Atlas America vs Patriot America Plus – Compare Travel Insurance

Atlas America vs Patriot America Plus will help you decide which plan meets your medical coverage needs. Among the visitors’ insurance plans these two are quite popular, especially for parents visiting the USA.

Atlas America and Patriot America Plus offer high medical coverage limits with policy maximums as high as $1mn. Did we mention that these plans are some of the most popular comprehensive medical coverage plans for international travelers offering comprehensive benefits?

Let us compare Atlas America vs. Patriot America Plus to understand the travel insurance benefits offered by both these visitor insurance plans to help you understand the best U.S. travel medical insurance plan for your travel needs.

Compare And Buy The Best Visitors Insurance For U.S.

Both plans ideally suited for:

- International Travelers

- Non-US Citizens, non-US residents traveling to the USA

- Parents visiting the USA

- B-1/B-2 Visa Visitors to the USA

Both these plans are amongst some of the best visitor insurance for the USA.

For those whose parents are visiting the USA knowing details of Visitors insurance will be helpful.

Compare Travel Insurance

Atlas America vs. Patriot America Plus Travel Insurance

Policy Details

The broad details of the plans:

Overall Maximum Limit And Other Limits

When it comes to travel insurance, you have the option to either go for comprehensive coverage or limited coverage. Knowing the difference between comprehensive coverage and limited coverage makes it easier to decide which type of insurance coverage to select.

It is also important to know the overall maximum limit of the plan and also understand eligible medical expenses. Do note that some plans may provide worldwide coverage and some plans limit the insurance coverage to specific countries, if your travel to the USA includes other destinations you should pay attention to this part.

A travel insurance plan will only pay for what is defined as a covered illness or defined as eligible expenses in the policy document. While each travel medical insurance plan has an overall maximum limit the coverage limits for incidents may be capped per incident.

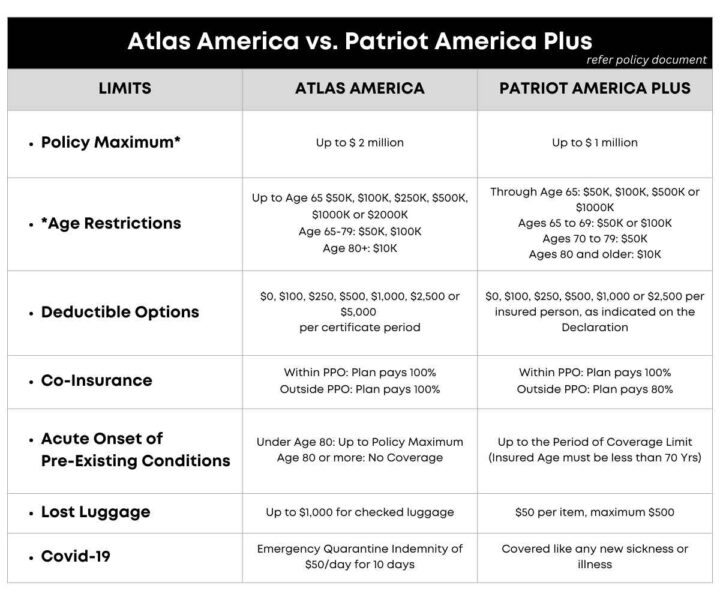

Listed below are the policy maximum limit with the elected overall maximum limit option and the maximum limit based on age restriction with other key limits.

Please read the policy document carefully before you decide to buy a travel insurance plan. It is important to know all coverage inclusions, exclusions, limits, and restrictions. This will help you avoid any disappointment in making a claim for medical benefits or other eligible medical expenses or travel-related expenses from your visitor medical insurance.

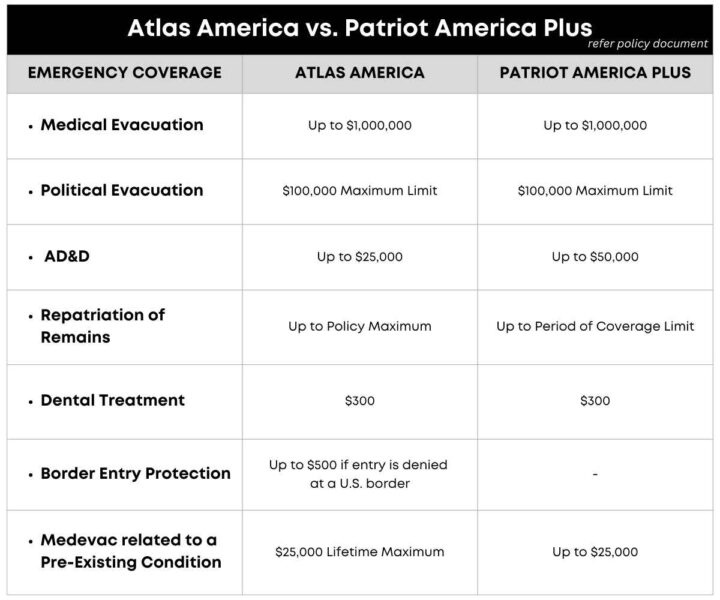

Emergency Coverage Limits And Limits For Emergency Medical Evacuation

Emergency Medical Evacuation and other emergency services like emergency local ambulance, emergency room treatment, or emergency travel arrangements can dent a hole in your pocket. Understanding the need for medical evacuation travel insurance can be useful.

Let’s look at some key emergency coverage limits of Atlas America vs. Patriot America Plus travel medical insurance plans:

A reputed travel insurance company or provider will extend emergency travel assistance and other emergency services (If included in your plan).

Both WorldTrips (Atlas America) and International Medical Group (Patriot America Plus) are international health insurance providers and have expertise in these areas. You need a trusted provider by your side when you travel outside your home country.

If you purchase travel medical insurance it is relatively easy dealing with companies that have experience and have the logistics in place to deal with emergency situations.

Atlas America Plan

Atlas America is a travel health insurance plan offering comprehensive coverage to foreign citizens who want to visit the US for various purposes such as visiting family and friends, tourism, study, etc.:

- Underwriter: Atlas America plan is underwritten by Lloyd’s, one of the world’s best insurance and reinsurance providers.

- PPO Access: The plan provides access to United healthcare ppo network

- Coverage: Atlas America offers coverage for hospitalization and outpatient treatment, including intensive care unit, and other medical expenses. The plan offers coverage for emergency medical evacuation, repatriation of remains, natural disasters, acts of terrorism, incidental trips home, and acute-onset of a pre-existing condition coverage for ages below 80 years.

- Duration: Atlas America Insurance plan is available for any duration from 5 days to 364 days.

- Benefits: The plan offers a complete package of international benefits available 24 hours a day to individuals, families, and groups of five or more travelers.

- Deductible: There are different deductible options available, ranging from $0 to $5,0

- COVID-19 Coverage: The plan offers coverage for eligible medical expenses related to COVID-19

- Buy Online: Visitors to the US can purchase Atlas America insurance online and get policy and ID cards over email. Atlas America Insurance is a very popular plan amongst parents visiting the USA.

Patriot America Plus Plan

Patriot America Plus is a comprehensive travel insurance plan, designed for non-U.S. residents traveling to the USA. Here are some key details about the plan:

- Underwriter: Patriot America plan is underwritten by SiriusPoint Speciality Insurance Corporation

- PPO Access: The plan provides access to United healthcare ppo network

- Coverage: The plan provides coverage for eligible medical expenses, emergency medical evacuation, repatriation of remains, accidental death and dismemberment, and more

- Duration: The coverage duration is available from 5 days to 365 days

- Benefits: The plan offers a complete package of international benefits available 24 hours a day to individuals, families, and groups of five or more travelers.

- Deductible: There are different deductible options available, ranging from $0 to $2,500

- COVID-19 Coverage: The plan offers coverage for COVID-19, treating it like any other sickness or illness that can occur

- Popular Option: The Patriot America Plus plan is one of the most popular comprehensive plans available for travel to the United States. You can buy the plan online and receive the policy and ID cards over email.

Both these travel insurance options are excellent comprehensive coverage choices as demonstrated by their popularity. You can also explore limited coverage plans like Visitor Secure or other comprehensive coverage plans like Safe Travels USA Cost Saver or Safe Travels USA Comprehensive.

Understand the differences between comprehensive coverage and limited coverage plans to decide which one is a better alternative for you: Comprehensive Coverage vs. Limited Coverage

What Should You Look For When Deciding On International Health Insurance Plans?

The following are some factors and aspects you must look out for and compare between plans as an international tourist searching for visitor medical insurance:

- Length of Coverage for Your Trip

- Eligibility Criteria and Purchase Restrictions

- Medical Coverage and Policy Maximum Limit

- Deductible Options

- Coinsurance Options

- Provider Network and PPO Access

- Renewability Options

- Pre-Existing Conditions Coverage

- Acute Onset Of Pre-Existing Conditions

- Accidental Death & Dismemberment (AD&D)

- Emergency Medical Evacuation

- Emergency Reunion

- Return of Mortal Remains and/or Local Cremation or Burial Benefits

- Return Of Minor Children

- Political Evacuation and Repatriation

- Covid-19 Coverage

- Average Cost of the Plan

Health Care Providers

An Insurance Company uses a network to manage healthcare costs. When an Insured person requires medical care and is admitted to a hospital or any medical facility, that is part of the insurance provider’s PPO network, the insurance company takes care of the patient’s medical care with lower out-of-pocket payouts. Networks provided by the plans compared:

Atlas Travel Insurance: United Healthcare PPO network

Patriot Travel Insurance: United Healthcare PPO network

Emergency Medical Evacuation

Both Atlas America and Patriot America Plus insurance plans provide coverage for emergency medical evacuation. Here are some details about the emergency medical evacuation coverage for each plan

Atlas America Insurance:

- Emergency medical evacuation coverage up to $1 million

- $25,000 medical evacuation under acute onset of a pre-existing condition

Patriot America Plus Insurance:

- Emergency medical evacuation coverage up to $1 million

- Evacuation coverage is up to the maximum limit of the policy

It is important to note that the specific terms and conditions of the emergency medical evacuation coverage may vary depending on the policy and the insurance provider. Visitors to the US should carefully review the details of their chosen insurance plan to understand the specific coverage limits and exclusions for emergency medical evacuation. These plans (Atlas & Patriot) provide coverage for political evacuation and repatriations to the home country.

Atlas America vs. Patriot America Plus Insurance Comparison

Both these plans are very similar and offer, excellent coverage for visitors to the USA.

These two plans are offered by different plan administrators

Both these plans are underwritten by different (independent companies) policy underwriters.

The major key difference between these plans is:

- Atlas America Insurance plan covers the Acute Onset Of Pre-Existing Conditions up to the age of 80 years

- Patriot America Plus insurance plan Covers the Acute Onset Of Pre-Existing Conditions Up to the age of 70 years

It is always a good practice to compare visitors’ insurance plans like Atlas America vs. Patriot America Plus Insurance plan, to review and find the best visitors’ health insurance for your parents and relatives visiting you in the United States

Atlas America vs. Patriot America Plus Insurance Plan, Which Is Better?

Atlas America and Patriot America Plus are two different travel health insurance plans for visitors to the USA.

When comparing the Atlas America and Patriot America Plus insurance plans, it is important to consider the following factors:

Coverage for pre-existing conditions:

- Atlas America Insurance covers acute onset of pre-existing conditions up to the age of 80 years

- Patriot America Plus Insurance provides coverage for the acute onset of pre-existing conditions for travelers

Maximum coverage:

- Atlas Travel Insurance offers maximum coverage of up to 2 million

- Patriot America Plus offers maximum coverage of up to 1 million

Administration:

- Atlas Travel Insurance plan is administered by WorldTrips

- Patriot America Plus Insurance is administered by a different company

Atlas America Insurance offers coverage for pre-existing conditions up to the age of 80 years and has a maximum coverage of 2 million. It is also administered by WorldTrips, a reputable insurance provider.

On the other hand, Patriot America Plus Insurance provides coverage for acute onset of pre-existing conditions and has a maximum coverage of 1 million.

Ultimately, the better insurance plan depends on your specific needs and preferences. It is recommended to carefully review the terms and conditions of both plans, including coverage limits, exclusions, and any additional benefits, to determine which one aligns better with your requirements.

Here are some key differences between the two plans:

Coverage For Pre-Existing Conditions Under The Atlas America And Patriot America Plus Policies

Both Atlas America and Patriot America Plus policies offer coverage for the acute onset of pre-existing conditions for travelers. Acute onset of pre-existing conditions refers to a sudden and unexpected recurrence of a pre-existing condition that requires immediate medical attention.

The coverage for pre-existing conditions under these policies is subject to certain conditions and limitations.

Atlas America Insurance covers acute onset of non-chronic pre-existing conditions up to the chosen policy maximum, If treatment is obtained within 24 hours

Atlas America Insurance also covers acute onset of pre-existing conditions up to the age of 80 years

Patriot America Plus Insurance provides coverage for the acute onset of pre-existing conditions for travelers

Frequently Asked Questions – FAQs

Does Atlas America Provide Maternity Benefits?

Atlas America provides coverage for complications of pregnancy during the first 26 weeks of gestation. However, it is important to note that this benefit applies only to complications of pregnancy and not normal childbirth.

Visitors to the US who are pregnant or planning to become pregnant should carefully review the terms and conditions of the Atlas America policy to determine if it meets their needs.

What Is The Minimum Eligible Age To Buy Atlas America Plan?

The minimum age eligible to buy Atlas America Plan is at least 14 days old

Who Must Buy Atlas America Plan?

You can buy Atlas America if you are a Non-US citizen, traveling outside your home country for 12 months or less

What Is Covered By Atlas America Plan?

Some of the coverage offered by Atlas America:

- Inpatient charges, Outpatient charges,

- Charges for dental treatment or surgery to restore sound teeth lost or broken in an accident

- Physician, Radiologist, Surgeon, anesthesiologist, Other medical specialist charges,

- Charges for emergency local ambulance

- Charges for prescription drugs for a covered injury or illness

- Charges for diagnostic testing using radiology, ultrasonographic or laboratory charges

For a complete detail refer policy document

What Excludes From Atlas America Plan?

Some exclusions from the plan are

- Pre-Existing conditions

- Mental Health Disorder

- Infertility

- Congenital Condition

- Pregnancy

- childbirth

- Act of Terrorism, War

For a complete list of exclusions, Refer your policy document

Travel Assistance Services Offered By Atlas America?

Some travel assistance services offered are:

- Emergency travel Arrangements

- Lost Passport, Travel document assistance

- Translation and interpretation services

- Locate lost baggage

- Medical Referrals

- Assistance with prescription drug replacement

For complete list and details refer policy document

Does Patriot America Plus Cover COVID-19?

The following are covered, If virus is contracted after the effective date of the policy,

- Medical Treatment and services related to COVID-19 are covered

- Emergency medical evacuation for COVID-19 can be covered

- Testing can be covered if ordered by an attending physician provided symptoms occur after policy effective date

COVID-19 vaccination/Booster and quarantine benefits are not covered