services for visitors to the United States during their travel and temporary stay outside of their home country

- Medical Expenses

- Emergency Medical Evacuation

- Local Burial and Cremation

- Repatriation of Remains

- Common Carrier Accidental Death and Dismemberment

- Other Benefits

The plan also offers a choice of deductibles and coverage options to help meet any budget.

Except for:

- Emergency Medical Evacuation,

- Repatriation of Remains

- Common carrier accidental death and dismemberment

All other benefits are subject to deductible and are per injury or illness, up to the overall policy maximum, unless stated otherwise.

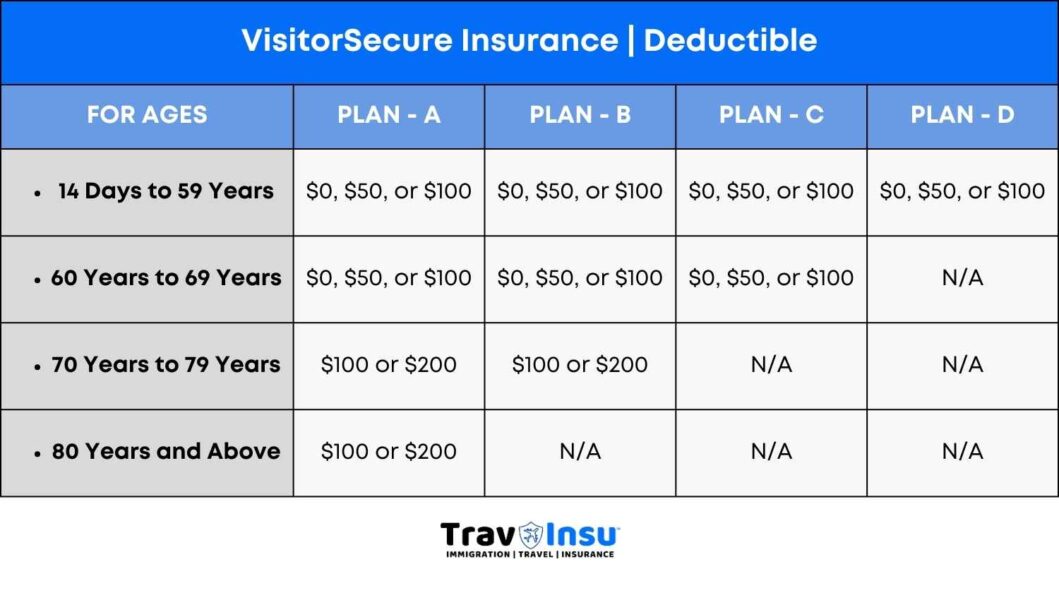

VisitorSecure Insurance Deductibles And Policy Maximum Limit

The plans offer the following deductibles and Policy maximum limits for various age groups.

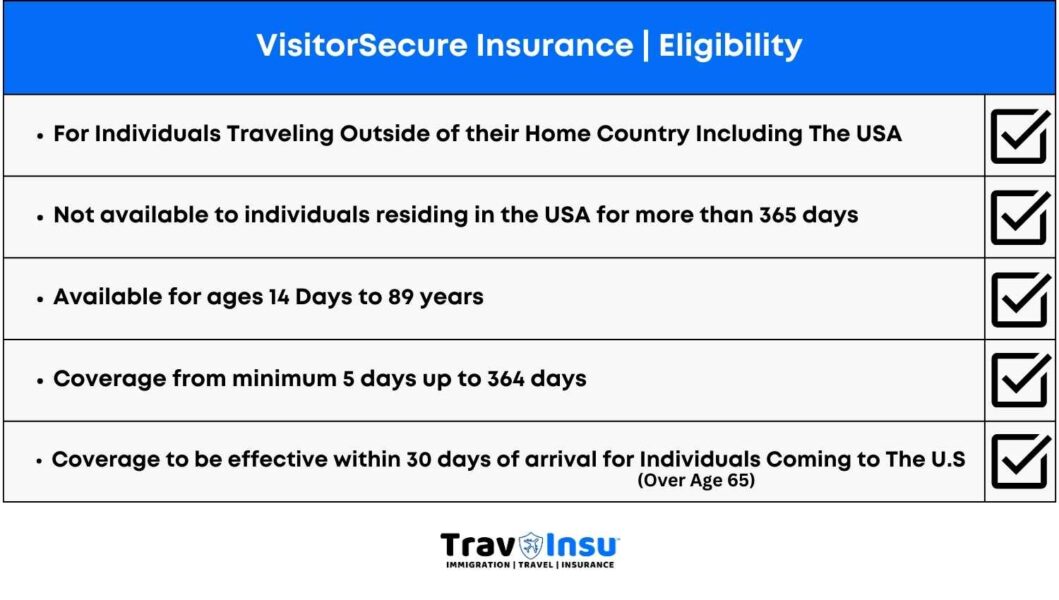

VisitorSecure Plan Eligibility

Eligibility for a Visitor Secure plan usually depends on factors such as:

- Your age

- The duration of your visit

- Your country of residence, and

- The specific insurance provider’s terms and conditions

VisitorSecure Member Eligibility

Obtaining VisitorSecure Insurance is highly recommended when visiting countries like the United States, where healthcare costs are significantly high and access to public healthcare may be limited for non-U.S. citizens or residents.

- Minimum age for coverage: 14 days

- Coverage: Minimum 5 days up to 364 days

- Extendable: Up to 364 Days

- Traveling: For individuals traveling outside of their home country (Including the U.S.)

- U.S. Citizens: Must be traveling outside of the continental U.S., Alaska, Hawaii, Puerto Rico, and the U.S. Virgin Islands

- Individuals Coming to U.S. (Age over 65 Years): Coverage must be effective within 30 days of arrival to the U.S.

Insurance companies may have specific requirements or restrictions, so it is crucial to review the eligibility criteria for each plan carefully.

By having adequate insurance coverage, you can safeguard your health, finances, and overall well-being during your trip, allowing you to focus on enjoying your time abroad with greater peace of mind.

Pre-Existing Condition

A pre-existing condition refers to a medical condition or illness that existed before obtaining insurance coverage. Examples may include chronic diseases, heart conditions, diabetes, asthma, or any other health condition that was diagnosed or treated prior to the start of the insurance policy.

VisitorSecure insurance policy excludes coverage for pre-existing conditions (except as provided under the Acute onset of pre-existing conditions benefit).

VisitorSecure plan provides coverage for the acute onset of pre-existing conditions.

Acute Onset Of Pre-Existing Conditions

The term “acute onset of pre-existing conditions” is commonly used in the context of travel insurance or international health insurance. It refers to a sudden and unexpected outbreak or flare-up or worsening of a pre-existing medical condition during the coverage period. It involves the rapid onset of symptoms that require immediate medical attention.

VisitorsSecure offers coverage for the acute onset of pre-existing conditions to insurers under the age of 70 only. Depending on the plan chosen the coverage varies:

- Plan A: $50,000 Lifetime Maximum limit for eligible medical expenses

- Plan B: $75,000 Lifetime Maximum limit for eligible medical expenses

- Plan C & Plan D: $1,00,000 Lifetime Maximum limit for eligible medical expenses

VisitorSecure Insurance Advantage

- Cheap travel insurance plan with limited coverage benefits

- Covers acute onset of pre-existing conditions (For travelers aged under 70 years)

- Suitable for international travelers

- Going to the U.S. and

- U.S. travelers traveling outside of the U.S.

- Maximum coverage for travelers aged 70 to 79 years: $50,000 and $75,000

- No co-insurance

- Good provider network

- Deductible per injury/illness

VisitorSecure Disadvantages

- Fixed benefit plan

- Any medical expenses should be pre-certified to avoid a 50% reduction in the benefits

- Maximum Coverage for travelers aged 80+: Only $10,000

Emergency Medical Evacuation

Emergency Medical Evacuation, also known as medical repatriation or Medevac is a crucial component of many travel insurance and international health insurance plans.

Emergency Medical Evacuation plans provide coverage and assistance in transporting injured or critically ill individuals to the nearest appropriate medical facility or back to their home country for further medical treatment.

key Points To Understand Emergency Medical Evacuation Coverage:

- Medical Necessity: Emergency medical evacuation is typically provided when it is deemed medically necessary. This means that the individual’s condition requires immediate transportation to receive appropriate medical care that is not available locally.

- Eligible Situations: Emergency medical evacuation may be covered in various situations, such as severe injuries, life-threatening illnesses, or when local medical facilities are inadequate to treat the individual’s condition effectively. The decision for medical evacuation is usually made by the insurance company’s medical professionals in consultation with the attending physicians. A Non-life-threatening situation usually excludes emergency medical evacuation.

- Arrangement and Coordination: Insurance providers that offer emergency medical evacuation coverage typically have specialized teams or assistance services that handle the logistics and coordination of the evacuation process. They work with local medical providers, transportation services (air or ground), and other necessary resources to ensure a safe and timely evacuation.

- Coverage Limitations: The coverage for emergency medical evacuation can vary between insurance plans. It is important to review the specific terms and conditions of your policy to understand the coverage limits, maximum benefit amounts, and any exclusions or requirements that may apply.

- Repatriation: In some cases, emergency medical evacuation may involve repatriation, which means transporting the insured individual back to their home country for further medical treatment. Repatriation may be necessary if the individual’s condition is stable enough for travel or if they prefer to receive ongoing care in their home country.

- Coordination with Medical Providers: Insurance companies offering emergency medical evacuation often work closely with the attending physicians and medical facilities involved in the case. This collaboration ensures a smooth transition and continuity of care throughout the evacuation process.

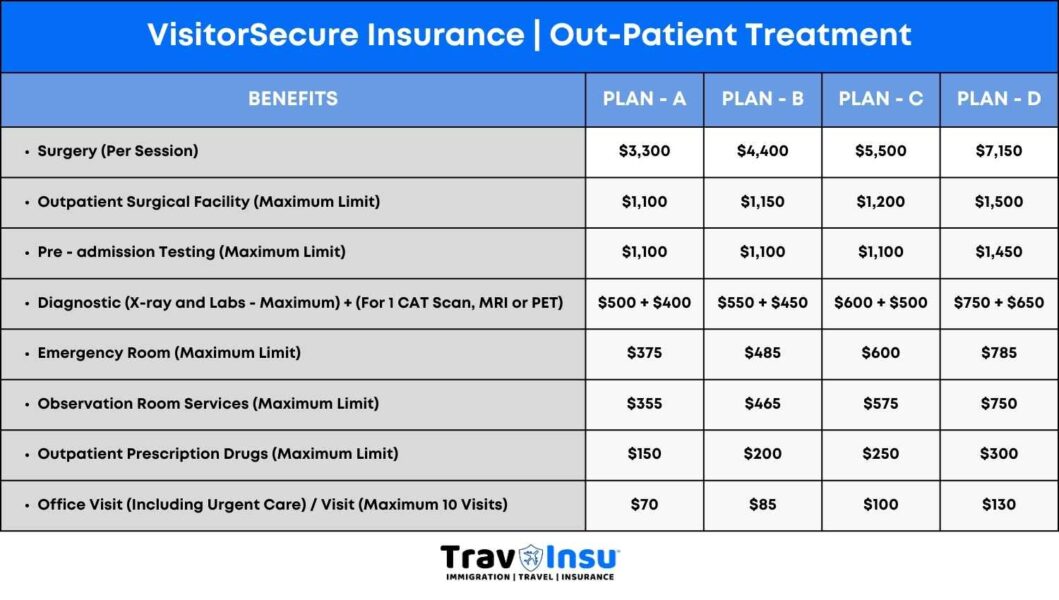

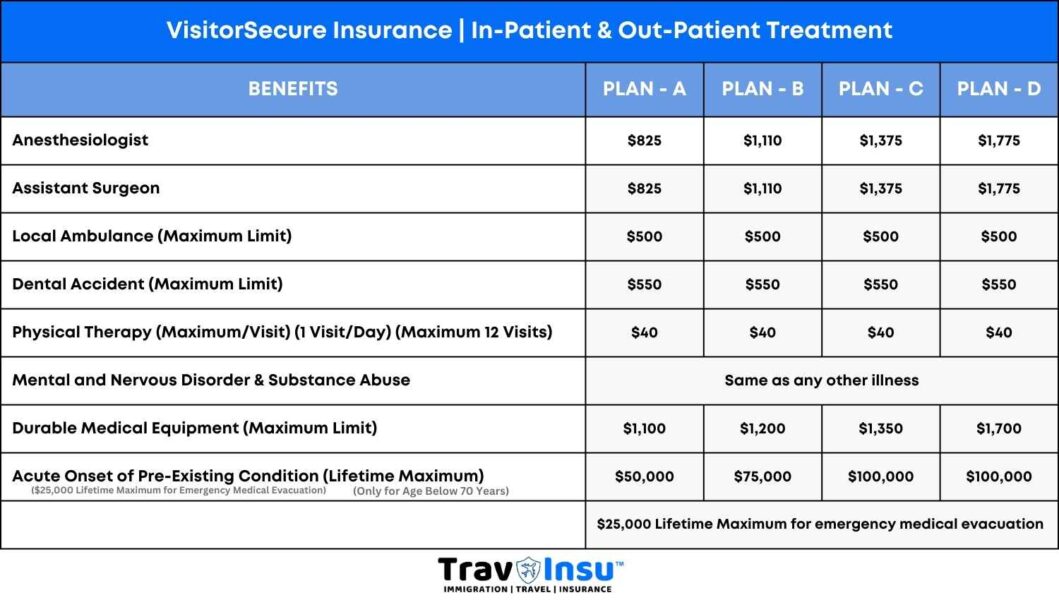

Schedule Of Benefits And Limits

VisitorSecure insurance provides Inpatient Treatment, Outpatient, Miscellaneous hospital services expenses, and other benefits. Price varies depending on the type of plan

Inpatient Treatment

- Hospital Room & Board

- Intensive Care Unit

- Surgery

- Consultant Physician

- Private Duty Nurse

- Physician Visits

Outpatient Hospital Medical Expenses

- Surgery

- Outpatient Surgical Facility

- Pre-admission Testing

- Diagnostic X-ray and Labs

- Emergency Room maximum limit

- Observation Room Services

- Outpatient Prescription drugs

- Office Visits, Including Urgent Care

Miscellaneous Hospital Service Expenses

- Anesthesiologist Maximum Limit

- Assistant Surgeon

- Local Ambulance

- Dental Accident

- Physical Therapy

- Mental and Nervous Disorders and Substance Abuse

- Durable Medical Equipment

- Acute Onset of a Pre-Existing Condition

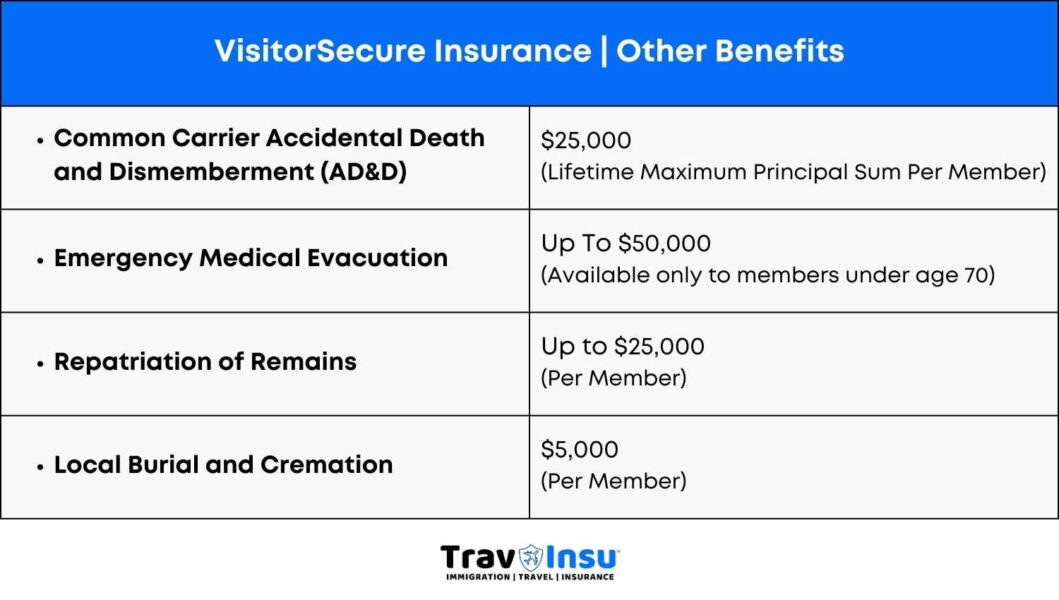

Other Benefits

- Emergency Medical Evacuation

- Repatriation of Remains

- Local Burial and Cremation

- Common Carrier Accidental Death and Dismemberment

VisitorSecure Plan Description Of Coverage

VisitorSecure is a travel insurance plan designed to provide coverage for visiting foreign countries.

Here is a typical description of coverage that may be included in a VisitorSecure plan:

- Medical Expenses: This coverage reimburses eligible medical expenses incurred due to unexpected illnesses or injuries during your trip. It may include hospitalization, physician visits, prescription medications, diagnostic tests, and emergency dental treatment.

- Emergency Medical Evacuation: If you experience a severe medical condition or injury that requires immediate transportation to a more suitable medical facility or your home country for treatment, this coverage helps arrange and cover the expenses of emergency medical evacuation.

- Repatriation of Remains: In the unfortunate event of a covered individual’s death during the trip, this coverage assists with the necessary arrangements and expenses to return the remains to their home country.

- Trip Interruption/Cancellation: If your trip gets interrupted or canceled due to covered reasons, such as unexpected illness, injury, or death of a family member, this coverage may reimburse the non-refundable expenses you incurred, such as airfare, accommodations, or tour costs.

- Baggage Loss/Delay: If your checked luggage is lost, stolen, or significantly delayed during your trip, this coverage helps reimburse you for the value of your belongings or provides a daily allowance for essential purchases until your baggage is returned.

- Emergency Medical Reunion: In the event that you are hospitalized for a certain number of days, this coverage may cover the transportation and accommodation expenses for a family member or relative to join you during your hospitalization.

VisitorSecure Insurance PPO Network

The PPO (preferred provider network) is a network of healthcare providers, including doctors, hospitals, clinics, and other medical facilities, that have agreed to provide services to insured individuals at negotiated rates.

When you receive medical care within the PPO network, you can typically benefit from discounted rates and higher coverage levels. VisitorSecure does not participate in the PPO network you can visit any doctor or hospital.

WorldTrips Medical Insurance Services Group

VisitorSecure Travel Insurance company is WorldTrips, they are a leading international travel insurance provider. WorldTrips is part of the Tokio Marine HCC group of companies. The insurance underwriter for VisitorSecure plans is Lloyd’s of London.

What Are The Limitations Of Fixed-Benefit Visitor Insurance Plans Like VisitorSecure?

Fixed benefit visitor insurance plans like VisitorSecure have limitations compared to comprehensive coverage plans. Fixed benefit plans provide limited coverage compared to comprehensive plans and are insufficient in most cases.

They pay a fixed amount for each covered medical benefit, and you will have to pay the difference from your pocket, which can be very large, as healthcare expenses are very high in the USA.

The policy maximum chosen is for the life insurance of the insurance plan and not per incident.

Fixed benefit plans do not provide acute onset of pre-existing conditions benefits. There is a fixed limit on doctor visits, urgent care visitors, emergency room, surgery, labs, etc.

With a schedule of benefit plan, you can go to any doctor or hospital, but the plan will only pay a fixed amount for each covered medical benefit.

Comprehensive coverage plans are recommended because fixed coverage plans can often be insufficient.

Visitor Secure Insurance Plan FAQ

Why do I need visitors’ health insurance coverage for my trip to the United States?

Most domestic health insurance plans offer limited or no coverage outside of policyholders’ home country. Visitors’ health insurance provides emergency expenses for medical coverage and medical evacuation.

Is VisitorSecure a good insurance plan?

VisitorSecure insurance is a very popular plan among people visiting the United States. It is a good plan depending on your travel insurance needs. It is a good option to compare travel insurance before you decide to buy one.

Can international travelers get medical insurance in the US?

Yes, international travelers visiting the USA can get short-term travel medical insurance for protection against unforeseen events like sickness, and injury and benefit from medical and emergency travel features of an insurance plan.

Conclusion

Overall, Visitor Secure Insurance is a low-cost option for visitors to the USA or for traveling outside of their home country who are looking for basic medical coverage and emergency services. However, it is important to review the policy information and restrictions carefully to ensure that the plan meets your needs.