Definition Of Travel Insurance To Benefits – Complete Guide

This definition of travel insurance article will help you with in-depth details. This article will be useful whether you travel with family for vacation or business travelers.

We know you’re busy. You’re always on the go, and sometimes it seems like there just isn’t enough time in the day. That’s why we’ve written this guide to answer all your questions about travel insurance.

Simply put it is a type of Insurance policy that you buy when you must travel internationally or domestically. It offers financial protection against the risks associated with travel.

Technically speaking travel insurance is a contract between the insured and the insurer i.e., the policyholder and the Insurance company.

Travel insurance can be confusing and knowing how it works can be of great help. It’s something that you need to get right if you’re planning on traveling. Getting familiar with the benefits empowers you to make the right choice about the kind of coverage you must consider for your next vacation.

Travel Insurance Explained – Things To Know

Apart from the definition of travel insurance, you should also know everything about travel insurance, if you have an upcoming trip. It is important to know what type of insurance plan you should get and how it works.

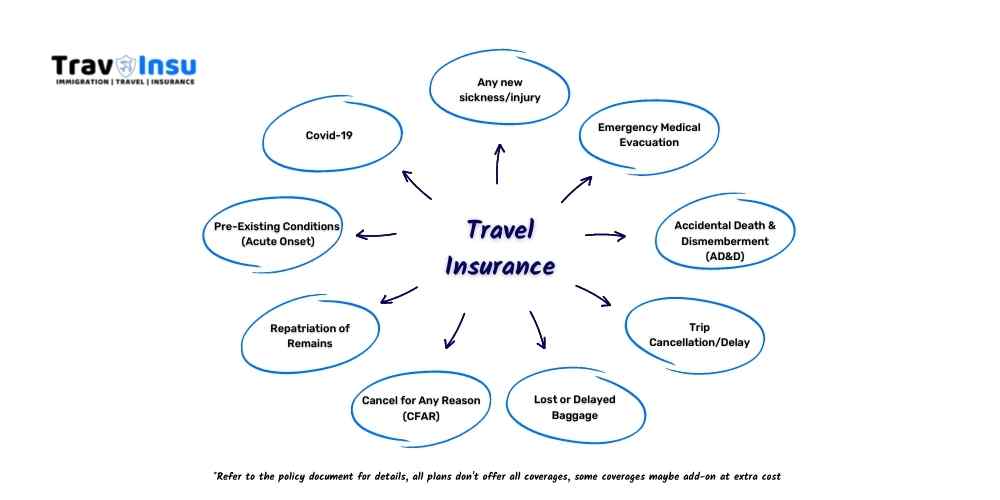

A Standard travel insurance policy provides coverage for the following:

- Protection for medical expenses

- Protection for your financial expenses

- Protection for your personal belongings

Look out for these three things whenever you are buying a travel insurance policy.

You must also read the fine print of the policy so that you understand:

- The cancellation policy

- What may be covered by the policy

- What may not be covered by the policy

- Limits or exclusions that may apply to certain types of claims

The main categories of travel insurance coverage include:

- Medical coverage

- Flight cancellation or interruption coverage

- Baggage and personal effects coverage

- Accidental death or flight accident coverage

The best time to buy travel insurance is right after you have completed your travel arrangements.

You can opt for Travel Medical Insurance or Trip Insurance. The former is designed for medical-related coverages and the latter is designed to cover your costs related to the trip. Do note that several benefits may overlap between the two kinds of insurance.

Types Of Travel Insurance Coverage

Some main types are:

- Single Trip: If you travel not so frequently then this will be the best option.

- Multi-Trips/Annual: If you are a frequent traveler you can opt for this coverage, the convenience of this coverage is you make a one-time purchase for multiple trips in a year.

- Group Plans: Offers the benefit of covering the whole group (usually 5 or more) for premiums at lower rates than individual policies for each one in the group.

- Single Destination: Covers travel to a single destination country, en-route visits to other countries might be covered.

- Worldwide basically two types of policies One that covers the U.S. and the other that doesn’t cover the U.S.

- Backpacker/Gap year provides you with multiple destinations over an extended period of time.

- Schengen Visa Insurance: policies coverage for visitors from countries that need travel insurance to be able to obtain and visit countries in this region of Europe.

- Cruise Insurance: some travel insurance policies extend coverage trips on cruise lines, and some travel insurance plans for the USA have built-in coverage for cruises

- Family Cover: Two Adults plus up to four children (Good if children are 18 years or younger)

Add-ons to Travel Insurance:

- Winter Sports Excluded from most standard policies, specialist coverage for high-risk activities like snowboarding skiing, or other winter sports.

- Cancel For Any Reason (CFAR) this option in Trip Insurance gives you the benefit of canceling your travel for any reason and still being able to get back a major portion of nonrefundable trip costs

Compare Travel Insurance Plans

What Does Travel Insurance Cover?

It covers your medical expenses, flight cancellations, trip delays, and lost luggage. It reimburses you for the money you lose from non-refundable deposits and payments.

Travel Insurance covers you for unforeseen risks.

- Emergency medical treatment

- Emergency medical evacuation

- Trip cancellation, trip Interruption, and/or delay

- Accidental death and dismemberment (AD&D)

- Lost, stolen, and damaged baggage

- Delayed baggage and emergency replacement

- Accident

- Flight delay

- Lost or stolen travel documents

- Hospitalization and hospital costs

- Repatriation of remains

- Travel delay

- Legal cost

Some travel policies even cover damages to rented equipment, rental cars, damage to personal property, or even costs for paying a ransom.

Note: Not all policies cover everything mentioned above, some benefits may be available as add-ons at extra cost. Always refer to the policy document for coverage details.

Other Coverages Offered

Some travel insurance plans offer add-on coverage for additional expenses, mostly it is sold as a package, it includes several types of coverages like:

- Trip cancellation coverage

- Trip interruption coverage

- Trip delay coverage

- Cover for lost or stolen travel documents

- Lost luggage (Baggage loss)

- Accidental death coverage

- Flight accident coverage

- Medical expenses and Emergency evacuation coverage

- Cover for additional living expenses -additional cover that you can buy with your policy if you want to: cover for loss, theft, or damage to personal belongings, cover for loss of cash

Coverage often includes 24/7 emergency services, such as re-booking canceled flights, cash wire assistance, and replacing lost passports.

What Does Travel Insurance Not Cover?

A lot of it will depend on the policy and the insurer, there are a few things that are not covered, or that may only be available for an extra cost as an add-on benefit:

- Travel Insurance policies usually exclude epidemics and pandemics

- Post the outbreak of COVID-19 it was included in the insurance company’s additional protection options or included in the plan as any other sickness or illness

- Still not all travel insurance plans offer COVID-19 coverage

- Some plans have medical coverage but pre-existing condition coverage may be excluded

- Many travel medical insurance plans only cover the acute onset of pre-existing conditions

- Age limits and maximum coverage limits may apply for plans that offer acute onset coverage

- There are only a select few travel medical insurance plans that cover pre-existing conditions

- For trip insurance, you may need to purchase a pre-existing conditions exclusion waiver if you want your policy to cover any of your existing conditions that flare up during your trip

- To know what your travel insurance or trip insurance does not cover, you must read the policy exclusions carefully

Travel Insurance may not cover the following:

- Travel to high-risk countries or the ones the foreign office recommends avoiding

- Does not cover if your trip is affected by earthquakes, pandemics, acts of terrorism, or Civil unrest

- High-risk activities such as scuba diving may not be covered

- Dangerous activities like white water rafting, climbing

- Adventure sports, Winter Sports

- Expensive or luxury items like laptops, cameras, jewelry, watches

- It doesn’t cover mental illness or psychological disorders,

- Damages caused by willful misconduct i.e., intentionally doing something wrong

- Medical tourism is not covered

- Cosmetic surgery, unless it’s medically necessary

- Any pre-existing medical conditions that existed before your trip

- Any injury or illness that occurred before your trip and resulted in medical treatment.

- Elective abortion services

- Drugs that are not prescribed by a licensed physician for medical purposes such as weight loss pills

Why Buy A Travel Insurance policy?

If something unexpected happens while abroad, having a valid, up-to-date policy can help protect against financial loss due to medical emergencies, theft, or damage.

Compare Travel Insurance Plans

This helps protect against unexpected expenses that arise from unforeseen circumstances; this could include anything from illness or injury while traveling overseas.

Let us discuss each scenario in detail.

Trip Cancellation, Trip Interruption, And Trip Delay.

Trip Cancellation: An Insurance company pays you if you need to cancel your trip because of a covered event, such as

- Sickness or injury

- Injury or death of a close family member

- Injury or death of a traveling companion

- Injury or death of the traveler

If the trip is canceled for a covered reason then your travel insurance policy can refund you for your prepaid, Non-refundable trip deposits, Some examples of covered reasons (Acceptable reasons ) for trip cancellation are,

- Hotel Rooms

- Airline Tickets

- Rental Cars

- Tours and Cruises

Trip interruption insurance is when an insurer pays for certain expenses associated with continuing your trip after a covered event, such as getting home from the airport or getting into another hotel room in another location.

Trip cancellation and interruption. Some policies pay out to travelers who are forced to cut their trip short because of circumstances outside their control—like weather disasters or job loss back home—while others provide coverage against cancellations due to illness, injury, or other personal reasons like family emergencies. If it’s too late to cancel but not too late to interrupt (e.g., if you’ve already purchased tickets), some policies may cover those expenses too.

Some policies also provide coverage if a tour operator goes bankrupt before your departure date; this can happen when things go wrong on the ground overseas as well as at home.

Other common situations covered by cancellation/interruption include natural disasters like hurricanes and earthquakes (but not floods), war declarations between countries where travelers would otherwise be headed (i.e., war with Syria would likely mean no trips there), and political unrest such as riots (this one could get tricky because it means different things depending on where exactly these disturbances took place).

Trip delay covers you if your flight has been delayed by more than six hours and you need to stay overnight at no additional cost (hotel, food). For example: if you are meant to fly and due to (ATC) air traffic control issues, your flight is late, arriving by seven hours and then taking off two hours later than scheduled – this would be considered a delay of greater than six hours. You would be eligible for financial compensation under trip delay terms and conditions.

What does it mean to have a missed connection?

A missed connection will occur when your flight gets delayed, causing you to miss your connecting flight. If this happens, then you will not be able to get to your final destination on time. This can result in additional costs and stress for passengers.

What travel insurance covers missed connections?

There are two types of insurance that cover missed connections:

- Trip cancellation insurance: covers lost income if you cancel your trip due to something unexpected happening (like getting sick),

- Trip delay reimbursement insurance: covers expenses such as food and lodging while waiting to rebook flights or getting home again after the canceled trip.

How do I know which one will work best for me?

The type of coverage that works best depends on what kind of traveler you are, where you’re traveling from/going to, if there’s another person accompanying you (or multiple people), etc…

Baggage Delay, Loss, Or Damage

Lost luggage and passports. If your bags go missing or are delayed, travel insurance will help ensure that you don’t have to pay for replacing any items that were in them (or find yourself facing an unexpected bill for new clothes).

Also, some policies cover the replacement costs associated with lost passports—a crucial service if you’re stuck abroad without ID!

In the event that you are delayed, or your baggage is lost or damaged during the trip, you are covered for up to $5,000 USD.

The coverage applies to international trips and some domestic flights.

Coverage begins when you leave on your trip and expires when your baggage arrives at its destination.

If your luggage is delayed or damaged in transit, coverage will apply if it is no longer required for use as personal baggage while traveling (e.g., if it contains clothing that has been worn). However, this does not include items that were packed specifically for commercial sale or trade (for example, samples) or any other property placed inside another object such as a suitcase or backpack – only those items contained within a bag/suitcase/backpack without being contained within another bag/suitcase/backpack will be covered.

Medical Expenses And Personal Accidents

If you happen to get sick or injured while you are traveling, travel insurance companies will reimburse you for the cost of medical care and related expenses. Insurance companies will reimburse your Medical costs, including hospitalization and treatment costs incurred during a trip abroad.

If you need to be evacuated because of an accident or emergency, It will arrange for you to be brought back home or to another country where adequate medical care is available.

It also covers eligible charges at foreign hospitals and clinics if you’re injured while traveling—but only if they can’t be treated in the country where they were sustained.

In addition, It provides emergency dental treatment should one of your teeth become damaged or lost on vacation (e.g., from falling).

Emergency Evacuation And Family Repatriation

When you’re traveling, there’s always a risk that something could go wrong. If you become ill or injured while on your trip and require medical attention.

Travel insurance may cover the cost of an emergency evacuation. This can be a lifesaver if you’re far from home and need to get to a hospital or other medical facility quickly.

In addition to covering the cost of an emergency evacuation, travel insurance often also covers the costs associated with family repatriation—that is, bringing someone back home with you after they’ve been left behind due to an accident or injury sustained while traveling.

The family member may not have been traveling with you in the first place; it could be a friend who was simply visiting for vacation at the time of their misfortune. While this isn’t as common as needing emergency transportation yourself (and isn’t likely covered by health insurance), it’s still something that can happen unexpectedly when hundreds of thousands of people are flying around at any given moment throughout North America alone every day!

The cost of medical treatment overseas can be incredibly expensive—sometimes thousands upon thousands per day! That’s why it’s essential for travelers who regularly visit foreign countries to carry adequate protection against both predictable risks like car accidents as well as unexpected ones such as injuries incurred during outdoor activities like hiking or scuba diving which may require evacuation back home with urgent care needed now rather than later when time becomes critical.

Cancel For Any Reason Coverage

Cancel for any reason (CFAR) coverage is an add-on to your base policy.

Not all insurance providers offer this add-on but you can upgrade your trip cancellation insurance to CFAR.

If you need to cancel for a reason not listed in your base policy. This add-on coverage is a good option to have as it gives peace of mind as you need not worry about the reason for not being able to go on the trip.

You pay an additional 40% to 50% and get this coverage. You can get back a percentage of your pre-paid, nonrefundable trip costs back, You can get reimbursed up to 75% of your total trip cost.

As long as the cancellation occurs within the specified time frame, two days in advance of the trip date, CFAR allows you to get a partial refund of your nonrefundable deposit.

From Where To Purchase Travel Insurance Coverage?

There are many options to purchase, if you have never purchased travel insurance before then,

- Going to a marketplace or comparison site is a good option to get your policy

- The other option is to get a quote by going to a specific travel insurance carrier’s website

- You can also get your policy from a travel agent or insurance agent

- It can be done instantly as you book your trip online. Nowadays many websites provide travel insurance along with their other travel services

As soon as you book your trip online you get the option of purchasing your Travel Insurance, not only this, but you will also be able to go through the terms and conditions of the travel Insurance here itself. You can read these and you can purchase your Travel Insurance instantly.

If you have not purchased travel insurance you should consider purchasing it.

Travel Insurance Cost!

According to the U.S. Travel Insurance Association (UStiA), in 2018-2019 $1.72 Billion was spent by consumers on various types of travel insurance products.

The cost of a policy varies widely, depending on the type of coverage you choose and the level of benefits you select. In general, the more extensive your travel plans are and the longer they are expected to last, the higher your premiums will be.

For Example:

The cost of travel insurance is roughly between 4% and 10% of trip cost. If your trip cost is $ 6000 then roughly your insurance cost will be around $240 to $ 600.

Then there’s the matter of how much risk you’re willing to assume. Many plans require a certain amount of deductibles, which are usually paid out-of-pocket by the insured party. Costs are linked to the following:

- Policy Maximum – The higher the policy maximum higher the cost

- Deductibles – Lower the deductible higher the cost

- Optional Add-ons increase the cost

Some other key factors that impact the premium cost are Age, Duration of Coverage, Destination, Policy Maximum and deductible option, Add-on coverage selected, whether buying comprehensive travel insurance or limited coverage plans, and more…

How To Make A Travel Insurance Claim?

To make an insurance claim, you need to be able to provide proof that the event took place. So keep all your documents, medical reports, and receipts handy and in a safe place, these will be needed to process your insurance claim.

Call your Insurance Provider as soon as possible after your injury has happened so they can start processing the paperwork right away!

You’ll need all of the following information:

- A copy of your police report (if applicable) detailing what happened;

- Any relevant medical bills or doctor’s notes;

- A copy of any invoices relating to lost property; Proof that you’ve paid these bills;

- A photo ID card showing proof of ownership such as receipts with serial numbers

It always helps if the insurance company is informed as soon as the incident occurs. For some expenses prior approval from the insurance company may be mandatory and refer to the claims process as defined in the insurance coverage, the process may defer from company to company, this helps to avoid any surprises while filing a claim.

Conclusion

Hope this definition of travel insurance and the benefits of buying travel insurance was helpful. Travel insurance should be an important consideration for all travelers. The cost of travel insurance is small compared to the potential costs if something goes wrong on your trip.

If in doubt, talk to travel experts who will be able to advise you on what type of travel insurance would suit your needs best.

Bon Voyage!