Best Visitors Insurance Plans For USA – [2024]

Seeking the best visitors insurance plans for the USA or considering insurance for parents visiting the USA?

Extremely high healthcare costs in the USA make it necessary to have a suitable visitor travel insurance plan.

From analyzing top visitors’ insurance policies to knowing what they cover, this article offers a concise guide to make your stay worry-free and protect your wallet.

The Best Travel Medical Insurance For Visitors To The USA

Here is a list of some of the best medical insurance for visitors to the USA

Best Comprehensive coverage plans:

- Patriot America Plus

- Patriot America Lite

- Patriot America Platinum

- Atlas America

- Safe Travels USA Comprehensive

- Safe Travels USA

The Best Fixed Benefit Travel Insurance Plans

- Visitors Secure

- VisitorCare

- Seven Corners Travel Medical USA Visitor Choice

Best plans for Pre-Existing Condition Coverage

- INF Elite

- INF Premier

Compare Travel Insurance Plans

Best plans are based on industry feedback on the most preferred and high sales volume

Let’s look at the coverage and other benefits offered by each type of plan

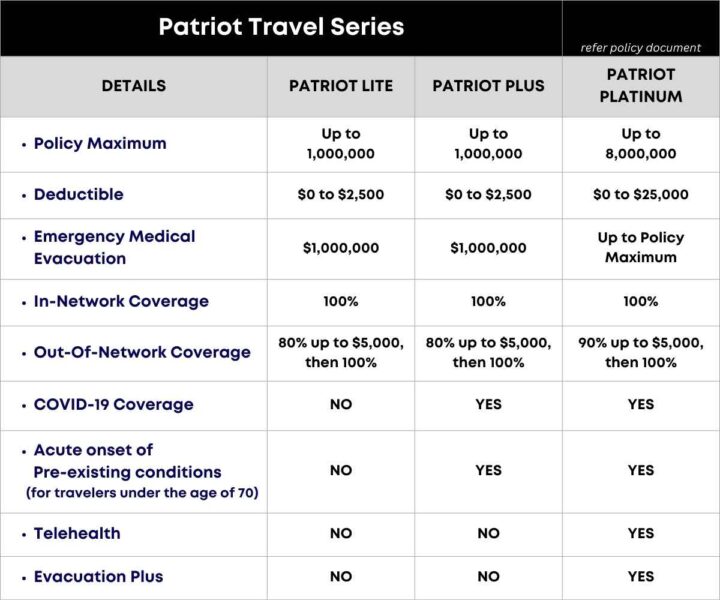

Patriot America Plus

The Patriot America Plus from IMG is a good option for health insurance for parents visiting USA.

| Eligible Age | 14 days to 99 years |

| Coverage Length | 5 days to 365 days |

| Extendable | Yes, up to 365 days |

| Pre-Existing Condition | Offers Coverage For Acute Onset of Pre-Existing Conditions |

| Choices of Coverage Maximums | $10,000, $50,000, $100,000, $500,000, $1,000,000 |

| Choice of Deductibles | $0, $100, $250, $500, $1,000, $2,500 |

| PPO Network used | United Healthcare PPO Network |

| Trip Interruption | $10,000 |

| Coverage for In-network urgent care | $25 co-pay, 100% thereafter up to policy maximum |

| Coverage for Out-of-network care | $25 copay, 80% for the first $5,000, 100% thereafter |

| Plan Administrator | IMG |

Consider Patriot America Plus if you are looking for decent coverage for a good price. Even if the plan does not offer coverage for pre-existing conditions, it offers coverage for Acute onset of pre-existing conditions.

Patriot America Lite

| Eligible Age | 14 days to 99 years |

| Coverage Length | 5 days to 365 days |

| Extendable | Yes, up to 365 days |

| Pre-Existing Condition | No Coverage |

| Choices of Coverage Maximums | $10,000, $50,000, $100,000, $500,000, $1,000,000 |

| Choice of Deductibles | $0, $100, $250, $500, $1,000, $2,500 |

| PPO Network used | United Healthcare PPO Network |

| Trip Interruption | $10,000 |

| Coverage for In-network urgent care | $25 co-pay, 100% thereafter up to policy maximum |

| Coverage for Out-of-network care | $25 copay, 80% for the first $5,000, 100% thereafter |

| Plan Administrator | IMG |

Patriot America Lite is worth considering if you are looking for a low-cost plan but need good trip interruption benefits. But remember it does not offer coverage for pre-existing coverage. If pre-existing coverage is your cause of concern then you can look out for another plan.

Patriot America Platinum

| Eligible Age | 14 days to 99 years |

| Coverage Length | 5 days to 365 days |

| Extendable | Yes, up to 36 months |

| Pre-Existing Condition | Offers Coverage For Acute Onset of Pre-Existing Conditions |

| Choices of Coverage Maximums | $2,000,000, $5,000,000, $8,000,000 |

| Choice of Deductibles | $0, $100, $250, $500, $1,000, $2,500, $5,000, $10,000, $25,000 |

| PPO Network used | United Healthcare PPO Network |

| Trip Interruption | $10,000 |

| Coverage for In-network urgent care | $25 co-pay, 100% thereafter up to policy maximum |

| Coverage for Out-of-network care | $25 copay, 90% for the first $5,000, 100% thereafter |

| Plan Administrator | IMG |

Patriot America Platinum plan is ideal for international travelers who need maximum coverage available. Additionally, the plan also offers enhanced benefits and services. The plan does not offer coverage for pre-existing conditions, However, it does offers coverage for Acute onset of pre-existing conditions.

Atlas America

Atlas America from WorldTrips is a comprehensive travel medical insurance for visitors (non-U.S. citizens) traveling outside their home country, it is one of the most popular travel insurance options to consider for parents visiting the USA.

You have the option to select a policy maximum from $50,000 to $2,000,000

The policy maximum is the amount of money an insurance provider will pay for covered medical expenses.

- For parents in their 70s, the maximum amount available for policy maximum is $100,000.

- For parents older than 80 years, the amount gets reduced to $10,000

The maximum gets capped depending on the age of your parents.

| Eligible Age | 14 days to 99 years |

| Coverage Length | 5 days to 364 days (total coverage) |

| Extendable | Yes, up to 364 days |

| Pre-Existing Condition | Offers Coverage For Acute Onset of Pre-Existing Conditions |

| Choices of Coverage Maximums | $10,000, $50,000, $100,000, $500,000, $1,000,000, $2,000,000 |

| Choice of Deductibles | $0, $100, $250, $500, $1,000, $2,500, $5,000 |

| PPO Network used | United Healthcare PPO Network |

| Trip Interruption | $10,000 |

| Coverage for In-network urgent care | $15 co-pay, 100% thereafter up to policy maximum |

| Coverage for Out-of-network care | $15 copay, 100% for the first $5,000, 100% thereafter up to policy maximum |

| Plan Administrator | WorldTrips |

Atlas America Optional coverage (for an upcharge):

| Accidental Death and Dismemberment |

| Crisis Response |

| Personal Liability |

Atlas America is worth considering if you are looking for a high coverage limit plan with a wide range of choices for deductible amounts. Out-of-network services are covered at 100%. Even if the plan does not offer coverage for pre-existing conditions, it does offer coverage for Acute onset of pre-existing conditions.

Safe Travels USA Comprehensive

| Eligible Age | 1 year to 89 years |

| Coverage Length | 5 days to 364 days |

| Extendable | Yes, up to 364 days |

| Pre-Existing Condition | Offers Coverage For Acute Onset of Pre-Existing Conditions |

| Choices of Coverage Maximums | $50,000, $100,000, $500,000, $1,000,000 |

| Choice of Deductibles | $0, $50, $100, $250, $500, $1,000, $2,500, $5,000 |

| PPO Network used | First Health PPO Network |

| Trip Interruption | $5,000 |

| Coverage for In-network urgent care | $30 co-pay, 100% thereafter up to policy maximum |

| Coverage for Out-of-network care | $30 copay, 100% thereafter up to policy maximum |

| COVID-19 Expenses | Covered and treated as any other sickness |

| Plan Administrator | TRAWICK International |

Even if the Safe Travels USA Comprehensive plan does not offer coverage for pre-existing conditions, it does offer coverage for Acute onset of pre-existing conditions. Trip interruption at $5,000 and Dental benefits at $250 are slightly lower than some other competitors. Urgent care and emergency room out-of-network are covered at 100% after copay. Price is competitive with a good choice of deductible choices.

Safe Travels USA

Safe Travels USA covers non-U.S. citizens traveling to the USA or USA and then other countries. This plan is not available to U.S. Residents and Green Card Holders. This policy is not available to anyone aged 90 or above.

| Eligible Age | 1 year to 89 years |

| Coverage Length | Minimum 5 days up to 364 days |

| Extendable | Yes, up to 364 days |

| Pre-Existing Condition | Offers Coverage For Acute Onset of Pre-Existing Conditions |

| Offers Coverage for | Emergency Medical Evacuation, Medically Necessary Repatriation, Repatriation of Remains, Local Burial/Cremation |

| Choices of Coverage Maximums | $50,000, $100,000, $250,000, $500,000, $1,000,000 |

| Choice of Deductibles | $0, $50, $100, $250, $500, $1,000, $2,500, $5,000 |

| PPO Network used | First Health PPO Network |

| Trip Interruption | $5,000 |

| Co-insurance per policy period | 90% of the first 2,500 then 100% up to the policy maximum |

| Urgent care | $30 per incident, If $0 deductible is chosen, there is no Co-pay |

| COVID-19 Expenses | Covered and treated as any other sickness |

| Plan Administrator | TRAWICK International |

The Safe Travels USA plan offers coverage for COVID-19. Trip protection benefits like Lost Baggage, Trip Interruption, and AD&D are included in the plan. There is the option to add supplementary sports coverage and Optional home country coverage.

Best Fixed Benefit Travel Insurance Plans

VisitorSecure

A limited travel medical insurance for visitors to the U.S. It provides pre-defined amounts for medical coverage and emergency services. The specific amounts are mentioned in the plan description of coverage. Ideal for international travelers traveling anywhere outside their home country including the U.S. The plan does not participate in any PPO you can visit any doctor of your choice.

| Eligible Age | 14 days to 89 years |

| Coverage Length | Minimum 5 days up to 364 days |

| Extendable | Yes, up to 364 days |

| Pre-Existing Condition | Offers Coverage For Acute Onset of Pre-Existing Conditions |

| Offers Coverage for | Emergency Medical Evacuation, Medically Necessary Repatriation, Repatriation of Remains, Local Burial/Cremation |

| Choices of Coverage Maximums | $10,000, $50,000, $75,000, $100,000, $130,000 |

| Choice of Deductibles | $0, $50, $100, $200 |

| PPO Network used | Does not participate in any PPO network |

| Emergency Medical Evacuation | $50,000 lifetime maximum |

| Repatriation of remains | $25,000 |

| Urgent care | $30, $85, $100, $130 per visit / maximum 10 visits |

| COVID-19 Expenses | Covered and treated as any other sickness |

| Plan Administrator | WorldTrips |

The plan is a good option if you are looking for a budget-friendly plan that provides coverage while traveling to the U.S. and internationally especially when you have relatives visiting you in the U.S. Even if the plan does not offer coverage for pre-existing conditions, it does offer coverage for Acute onset of pre-existing conditions.

Visitors Care

Visitors Care is a fixed benefit plan for visitors (non-U.S. residents) traveling to the U.S. (outside of their home country) for a minimum of five days. Renewals are available in whole months or daily increments.

| Eligible Age | 14 days to 99 years |

| Coverage Length | Minimum 5 days up to 2 years |

| Extendable | Yes, up to 24 months |

| Pre-Existing Condition | Offers Coverage For Acute Onset of Pre-Existing Conditions |

| Offers Coverage for | Emergency Medical Evacuation, Common Carrier Accidental Death & Dismemberment, Medically Necessary Repatriation, Repatriation of Remains, Local Burial/Cremation |

| Choices of Coverage Maximums | $25,000, $50,000, $100,000 |

| Choice of Deductibles | $0, $50, $100 |

| PPO Network used | First Health PPO network |

| Emergency Medical Evacuation | $25,000 maximum |

| Repatriation of remains | $25,000 |

| Urgent care | $40, $60, $85 per visit / maximum 10 visits |

| COVID-19 Expenses | Covered and treated as any other illness or injury |

| Plan Administrator | IMG |

The plan is a good option if you are looking for a budget-friendly plan that provides coverage while traveling to the U.S. Even if the plan does not offer coverage for pre-existing conditions, it does offer coverage for Acute onset of pre-existing conditions.

Seven Corners Travel Medical USA Visitor Choice

This plan is a limited coverage plan if your destination is the USA. The policy provides travel insurance benefits. The plan is available to non-U.S. citizens and non-U.S. residents traveling outside of their home country traveling to the U.S.

| Eligible Age | 14 days to 99 years |

| Coverage Length | Minimum 5 days up to 364 days |

| Extendable | Yes, up to 1092 days |

| Pre-Existing Condition | Offers Coverage For Acute Onset of Pre-Existing Conditions |

| Offers Coverage for | Emergency Medical Evacuation, Common Carrier Accidental Death & Dismemberment, Medically Necessary Repatriation, Repatriation of Remains, Local Burial/Cremation |

| Choices of Coverage Maximums | $50,000, $100,000, $150,000 (Ages 14 days to 69 years), $50,000, $100,000 (Ages 70 to 99) |

| Choice of Deductibles | $0, $50, $100 (Ages 14 days to 69 years), $100, $200 (Ages 70 to 99) |

| PPO Network used | Does not participate in any PPO network |

| Emergency Medical Evacuation | $100,000 maximum |

| Repatriation of remains | $25,000 |

| Urgent care | $100 per visit / maximum 30 visits / 1 visit per day |

| COVID-19 Expenses | Covered and treated as any other illness |

| Plan Administrator | Seven Corners Travel Insurance |

The plan is a good option if you are looking for a budget-friendly plan that provides coverage while traveling to the U.S. Even if the plan does not offer coverage for pre-existing conditions, it does offer coverage for Acute onset of pre-existing conditions.

Pre-Existing Conditions Coverage Plans:

The following plans offer coverage for Pre-existing conditions coverage:

INF Elite

The INF ELITE IVAS (international visitor accident & sickness) Plan offers coverage to non-US Residents traveling to the US, Canada, or Mexico. INF Elite is not available to US residents and is only available to non-US residents.

| Eligible Age | 0 years to 99 years |

| Coverage Length | 90 days to 364 days |

| Extendable | Yes, up to 364 days |

| Pre-Existing Condition | Offers Coverage For Pre-Existing Conditions |

| Choices of Coverage Maximums | $75,000 (age 70-99 years) or $150,000, $250,000, $300,000, $500,000 or $1,000,000 (age 0-69 years) |

| Choice of Deductibles | $100, $250, $500, $1,000, $2,500, $5,000 |

| PPO Network used | United Healthcare PPO Network |

| Trip Interruption | $1,000 |

| Coverage for In-network urgent care | $25 co-pay, 80% or 90% of the Preferred Allowance |

| Coverage for Out-of-network Urgent care | $50 copay, 60% or 70% of Usual and Customary Charges (URC) |

| COVID-19 Expenses | Covered and treated as any other sickness |

| Plan Administrator | INF Visitor Insurance |

You can consider INF Elite plan if you are looking for a plan offering coverage for Pre-existing conditions, INF Elite provides coverage for pre-existing conditions as defined in the plan, as per policy limitations, exclusions, and maximums, with no benefit waiting period.

INF Premier

INF PREMIER IVAS (international visitor accident & sickness) Plan offers coverage to visitors traveling anywhere worldwide outside their home country, including the USA, Canada EU, UK, and Australia. This is a fixed benefit plan and pays a pre-defined fixed benefit for every service or treatment. INF Premier is not available to US residents and is only available to non-US residents.

| Eligible Age | 0 years to 99 years |

| Coverage Length | 90 days to 364 days |

| Extendable | Yes, up to 364 days |

| Pre-Existing Condition | Offers Coverage For Pre-Existing Conditions |

| Choices of Coverage Maximums | $100,000, $1,50,000, $3,000,000, $500,000, $1,000,000 |

| Choice of Deductibles | $75, $100, $250, $500, $1,000, $2,500, $5,000 |

| PPO Network used | United Healthcare PPO Network |

| Trip Interruption | $1,000 |

| Urgent care Visits | Covered with a $25 copay |

| Co-insurance Rate | 100% of the Usual and Customary Charges (URC) |

| COVID-19 Expenses | Covered and treated as any other sickness |

| Plan Administrator | INF Visitor Insurance |

You can consider this plan if you are looking for a plan offering coverage for Pre-existing conditions, INF Premier provides coverage for pre-existing conditions as defined in the plan, as per policy limitations, exclusions, and maximums, with no benefit waiting period.

Key Takeaways

- Protection for medical and financial risks is crucial, types of travelers who need visitors insurance:

- Visitors insurance for international travelers

- Visitors insurance for Non-U.S. citizens visiting the USA

- Visitors insurance for U.S. citizens traveling abroad

- Visitors insurance for parents visiting USA

- Visitors’ Insurance provides coverage for hospital visits, and prescribed medication, and some plans may also cover pre-existing conditions

- Visitors’ insurance plans vary in terms of coverage:

- Comprehensive coverage plans offer broad benefits like emergency evacuation, while fixed benefit plans offer basic protections at a lower cost

- Fixed-benefit travel insurance plans offer limited or fixed amounts for medical care benefits per incident and may exclude travel-related expenses like trip interruption coverage limits

- Travel insurance coverage requires careful review to ensure that a travel medical insurance policy meets individual needs and coverages:

- Pre-existing conditions may be covered by some plans

- COVID-19 may be limited or specific

- Some coverage limits may be higher or lower, with exclusions

Understanding Visitors Insurance And Its Importance

Travel medical insurance, or visitors insurance, is a temporary medical coverage plan designed for non-U.S. citizens visiting the USA, as well as American individuals traveling abroad.

These international travel insurance plans are specifically designed for those who don’t have health insurance accepted in the US, ensuring they have access to necessary medical care during their travels.

The significance of visitors insurance arises from the fact that health plans from other nations are usually not acknowledged in the USA.

Without travel health insurance plans, travelers would be responsible for all medical expenses incurred during their trip, which can accumulate into a big expense.

For instance, Safe Travels USA, CoverAmerica-Gold, and Atlas America are some of the travel insurance plans available for non-U.S. citizens visiting the USA. These plans can be easily purchased online, making it straightforward for travelers to secure coverage before their trip.

Deciphering Visitor Medical Insurance Coverage

Visitor medical insurance offers temporary health care coverage encompassing medical expenses related to:

- Urgent medical care

- Hospital and doctor visits

- Physician fees

- Prescribed medication

- Hospital stays

Grasping the intricacies of visitor medical insurance coverage can be intricate. Rest assured, we’re here to help you navigate it.

Let’s delve into what this coverage entails, starting with hospital and doctor coverage.

Hospital And Doctor Coverage

Securing coverage for hospital and doctor visits is vital when you’re abroad. Visitor insurance plans like CoverAmerica-Gold and Patriot America Plus provide coverage for:

- Physician consultations

- Diagnostic X-rays and laboratory services

- Outpatient and inpatient surgical procedures

- Anesthesia

- Hospital accommodation

- Intensive care unit stays

These medical benefits ensure that travelers receive the necessary healthcare services during their stay in the USA.

Apart from these, visitor insurance plans also provide coverage for diagnostic tests like X-rays and lab services, as well as prescription medications. For instance, in the case of unexpected illnesses like COVID-19, coverage ensures that travelers are protected from related medical expenses during their trip to the USA. Bear in mind, though, that certain plans may provide limited coverage for specific services or treatments. Hence, reviewing policy details before purchasing is a must.

Handling Pre-Existing Conditions

In the context of visitors insurance, a pre-existing condition is any health-related issue that has been recorded in an individual’s medical history by a qualified medical practitioner. This could include:

- illnesses

- injuries

- medical issues that have necessitated examinations

- treatments

- a modification in prescribed medication.

Comprehensive travel medical insurance plans often offer coverage for:

- Acute onset of pre-existing conditions, providing additional protection for travelers

- Medical treatment expenses during your trip

- Trip interruption coverage can help cover the costs of an early return home due to a covered reason, such as a medical emergency or the death of a family member.

These plans provide peace of mind and financial protection while traveling.

For instance, Safe Travels USA provides coverage for acute onset of pre-existing conditions up to $1,000. Keep in mind that the pre-existing conditions must be stable with the traveler in good health at the time of insurance purchase. Common exclusions consist of:

- Pregnancy

- Cancer

- Dialysis

- Eye sickness/cataracts

Some plans provide a restricted option for the acute-onset of pre-existing conditions.

Emergency Evacuation Benefits

Emergencies are unpredictable, and when they strike, they can be nerve-wracking, especially when you’re in a foreign country. But with visitor insurance, you have one less thing to worry about. The emergency evacuation coverage in visitor insurance includes coverage for:

- Emergency transportation to a medical facility when deemed necessary

- Costs ranging from $99 to $255 per individual

- Certain plans offering up to $1 million per person

During medical emergencies, emergency evacuation coverage encompasses covered medical expenses such as:

- Emergency transportation

- Medical escorts

- Expenses for a companion

- Evacuation through ambulance or air travel to the closest medical facility equipped to provide treatment for the condition

In the event of natural disasters, emergency evacuation coverage assists by arranging transportation from the affected area to a safe location, often including transfer to the nearest medical facility capable of treating injuries or conditions resulting from the disaster. However, the restrictions and exclusions for emergency medical evacuation benefits differ based on the insurance company and the specific plan.

While larger travel insurance plans may provide coverage of up to $1 million, certain plans may only cover evacuation expenses to the individual’s place of residence. Common advice suggests maintaining at least $50,000 in emergency medical evacuation coverage.

Top Picks For Best Visitor Insurance In 2024

The importance of travel medical insurance for visitors cannot be underscored, if you are planning an international trip you might be wondering which plans are the best fit for you.

Some of the top visitor insurance plans for 2024 should include:

These medical insurance for visitors are known for their high policy maximum limits, trip interruption benefits, and coverage of the acute onset of pre-existing medical conditions. These plans also offer coverage for emergency medical evacuation and repatriation of remains.

The policy maximum for these plans varies, offering a range of choices to suit individual requirements. For example, Atlas America offers coverage ranging from $50,000 to $2 million, depending on the age of the insured, while Patriot America Plus offers coverage up to $8 million.

Additionally, some insurance plans explicitly include COVID-19 medical coverage, such as Patriot America Plus and Safe Travels USA.

But remember, when assessing the best medical insurance for visitors to the USA, it is crucial to take into account the following factors:

- Policy maximum coverage amounts

- Cost of travel insurance plan

- Trip interruption benefits

- Emergency medical evacuation

- Repatriation of remains

- Emergency room out-of-network reimbursement

- Urgent care out-of-network reimbursement

- Emergency dental care

Visitors Insurance: Comprehensive vs. Fixed Benefit Plans

International travelers come across two main types of visitor insurance plans:

- Comprehensive coverage plans

- Fixed benefit plans or limited coverage plans

Know the difference between comprehensive vs limited coverage travel insurance plans.

Fixed benefit plans offer fundamental coverage at a lower cost, whereas comprehensive plans provide broader coverage and a higher level of protection.

Comprehensive health insurance provides a financial safeguard against unforeseen healthcare expenses, offering reassurance during periods of illness or injury. But what exactly does each type of plan cover? Some examples of coverage limits in fixed benefit visitor insurance plans include surgery up to $3,000, local ambulance up to $300, and hospital emergency room up to $350.

Thus, reviewing policy details before purchasing is crucial to ensure adequate coverage for your specific needs.

Policy Maximums To Consider

The term ‘policy maximum’ in visitor insurance refers to the maximum amount that the insurance company is willing to pay for covered expenses. This can vary greatly depending on the visitor insurance plan, with limits ranging from as low as $25,000 to over $1 million.

The policy maximums in visitor insurance plans are determined by factors such as:

- The insured’s age

- Trip duration

- The desire for optional coverage benefits

- Their budget

- The type of policy chosen

However, opting for a higher policy maximum typically leads to an increased insurance premium due to the insurance company taking on a greater potential liability for covered expenses.

How To Choose The Right Visitor Health Insurance Plan

Choosing the right visitor health insurance plan can be a daunting task. But don’t worry, we’ve got you covered. The first step in making an informed decision is to assess your personal health coverage needs. Consider factors like:

- The cost of the trip

- Your budget

- Your health status

- The destination’s healthcare system

Understanding policy terms and exclusions is also crucial in choosing the right visitor health insurance plan. Typical policy terms in visitor health insurance plans that you should familiarize yourself with include:

- Policy maximum, which denotes the maximum amount the insurance will pay

- Specifics of the short-term coverage period

- Inclusion of non-U.S. citizen coverage in the plan

Also, be mindful of policy exclusions that limit coverage for specific circumstances or expenses. For instance, coverage for pre-existing conditions may be excluded, and expenses related to flight or travel may not be covered.

Assessing Your Health Coverage Needs

When evaluating your health coverage needs for visitor insurance, it’s essential to take into account your age, overall health, and the duration of your trip. For instance, as individuals age, there is typically an increase in the cost of visitor health insurance. Older travelers may place greater emphasis on obtaining travel medical insurance to cater to their specific health needs while traveling.

The duration of one’s trip also plays a crucial role in assessing health coverage needs due to its impact on the probability of falling ill or getting injured while traveling. Longer trips may necessitate more extensive coverage to guarantee sufficient protection throughout the entire duration of the journey.

When evaluating health coverage needs, consider the following:

- Coverage benefits

- Premiums

- Out-of-pocket costs

- Eligibility for health savings accounts

- Understanding different types of health plans

- Comparing out-of-pocket costs

Understanding Policy Terms and Exclusions

Understanding policy terms and exclusions in visitor health insurance plans is essential to gain clarity on the medical coverage offered and to remain informed about situations or activities that are not included, thereby preventing surprises during a claim. Some of the commonly misunderstood policy terms in visitor health insurance include:

- Fixed coverage plans

- Primary coverage

- Secondary coverage

- Single trip

- Multi-trip

Policy exclusions in visitor insurance can be significant, as they limit coverage for specific circumstances or expenses. Some typical exclusions in visitor health insurance plans that travelers should be mindful of include:

- Intentional self-harm or suicide

- Nervous disorders like anxiety

- Pre-existing conditions

- Pregnancy

- Dental treatment

- Mental illnesses

- Loss of baggage

- Loss of passport

- Flight delays

- Flight cancellations

- Hospitalization expenses

- Medical evacuation

- Personal liability

It’s important to carefully review the policy exclusions before purchasing visitor insurance to ensure that you have the coverage you need.

Buying Travel Medical Insurance Made Easy

Buying travel medical insurance doesn’t have to be a complicated process. With the advent of technology, you can now easily buy travel medical insurance online.

Whether you’re looking for a comprehensive plan or a fixed benefit plan, you have the convenience of purchasing it online from the comfort of your home.

But where exactly can you buy these plans, and how does the process work? Let’s delve deeper.

Where To Buy Visitor Insurance

You have a few options when it comes to purchasing visitor insurance:

- Buy from a marketplace

- Buy it from travel insurance providers directly

- Buy it from a standalone agent

- Buying travel insurance from the airline or travel website while booking air tickets

Travel insurance marketplace offers a platform where you can compare different plans based on your specific needs and budget.

Buying it from insurance providers can be helpful if you are sure about the travel insurance plan you need and do not need any help to compare them or get an independent view of the plan.

Buying it from an agent has some limitations again like not being able to compare the plans and opting for the best travel insurance option.

When you buy insurance while booking air tickets you generally get offered what is called Trip Insurance, it protects your financial investment in the trip but may not be the most optimal plan from a medical care perspective.

Know the difference between Trip insurance and Travel medical insurance for visitors.

Some of the reputable and popular visitor insurance for parents visiting the USA include:

- Atlas America

- Patriot America Plus

- Safe Travels USA Comprehensive

- Safe Travels USA Cost Saver

- Visitor Secure

- Atlas Essential America

See a detailed comparison of two of the most popular travel medical insurance plans for the USA

Purchasing Coverage Online

Purchasing insurance coverage online offers several advantages:

- It is cost-effective and offers comprehensive coverage for potential illnesses or injuries.

- It offers the convenience of comparing various providers.

- It provides prompt and precise quotes customized to your travel plans.

Visitors insurance comparison websites offer a platform where you can review benefits, compare plans, and select the most suitable insurance plan based on your requirements and financial constraints.

Once you’ve selected a plan, the purchase can be completed via the insurance company’s website or the comparison site.

Note: When buying visitors insurance through online channels, it’s important to consider the cost, coverage for medical emergencies, pre-existing conditions coverage, loss of baggage, travel documents lost or stolen, hassle-free claim settlement process, cashless medical assistance if available, and the reviews and reputation of the provider.

Navigating Claims And Assistance Services

Once you’ve purchased your visitors’ insurance, it’s important to understand how to navigate claims and assistance services.

The procedure for initiating a claim with visitor insurance involves:

- Selecting a method to initiate the claim

- Verifying the initiation methods with your insurance provider

- Furnishing essential documents along with the claim

Travel insurance companies oversee the processing of claims by offering an online portal for submission of documentation, mandating comprehensive documentation to substantiate the claims, and verifying the accurate completion of the claims form.

To expedite the processing time of their claim, policyholders should promptly notify the insurance company about the claim and submit a comprehensive claims form along with a written timeline and detailed receipts.

Visitors insurance plans provide a range of assistance services, including:

- 24-hour emergency help

- Customer service

- Emergency travel assistance

- Lost luggage tracking

- Emergency message conveyance

- Emergency cash transfer options

Tailoring Insurance For Parents Visiting USA

If you’re planning to invite your parents to visit you in the USA, it’s important to ensure they have adequate insurance coverage.

Tailoring insurance for parents visiting the USA involves considering factors like their age, health conditions, and trip duration. For instance, the CoverAmerica-Gold plan is accessible for parents up to 79 years old and provides $10,000 of comprehensive coverage for the acute onset of pre-existing conditions, along with supplementary travel benefits.

Choosing a plan with COVID-19 coverage and access to the UnitedHealthcare PPO network is also important.

Plans like Atlas America and Patriot America Plus are part of this network, offering broad recognition and trust, as well as extensive coverage for diverse medical services including inpatient and outpatient care, urgent care, and emergency medical expenses.

Summary

Choosing the right visitor insurance when visiting the USA is crucial to protect yourself from unforeseen medical expenses. From understanding the importance of visitor insurance to learning how to choose the right plan, this guide provides valuable insights to help you make an informed decision.

Remember, visitor insurance not only covers your medical expenses but also provides financial protection against unexpected emergencies, ensuring a stress-free trip.

As a final takeaway, remember to assess your health coverage needs, understand policy terms and exclusions, and compare different visitor insurance plans before making a purchase.

Choosing the right plan can provide peace of mind and allow you to focus on enjoying your trip to the USA.

Frequently Asked Questions

What does visitor health insurance cover?

Visitor health insurance typically covers new illnesses or injuries that occur during the trip, accidents resulting in injuries, and emergency medical evacuation. It may also provide coverage for inpatient and outpatient services, urgent care, emergency dental care, and emergency medical treatment for pregnancy complications.

Can a tourist in the US get insurance?

Yes, tourists in the US can purchase travel medical insurance from US companies to ensure coverage during their visit, even if they have pre-existing conditions. This short-term health insurance is important due to the high healthcare costs in the country.

How much does travel insurance cost?

Travel insurance can cost between 5% and 6% of your total trip cost, with an average trip cost for US travelers from April 2022 to November 2023 around $6,267.

What is visitor insurance and why is it important?

Visitor insurance, also known as travel medical insurance, is important as it provides temporary medical coverage for non-U.S. citizens visiting the USA, protecting them from potential medical expenses as health plans from other countries aren’t recognized in the USA.

How do comprehensive and fixed benefit plans differ?

Comprehensive plans provide broader coverage and a higher level of protection, while fixed benefit plans offer fundamental coverage at a lower cost.