Visitors Insurance For Parents Visiting USA

Visitors insurance for parents visiting USA is critical as healthcare in the USA is very expensive. Parents visiting the United States are not mandatorily required to have health insurance. Given the cost of medical treatment in the USA they are encouraged to get visitor insurance.

Travel Insurance popularly known as Visitors Insurance is short-term temporary medical insurance. Travel Insurance lowers the cost of access to medical care, it covers medical expenses for any new sickness or injury.

This article delves into the details of visitor health insurance aka travel insurance. For those who may be looking for visitor insurance for parents visiting USA, we have compiled a list of some of the top insurance providers that offer such services.

What does Visitor Insurance for Parents Visiting USA Cover?

Visitor health Insurance covers eligible medical expenses. Given the extremely high cost of medical treatment in America, travel insurance can be a savior.

Visitors Insurance pays for eligible medical expenses for:

- Any new Sickness or Injury

- Medical Emergency & related expenses

- Emergency Medical Evacuation in a life-threatening situation

- Prescription Drugs & Urgent Care

- Emergency Dental Treatment

- Acute Onset of Pre-Existing Conditions Coverage benefits

- Accidental Death & Dismemberment (AD&D)

- Repatriation of Remains

- Access to PPO Network for medical treatment

- Flight Delay or Flight Cancellation

- Baggage Delay

- Baggage Loss

- Missed Connection

- Trip Cancellation

- Trip Delay

- and more…

We recommend you compare travel insurance plans to evaluate buying visitor Insurance for your Parents. Travel insurance will help cover unforeseen medical expenses. If they need urgent care for medical reasons the expenses can be covered.

Domestic Health Insurance from home country

If your parents have domestic health insurance plans from their home country, you can check if domestic health insurance for parents covers any eligible medical expenses while overseas.

For example, ICICI Lombard Health Insurance in India offers worldwide coverage as a benefit under their Health AdvantEdge Plan Royal Plus, and Apex Plus, if the sum insured, is over 1 million or 2.5 million Indian Rupees respectively. If your Indian parents visiting the USA do check with their domestic health insurance providers on international travel insurance-related coverage benefits available to them.

It would not be prudent to rely only on the coverage of domestic health insurance for parents but add visitors’ health insurance plans when they travel. But knowing that their health insurance covers them worldwide will add comfort.

Travel insurance plans offer coverages similar in many aspects to that of regular health insurance plans; however, they may not cover all medical expenses and some policies may have limits on how much they will pay out for specific treatments or procedures.

Visitors’ insurance plans can be limited coverage plans or comprehensive coverage plans. Your coverage benefits will depend on the plan. The policy document is a good reference for what is covered. Always read the policy document before you purchase insurance. Some of the best travel insurance plans offer a wide variety of coverage benefits and these plans are usually comprehensive plans.

Tips for Shortlisting the Best Visitors Insurance For Parents Visiting USA

We have covered this topic in detail: Best Visitor Insurance Plans for Parents visiting the USA

It’s important to take some time to decide which is the best Visitors Insurance Plan for parents visiting the USA. The one that suits your medical insurance and other travel-related needs is the best visitor insurance plan.

The best way to start is by asking yourself a few questions:

- How much coverage do I need?

- What should be the policy maximum?

- Is there a deductible?

- Is there an out-of-pocket maximum?

- What are the benefits of each plan:

- medical insurance component

- prescription drug coverage

- kind of medical procedure gets covered

- how will the medical bills be paid, understand the claims process

- If considering Trip Insurance, can I purchase additional services through the policy, such as:

- travel assistance

- trip cancellation/interruption benefits if not part of standard coverage

- Cancel For Any Reason (CFAR) add-on if you are buying Trip Insurance

- Does the plan offer acute onset of pre-existing conditions coverage?

- Are any specific medical conditions/situations you need to be covered

- Does the plan provide access to a PPO network? (PPO: Preferred Provider Network)

- Does the plan provide Emergency Medical Evacuation and Repatriation of Remains Coverage?

- If considering Trip Insurance, can I purchase additional services through the policy, such as:

- travel assistance

- trip cancellation/interruption benefits if not part of standard coverage

- Cancel For Any Reason (CFAR) add-on if you are buying Trip Insurance

Choosing the best visitor insurance policy for parents is a crucial step. When choosing a plan, think about the following:

- How much policy maximum cover do you need?

- Some plans have an annual maximum limit, while others have a daily maximum limit

- What does your parents’ current health insurance policy cover?

- Depending on their country of residence, it may be possible to claim costs from there as well (ICICI Lombard health insurance plans in India example referred above)

- If traveling with multiple people make sure everyone has different coverage in case one person needs treatment and another doesn’t (this could mean two policies) OR if someone needs to cut short the trip or extend the stay then having separate policies helps.

- If a group of parents or individuals are traveling together, 5 or more individuals with a fixed schedule then maybe a group visitor medical insurance help you save on costs

An insurance plan that meets your specific needs is the best visitor insurance, comprehensive coverage plans provide more benefits.

Features and Benefits of Visitor Insurance Coverage

Features and benefits of visitor insurance coverage that are essential in shortlisting visitor insurance plans for parents, especially for senior relatives or elderly parents.

- Flexibility to select low policy maximum to high policy maximum limit

- Flexibility to select a low or high-deductible

- Cover medical and travel emergencies

- Cover costs for urgent care for a new sickness or injury

- Surgery charges for both inpatients and outpatients

- Recurrence or sudden relapse (acute onset of Pre-existing conditions)

- Emergency dental/vision, and medical costs

- Dental Pain and Laboratories/diagnostics

- Costs of prescription drugs and medications

- Reunion or emergency medical evacuation

- Accidental death and dismemberment (AD&D)

- Coverage for common carrier accidents or flight accidents

- Coverage of the repatriation of mortal remains

- Coverage of local cremation or burial expenses

- Affordable (comprehensive or low-cost fixed benefit choices)

- Trip cancellation and Travel interruption benefits

- In an emergency returning to one’s home country

- Access to a PPO network with good doctors and medical facilities

Which is the Best Visitor Medical Insurance Policy for visiting parents?

When your parents visit the US, it’s important that they have the right visitors’ insurance plan. Let’s understand the types of insurance categories:

Categories of Travel Medical Insurance Policies for Visiting Parents

There are two main categories of policies:

- Fixed Benefit Plans/Limited Coverage Plans

- Comprehensive Coverage Plans

It can get confusing to decide if you should opt for fixed coverage plans or comprehensive coverage plans policy for visiting parents.

Here’s what you need to know about each type of insurance, and which one is best for your needs.

Fixed Benefit Plans/Limited Coverage Plans

- A fixed insurance policy provides limited coverage only for the losses specifically mentioned in the policy up to pre-defined limits.

- These plans are low-cost

- A fixed coverage policy for Indian parents visiting the USA is cheaper than a comprehensive one.

- While fixed coverage plans are cheaper, they only cover medical expenses due to illness or injury.

- It does not cover any other expenses or losses.

- This can be a good option if you’re on a budget, or

- Your parents’ visit is covered by their domestic health insurance plan from their home country and you only foresee a need for limited medical bills

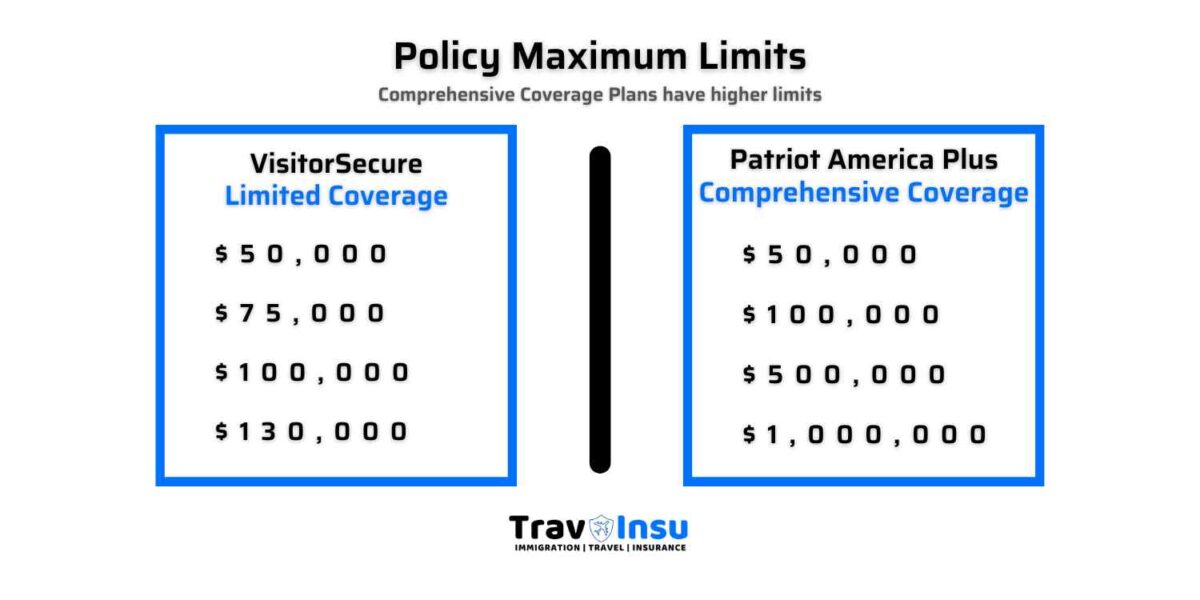

- Let’s look at a policy maximum example of a limited benefits plan VisitorSecure from WorldTrips, the policy maximum limit options offered are (age restrictions apply):

- $50,000 policy maximum

- $75,000 policy maximum

- $100,000 policy maximum, or

- $130,000 policy maximum

Comprehensive Insurance Plan

- A comprehensive travel insurance policy with a higher policy maximum is one that covers all losses except those specifically excluded.

- A comprehensive plan costs more but during a medical emergency with this type of health insurance plan, you get better coverage benefits than fixed benefits.

- A comprehensive plan for parents visiting the USA covers all kinds of unexpected events, including medical expenses incurred as well as losses due to theft or damage.

- A Comprehensive plan can be a good option if you’re worried about any possible mishaps while your parents are away from home.

- Let’s look at a policy maximum example of a USA comprehensive plan Atlas America Insurance, the policy maximum limit options offered are (age restrictions apply):

- $50,000 policy maximum

- $100,000 policy maximum

- $250,000 policy maximum

- $500,000 policy maximum

- $1,000,000 policy maximum or,

- $2,000,000 policy maximum

Popular Travel Medical Insurance Plans:

Some of the popular plans for parents visiting the USA are:

- Patriot America Plus

- Atlas America

- Safe Travels USA Comprehensive

- Diplomat America

- Cover-America Gold

- VisitorSecure

- Visitors Care

- Choice America

- Inbound USA Choice

- INF Elite

Compare Travel Insurance Plans

How much Travel Medical Insurance for parents visiting the USA do you need?

Visitors insurance for parents visiting USA includes medical coverage. The amount of travel medical insurance coverage that you need depends on several factors, including how long you’ll be traveling, your age and health status, and the country or countries where you’re going.

If you’re visiting the United States (or any other country), make sure that your plan includes at least $100,000 in medical expense coverage per person (if not more).

This will allow for immediate care for serious injuries or illnesses without having to worry about meeting high deductibles or paying lots of out-of-pocket expenses.

Visitors Insurance for Parents Visiting the USA and Pre-Existing Conditions Coverage Details

Many people are unaware that it’s possible to get pre-existing condition coverage. This means that if your parent has a medical condition and needs to see a doctor while in the United States, they can do so without worrying about paying out of pocket for their care.

This can be especially important if they have chronic conditions or ongoing treatment plans that require regular visits to specialists.

What is a Pre-Existing Condition?

A pre-existing condition is a health problem that you had before the policy was purchased. Some examples of preexisting conditions are diabetes, cancer, heart disease, obesity, and high blood pressure.

If you have one or more of these conditions before you buy your policy, it could affect your coverage.

For example, if you have asthma and want to buy insurance, it will be difficult to get coverage if you don’t already have insurance or if your previous health plan only covered emergencies.

What are some examples of pre-existing conditions?

- Diabetes

- Asthma

- Allergic reactions to foods, medicines, or other substances

- Cancer (other than basal cell skin cancer) or signs of cancer

- Heart Disease (heart attack or stroke)

- High blood pressure (hypertension) that requires treatment with medicine

- Lung disease (such as chronic obstructive pulmonary disease [COPD]) except asthma and emphysema

- Obesity

- Stroke

Does Visitors Insurance for Parents Visiting USA Cover Pre-Existing Conditions?

Yes, visitor insurance for parents visiting the USA covers pre-existing conditions. However, the cover will be limited to the maximum amount specified in your policy. The coverage is restricted to the Acute Onset of Pre-Existing Medical Conditions.

Some plans cover up to the policy maximum or the policy document will list the coverage amount. Each plan may have different terms, always read the policy document of the plan. While the coverage provided is not comprehensive and does not include treatment of pre-existing medical conditions, it is still better than none at all.

Also, if your parents have a recently developed complication that needs hospitalization or surgery while traveling, visitor insurance for parents visiting the USA plans may cover the full amount or as defined in the policy coverage limits and there will be no waiting period.

Some select few plans do offer pre-existing conditions coverage, these plans need a minimum 90 days purchase and there are limits defined on how much will the plan cover for each incident. The premiums for these plans are expensive compared to regular travel insurance plans.

Acute Onset of Pre-Existing Conditions Coverage Benefits

The acute onset of a pre-existing condition is tricky to cover in an insurance policy. We will help you understand what it means,

What is the Acute Onset of Pre-Existing Medical Condition?

Acute onset of a pre-existing medical condition is a term used to describe an illness or injury that occurs while you are visiting the United States. It’s different from a chronic illness because it happens suddenly and unexpectedly, as opposed to being something that has been ongoing for some time.

How do I cover it in insurance?

If you have visitor insurance for parents visiting the USA who need urgent care, this coverage will help pay for medical care related to the acute onset of pre-existing medical conditions. Select a plan that offers coverage for this.

Should you buy Visitors Insurance from the USA or your home country?

Visitors Insurance for parents visiting can be purchased from your home country and the USA. If you’re like most people, you probably think that getting visitor insurance from your home country is cheaper than getting it from the US.

Some reasons you should consider buying visitors insurance for parents visiting USA from a US-based provider are:

- The insurance industry is regulated in the United States

- All travel insurance companies based in the USA are regulated by the Dept. of Insurance

- The US-based travel insurance plans may provide PPO access

- US-based travel insurance plans are more recognized by medical service providers like hospitals

- You may be able to get the benefit of direct billing or cashless settlement

- US-based plans are designed for visitors to the USA knowing the high cost of medical expenses

Some common Terms about Visitor insurance for parents visiting the USA.

What is the meaning of Co-insurance?

Co-insurance: It is the percentage of the costs you’ll have to pay when you use your plan. It’s usually expressed as a percentage and can be anywhere between 20% and 100%.

You may be able to choose how much co-insurance you want to pay. For example, if your plan has a $1,000 deductible, and your plan has 10% co-insurance, you’ll need to pay $100 each time you need care.

Co-insurance is the percentage of the total cost of a claim that you pay after your deductible is met. For example, if your deductible is $500 and your co-insurance rate is 80%, then you’ll pay 20% of the remaining costs.

Co-insurance rates vary from plan to plan, so be sure to check your plan details before purchasing a policy.

What is the Deductible in Visitors’ Insurance for Parents Visiting USA?

Deductible: The deductible is the amount of money you pay before insurance kicks in. If your parents get sick and need to see a doctor, this will be the amount that you must pay out-of-pocket before your insurance company begins covering your expenses. The lower the deductible, the higher your premium will be—and vice versa!

What do you mean by Certificate Period?

Certificate Period: The Certificate Period is the time period in which you are covered by the policy. The Certificate Period starts on the date of your arrival and ends on the date of departure.

What is a PPO Network?

PPO: Stands for Preferred Provider Organization. It’s a health insurance system that allows you to choose from a list of doctors, hospitals, and other healthcare providers who have agreed to accept your plan’s negotiated rate as payment in full for covered services. In other words, you can go anywhere in the network and not worry about paying more out-of-pocket costs.

Suppose your parents are coming to visit you in the USA. You want to make sure they get the best medical care possible, but you don’t want to pay out-of-pocket for their medical expenses. A PPO network provides a wide range of benefits that can help you cover the costs of their treatment.

First and foremost, PPOs provide access to a broad network of providers nationwide. This means that if your parents need medical attention while they’re in the United States, they’ll be able to find a nearby doctor who accepts their insurance and gets immediate treatment without having to go through any additional hoops or paperwork.

PPOs also allow you to choose from several different levels of coverage based on your needs and budget. Some plans offer more generous benefits than others and some cover more services than others—so if you’re looking for something specific like outpatient therapy or prescription drugs, you’ll be able to find an option that fits your needs perfectly!

Best Visitor Insurance Plans for Parents Visiting the USA

Some of the best USA Comprehensive Plans:

- Atlas America

- Patriot America Plus

- Patriot Platinum

- Atlas Premium

- Safe Travels USA Comprehensive

- Safe Travels USA Cost Saver

Compare Travel Insurance Plans

Some Best Fixed Benefits Plans:

- Visitors Care

- VisitorSecure

- Safe Travels for Visitors to the USA

- Inbound USA

Compare Travel Insurance Plans

There are so many choices – which coverage is best suited to the parents’ needs and budget?

It always helps to shop for travel insurance on a marketplace and compare travel insurance plans to find one that meets your needs and budget.

When it comes to finding the right visitor insurance policy, there are so many choices – which coverage is best suited to the parents’ needs and budget? let’s discuss this.

For starters, You should check for coverage for an emergency medical evacuation for your parents. This can be expensive and it’s not always covered by travel insurance policies.

If a parent becomes seriously ill during their visit or if they’re injured in an accident, this coverage will pay for them to be flown back home or transferred to a hospital back in their home country.

In such a situation your Insurance Provider coordinates and pays for your evacuation home. It may also cover travel expenses like hotel stays and meals while awaiting care at home.

Also look into how much your policy covers for pre-existing conditions such as heart disease, cancer, or diabetes before purchasing visitor insurance.

If you have any of these conditions now but want to go abroad later in the year after recovery from surgery or treatment has begun – make sure your policy includes “resumption” so that any waiting periods won’t apply again when you return overseas (for example: if someone had surgery scheduled before going on holiday).

Where to Purchase Visitor Insurance for parents visiting the USA.

Visitor insurance is a type of travel insurance that covers visitors to the United States who are planning to stay in the country for less than 90 days.

Visitors’ insurance policies can help protect travelers from unexpected medical expenses, lost luggage, car rental damages, and more. Additionally, many visitors’ insurance policies also offer coverage for trip cancellation or interruption, emergency assistance, and even legal defense costs.

There are several different types of visitor policies including single-trip plans which cover one trip only; annual plans which cover multiple trips within a 12-month period; and multi-trip plans which allow you to purchase separate policies for each individual trip you take.

You can find visitor insurance policies from travel insurance providers like:

- IMG Travel Insurance

- Seven Corners Travel Insurance

- WorldTrips – Tokio Marine HCC Travel Insurance

- Trawick International Travel Insurance

- Travelex Insurance Services

- INFPlans Travel Insurance

Compare Travel Insurance Plans

Frequently Asked Questions (FAQs) – Insurance for Parents Visiting USA:

Can I add my parents to my health insurance USA?

Visiting parents on B-1/B-2 visas who are non-US residents cannot be added to your health insurance plan in the USA, nor buy a health insurance plan for them, you need to look at travel insurance as an option.

Can I buy travel insurance for the parents of my spouse?

Absolutely, anyone can buy travel medical insurance for their parents and/or their family members.

Which is the best travel insurance for parents?

A plan that meets your needs is the best plan, we have listed some popular plans in the article.

Can you get health insurance as a visitor in the USA?

No, you cannot apply for health insurance as a visitor to the USA, you need to avail of travel health/medical insurance.

Is it worth buying visitor insurance in the USA?

It is extremely risky to travel to the USA without insurance, visitors insurance helps lower the risk of unforeseen medical expenses and other travel-related expenses.

Can US visitors get health insurance?

No, US Visitors on B1-B2 visas are not eligible for domestic health insurance. Visiting the USA for tourism or business? explore short-term travel health insurance

Conclusion

Consider reading the policy terms carefully, especially if you’re looking for a specific type or level of coverage, as coverage differs between insurance companies and the plans they offer.

Bon Voyage!!!