Is Travel Insurance Mandatory For Going To The USA?

Is travel insurance mandatory for travel to the USA? Simple answer, No. Some countries may require travel insurance to enter as a visitor but not the United States.

Well, while purchasing a travel insurance plan is not mandatory for travel to the US, amidst the excitement of planning your trip, don’t forget this crucial aspect.

It can prove immensely beneficial in managing unforeseen expenses and travel-related crises. travel insurance should be regarded as a paramount consideration.

In general, medical costs in the US are significantly higher than in other countries, and encountering a medical emergency while traveling to the USA could pose a substantial financial burden.

Know about the best Visitor insurance plans for the USA before planning your trip to the USA. You must always protect your trip with travel insurance for the USA.

Is Travel Insurance Mandatory To Enter The USA?

Travel medical insurance is not mandatory for travel to the USA. To enter the USA you need your passport and a valid visa relevant to the purpose of your visit.

Though not mandatory it is recommended to have travel medical insurance for your entire stay, especially considering the high cost of healthcare in the USA. Your domestic health insurance from your home country may not cover your expenses for medical treatment while visiting the USA.

Is Travel Insurance Worth It?

Having travel insurance can provide coverage for emergency medical services abroad, coverage for unexpected medical bills (expenses), emergency evacuation, medical costs, trip cancellations, lost luggage, and other unforeseen events, offering travelers peace of mind during their trip.

While it’s not a legal requirement for foreign visitors to obtain a travel medical insurance policy, it’s a wise investment and a smart move to protect your health and financial investment while traveling abroad.

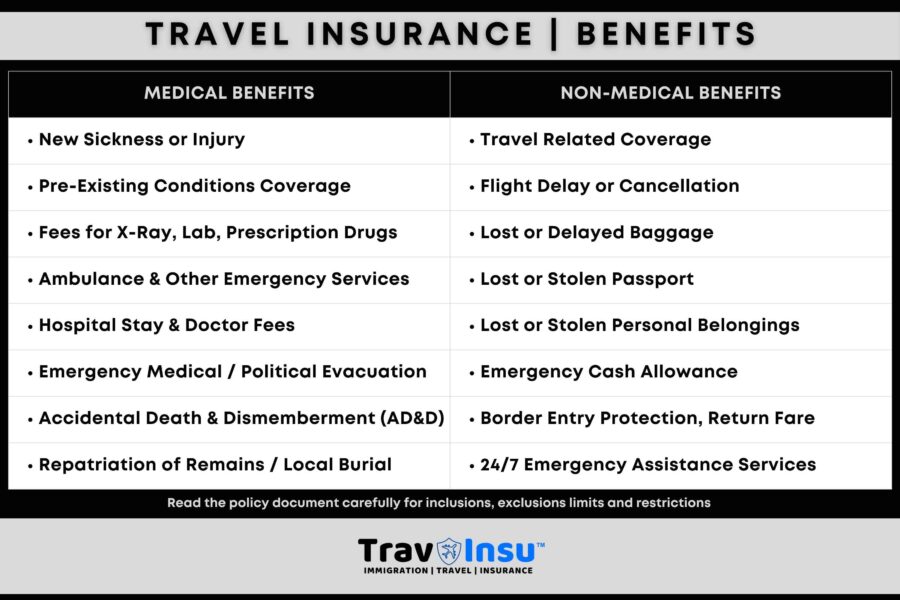

Key Features And Benefits Of Travel Insurance

It Typically offers extensive medical coverage, including expenses for hospitalization, doctor consultations, diagnostic tests, prescription medications, and emergency medical evacuation.

It can cover the expenses incurred for medical treatment necessitating hospitalization while you’re in the US.

- Pre-existing Condition Coverage: You can get the acute onset of a pre-existing condition coverage or some selective plans also offer coverage for pre-existing conditions

- Emergency Dental Coverage: some plans offer limited coverage for dental injuries or emergency dental procedures as well

- Complimentary Diagnostics: Medical tests essential for diagnosing ailments, including blood tests, X-rays, MRIs, and other procedures, are typically included in the insurance policy’s benefits.

- Physician Consultations: Policyholders can benefit from coverage for doctor consultations under the plans, addressing new illnesses or injuries

- Prescription Medication: Visitor Insurance to the USA may include coverage for prescription medications required for new illnesses or injuries

- Baggage and Personal Belongings Coverage: Coverage is available for lost, stolen, or damaged baggage and personal belongings during your trip, offering compensation for replacement items and essential purchases due to baggage delay

- Emergency Assistance Services: Travel insurance includes access to 24/7 emergency assistance services, providing support for medical referrals, travel arrangements, legal assistance, and translation services in case of emergencies

- COVID-19 Coverage: Given the ongoing pandemic, many policies now include coverage for COVID-19-related expenses, quarantine costs, and trip cancellations or interruptions due to the virus

Popular Comprehensive Travel Insurance Plans

Compare Travel Insurance Plans

Can I Purchase Travel Insurance Along With Air-Ticket?

Yes, you can often purchase travel insurance through the airline or travel agency you are using to book your trip. Many airlines and travel agencies offer it as an optional add-on when you book your flights or travel packages.

However, it’s essential to carefully review the terms, coverage limits, and exclusions of the insurance policy offered by the airline or travel agency to ensure that it meets your needs and provides adequate protection for your trip.

Most embedded or one-click purchase with an airline or travel agency involves a trip insurance plan purchase providing benefits like trip interruption, canceled flights, and delayed flights with limited medical coverage.

Evaluate your travel insurance needs to decide if you need trip insurance or travel medical insurance.

Better Alternative To Purchase Medical Travel Insurance Plan

If you have specific requirements or prefer to compare insurance options from multiple providers, you may also consider a reputable and reliable travel insurance comparison marketplace for purchasing travel insurance policies.

This helps you evaluate plans from multiple providers and get the best one to meet your travel health insurance policy needs.

Impact Of Travel Insurance On The Approval Of Visa Applications

Adequate travel insurance coverage can have a positive impact on the approval of visa applications, as it demonstrates to immigration authorities that the applicant is financially prepared and responsible for any unforeseen circumstances during their travels.

Many countries, including those in the Schengen Area and some US visa categories, require applicants to provide proof of travel insurance coverage as part of their visa application process.

Having comprehensive coverage can enhance the credibility of the visa application and reassure immigration officials that the applicant is equipped to handle potential emergencies, pay for medical expenses, and other travel-related risks.

The Importance Of Travel Insurance

While travel insurance may not be mandatory, it is highly recommended for anyone visiting the USA. There are several reasons why having it can be invaluable during your trip:

- Medical Coverage: The cost of healthcare in the United States is among the highest in the world. Even a minor illness or injury could result in significant medical expenses if you require treatment during your visit

- Trip Cancellation or Trip Interruption: Unexpected events, such as illness, family emergencies, or natural disasters, can disrupt your travel plans and force you to cancel or cut short your trip

- Lost Baggage Or Delayed Luggage: Airlines occasionally misplace luggage or experience delays in baggage delivery, leaving travelers without their belongings for an extended period

- Emergency Assistance: Encountering a travel-related emergency in unfamiliar surroundings can be daunting. Fortunately, many plans feature round-the-clock emergency assistance services

- Personal Liability: Accidents happen, and if you accidentally damage property or injure someone during your trip, you could be held liable for the resulting expenses.

Foreign visitors must consider having a travel health insurance policy for the complete duration of their stay in the U.S.

Is Travel Insurance Mandatory: Which Countries Require Travel Insurance?

The requirements can vary widely from country to country and may depend on factors such as the traveler’s nationality, the purpose of travel, and the duration of stay.

Some countries require travel insurance and explicitly mandate it as a condition of entry, others like Australia strongly recommend it without making it compulsory.

List Of Countries That Require Travel Insurance

Several countries require travel insurance for visitors as a condition for entering their borders.

While the specific requirements may vary depending on factors such as:

- The Traveler’s Nationality

- The Purpose Of Travel, and

- The Duration Of Stay

Here is a list of countries known to mandate it for certain visitors:

Schengen Area Countries:

- Austria, Belgium, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Slovakia, Slovenia, Spain, Sweden, and Switzerland.

- Travel health insurance (with emergency medical care) with coverage of at least €30,000 for medical emergencies and repatriation is required for visitors from non-Schengen countries traveling to the Schengen Area.

Have sufficient travel insurance coverage before visiting any of these European countries.

Cuba:

- Renowned for its beautiful colonial architecture, travel with medical coverage insurance is mandatory for all travelers to Cuba, and it is often required to be purchased from a Cuban insurance provider upon arrival.

Ecuador:

- Visitors to the Galapagos Islands are required to have travel health insurance that includes medical coverage for the duration of their stay.

Russia:

- Culturally rich and Known for its historic cities having stunning architecture, travelers applying for Russian tourist visas are required to have medical insurance valid for the duration of their stay in Russia.

- Russia is one of the many countries that made it mandatory to travel to Russia.

Turkey:

- Visitors to Turkey are required to have insurance that covers medical expenses, including COVID-19 treatment, for the duration of their stay. Purchase of medical travel insurance is mandatory for all visitors before they enter Turkey

United Arab Emirates (UAE):

- Known for its glitz and glamour – Dubai, and Abu Dhabi – having a historical significance, have mandated travel health insurance for tourists covering COVID-19 medical expenses and quarantine costs.

Thailand:

- Travelers entering Thailand under the Special Tourist Visa (STV) program need to have travel health insurance with coverage for COVID-19.

Vietnam:

- Travel health insurance with medical coverage is required for tourists entering Vietnam. Proof of insurance may need to be submitted on arrival.

Qatar:

- Before visiting Qatar, travelers must ensure they have both health and travel insurance. Under the Qatari legislation, visitors with essential insurance are eligible for entry as foreign guests. Visitors to Qatar must have travel medical insurance that includes coverage for COVID-19 medical expenses and quarantine costs.

Antarctica:

- Travelers to Antarctica often require comprehensive travel health insurance due to the extreme and remote nature of the destination.

These requirements are subject to change, and travelers need to verify current entry requirements with the respective embassy or consulate of the country they plan to visit.

Additionally, even in a country where travel insurance is not mandatory for entry, travelers can protect against unforeseen emergencies and expenses during their trip with travel insurance.

NOTE: Not an exhaustive list. If you are visiting a foreign country, please research your destination to see if it is among countries that require travel insurance as mandatory.

Is Travel Insurance Mandatory: Should I Get Travel Insurance For The Schengen Area?

For visitors from non-Schengen countries to the Schengen Area: travel insurance with coverage of at least €30,000 for medical emergencies and repatriation.

How to get a visa for Schengen Area?

Countries That Introduced Mandatory Travel Insurance Due To COVID-19

Several countries have introduced mandatory travel insurance requirements as a response to the COVID-19 pandemic.

These measures aim to ensure that travelers have adequate coverage for expenses related to COVID-19 treatment and other emergencies.

Some international destinations still mandate that travelers arrive with designated travel medical insurance that includes coverage for COVID-19. Here are some countries that have implemented mandatory travel insurance due to COVID-19:

- Turkey:

- Turkey with unparalleled natural beauty requires all visitors to have travel insurance. It needs to cover COVID-19-related expenses for the duration of their stay in the country.

- United Arab Emirates (UAE):

- Dubai and Abu Dhabi have mandated travel insurance for tourists covering COVID-19 medical expenses and quarantine costs.

- Thailand:

- Travelers entering Thailand under the Special Tourist Visa (STV) program need to have travel insurance. It needs to cover COVID-19 treatment and a minimum coverage amount.

- Qatar:

- Visitors to Qatar must have travel insurance that includes coverage for COVID-19 medical expenses and quarantine costs.

These are just a few examples of countries that have introduced mandatory travel insurance requirements specifically related to COVID-19. Travelers need to stay informed about the latest travel restrictions and entry requirements for their destination. Regulations can change frequently in response to the evolving situation with the pandemic.

Is Travel Insurance Mandatory: Why Are More Countries Making Travel Insurance Mandatory?

More countries require travel insurance and are making it mandatory due to several factors, including:

- The high healthcare costs associated with providing medical treatment to visitors

- Preventing the host country suffer financial loss

- The need to manage public health risks such as those posed by global pandemics like COVID-19

- The importance of risk management in mitigating travel-related emergencies and disruptions

- The aim is to provide consumer protection for travelers against unforeseen events

Type Of Coverage Required For Travel Insurance In Countries That Mandate It?

Countries that mandate travel insurance typically require coverage for specific risks, particularly medical expenses and sometimes other emergencies.

Common requirements include coverage for:

- Emergency medical treatment for a sickness or injury

- Hospitalization & doctor visits

- Emergency medical evacuation, and

- COVID-19-related expenses.

Additional coverage like trip cancellation/interruption, baggage protection, and personal liability could also be mandatory. It is always good to read the country’s regulations related to mandatory travel insurance.

It’s essential to thoroughly research the entry requirements of your destination and ensure that your policy meets all mandatory coverage requirements to avoid potential issues or penalties upon arrival.

Always go for a reputed insurance company-provided plans with top-notch ratings.

What Should A Good Travel Insurance Policy Include?

A medical emergency abroad can be financially devastating. However, with a reliable and good travel insurance policy, you gain essential financial protection in the event of trip cancellation and coverage for medical expenses incurred during a medical emergency overseas.

A comprehensive travel insurance policy should include coverage for a range of potential risks and emergencies during your trip.

Essential features include medical coverage for illness or injury, trip cancellation/interruption protection, coverage for travel delays and missed connections, compensation for lost or delayed baggage, access to emergency assistance services, and personal liability coverage.

Optional coverage for specific needs such as rental car insurance or adventure sports coverage may also be available.

NOTE: It’s crucial to review policy details, coverage limits, exclusions, and terms and conditions to ensure that the policy meets your specific needs and provides adequate protection for your travels.

Can I Buy Travel Insurance At The Border Or Once I Arrive In The Country That Requires It?

It may be possible to purchase travel insurance at the border or upon arrival if entering that country is mandatory.

While this option could meet entry requirements, purchasing it before your trip is generally advisable to ensure comprehensive coverage and avoid potential delays or complications.

Buying insurance in advance allows you to research and compare options, review policy details, and select coverage that best meets your needs, providing peace of mind for your travels.

What Happens If I Don’t Have The Required Travel Insurance When Entering A Country That Mandates It?

If you don’t have the required travel insurance when entering a country that mandates it:

- You may be denied entry or

- Face other consequences depending on the specific regulations of that country

In some cases:

- Immigration authorities may require you to purchase insurance on the spot

- Or provide proof of coverage before allowing you to enter

Failure to comply with the mandatory insurance requirement could result in:

- Refusal of entry

- Deportation

- Fines, or

- Other penalties as stipulated by the country’s laws and regulations

It’s essential to research the entry requirements of your destination thoroughly. Ensure that you have the necessary insurance to avoid any potential issues or disruptions to your travel plans.

Conclusion

While travel insurance is not mandatory for travel to the USA. It is a wise investment that can provide invaluable protection and peace of mind during your journey.

From covering medical expenses to offering assistance in emergencies, It offers a safety net. It protects against unforeseen events that could otherwise derail your trip and leave you facing significant financial burdens.

Before embarking on your travels to the USA, carefully consider the benefits. Always choose a policy that suits your needs and budget.

After all, a worry-free trip is the best way to fully enjoy. The United States is a diverse and dynamic country and has a lot to offer to visitors.