INF Premier Insurance Information, Benefits And Eligibility

INF Premier insurance plan offered by INF Visitor Insurance is an ideal choice for individuals seeking excellent coverage in a budget-friendly way.

The INF Premier is a limited coverage (aka fixed benefits) travel medical insurance plan.

INF Premier provides pre-defined amounts for medical costs and emergency services to non-US residents traveling outside their home country to the United States, EU, UK, Australia, and other countries worldwide.

NOTE: Pre-defined means the plan pays a pre-defined fixed amount for every treatment or service. These pre-defined amounts are mentioned in the plan brochure and/or policy documents.

| Plan Name | INF Premier |

| Plan Type | Limited Coverage Travel Medical Insurance Plan |

| Area Of Coverage | United States, EU, UK, Australia, & Worldwide |

| A.M. Best Rating | “A” |

| Administrator | INF Plans |

| Underwriter | Crum & Forster SPC |

| For Ages | 0 to 99 years |

| Policy Duration | 90 days to 364 days |

| Extendable | Yes (for up to 364 days) |

| Cancellable | Yes (before the trip begins) |

| PPO Network Provider | Yes (United Healthcare PPO Network) |

| Pre-Existing Conditions Coverage | Yes |

| COVID-19 Coverage | Yes |

Key Benefits

INF Premier offers several key benefits for non-US residents traveling outside their home country, including:

- Pre-existing condition Coverage as defined in the plan, with no benefit waiting period

- Direct billing and cashless claims with providers worldwide through INF-Robin Assist

- 24/7 responsive claims, emergency travel, and medical assistance

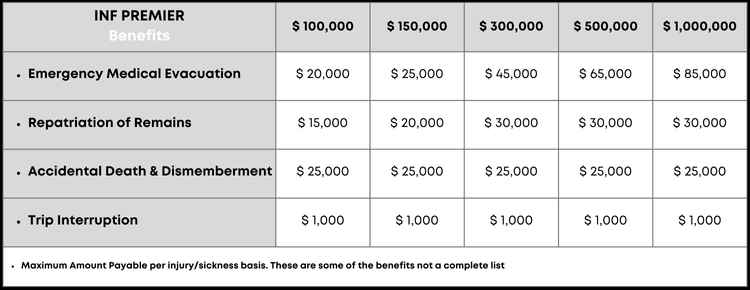

- Accidental death & dismemberment coverage

- Emergency Medical Evacuation

- Repatriation Services

- Various other medical services such as:

- Hospital room & board

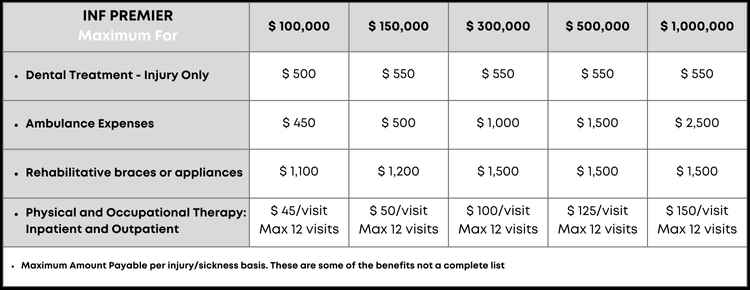

- Ambulance expenses

- Rehabilitative braces or appliances

- Dental treatment

- Physical & occupational therapy, and

- Private duty nurse services

- Deductibles and maximums for covered medical services and pre-existing conditions

INF Premier Plan – Key Highlights

- Offers coverage for pre-existing conditions

- Policy maximum limits up to 1,000,000

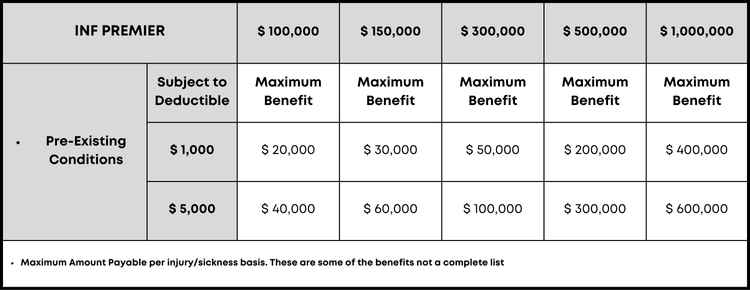

- Pre-existing condition coverage limit options from $20,000 to $600,000

- Co-insurance 100% of usual, reasonable & customary (URC) charges

- Urgent care visits are covered with a $25 copay

- Emergency medical evacuation up to $85,000

- Repatriation of remains up to $30,000

- Accidental death & dismemberment (AD&D) benefits up to $25,000

- Trip interruption benefits up to $1,000

- Covid-19 is covered like any other covered medical condition (if the virus is contracted after the policy effective date)

- Offers INF-Robin Assist for direct billing & cashless claims with providers worldwide

INF Premier Travel Insurance – Eligibility

The plan is available to non-US residents:

- Visiting the USA, Canada, and Mexico

- Traveling outside their home country to the EU, UK, Australia, and worldwide

- Coverage for ages 0 to 99 years, age-specific limits apply

- The plan must be purchased for a minimum of 90 days

- The plan must be purchased before departing the home country

This plan is a great option to evaluate when considering travel insurance for parents visiting the USA.

INF Premier IVAS Plan Details

The INF Premier plan provides coverage for pre-existing conditions as defined in the plan, as per policy limitations, exclusions, and maximums, with no benefit waiting period.

The Premier IVAS (International Visitor Accident & Sickness Insurance) Plan provides up to $100,000 total maximum per accident or sickness expense benefits.

The plan is not available to US residents and is not subject to guaranteed issuance or renewal.

INF Premier IVAS Plan is:

- Available to Non-US residents

- Not available to US residents

The coverage duration is from 90 days to 364 days.

The plan is available for individuals aged 0 to 99 years.

The plan provides direct billing and cashless claims with providers worldwide through INF-Robin Assist.

INF Premier plan also provides 24/7 responsive claims, emergency travel, and medical assistance – from any device, at any time, and any place.

The Plan provides accidental death & dismemberment coverage, and emergency medical evacuation and repatriation services.

The plan comes with various medical services, such as hospital room & board, hospital stays, ambulance expenses, rehabilitative braces or appliances, dental treatment, physical & occupational therapy, and private duty nurse services apart from other benefits.

Other Competitive Fixed-Benefit Travel Insurance Plans:

- VisitorSecure

- Visitors Care

- Seven Corners Travel Medical USA Visitor Choice

Note: These plans do not offer coverage for pre-existing medical conditions

Compare travel insurance plans

Should you get comprehensive coverage or fixed coverage, what is the difference?

INF Premier Pre-Existing Conditions Coverage

One of the biggest worries for people traveling especially to the USA is if there is any travel insurance for pre-existing medical conditions available.

INF Premier is one of the few plans that covers any medical event caused by a pre-existing condition, most visitors’ insurance plans cover the acute onset of pre-existing conditions.

Medical treatment under acute onset of pre-existing medical conditions coverage is to help stabilize the condition, it doesn’t pay for any medical bills for treating the condition itself.

Other options for pre-existing condition coverage plans:

- INF Elite

- INF Elite Plus

- INF Premier Plus

- Visitors Protect by IMG

- HOP Mindoro

- HOP TripAssist Plus

Additional Non-Insurance Features Of Premier Plan

Access to the Careington discount program at an additional cost, which provides savings on Dental services (savings of up to 50% for Dental Procedures), Vision, Prescription, and Hearing products and services in the U.S.

Access to Doctor Please a telehealth app to access medical care from the comfort of your own home. You can schedule an appointment with a healthcare provider.

The doctor will video or audio chat with you and if required, send a prescription to the nearest pharmacy (prescriptions may require out-of-pocket expense if they are not eligible expenses)

VIP Airport addon for personalized, high-end support throughout the airport experience for a seamless and comfortable experience. including

- Fast Track Immigration and Security

- Private Transportation to and from the plane

- Exclusive lounge access

- Assistance with baggage and check-in

Where To Use The INF Premier Plan?

The INF Premier Plan can be used if you experience an accident or sickness during your trip.

- INF is associated with the United Healthcare PPO Network (UHC PPO)

- UHC PPO access allows you to take advantage of a network of healthcare providers

- Which may bill the insurance company directly and

- Could reduce your out-of-pocket expenses if any, once your deductible is met

Why Should I Purchase The INF Premier Plan?

The INF premier plan covers travelers to the U.S., Medical expenses in the U.S. are extremely high.

This travel insurance is designed to provide coverage for sickness and accident medical expenses, an Accidental Death and Dismemberment Benefit, Emergency Medical Evacuation, and Repatriation of Remains benefits while you are on your trip.

To guard yourself against financial losses incurred as a result of a medical emergency you can purchase the INF Premier Plan if it suits your needs.

Premier Travel Insurance Plan’s Premiums

Insurance premiums for premier travel insurance plans are pro-rated and are based on a 30-day calendar and are pro-rated on that basis.

For example, if you apply for 1 month and 10 days, that is the exact amount you pay. The premiums are higher as compared to other limited coverage plans because this plan offers pre-existing coverage.

INF Premier Insurance Reviews

The INF Premier is a limited travel medical insurance plan with pre-existing coverage.

The plan provides pre-defined amounts for medical coverage and emergency services for non-US residents visiting the United States, Canada, EU, UK, Australia, and other countries worldwide.

The plan offers coverage for pre-existing conditions as defined in the plan, with no benefit waiting period, and direct billing and cashless claims with providers worldwide through INF-Robin Assist.

INF Premier also provides 24/7 responsive claims, emergency travel, and medical assistance, accidental death & dismemberment coverage, and emergency medical evacuation and repatriation services.

The plan comes with various medical services, such as hospital room & board, ambulance expenses, rehabilitative braces or appliances, dental treatment, physical & occupational therapy, and private duty nurse services.

The INF Premier IVAS Plan provides up to $100,000 total maximum per accident or sickness expense benefits, the total maximum per accident or sickness expense benefits.

INF Premier has received positive reviews from customers on Trustpilot

The INF Premier is rated as a good option for basic health insurance coverage with limited coverage for worsening pre-existing conditions.

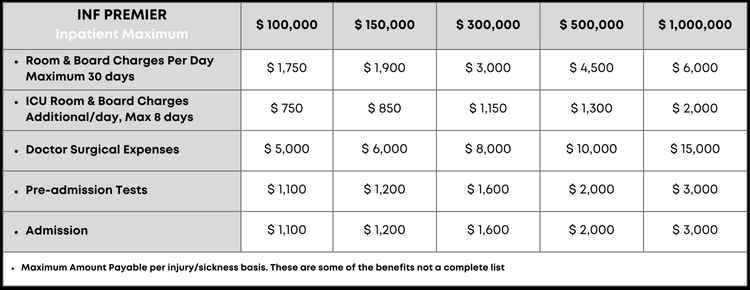

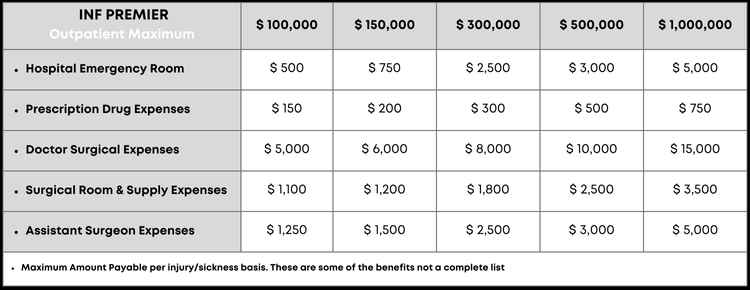

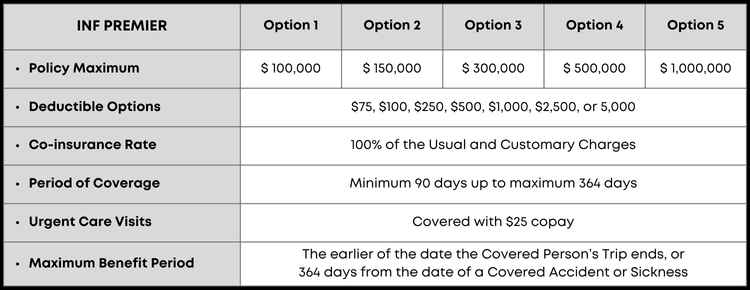

INF Premier IVAS – Specific Schedule Of Benefits

Total Maximum for all Accidents:

- $100,000

- $150,000

- $300,000

- $500,000 or

- $1,000,000

Deductible Options: $75, $100, $250, $500, $1,000, $2,500, or $5,000

Co-insurance Rate: 100% of the Usual and Customary Charges

Maximum Period of Coverage: 364 days

Incurral Period: 90 days after the date of covered accident or sickness

Maximum Benefit Period:

- The earlier of the date the covered Person’s Trip ends, or

- 364 days from the date of a covered Accident or Sickness

Urgent Care Visits: Covered with a $25 copay

Other Travel Insurance Plans To Consider

If you are looking for a comprehensive coverage plan and need only the acute onset of a pre-existing condition, these are some of the best comprehensive coverage plans:

These plans are very popular among visitors to the USA and

Reasons to consider these plans:

- The trip is less than 90 days

- Already arrived in the USA

- Already departed from your home country

- Looking for affordable plans with risks being covered

- Don’t have a pre-existing condition

Does INF Premier Plan Use PPO Network?

INF is associated with the United Healthcare PPO network. If you experience an accident or sickness during your trip, you can seek treatment with a United Healthcare Provider Network, which will allow you to take advantage of a network of healthcare providers.

What Must You Say When You Visit A Healthcare Provider?

When seeking treatment with a United Healthcare PPO while covered under the INF Premier Plan make sure to state:

“I have a short-term accident & sickness insurance plan that uses United Health Care PPO. Do you accept plans that work with the United Health Care PPO?”

What Must You Avoid Saying When You Visit A Healthcare Provider?

Avoid stating:

“I have INF Visitor Accident & Sickness Insurance” or “I have INF Premier plan covers”. Providers may not be aware of all the plans and may not recognize this, as a result, your coverage may not be accepted.

More Pre-Existing Conditions Plans?

See Plans that cover Pre-Existing Conditions.

INF Premier Travel Insurance Plan – FAQ’s

What Is The Coverage Area Under The INF Premier Plan?

The INF Premier plan provides coverage worldwide and during trip to the United States, Canada, and Mexico.

What Age Group Is Covered By The INF Premier Plan?

This plan works for all age groups, from age 0 to age 99 years old.

What Is The Minimum Period Of Coverage For The INF Premier Plan?

The minimum period of coverage is 90 days up to 364 days. Once the coverage is purchased the insured is covered from the start date of the trip.

Are Pre-existing Conditions Covered Under The INF Premier Plan?

Yes, pre-existing conditions may be covered according to the terms of the policy.

Who Is Eligible For The INF Premier Plan?

Any non-US citizen can apply for the INF Premier Plan. Including Green Card holders, H-1B Visa Holders, Permanent Residents, Students on F1/F1 Visas, and those on OTP.

Can I Renewal The Premier Travel Insurance Plan?

Yes, the premier plan is renewable, You can renew the INF Premier Travel Insurance Plan.

How To Apply And When Can Cancellation Be Done For INF Premier?

You can apply for the INF Premier plan online or by phone. You can cancel this plan for a full refund before the start date of the coverage, but after the policy start date, the premium is fully earned and therefore can’t be refunded.

Can I Add My Spouse As A Dependent?

Yes, You can add your spouse as a dependent.

If your spouse is traveling along with you your spouse is eligible for the same type of coverage.