Cancel For Any Reason Travel Insurance (CFAR): Complete Guide

Traveling is an amazing experience that allows you and your traveling companion to explore new cultures, meet new people, and create unforgettable memories.

However, there are always unforeseen circumstances that can disrupt plans for you and your travel companion due to reasons such as unforeseen illness, injury, accident, natural disaster, or even political unrest.

A little more protection can really help when it comes to vacation planning and knowing the details of how travel insurance works helps us get the protection we need.

That’s why it’s important to have travel insurance that covers these unexpected events and Cancel For Any Reason (CFAR) is one optional benefit that provides added protection.

Cancel for Any Reason coverage (commonly known as “CFAR”) is an add-on optional upgrade to consider when evaluating travel insurance.

In this blog, let us discuss the best travel insurance options that provide CFAR – Cancel For Any Reason benefit and their limitations.

Compare Travel Insurance Plans

What Is Cancel For Any Reason – CFAR Coverage?

Your travel insurance may cover medical expenses and provide travel delay coverage but what happens if you can’t start the trip for a reason not covered in the standard insurance policy terms?

Note that the policy term may also include that the travel delay coverage will only be valid if the delay is beyond your control and you are not the reason for the delay, for example, if the airline delays the flight due to maintenance issues.

Travelers can cancel plans using CFAR coverage for reasons other than those that are specified on their policy as “covered reasons.”

By-passing that list is made possible by CFAR, giving many passengers a feeling of more flexibility and assurance when choosing their trip cancellation insurance plans.

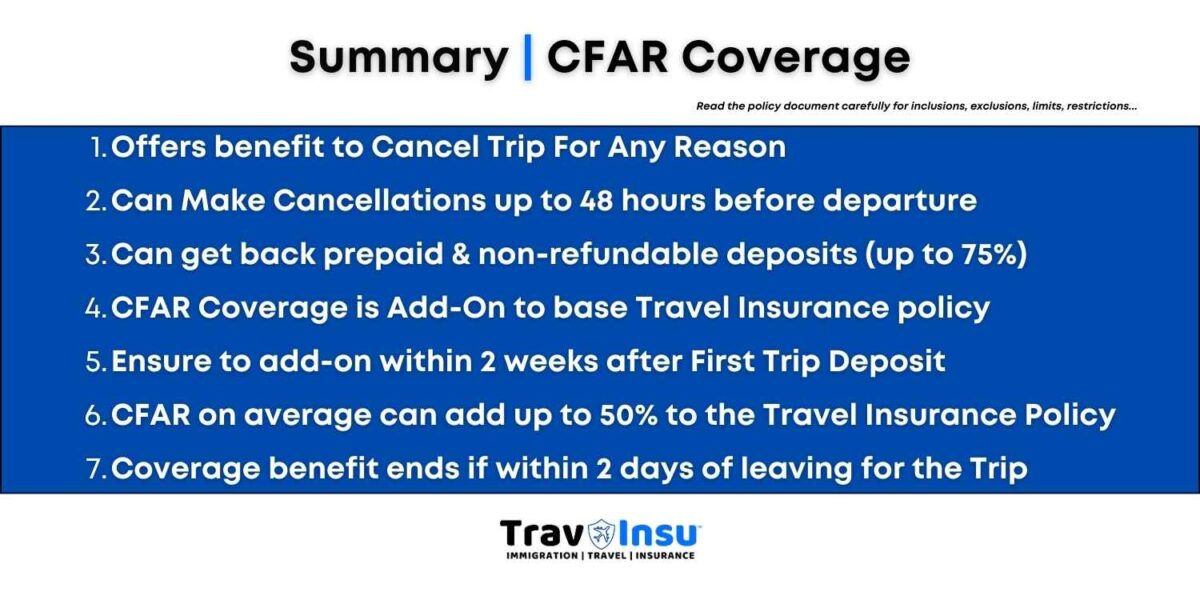

CFAR coverage is an optional add-on to travel insurance policies that allow you to cancel a trip for any reason, even if it’s not covered by the standard policy.

With CFAR coverage, you can receive a partial refund of your trip costs, a refund usually between 50% and 75%, depending on the policy.

This coverage is a time-sensitive benefit and is only available for a limited time after you book your trip, usually within 10-21 days, so it’s important to purchase it as soon as possible.

CFAR may only be accessible to persons who meet certain requirements and is offered as a component of some comprehensive plans. Unless otherwise stated, if you cancel at least 48 hours before departure, you may be eligible for recovery of 50%–75% of your insured, pre-paid, nonrefundable trip costs.

Keep in mind that if you cancel for a covered reason under standard trip cancellation coverage, you will be covered for 100% of your insured pre-paid and non-refundable trip costs.

Travelers typically opt to use their CFAR coverage if they need to cancel for any incident that may not be covered under the typical trip cancellation coverage.

Note: CFAR is a feature usual

What Is Covered By Cancel For Any Reason Travel Insurance Benefit?

The Cancel For Any Reason Travel Insurance Benefit – CFAR is intended to offer coverage for travelers who change their plans for a cause not covered by their trip cancellation coverage.

Not all travelers are aware of CFAR insurance. Though optional Cancel For Any Reason could be done for any purpose, still some conditions must be met.

The Trip Cancellation claim benefit present in the majority of comprehensive insurance is different from CFAR.

You must cancel your trip due to a covered reason in order to be eligible for reimbursement of up to 100% of your insured, pre-paid, non-refundable trip costs under the Trip Cancellation policy.

Yet, as many of us are aware, life doesn’t always go as planned. If you need to cancel for a reason covered by CFAR, you may be able to get reimbursed for most of your paid-for, non-refundable trip cost.

Examples of the kind of reasons that Cancel for Any Reason may cover:

- Travel destination worries related to the testing requirement for Covid-19

- Conflict/War

- Issues in Relationships

- Pregnancy

- Sickness of a Friend

- Cover Fear of Flying

- Having Second Thoughts

Simply put, if you choose the Cancel for Any Reason travel insurance upgrade, your travel insurance policy may be able to pay for cancellation for any reason.

Pro-Tip: The CFAR only activates if you add it to your trip insurance plan within the number of days specified after the first trip payment. Consider adding on the benefit when you purchase travel insurance.

What Are The Eligibility Requirements Of Cancel For Any Reason Travel Insurance?

To be eligible for CFAR benefits, insurance typically needs to be obtained within 10 to 21 days of completing the initial trip payment. In order to acquire coverage, providers frequently demand that CFAR buyers buy insurance for every dollar of their travel expenses.

For this coverage choice, there are additional qualifying restrictions, so make sure you carefully read the policy document to understand before you buy CFAR coverage.

Many CFAR policies demand that you cancel your insured travel plans and notify suppliers at least 48 hours (two days) before your intended departure in order to be eligible for reimbursement.

Why Should You Consider CFAR Coverage?

CFAR coverage provides additional flexibility and peace of mind when planning a trip, especially if you’re concerned about unforeseen circumstances that may disrupt your plans. Here are some reasons why you might consider CFAR coverage:

- Unforeseen Circumstances: Life is unpredictable, and things can happen that are beyond your control. With CFAR coverage, you can cancel your trip for any reason, whether it’s a sudden illness, injury, or family emergency.

- Peace of Mind: Travel can be stressful, and worrying about unexpected events can add to that stress. CFAR coverage gives you peace of mind, knowing that you have a safety net in case something goes wrong.

- Flexibility: With CFAR coverage, you have the flexibility to cancel your trip for any reason, even if it’s not covered by the standard policy. This gives you more control over your travel plans and allows you to make changes if needed.

- Refund Protection: CFAR coverage provides a partial reimbursement of your trip costs, which can help offset the financial loss of canceling your trip. This can be especially important if you’re traveling on a tight budget or have invested a significant amount of money in your trip.

What Are The Limitations of CFAR Coverage?

While CFAR coverage provides added protection, it’s important to understand its limitations. Here are some things to keep in mind:

- Time-Sensitive: CFAR is a time-sensitive benefit. The purchase of insurance must typically take place within a time frame, typically between 10 to 21 days of the initial trip deposit or the final payment, in order to qualify for CFAR benefit.

- Time Limit To Redeem: According to certain CFAR regulations, you must change your arrangements and inform your travel supplier at least 48 hours before your scheduled departure. Several travel insurance providers demand cancellations be made at least 72 hours prior to departure. Any cancellation you make after that time period must be justified by one of the “covered reasons” listed in your policy’s fine print.

- Specific Requirements: CFAR coverage may have specific requirements or limitations, such as minimum trip cost or length of coverage, so it’s important to read the policy carefully and understand the terms and conditions before you buy CFAR Insurance.

- Higher Cost: CFAR coverage is an optional add-on to travel insurance policies, which means it comes at an additional cost. You’ll need to weigh the benefits of CFAR coverage against the added trip cost to decide if it’s worth it for you.

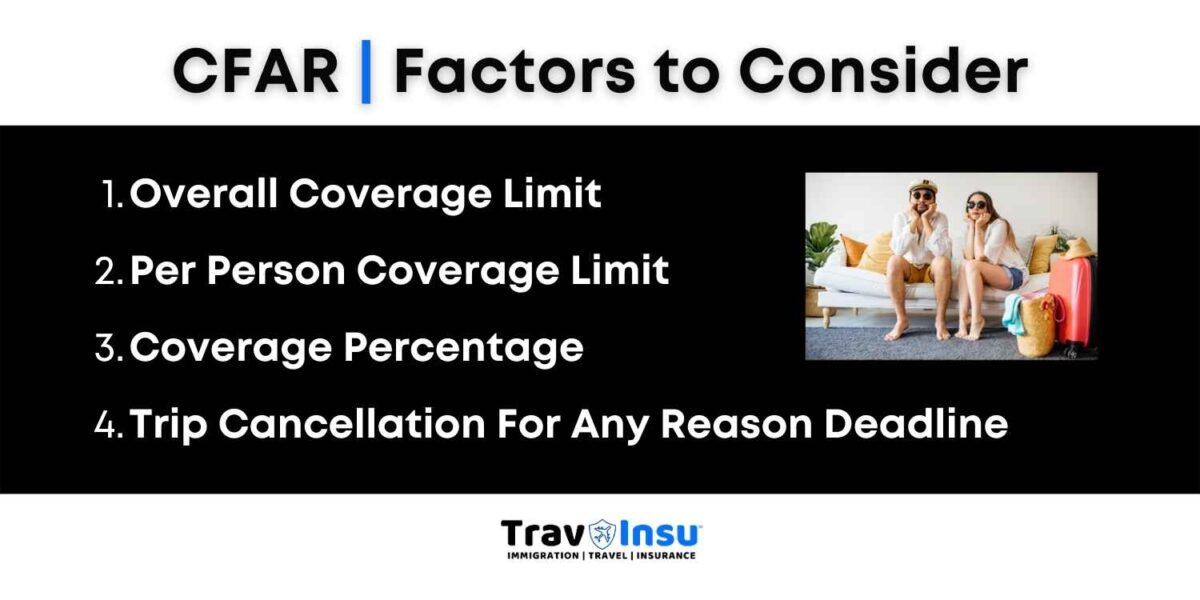

How To Purchase The Right CFAR Policy?

To consider possibilities, compare the plans offered by various suppliers. To choose the ideal plan, make a list of your unique demands. After purchasing one, note the summary below:

- The maximum amount of coverage

- The maximum per-person coverage

- The fine or percentage of coverage

- The deadline for trip cancellation for any reason

Print/Read a copy of the terms before making an online trip insurance purchase. Bring over a coverage summary, the policy ID, and the contact details of the travel insurance company.

What Are The Top Travel Insurance Companies That Provide Cancel For Any Reason – CFAR Coverage?

CFAR is a feature available in Trip Insurance Plans, for Travel Medical Insurance plans the trip interruption and trip cancellation benefits are usually defined in the policy document and you don’t get the option to add CFAR to it.

Some of the top travel insurance companies which provide CFAR travel insurance benefits are:

Seven Corners

To be insured for 75% of the trip cost with Seven Corners, you must buy insurance for your trip within 20 days of the initial trip deposit. The cancellation cannot take place less than two days before the departure time. The availability of this benefit varies by state.

Trawick International

Trawick International’s Safe Travels First Class and Safe Travels Voyager protection plans also offer Cancel For Any Reason insurance as an add-on. Depending on the plan, you must purchase the insurance within 14 to 21 days of completing your initial trip deposit and must cancel your trip no less than two days prior to the scheduled departure date.

Travel Guard by AIG

The CFAR upgrade is available from Travel Guard for a few select comprehensive plans. You must purchase the CFAR upgrade within 15 days of the initial trip deposit, cancel the trip more than 48 hours before departure, and cover all pre-paid trip costs, and nonrefundable charges when purchasing the policy in order to be eligible for a partial refund.

Travelex Insurance Services

Consumers are required to obtain the CFAR coverage through Travelex within 15 days of the initial trip payment date. Then, up to 48 hours prior to departure, you have the freedom to reschedule your trip for any reason. After making a claim, you will be reimbursed for up to 50% of your insured, nonrefundable travel expenses (such as airfare and lodging fees).

IMG Travel Insurance Company

As an add-on to their iTravelInsured Travel LX plan, IMG provides CFAR coverage. This comprehensive travel insurance package offers protection against trip interruption and cancellation, travel delay, up to $1 million in coverage for emergency medical evacuation coverage, and repatriation of remains, among other benefits.

Clients have the option to purchase CFAR coverage, which entitles them to the recovery of up to 75% of pre-paid, insured travel costs. However, the trip must be canceled at least two days prior to the departure date and this coverage must be obtained within 20 days of the initial trip payment.

Compare Travel Insurance Plans

When Should You Buy Cancel For Any Reason Coverage?

The CFAR coverage is purchased within 15 days of the initial trip deposit. The full cost of all non-refundable, prepaid trip arrangements is insured at the time of purchase. Be sure to read your description of coverage.

When quoting and buying comprehensive travel insurance plans, you’ll be offered CFAR as an optional upgrade if you meet the eligibility requirements around the initial trip payment date and per-person trip cost.

CFAR option is available as an upgrade on several comprehensive trip insurance plans and is a great option that allows travelers or their family member to cancel their trip for any reason that is not otherwise covered in their base plan, provided they cancel their trip more than 48 hours before their departure date.

How Does Cancel For Any Reason Travel Insurance Work?

Travelers may wish to weigh the price of a plan and the coverage it offers when choosing trip insurance. Every trip carries a certain amount of risk, so having travel insurance that covers cancellation for any reason could have a big impact on what occurs afterward.

When obtaining travel insurance, it’s critical to comprehend the policy’s exclusions so you can decide whether you might require specific advantages. Some tourists may believe that reduced restrictions are adequate for a weekend excursion that is only a short distance away.

Yet, a vacation with many flights or legs, prepaid activities, and excursions, or an extended or overseas trip may have more at stake. If your vacation is still weeks or months away, it may be wise to think about what the future may hold before you leave for your trip and what kinds of events would necessitate.

Unlike trip cancellation coverage, the optional trip insurance cancel for any reason benefit (CFAR) offers partial reimbursement on prepaid, nonrefundable costs if you cancel for any reason, even those not typically covered by your comprehensive travel insurance policy.

Frequently Asked Questions

How is the cancel for any reason travel insurance different from trip cancellation insurance?

The list of situations that trip cancellation clauses normally cover in a policy includes natural disasters, airline strikes, hurricanes, and jury duty. A reason is not covered if it is not included. By definition, a CFAR policy covers situations that aren’t covered by the policy, including border closures or travel anxiety, so you can cancel without giving a reason.

Because you purchase the two benefit components together, a typical trip cancellation policy is still in effect. This implies that instead of the half return that a CFAR plan offers, you can be qualified for 100% reimbursement if you have to cancel for a covered cause.

Is it worth it to purchase travel insurance with CFAR benefits?

Each traveler will have a different response to this. The coverage option known as “Cancel for Any Reason” gives customers the most freedom to cancel for a reason not covered by the policy, like a dread of traveling, and still receive some compensation.

While thinking about this, it’s crucial to ask yourself what you stand to lose if you can’t take your vacation. That could result in significant financial loss for some travelers. By being prepared, you may be able to recover part of those non-refundable, pre-paid fees through CFAR and reduce your financial risk in the event that something goes wrong.

In the end, your decision to purchase CFAR coverage may be influenced by your own priorities and the amount of risk you are comfortable accepting as you make travel arrangements.

Can I Use “Cancel for Any Reason” Coverage to Cancel My Trip Due to the COVID-19 Pandemic?

The majority of travel insurance policies do not cover cancellations due to changes in plans or interruptions caused by COVID-19 travel limitations. Occasionally, purchasing travel insurance with Cancel for Any Reason coverage is the only option to get around this cancellation restriction.

This feature gives travelers the most freedom to determine for themselves under what conditions they should cancel their trip arrangements. To be eligible for CFAR travel insurance benefits, travelers must meet all other eligibility requirements and cancel their travel plans at least 48 hours before.

Conclusion

Travel insurance with CFAR coverage provides added protection and peace of mind when planning a trip.

While it comes at an additional cost and has specific requirements, it can be a valuable investment if you’re concerned about unforeseen circumstances that may disrupt your travel plans.

By purchasing CFAR coverage, you can enjoy your trip with the knowledge that you have a safety net in case something goes wrong.

We hope this article has helped you understand the benefits of a CFAR insurance policy and why it is important to consider while traveling abroad.